On June 22, 2022, dYdX, a popular derivatives exchange, announced that it will be setting up its own chain in the Cosmos ecosystem. This will be part of dYdX’s V4 update, currently due for release by end of 2022. Today, we look at what this chain migration means for Cosmos and its ecosystem. Also, we review its standing in the interoperability space.

Now, before we delve deeper, let us first look at what dYdX is.

Introduction to dYdX

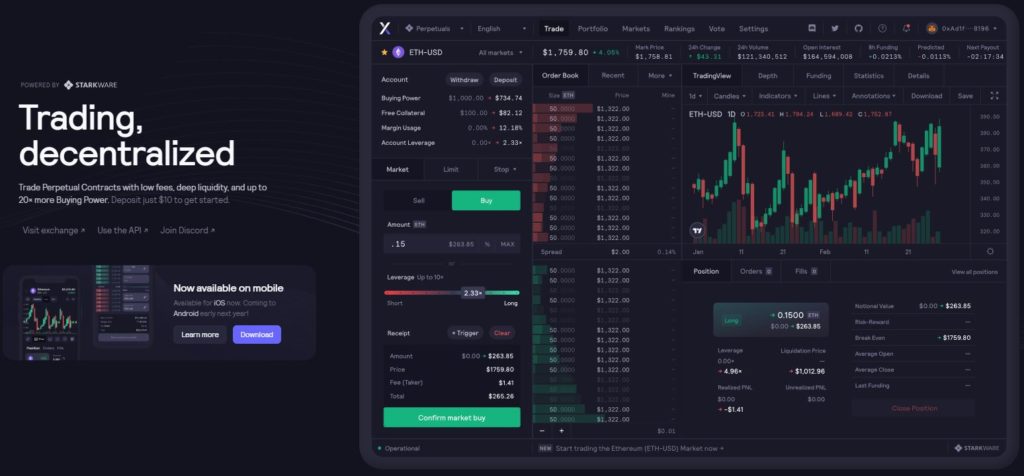

To recap, dYdX is a decentralized exchange (DEX) with almost $1 billion in daily trading volume over the last 24 hours. Currently, dYdX V3 is operational on StarkNet, a Layer 2 solution on Ethereum. It features an order book design for its trading products, such as:

- Derivatives trading

- Margin trading

- Spot trading

Also, dYdX also offers lending and borrowing services as well.

Now, you may be thinking of Celsius as they also offer lending and borrowing for crypto users. Yet, they are inherently different. In terms of platform design, dYdX is decentralized whilst Celsius is centralized. What this means is the funds which you deposit into dYdX cannot be controlled by the dYdX team themselves. Simply put, there is no centralized control of a user’s funds on dYdX. The opposite would be true for Celsius.

Why Cosmos and Not StarkNet/Ethereum?

So, why did the dYdX team choose to build their upcoming V4 DEX on Cosmos? There are three key reasons as quoted below by Antonio Juliano, the founder of dYdX:

- It offers better decentralization compared to StarkNet, which dYdX V3 is currently operating on. dYdX V4 will also be independent of any external blockchain or system.

- It offers a higher throughput. This allows dYdX to effectively run its order book and matching engine.

- It allows dYdX the ease of building more features such as options, multi-collateral lending, and so forth.

How does Cosmos provide dYdX the above advantages? It all boils down to customization of the blockchain and the validator’s scope of work.

An example of adapting the validator’s scope of work would be dYdX’s off-chain order book. On dYdX V4, the order book that each validator stores is off-chain. Changes to the order book are made through transactions on-chain. Also, matching trades will be executed and settled on-chain. This allows for greater throughput, as compared to having an on-chain order book. For dYdX’s users, this translates to lower gas fees and a more seamless trading experience.

For more information on why the dYdX team decided on migrating to Cosmos, you can refer to their blog post here as well as the tweet below.

Yesterday @dYdX announced their decision to spin up their own chain using the Cosmos SDK, which immediately made the #Cosmos hashtag trending on Twitter everywhere

In this thread, I cover what is DyDx, their decision and the massive impact for both Cosmos & Ethereum roll-ups 🧵

— Thyborg (@Thyborg_) June 23, 2022

As dYdX prepares for its V4 launch, what does this mean for its users? Well firstly, $ETH will no longer be the gas token to use dYdX. Now, the $dYdX token will be used as the Layer 1 gas token instead. Secondly, users will get to use Cosmo’s inter-blockchain communication protocol (IBC). This allows users on dYdX to enjoy its new cross-chain capabilities.

So far, we’ve looked at the benefits to dYdX and its users for migrating to Cosmos. Yet, it does seem likely that more projects could be following dYdX’s footsteps. If a migratory trend is developing, then what does it mean for Cosmos?

Migrations – Effect on Cosmos

Indeed, it all seems good and well for both dYdX and its users. But, does the Cosmos ecosystem also stand to gain with more incoming migrations? The answer is a resounding yes. Here are two main reasons why:

- As more projects migrate to Cosmos, more utility and value are brought into the network. In turn, this attracts more projects hoping to interoperate with Cosmos’ chains.

- Cosmos Hub is the first blockchain deployment on the Cosmos network. It aims to provide services to projects that deploy on Cosmos. Such services include security, exchange services, bridges, and so forth. As more projects join the network, Cosmos Hub becomes more valuable. This is because more business activity and transactions are carried out in the Cosmos Hub through IBC.

Migrations – Effect on Terra

Currently, the Cosmos network houses a wide array of existing blockchains and dApps. As more blockchains migrate to Cosmos, these existing projects stand to benefit. This is because each migrating blockchain brings with them their current user base. With this, said users will then have easy access to all projects on Cosmos via IBC.

Yet, one particular blockchain on Cosmos seems to be bearing the brunt of this migration trend. This would be the Terra 2.0 chain. In case you haven’t heard about what happened to Terra’s original ecosystem, you can refer to our previous research here.

As Terra’s ecosystem crumbled, many teams were unable to continue building or attracting users. Terra 1.0 has simply become a dead chain. Instead of opting to build on Terra’s new 2.0 chain, many chose to emulate dYdX’s migration. In other words, they opted to build their own sovereign chain on Cosmos network, rather than build a dApp on Terra 2.0.

This did not bode well for Terra’s 2.0 chain. Talented teams of dApp builders are being drained from Terra 2.0 to the Cosmos network. With less talent, Terra 2.0 is unlikely to attract more TVL. These teams include:

- Kujira – A liquidation protocol.

- Mars Protocol – A lending and borrowing protocol.

- Apollo DAO – A yield optimizer.

For a full list of projects migrating to Cosmos, you can refer to the tweet below.

If #Cosmos was a European football league, it's safe to say it just had its biggest transfer season ever

A recap of the confirmed migrations and why it matters 🧵

— Thyborg (@Thyborg_) June 26, 2022

Migrations – Effect on Terra’s dApps

If such dApps are already compatible with Terra’s chain, then why is there a need to build a sovereign chain on Cosmos? In this case, their reasons for migration differ slightly from dYdX’s. Let’s look at them below:

- Building a Cosmos chain allows the teams to have a say of their own chain’s design. This stems from a recent painful lesson. In May 2022, Terra’s ecosystem collapsed due to the failed $LUNA-$UST stablecoin design. For teams with products on Terra, they lost all their users and TVL due to said design flaw on the main chain. This was not their fault. Now, by designing their own chain, these projects are not dependent on external chains or systems.

- Teams migrating to Cosmos from Terra can interoperate with other blockchains through IBC.

- Existing dApps are easily ported over from Terra over to the Cosmos network.

Cosmos – Competitor Analysis

It does seem clear that more projects would soon be joining the Cosmos network. However, Cosmos does have some notable competitors. Lets do a quick comparison below:

Source: Mapofzones

- Cosmos currently houses 49 blockchains (or zones). IBC allows zones to communicate with each other.

- Avalanche currently houses 24 subnets, out of which only two are mainstream projects. You can find out more about subnets here. Simply put, an AVAX subnet is similar to a Cosmos zone. Currently, there is no way for subnets to communicate.

- Polkadot currently houses 21 parachains. You can find out more about parachains in our previous research here. Cross-chain messaging (XCM) allows parachains to communicate with each other.

Judging from the number of projects deployed, it’s clear that Cosmos is ahead of its competitors. Also, its IBC is developed and functional. As of the last 30 days, IBC transfer volumes have reached almost $330 million.

Conclusion

To summarize, Cosmos’ future seems bright. As they attract more migrating projects, Cosmos will continue to lead the interoperability space.

⬆️ Now as a crypto investor, it is up to you to look for opportunities on Cosmos. On our end, we’ve already identified a few gems on their ecosystem. If you’d like to learn more about our research methodologies and gem picks, check us out at Altcoin Buzz Access.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.