Nowadays, the most important PoW blockchain has already created 18.9 million bitcoins since the “genesis block” in 2009. Therefore, there are only 1.1 million to be generated until February 2140.

Such availability is purchased by exchanges but something is happening that is leaving such platforms with less and less bitcoin. In this article, you will discover why the Bitcoin Supply is having that behavior.

Bitcoin Supply Timeline

The declining supply is nothing new; it has been moving down since the Bitcoin Halving in 2020. As a result, the availability of BTC on exchanges also continued to gradually decline over the last year.

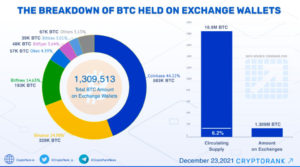

Then, in October 2020, right before the all-time highs of the 2020 Christmas season, exchange wallets accounted for 9.5% of the BTC supply, and 7.3% in July this year. But in December of this year, it ended up with only 6.3%.

As you can see in the picture below, Coinbase’s dominance in the BTC wallet space is decreasing. The American exchange used to own more bitcoins than the rest of the world combined. However, over the last year, its dominance has dropped from 50.52% to 40.65%.

Source: Cryptorank

Why do Exchanges have so Little Bitcoin?

Despite that many retail investors store their BTC on exchanges, and that some BTC holders would leave the custody of their keys to exchanges, the bitcoin liquidity in exchanges is continually decreasing.

Surprisingly, there are many institutional investors who buy bitcoin through these centralized platforms that do not guarantee their ownership. This shows that there is a lack of decentralized solutions for buying cryptocurrencies that do not put the assets at risk.

As a result, although 1.3 million BTC sit on exchanges, they may not be “circulating,” contributing to the illiquid supply.

Despite expectations for a dump season based on some optimistic statistics, there aren’t signs of it coming yet. Bullrun Invest’s tweet, based on Glassnode statistics, reveals that 24.6 percent of all BTC supply is trading over $47,000.

24.6% of all #Bitcoin supply is sitting above the current price around $47,000, meaning 1 in 4 #BTC is currently under water. @glassnode pic.twitter.com/Sh9VesLPne

— BullRun Invest (@BullrunInvest) December 22, 2021

Finally, It is important to say that the rising price of bitcoin is causing its holders to trade it less and less, reducing its use to an asset that accumulates value in cold wallets.

BTC Price Overlook

At the time of writing this article, the price of BTC is $50,026 with a marketcap of $946 billion and a 24-hour trading value of $ 18 billion. In the last 24 hours, bitcoin has decreased its value by 1.9%.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.