The fast growth of the DeFi market makes it challenging to identify the most lucrative opportunities. Every day, new protocols emerge, and those that do exist are constantly searching for fresh strategies to remain competitive. With investors seeking higher rates and lower fees, DeFi platforms aim to provide more rewards and better stake incentives. Beefy Finance has become a popular choice when it comes to yield farming. Let’s explore Beefy Finance and how you can use it to earn passive income.

What Is Beefy Finance?

Beefy is a multi-chain, decentralized yield optimizer that allows users to earn compound interest on their crypto holdings. With safety and efficiency in mind, Beefy offers you the finest APYs.

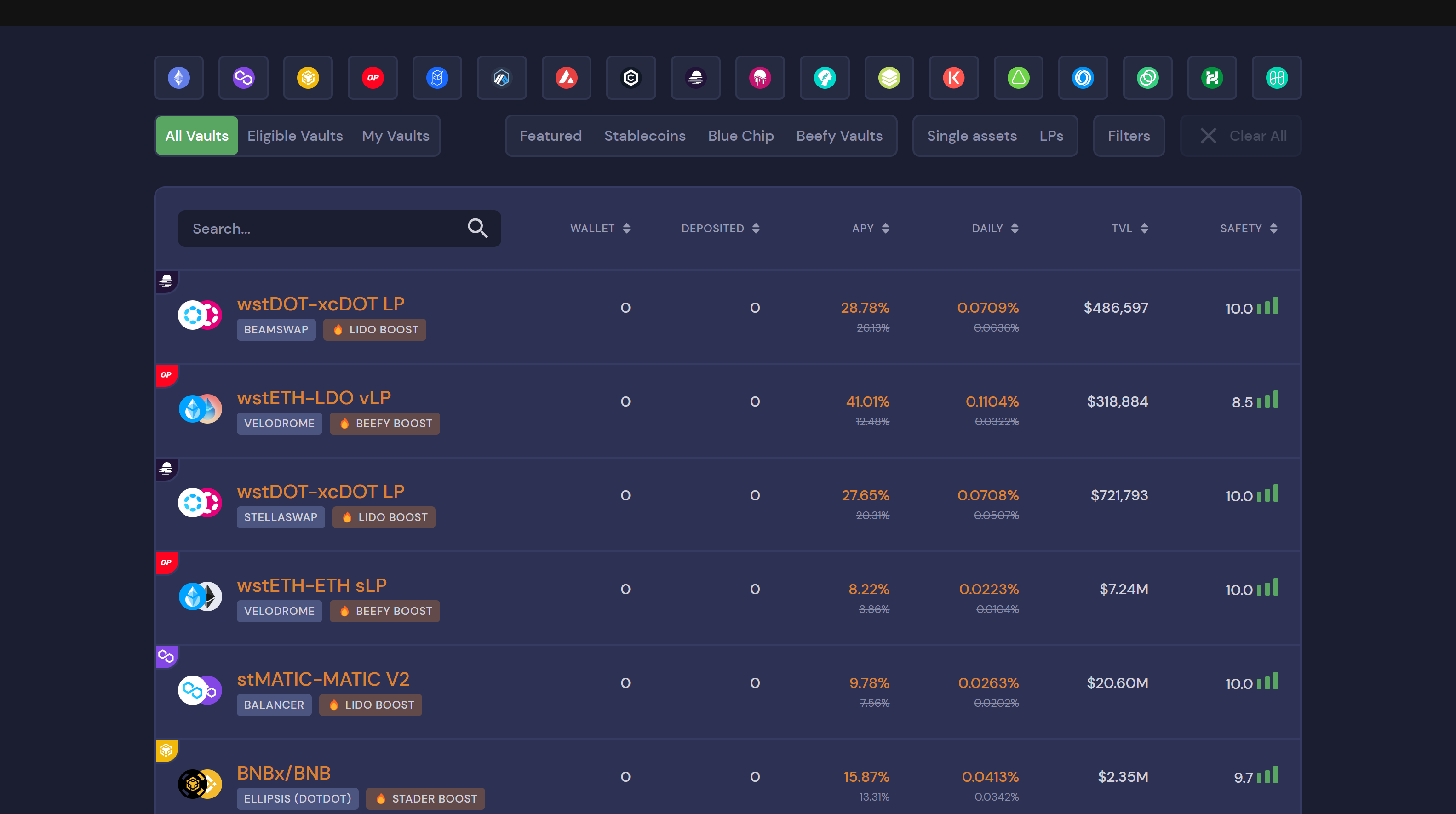

Like most DeFi platforms, Beefy Finance features yield farms and staking pools. However, what sets them apart from rivals is their almost unbelievable APR returns on their vaults while offering multi-chain staking and farming pools. Of course, as liquidity increases, the APR will also decrease.

Beefy automatically maximizes user returns from various liquidity pools (LPs), automated market-making (AMM) initiatives, and other yield farming opportunities in the DeFi ecosystem with a set of investment techniques secured and enforced by smart contracts.

Beefy Finance’s main product is the Vaults, where you can stake cryptocurrencies. The investment strategy linked to the Vault will automatically boost the number of tokens you have deposited by adding random yield farm reward tokens back into your initially placed asset. And contrary to what the word “Vault” might imply, your money is never “locked” in any Vault on Beefy; you can always withdraw at any time.

$BIFI is the native token of Beefy Finance. It offers two use cases:

- Both holders and stakers of $BIFI have the right to vote on crucial governance decisions

- $BIFI stakers can receive a portion of Beefy’s revenue as compensation.

Who Owns Beefy Finance?

The team behind Beefy Finance is anonymous. However, two of the ten developers are searchable by usernames; “@superbeefyboy” and “@beefyfinance.” Nevertheless, its team members have attended insider conferences and gotten interviewed; both requiring physical presence. And integrations with prominent cryptocurrency exchanges like Binance demand the submission of personal data.

The Pool’s Liquidity Providers and the Beefy Team are the only participants in the BIFI Token Allocation. So the project has not received any funding from early investors. As a result of Beefy Finance’s multi-chain debut, this platform has numerous partners in various ecosystems, the bulk of which are AMM & DEX, where the project has a liquidity pool.

They include BabySwap (Binance Smart Chain), Beethoven (Fantom), Qi Dao (Polygon), and many others.

When Did Beefy Finance Start?

Launched on the Binance Smart Chain (BSC) in September 2020, Beefy Finance is a multi-chain decentralized yield optimizer. Its purpose is to automate liquidity pool-based investment strategies. The platform reinvests users’ yield profits to boost gains. Also, owners of the Beefy Finance token can stake tokens to earn daily interest payments and participate in governance votes on the project’s development. Vaults’ initial opening was on October 8, 2020.

Is Beefy Finance Safe?

According to Beefy Finance, DefiYield audited it in 2021. The actual project got underway in late 2020. The first audit was on the $BIFI token, the RewardPool, and the timelocks. Later, CertiK verified the smart contracts and other security features of Beefy through an audit.

Beefy Finance contains Smart Contracts to employ a set of investing strategies. So the platform is also at risk of Smart Contract vulnerabilities. The project is still live today with more growth than before. The project is, therefore, less susceptible to pump-and-dump schemes. Moreover, their listing criteria are also top-notch. But you must educate yourselves about the risks associated with farming, and always do your research and take the appropriate risk-to-reward ratio.

Is Beefy Finance A Good Investment?

Investing money into yield farming is a risky endeavor. We would not recommend putting your life savings into this. Start by investing in the 50s or 100s, and once you get familiar with it, put in more.

Impermanent loss is, without a doubt, one of the most recognized hazards associated with liquidity pools. If the value of the assets held in a liquidity pool changes after provision, there will be an impermanent loss. It will cause users to lose money when they make withdrawals. The loss rises with a higher price change.

Defiyield and CertiK audited Beefy first, but that doesn’t guarantee their security. Smart Contracts are always at risk from attackers, so it is vital to consider all the information before making any conclusions. Nevertheless, Beefy Finance employs more than ten Smart Contract designers to examine and test the investment plans, vaults, and Smart Contracts, preventing as many bugs as possible.

The phrase “With great power comes great responsibility” is undoubtedly true to De-Fi protocols. This well-known adage, in this case, can be stated as “With big profit comes bigger risks.” Therefore, do your research before investing in any De-Fi protocol.

Read article two in our series to learn more about Beefy Finance and what makes it different from its counterparts!

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.