Ethereum was the first project to do much more using blockchain than just processing financial transactions. Over the last 5 years, Ethereum has established itself as one of the most groundbreaking technological innovations. But then unexpectedly Ethereum’s scalability became a big challenge.

And now projects like Cardano and Algorand are working to solve the problem. The army of Ethereum developers started grappling with what is known as the “trilemma.” It is the phenomenon according to which, at a given point in time, Ethereum can only achieve two parameters out of security, decentralization, and scalability. While the developers made co-existence of security and decentralization possible, the scalability of the network remains stunted yet.

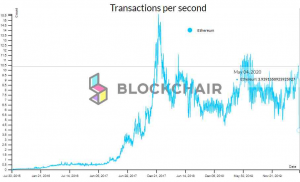

Source: Blockchair.com

Out of sheer curiosity, we referred Blockchair to know the transactions per second (TPS) of Ethereum. It was a knee-jerking discovery. On 4th May 2020, the Ethereum network was rendering throughput of 3.939 TPS, whereas Visa continued to process 1,700 transactions every second. It must be noted that the scalability of any network gets directly translated to its market adoption.

Primarily, this is the reason why Cardano and Algorand came into existence. Both projects promise to solve the “trilemma” of Ethereum blockchain to an end.

I will start the blog with the basics of both Cardano and Algorand. After that, I will list down the similarities and then draw the comparisons. Near the end of the article, I will talk about the working products and performance of projects so far. And in conclusion, I will share my opinion. So after reading this article, you will have all the information to decide between Cardano and Algorand.

Understanding Cardano

Cardano is an open-source blockchain technology project that is completely patent-free. The project offers both platform and cryptocurrency to the users just like Ethereum. Its crypto token ADA is trading close to $0.050269 at the time of press and holds the 13th largest market cap in crypto-verse.

-

What is Cardano all about?

Ethereum CEO and co-founder, Charles Hoskinson, came up with the idea of the project in 2015. After leaving Ethereum, Hoskinson established IOHK (Input Output Hong Kong) and started developing Cardano. And the project launched on 29th September 2017, after two years of development. It follows Ethereum’s smart contract functionality but promises to deliver extreme scalability as compared to Ethereum.

While Ethereum is known as Blockchain 2.0, Cardano claims to be Blockchain 3.0.

Ethereum’s answer to the scalability issue is “Casper”, the future proof-of-stake (PoS). Similarly, Cardano relies on PoS. So, what does that mean? It means the Cardano network does not have miners to validate transactions. But it has developed a unique PoS algorithm called Ouroboros. Ethereum’s Casper and Ouroboros are different in the way they select block validators.

Growing out from a scientific philosophy, Cardano is moving at a slow pace but looks like a solid pick. And that’s because Hoskinson believes only sound research can deliver impeccable quality.

The Cardano ecosystem comprises of 3 bodies:

- The Cardano Foundation

- Emurgo

- IOHK

-

What does Cardano promise to solve?

Cardano promises to address the following issues precisely.

- Scalability

- Interoperability

- Sustainability

- Ease of development

As the first project to use Haskell and Plutus programming languages, it ensures the developers can easily contribute to its open-source code. It positions an academic peer review system to make sure the code is secure and always audited. Moreover, it plans to become more scalable through sidechains.

On top of all this, the project has taken the forefront of crypto regulations as it strongly believes that sooner or later, crypto will come under the umbrella of regulators. But it promises to maintain the use of seclusion at the same time.

-

How does it address the scalability challenge?

Bitcoin’s record high TPS has been 7 while Ethereum’s best has been 15.623. For Cardano to become a real-time financial services tool, the TPS must be much higher than what Bitcoin and Ethereum are delivering. Currently, Cardano is capable of delivering 50-250 TPS, but according to Hoskinson, this is not enough to serve billions across the globe.

To overcome the problem of scalability, the team developed Ouroboros Hydra, the PoS system that uses sharding. Effectively, sharding boost the processing speed of the protocol as more nodes can participate in the system. And this will grow as the users on the platform grow.

-

Cardano architecture

Undoubtedly, Cardano is not an easy project to wrap one’s head around. Here is a very simple explanation of Cardano’s architecture.

Source: Trybe.one

Cardano Settlement Layer (CSL)

As a cryptocurrency layer of the project, CSL operates on top of Ouroboros. This is the PoS mechanism that helps the network settle the transactions at lightning-fast speeds. Recently, the project tested Ouroboros Hydra 2.0, and it reportedly delivered 1,000 TPS. According to Hoskinson, this could take Hydra to millions of TPS.

Cardano Computational Layer (CCL)

CCL is the layer that handles smart contracts and decentralized applications (DApps). It supervises the deployment and management of both and is built on Plutus.

Understanding Algorand

Algorand is an open-source blockchain technology project. As an Ethereum competitor, it brings its users a platform as well as cryptocurrency (ALGO). Its crypto token ALGO is trading close to $0.207423 at the time of press and holds the 45th largest market cap in crypto-verse.

The core principles are simplicity, performance, instant transactions, direct usage, and adoption of crypto. Just like Cardano, Algorand is trying to solve the blockchain trilemma. Along with that, it is trying to minimize the computational cost of transacting.

-

What is Algorand all about?

Silvio Micali, a computer scientist at MIT Computer Science and Artificial Intelligence lab thought of creating a new consensual algorithm. Micali is also co-inventor

of Zero-Knowledge Proofs. With Algorand, the intent was to scale the blockchain without compromising the security and decentralization.

Micali called this consensus, Pure Proof-of-Stake (PPoS). And this randomly selects the block producers through Verifiable Random Functions (VRF). After two years of extensive research and development work, the first block of Algorand was mined on 11th June 2019.

Algorand claims to be a truly decentralized network as it is controlled completely by its users. As the users are the block producers, there is hardly any chance of a bad actor being present.

-

The Algorand ecosystem comprises of 2 bodies:

- The Algorand Foundation – Controls token sale

- Algorand – Builds protocol

-

What does Algorand promise to solve?

Algorand promises to address the following issues precisely.

- Scalability

- Security

- True decentralization

- Accidental forking

It establishes the unique PPoS consensus. According to the research conducted by the Algorand team, DpoS (Delegated-PoS) never assures that the selected block producer will be honest always. Therefore it leaves a chance of centralization.

On the other hand, in bonded PoS, a staker puts in some of the funds and could harm the network as he doesn’t have much to lose. Effectively, all this leads to less distribution of consensus. In the light of how PPoS of Algorand operates, the network will remain most decentralized as all network users will be involved in consensus.

-

How does it address the scalability challenge?

The Algorand protocol uses cryptographic sortition to enable the fast finality of transactions. The blocks are constructed into 2 phases through lotteries. As Algorands mainnet was launched with the capability of handling 1,000 TPS, we believe that Algorand can achieve what it promises.

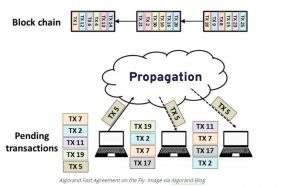

Source: Researchgate.net

This process works in two phases.

-

Proposal phase

The cryptographic sortition randomly selects an ALGO owner to create a block. And only the selected ALGO owner knows about this. Before he even lets anyone else know, the new block creation is complete, leaving no chance of vote-selling.

-

Voting round

The network randomly selects a committee of 1,000 verifiers. They are informed about the new block creation. These verifiers validate the block and this process takes only 5 seconds.

-

Algorand architecture

In a traditional blockchain, for the block to be finalized, it must be propagated to everyone. After everyone agrees on the validity of the block, using some mechanism it is added to the chain. This is a lot of work. And Algorand has effectively brought down the block addition time with its PPoS protocol.

This is known as Algorand Fast Agreement on the Fly. While the block is still propagating, the agreement on the proposed block is reached. The moment, the users receive the block, they vote and the block continues to propagate. Effectively, when the block reaches the last user, the voting is already over and it is immediately added to the chain.

Thus it gives the experience of instant agreement.

Now is the time to draw the comparisons between Cardano and Algorand.

Price Performance

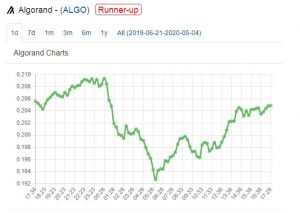

ALGO

Source: walletinvestor.com

ADA

Source: walletinvestor.com

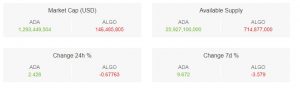

More stats

Source: walletinvestor.com

Parameter |

Cardano |

Algorand |

| Project launch date | 2015 | 2017 |

| Foundation | IOHK | The Algorand Foundation |

| Consensus | Ouroboros Proof of Stake | Pure Proof of Stake |

| Ticker | ADA ($0.050269) | ALGO ($0.207423) |

| Token Listing | Binance, UpBit, Huobi, Kraken, Bittrex, Binance US, OKEx, KuCoin, Gate.io, Bitcoin.com, Latoken and more | Coinbase Pro, Binance, Huobi, Kraken, Gate.io, Binance US, KuCoin, Bitfinex, WazirX, Bittrex and more |

| TPS | Each Hydra head can handle 1,000 TPS | 1,000 TPS |

| Mainnet | Shelley mainnet will launch in Q2 of 2020. This will make Cardano fully decentralized | Launched officially on 5th June, 2019 |

| Wallet | Full-featured Yoroi and Daedalus wallets. These can be integrated with Ledger Nano X | Algorand Wallet can be integrated with Ledger Nano X |

| Latency | Low latency claims | Latency < 5 secs |

| Token launch | 25,927,070,538 ADA were sold at the time of launch at $0.025 | On June 19th, 2019 held its first in series Dutch auction at $2.40 and raised $60 million |

| Transaction fees | $0.0072 per transaction | $0.00204 per transaction |

| Partnerships |

|

|

| Staking Rewards | 3.7% | 5.43% |

My take

It was indeed a long one. But when it is about two neck-to-neck competitors, the verdict is never going to be an easy one. Both the projects are forging ahead with the same philosophy, their teams believe in extensive research and carefully developed and curated products.

However, there is a sea of a gap between the popularity of both the projects. But there is a reason for that. Cardano is extremely transparent about its products, product reviews, and third-party audit reports. On the contrary, Algorand is keeping quiet about its products. Although Algorand has been quite transparent about its token sales, nothing much is known about the project.

As we know much more about Cardano, it wins over Algorand hands down for me. With Cardano’s Shelley upgrade just around the corner, we are really excited, let us now wait and watch what Algorand throws at us.

—

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided.

Do your own due diligence and rating before making any investments and consult your financial advisor. The researched information presented we believe to be correct and accurate however there is no guarantee or warranty as to the accuracy, timeliness, completeness. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd. All rights reserved.