Compound Finance is an Ethereum-based, open-source, decentralized protocol that allows the users to lend and borrow cryptocurrencies by locking up their assets in smart contracts.

Users can directly lend their assets to the Compound Finance “liquidity pool” from which a borrower can borrow by locking up their assets as collateral. The amount of tokens a user can borrow depends upon the collateral factor. Users can also earn interest from lending. The token interest rates are adjusted based on market demand and supply of the asset. The platform is supported by smart contracts that determine interest rates.

We can divide the platform users into two groups:

- Supplier – Users who lend their funds into the protocol and can earn interest from it.

- Borrower – Users who borrow funds from the supply market.

Table of Contents

Supported Cryptocurrencies

- BAT

- ETH

- DAI

- COMPOUND

- UNISWAP

- USD Coin

- Tether

- Wrapped BTC

- ZRX

Working Guide

Visit the Compound Finance website.

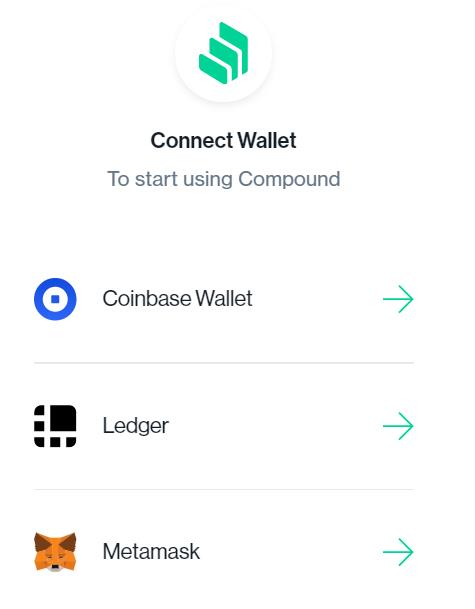

Connect Wallet

The platform currently supports three wallets through which users can connect to the Compound Finance application.

Connect your MetaMask wallet. The landing page looks like this.

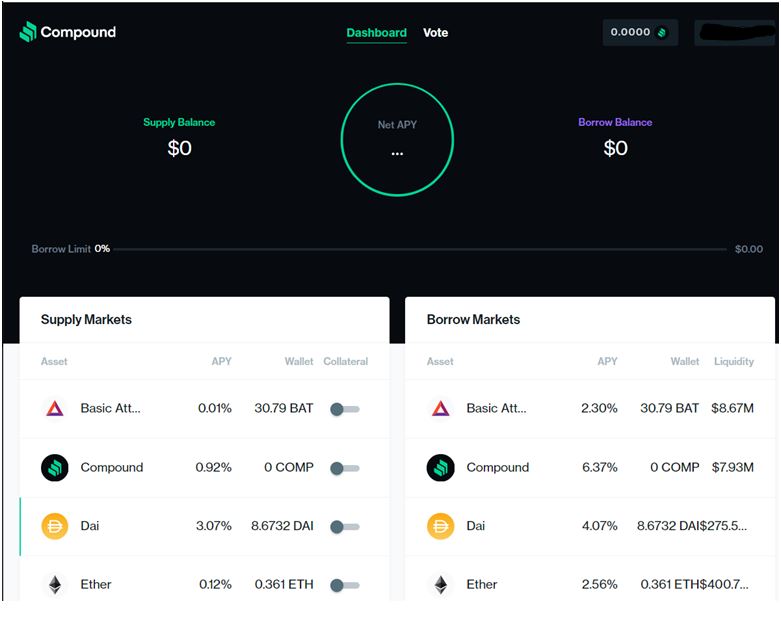

The dashboard can be roughly divided into three parts:

- Supply Market – Left-hand side.

- Borrow Market – Right-hand side.

- Lending/Borrowing summary information – Top part.

Users deposit collateral in the supply market and then borrow tokens against it.

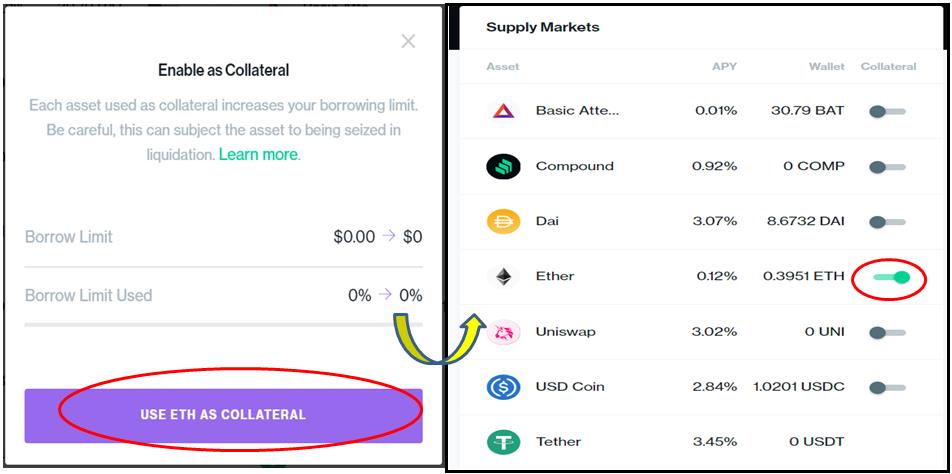

Users are required to first enable the collateral for supply before applying it for actual supply.

Enable Collateral

To enable any collateral, you just need to click on the desired collateral.

We have selected ETH as our collateral.

Now click on Use ETH as Collateral and grant permission by approving the MetaMask transaction.

Once approved, the ETH supply toggle button becomes green and activated.

Important: APY% is the amount of interest that a user will receive annually on a particular token. This value is not fixed and can fluctuate, depending upon the market supply and demand of the asset.

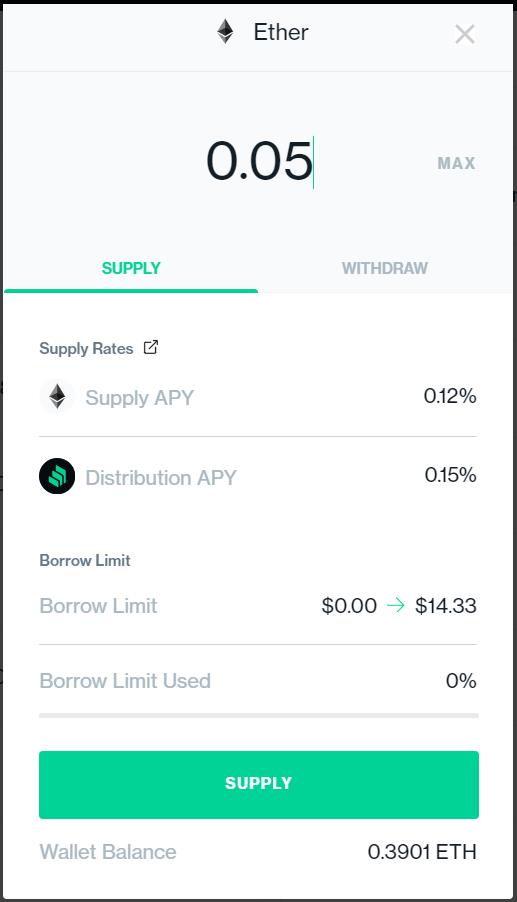

Supply ETH Collateral

In the Compound Finance protocol, the users lend their tokens to the protocol. The protocol then aggregates the total lending supply tokens, which result in a high level of liquidity. Also, the users are entitled to earn interest from lending their tokens.

Once you have enabled the collateral supply, you are now able to supply the desired amount of collateral.

Enter the amount and click on Supply.

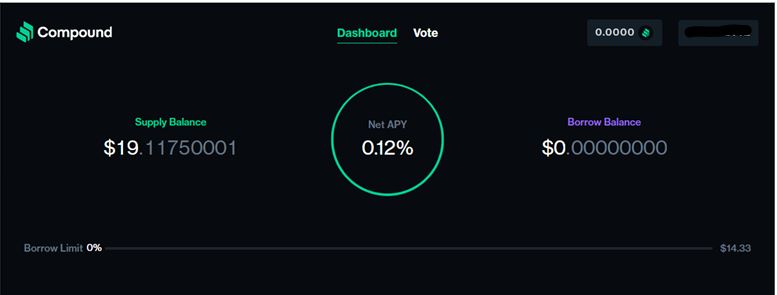

Approve the MetaMask transaction. Now you can see the supply amount on your dashboard. Users start earning interest once they have supplied their assets, and it sums up directly to the Supply balance.

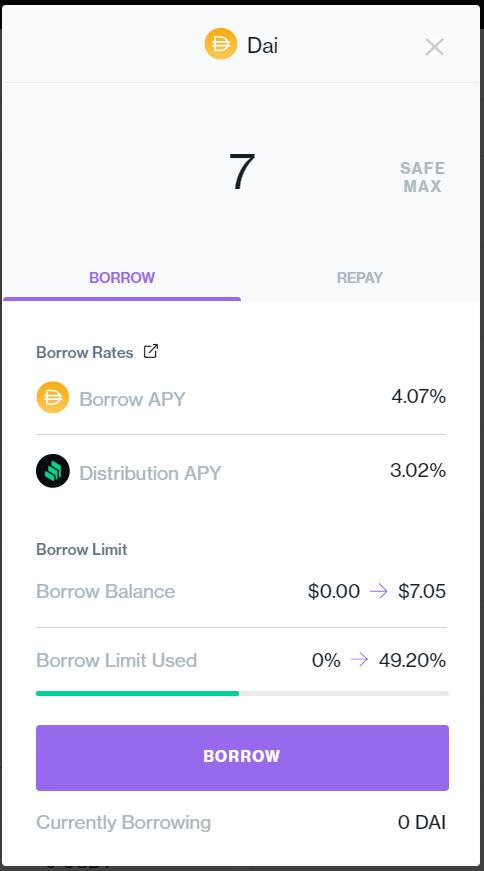

Borrow DAI

Users can borrow an asset directly from the protocol. You can also check the annual borrow rate that is associated with the token.

Now on the right side of the pane, select the token you want to borrow.

We have selected DAI. Enter the token amount that you want to take out as a loan.

Once again, a transaction is triggered, which a user needs to approve.

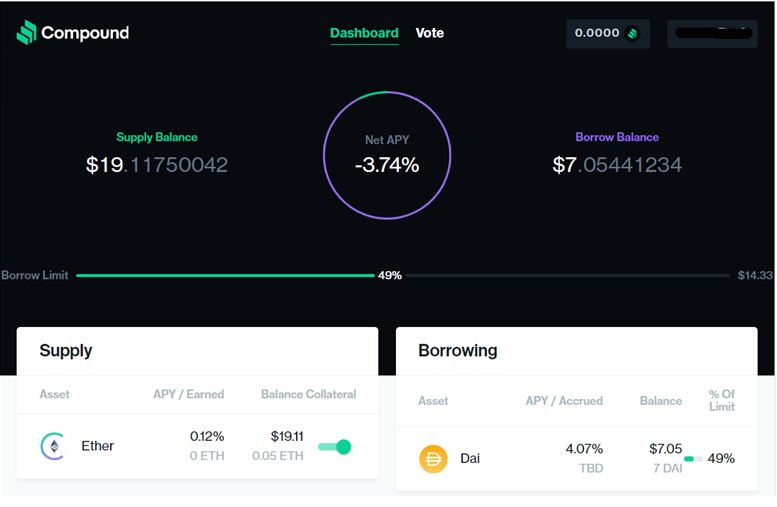

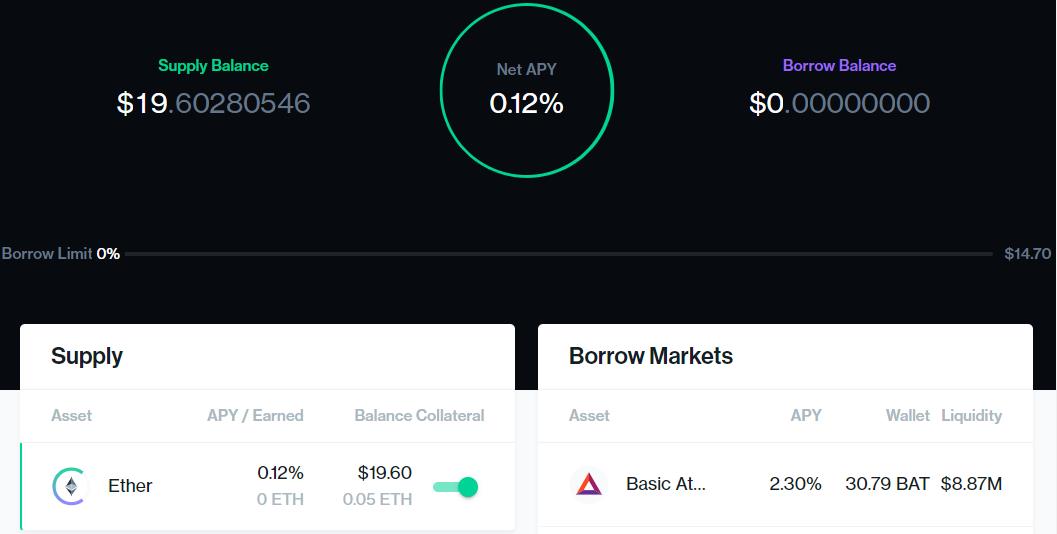

Now you can see the borrow, as well as the supply balance, in your dashboard.

The same amount of tokens will also appear in your MetaMask wallet, which you can use for further transaction activities.

Important: In Compound Finance, a user can either lend or can lend and borrow simultaneously, but he is not allowed to simply borrow as borrowing requires lending some collateral.

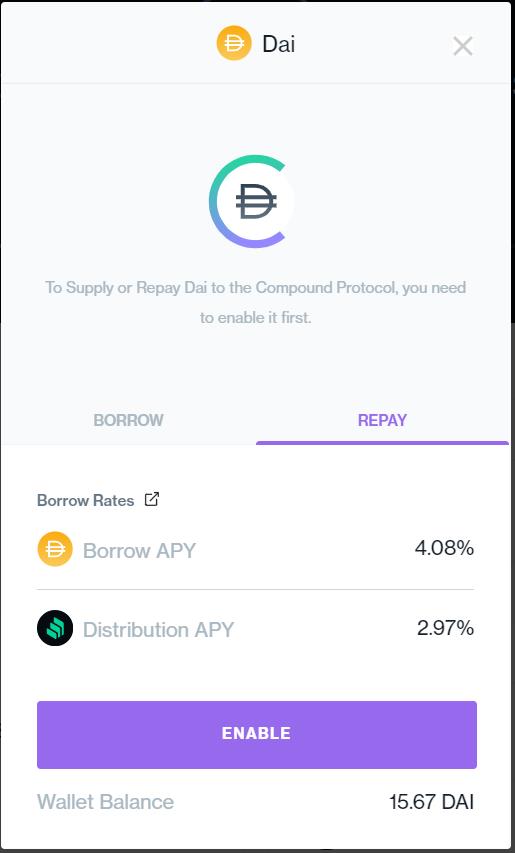

Enable Repay

For Repaying, you have to enable it first.

Click on Enable and approve the MetaMask transaction.

Repay

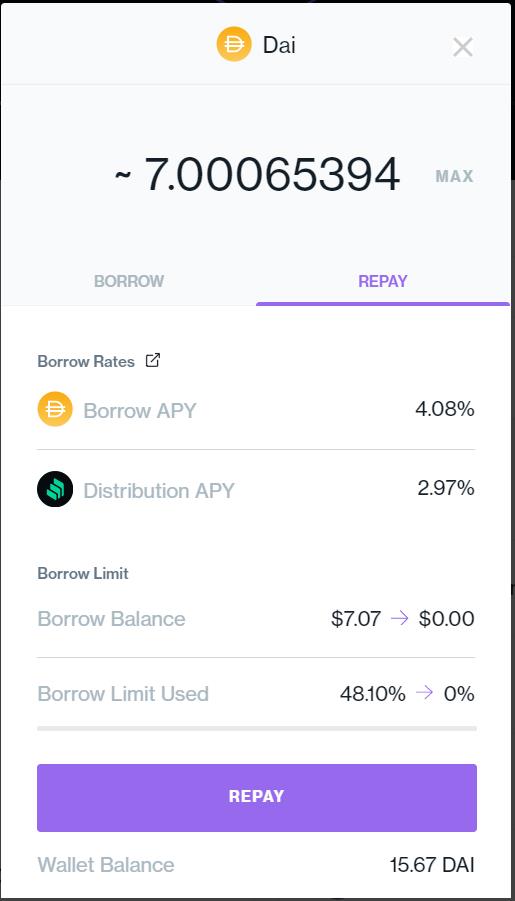

Once enabled for Repay, you can now actually repay the borrowed token.

Click on Repay and approve the transaction to repay your borrowed loan.

You can now check from the dashboard that your borrowed balance becomes zero.

Withdraw

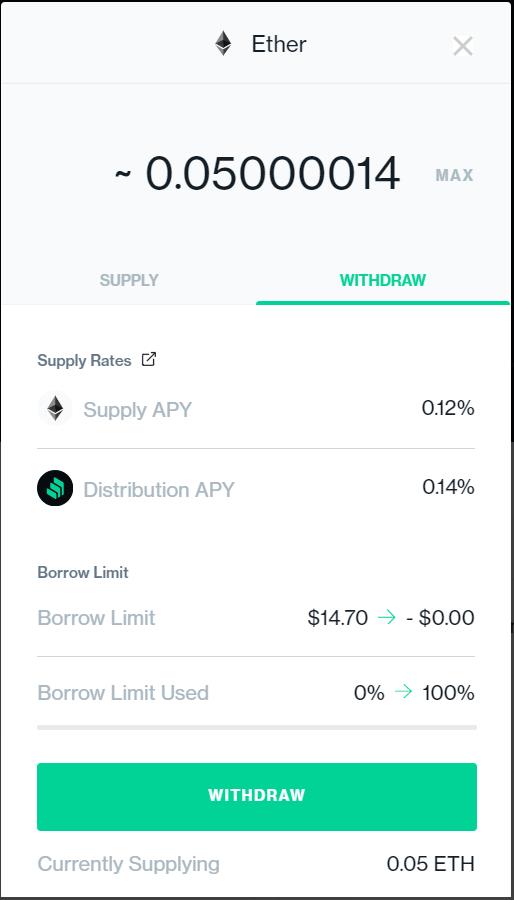

If you have repaid all your borrowed tokens, you can now withdraw the collateral.

Click on withdraw and confirm the transaction in MetaMask.

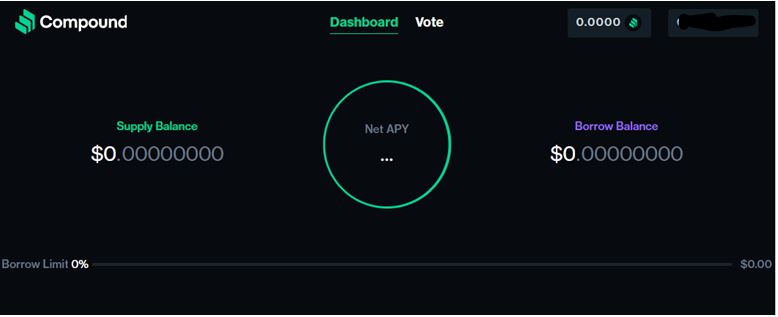

After withdraw, your supply also becomes zero on the Compound Finance dashboard.

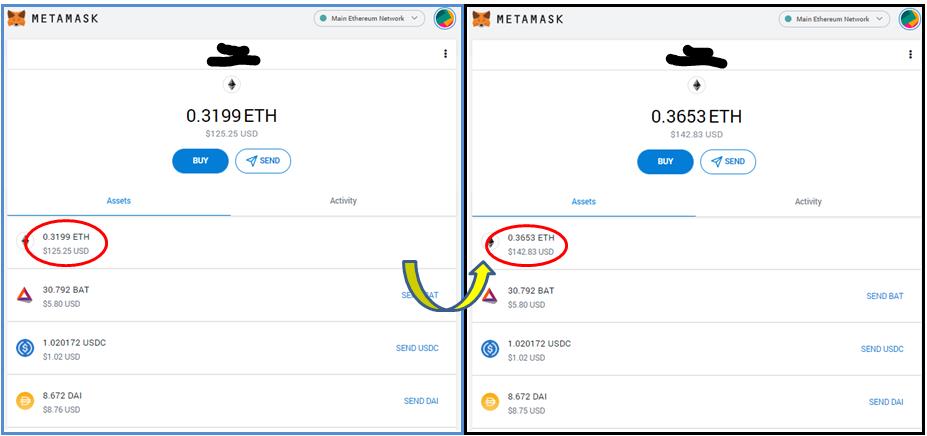

The collateral amount now moved to your MetaMask wallet.

MetaMask wallet before and after withdraw

Vote

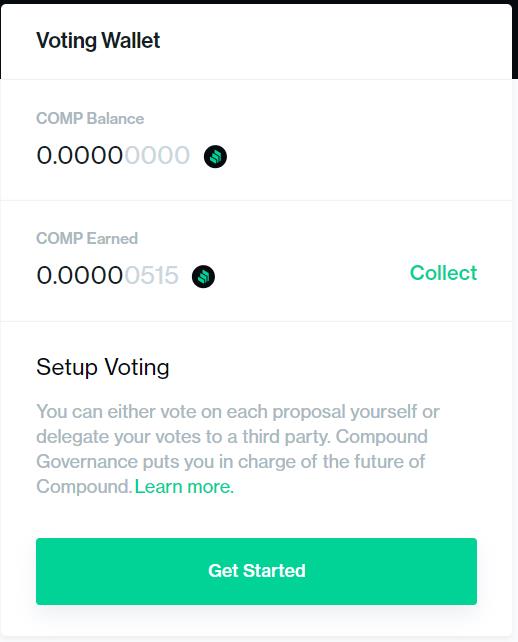

Users can vote on proposals. All users are required to set up the voting method before voting.

Click on Get Started to set up the voting process.

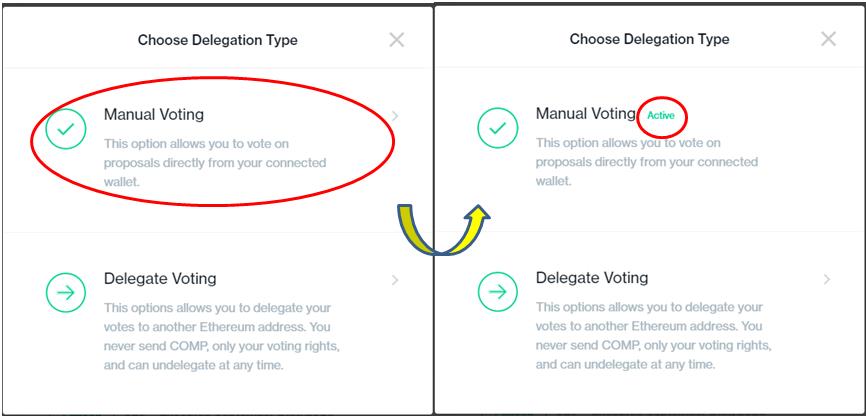

Compound supports two kinds of voting:

-

Manual Voting

Manual voting allows you to directly vote on proposals.

Confirm the transaction to activate the manual voting setup.

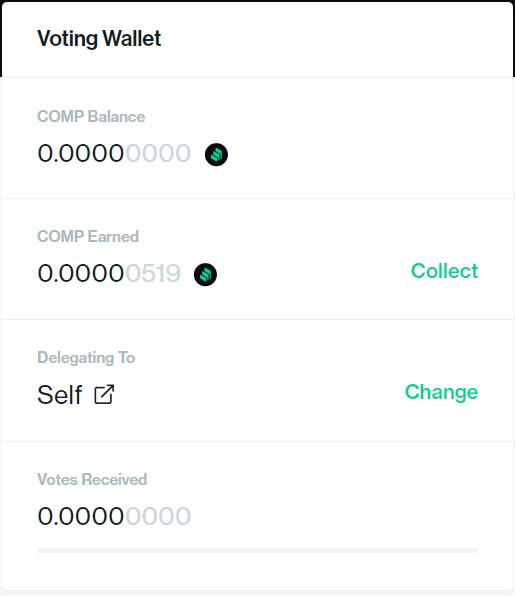

Now you can see the voting wallet is setup to Self.

To get the COMP Earned, you can click on the Collect button that will trigger a MetaMask transaction which users need to confirm.

-

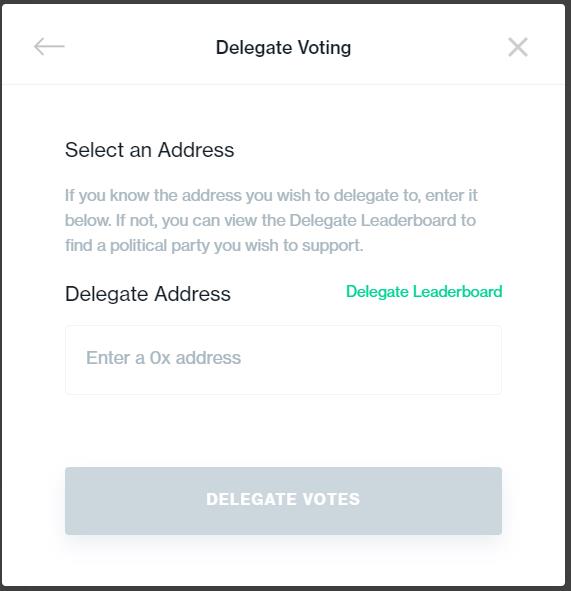

Delegate Voting

Users can also delegate their voting power to other users.

Click on Delegate Leadership it will redirect you to a page where you can check the list of Delegate Users’ rank, total votes, and vote weight. Select the username whom you want to give your voting rights, and the user’s wallet address will automatically be filled in the Delegate Address box.

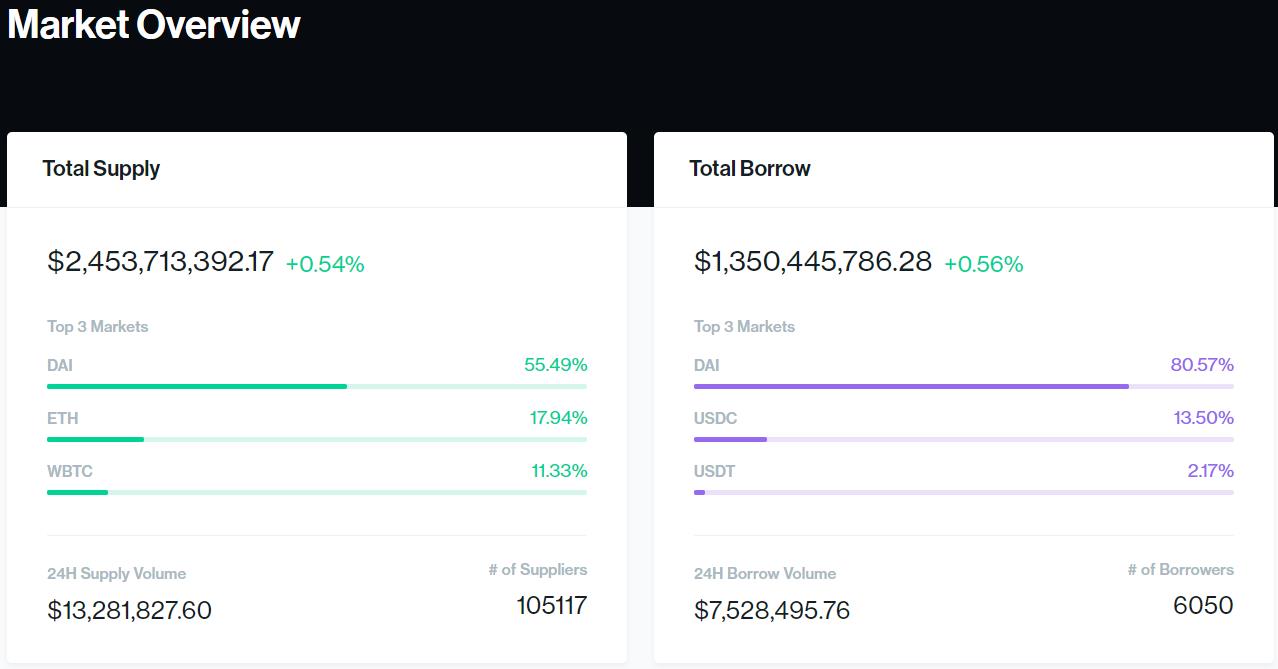

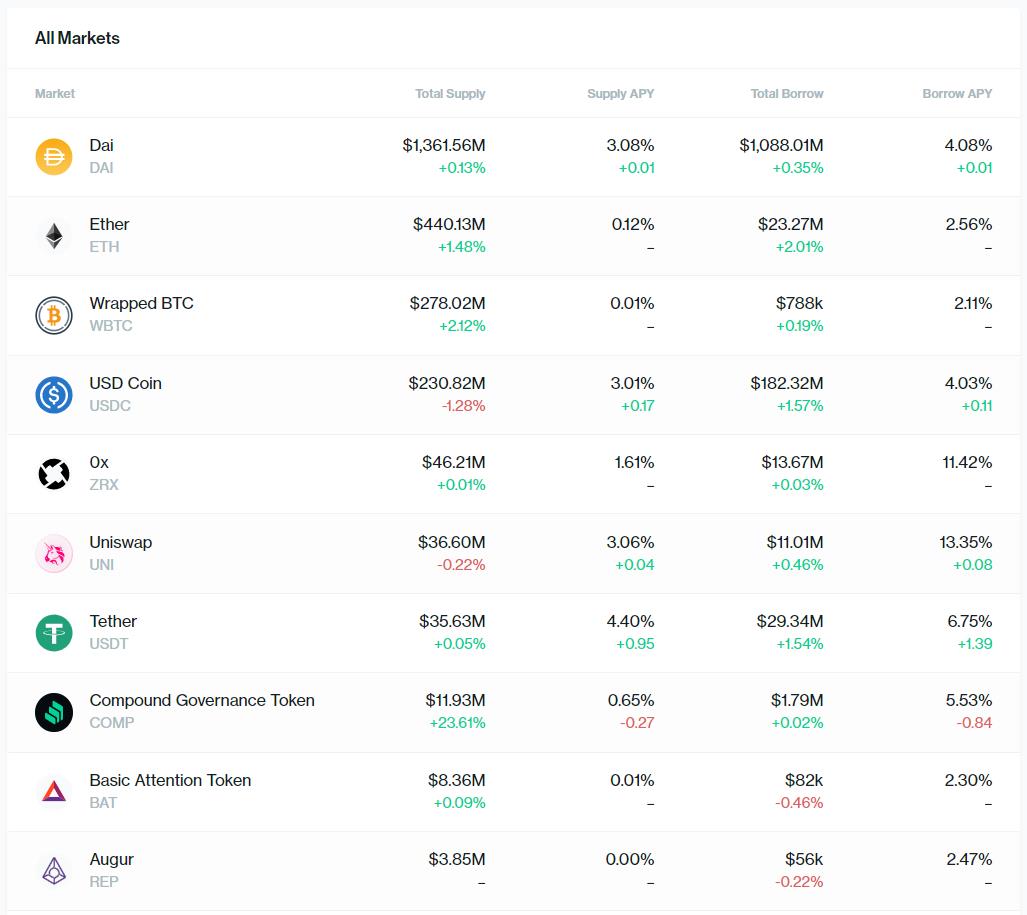

Market

You can check the protocol’s market overview of supported tokens from the page here.

Liquidation

When the value of the loan becomes more than the value of the collateral, then it triggers liquidation.

This situation will arise in a case where you have taken a loan in the crypto token (other than a stablecoin) and kept stablecoins as collateral. With the market rise, the value of the stablecoin remains constant but the value of the assets will rise, which, in turn, increases the loan amount than that of collateral value and thereby increases the risk of liquidation.

In case of liquidation, a fellow community member can repay up to 50% of your outstanding borrowed assets, and in return, the user receives a proportionate amount of your collateral as a reward with an 8.0% discount.

Hence, it is suggested to monitor the Borrow Limit continuously with market fluctuations.

Conclusion

The DeFi platforms offer an innovative and advanced solution to the common user’s problems. These platforms address the issue that exists in the traditional system by eliminating the existence of a middle-man. Compound Finance is one such platform that is gaining attention. It supports lending and borrowing features and also offers interest on lending assets.

However, the users are advised to closely monitor their borrow limit to avoid liquidation.

Resources: Compound Finance official blog

Read More: Exploring the Borrow Feature of MakerDAO