The AAX exchange has been gaining a lot of traction lately. It has been built on LSEG Technology’s matching engine in a cloud computing environment which offers ultra-low latency trading (as low as 90 microseconds) for the best prices. The trading fee is considerably low, and the order book is highly liquid. Due to this, many traders have started preferring the AAX exchange.

The AAX exchange has four primary buying and selling options:

- Fast Buy

- OTC

- Spot

- Futures

Let us review each of these options.

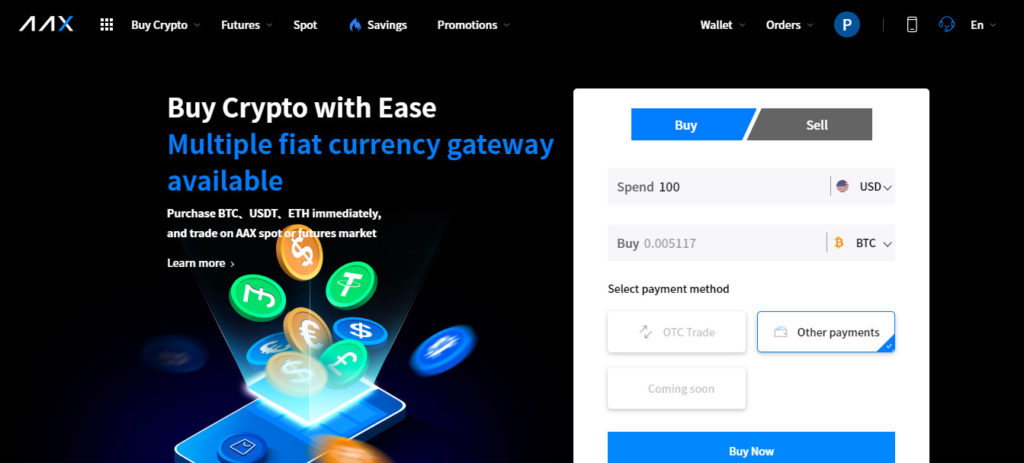

Fast Buy

The Fast Buy section offers a platform to convert 20+ currencies to crypto. It is very simple to use. You can convert your fiat currency to crypto using your bank through various payment methods.

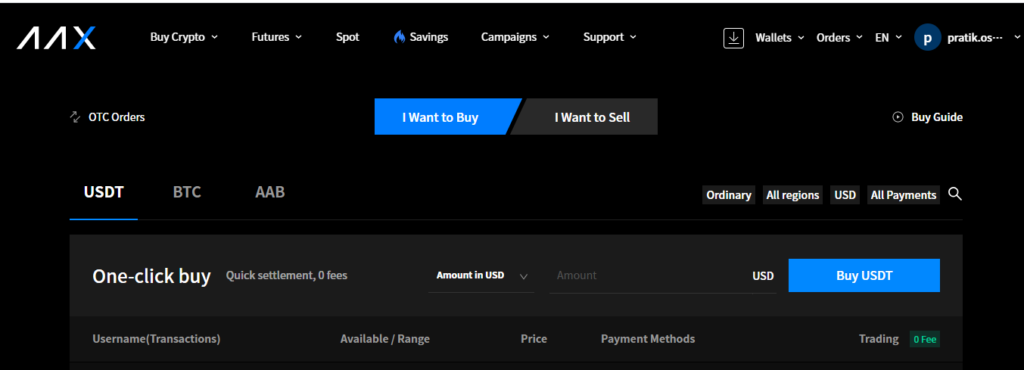

OTC

OTC stands for over-the-counter. It is suitable for traders who are trading with a very high volume.

OTC trades make sure that the orders are fulfilled at a fixed price for high volume traders without slippage. The platform will automate the trade between two parties without the order being a part of the order book.

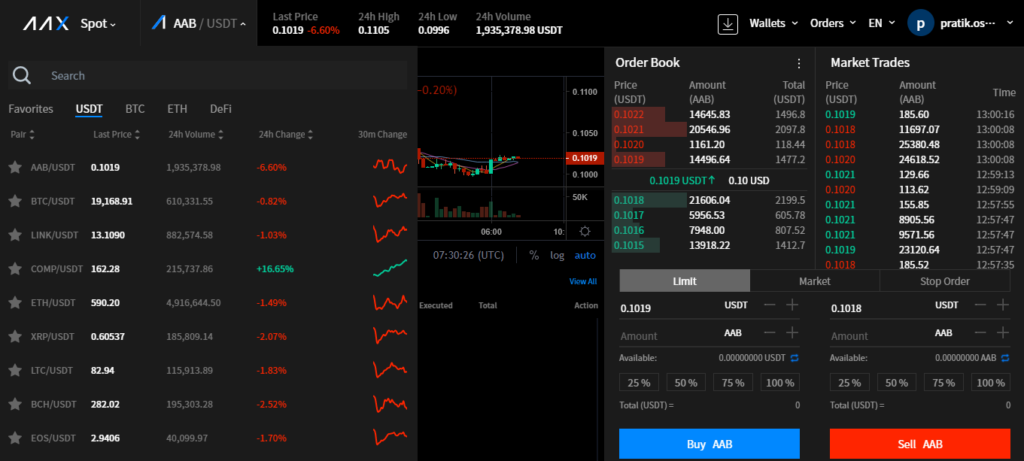

Spot Trading

Spot trading provides a wide range of crypto-to-crypto trade options. You can buy and sell crypto paired with USDT, BTC, and ETH.

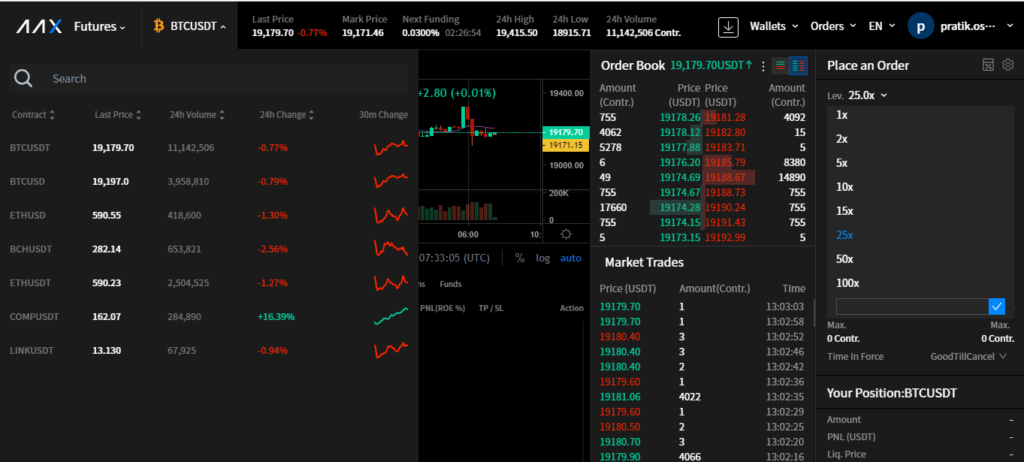

Futures Trading

AAX offers BTC-settled and USDT-settled perpetual (no expiry) futures trading contracts with up to 100X leverage.

Now let us review the order types on AAX. There are three types of orders on AAX:

- Limit Order

- Market Order

- Stop Order

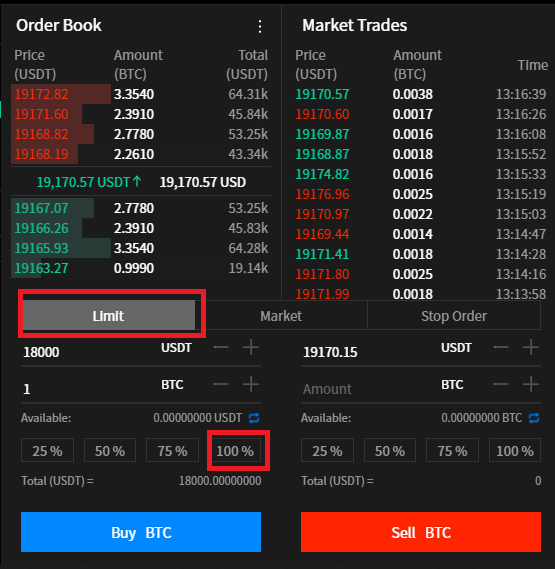

Limit Order

Limit orders are set to buy or sell an asset at a pre-determined price. Let’s say BTC is trading at $19,000 and you want to buy BTC when the price drops to $18,000. So you set a limit buy order for X number of BTC at $18,000. Similarly, if you have bought X number of BTC at $18,000 and you want to sell them at $19,000, you can set a limit sell order for X number of BTC at $19,000.

It also provides you a quick access button to select the percentage of your asset you want to use in the trade: 25%, 50%, 75%, or 100%.

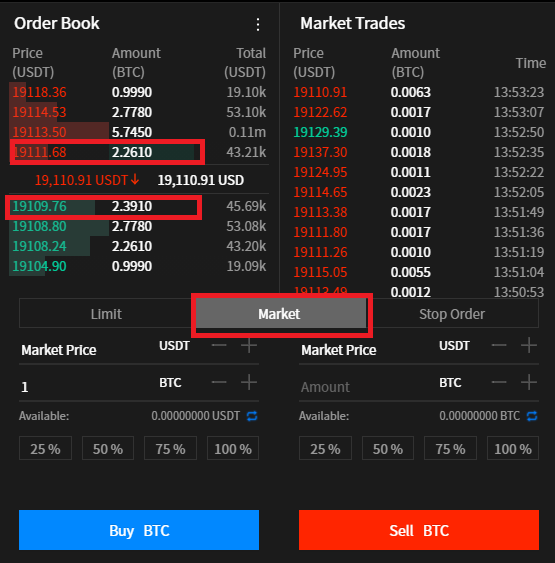

Market Order

Market orders are the orders which will get filled instantly. If you wish to sell, it will match your order size with the closest buyers and execute the trade immediately. Similarly, if you wish to buy, it will match your order size with the closest seller and execute the trade immediately. Latency may affect the final price that you get. You cannot set a price for your order in market order.

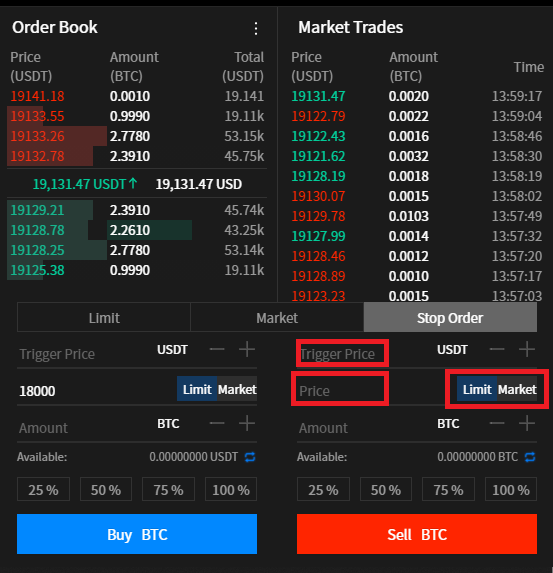

Stop Order

Limit orders are orders which will trigger when the market reaches a specific price. There are two ways in which you can set a stop order.

Stop Limit: You have to specify a trigger price which will be the price where the trade gets activated and a limit price where you wish to execute the trade just like a limit order.

Stop Market: You have to specify a trigger price which will be the price where the trade gets activated and then the trade will execute at the market price just like a market order.

You can use stop orders to set your target price or stop loss.

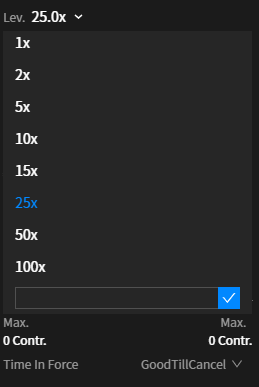

Leverage

In futures, AAX provides you an option to set your desired leverage. You can set a leverage up to 100X.

Once your trade is open, you will be able to see your position in the open position section, and your pending unfilled orders will be seen in the open orders section. You can also see your order history, conditional orders, trade history, closed positions, and funds in this section.

TP/SL

Once your position in futures is open, you can set a desired TP (Take Profit) and (Stop Loss) directly in the TP/SL section.

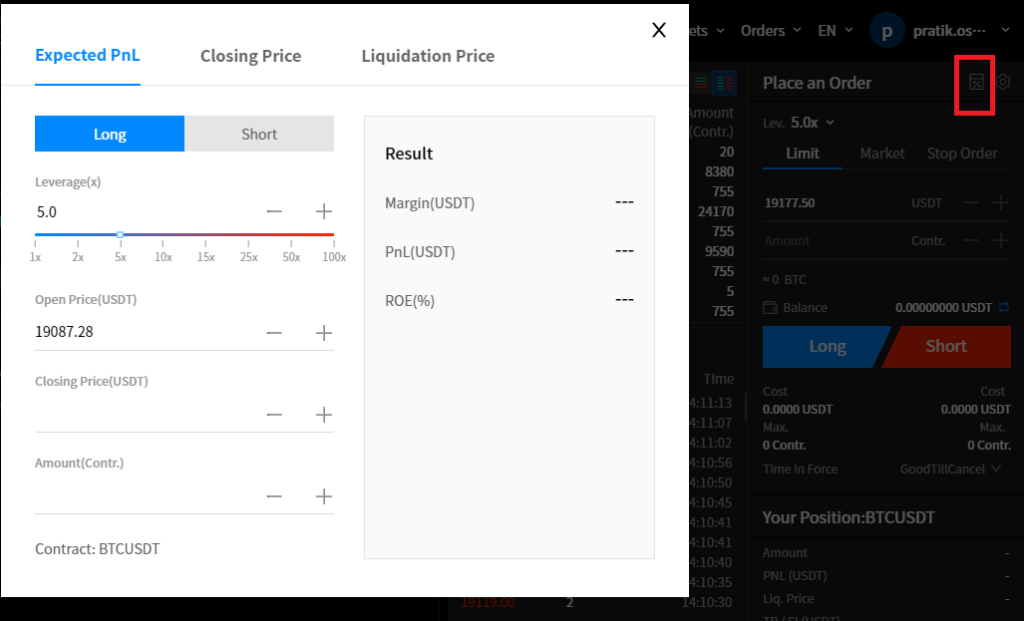

Calculator

An inbuilt calculator has been provided which can help you calculate your potential profits and losses for your positions at your desired TP and SL.

You can also calculate your ROE percentage and your liquidation price for a selected leverage. This way, you can plan your trades carefully and make sure that you can place a stop loss above your liquidation point.

With all of these cutting edge features, highly liquid order book, and ultra-high speed trades, AAX is on the path to becoming one of the leading exchanges in this crypto ecosystem.

Sign up on the exchange using this link to get discounts on trading fees.

DISCLAIMER:

The information discussed by Altcoin Buzz is not financial advice. This information is for educational, informational and entertainment purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to information provided.

Do your own due diligence and rating before making any investments and consult your financial advisor. The researched information presented we believe to be correct and accurate however there is no guarantee or warranty as to the accuracy, timeliness, completeness. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This interview, review or update article has been compensated for media cooperation and has been sponsored for by the interviewed or reviewed organization. Copyright Altcoin Buzz Pte Ltd. All rights reserved.