The quantitative and machine learning- based models generate signals that are then executed on the clients’ connected exchange account.

B-Cube aims to be a global community, marketplace, and educational center for cryptocurrency traders, whether experienced or newcomers. Traders will have all the necessary tools and information on a single platform to trade and maximize their profits while minimizing their risks successfully. It already built a marketplace of crypto trading bots driven by AI, Sentiment Analysis, and Mathematical models. B-Cube leverages the latest advances in scientific research thanks to the company’s partnership with Université Paris-Saclay, ranked first institution in the world for mathematics (Shanghai ranking 2020). In this article, we will explain you how to use B-Cube to automate your portfolio management and also introduce the B-Cube Trading Challenge.

Dashboard

The B-Cube dashboard gives you an overview of:

- All the bots that you have subscribed

- How your portfolio has been distributed

- What is the status of your Staking

Bot Trading

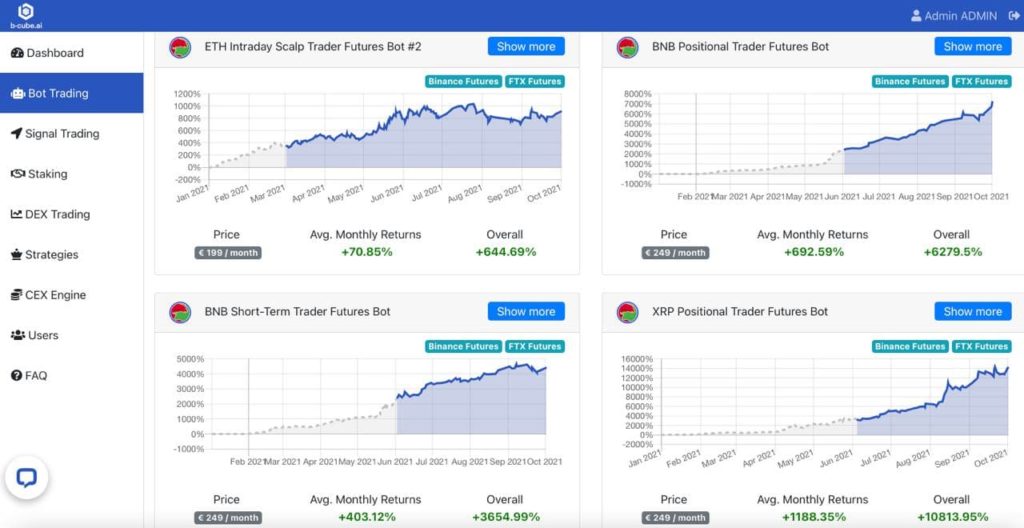

B-Cube provides multiple bots to automate your trading experience. Some of the bots in B-Cube are as below:

You can find the whole list of bots here.

Let us see how to set up the bots for automated trading.

There are 2 ways to subscribe for the Bot:

1. Bot Trading with Staking

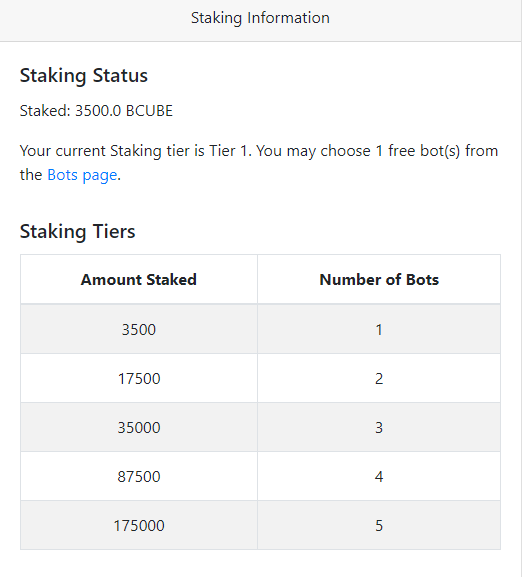

This is a very good option since you don’t have to pay any monthly fee. You just need to stake B-Cube tokens worth USD$1000 in order to activate one bot. Staking 3500 B-Cube tokens will give you access to 1 bot and as long as the B-Cube tokens are staked, your bot will be active. For access to multiple bots, you can stake more tokens.

Let us see how to activate the bot by staking:

Wallet

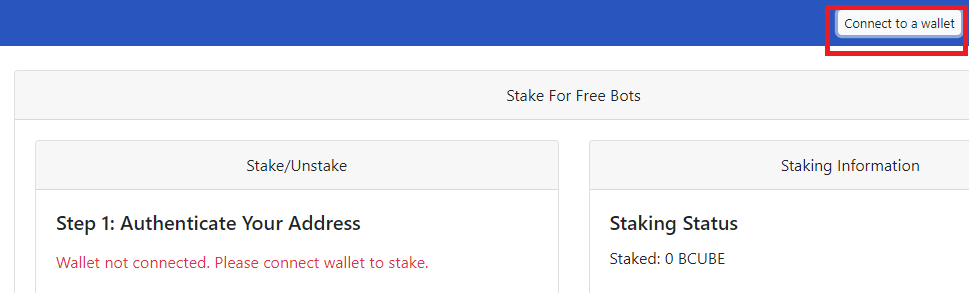

Go to Staking page and connect your MetaMask wallet to B-Cube.

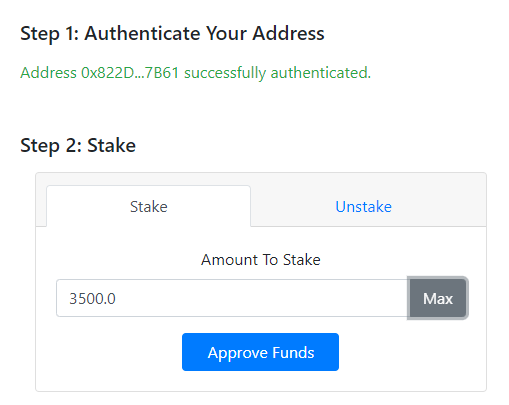

Authenticate Wallet

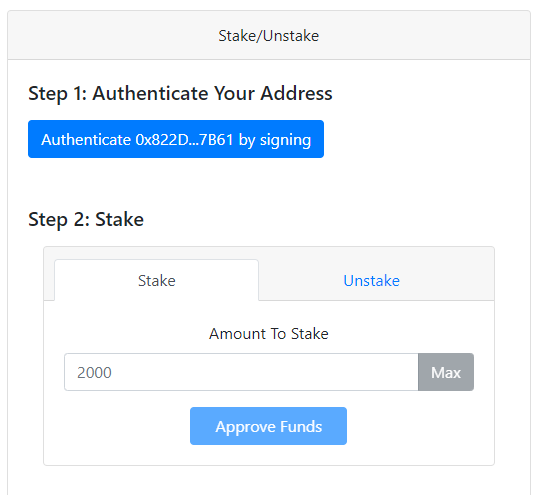

You need to authenticate your wallet.

Approve and Stake

Once you have authenticated your wallet, you need to approve funds before staking.

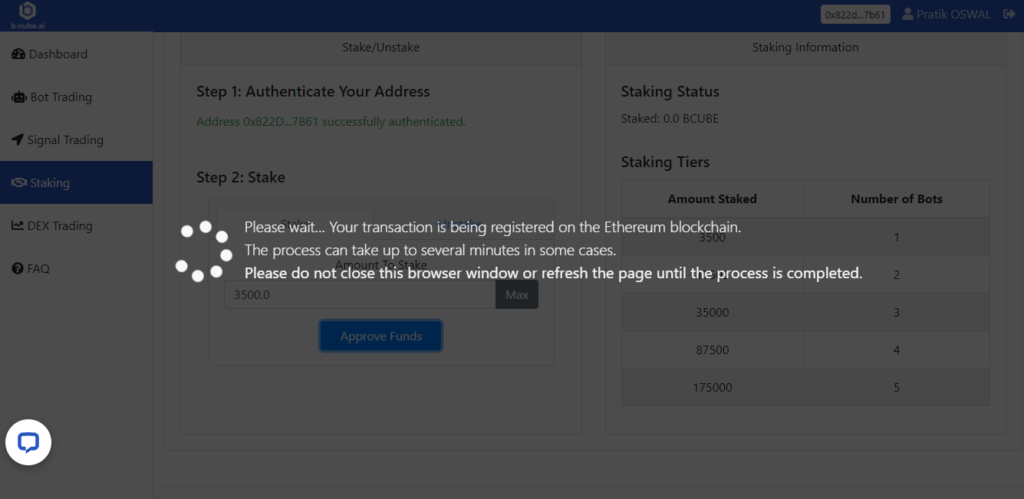

Staking

After approving, this window will pop up once you approve the gas fee.

2. Bot Trading with Subscription

The second option for activating the bots is to buy a monthly subscription of the individual bots. You can go to their Bot Trading page to review the past performance of all the bots along with their monthly fee and decide which one you want to subscribe.

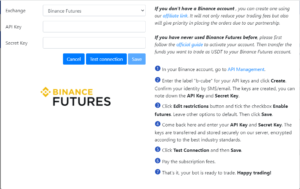

API

Go to Binance/FTX and generate your API keys. Enter the API keys and set how much of the portfolio do you want to allocate and you can get started.

Trading Challenge

We will be deploying an amount evenly split between XRP Short Term Traders Future Bot and BNB Positional Trader Bot.

BNB Positional Trader Bot:

a) Info

This bot is a long- term Positional trader on hourly charts using momentum driven technical indicators and Volume data Analysis actively trading on BNBUSDT Perpetual Futures on Binance Futures. Another layer of Machine Learning models using random forest allows adapting to the markets condition. The intent is to have good entries so that there is sustained activity in the market when it is trading. It outperforms the market over a longer period of time with very high success ratio.

b) Statistics

Best Trader: +13.57%

Worst Trader: -12.78%

Average Trade: +5.07%

Average Monthly Returns: +692.59%

Overall Performance: +6279.5%

(Statistics include all the fees (trading fees, funding fees) and slippage.)

c) Historical Performance Chart of BNB Positional Bot

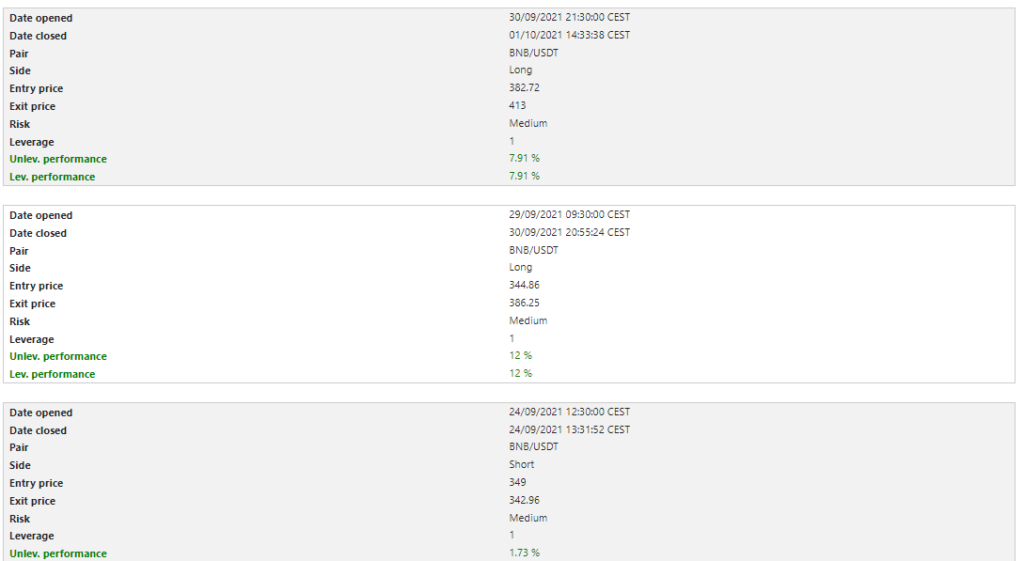

d) Details of the trades

You can see the details of all the trades that the bot has executed once you click on “Show More” tab of the bot.

We will update you with the results of the challenge timely.

Join us on Telegram to receive free trading signals.

For more information on cryptocurrency, visit the Altcoin Buzz YouTube channel.

Images courtesy of TradingView.