Today, June 7, 2022, should see a large piece of crypto legislation start the process in the US. It should define the position of coins as a security or a commodity. It should also include stablecoins and the direction of NFTs. The report even includes CBDC frameworks.

However, yesterday, June 6, a first draft appeared. Sometimes leaks are nice. In this case, it gives us a better idea of what to expect. So, let’s have a look at what this crypto legislation is all about.

One of the largest pieces of crypto legislation will be introduced this Tuesday (6/7).

It includes definitions of which coins are commodities, coins considered securities, stablecoins, CBDC framework, and NFT direction.

Let's dive into why you should be paying attention. 🧵

— Small Cap Scientist 👨🔬🧪🥼 (@SmallCapScience) June 4, 2022

The Legislation, a First Look

Small Cap Scientist was one of the first to mention this news in a thread. He is active on Crypto Twitter and claims to be an investor and researcher. He also states that he has a first script of the bill, dated March 1, 2022. That’s a while back. His first insights are worth mentioning, though. After that, we have a look at yesterday’s leaked paper.

Senator Cynthia Lummis (R) from Wyoming and Senator Kirsten Gillibrand (D) from New York are behind this bill. Sen. Lummis has been buying Bitcoin since 2013, when the price was around $320 per BTC. Quite a few prominent Bitcoin maximalists helped her to prepare this bill.

- Michael Saylor—CEO of tech firm MicroStrategy. He owns around 129,000 BTC.

- Ted Cruz—Texas Senator who owns Bitcoin.

- Caitlin Long—CEO of Custodia Bank and a 22-year Wall Street vet.

Crypto Small Cap findings show among others the following.

- Almost all cryptocurrencies become a security. This includes ETH, but most likely excludes BTC.

- Supposedly, it bans CBDCs.

- CEXs may need to comply to legislation. Is that the reason for the Coinbase 180° turnaround about their job announcement?

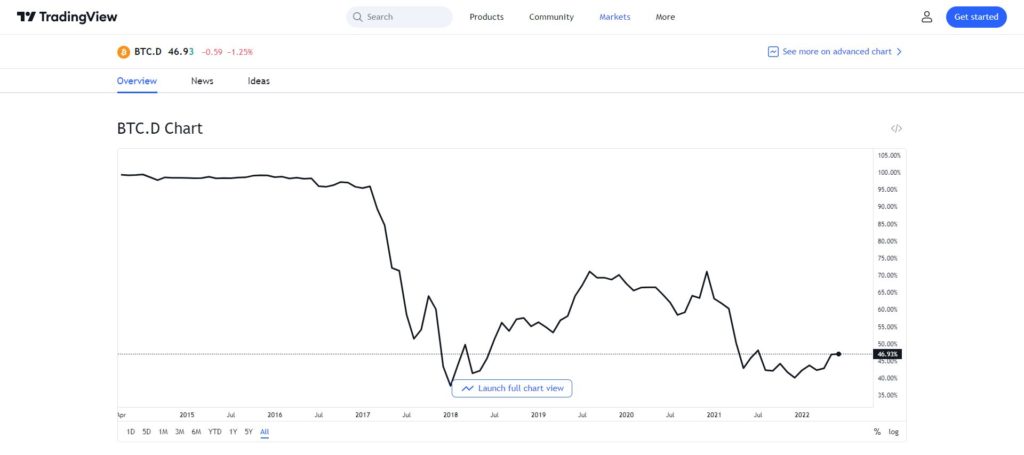

To sum up, his conclusion is that this bill favors Bitcoin over other cryptos. Among others, he predicts a Bitcoin dominance of 60-73%. Currently, this stands at almost 47% according to Trading View. He also says that current US leaders don’t understand crypto. Another positive, he sees, is that Lummins and helpers at least understand crypto. He saw an early version of this bill. However, it addresses pretty much all current outstanding questions in the crypto space.

Source: Trading View

The Leaked Version From June 6, 2022

The Twitter moniker slam (@bot_slam) leaked the bill in a Twitter thread. It didn’t take long for Crypto Twitter to give its two cents worth.

We picked Adam Cochran to dissect the bill. He’s a partner at Cinneamhain Ventures. Furthermore, he’s also an Adj. Professor Info Sci/Biz Analysis. His first opinion is that it is a good thing, this bill concept. It will move crypto forward, but it will cause growing pains. It will also come at a huge cost.

His Twitter thread has the following conclusions on this crypto legislation.

- DAOs need to register as entities in the US. This is for tax benefit. No registration makes them an unincorporated association. If not registered in the US, the US views it as personally taxable.

- All exchanges and stablecoin providers must become a registered entity. However, for DeFi, there’s no clear definition yet.

- It clears up securities laws. They look upon many assets as commodities under the CFTC. This is the Commodity Futures Trading Commission.

- With any debt, equity, profit revenue, dividend of any variety, sees a big change. Now it explicitly is not a digital asset commodity!

- Anonymous projects cannot comply with this new bill.

- Trading just 1 digital asset meets the burden of being a digital asset exchange. This may include AMMs in the current version.

- Increased control over exchanges. A massive increase in compliance costs. This implies higher fees. On the upside, likely better listings, and no trading against their users.

- A new bankruptcy definition. This means that deposited assets will get returned and not liquidated.

- Every time a source code changes, users need to agree upon a new ToS (terms of service). Language is not yet clear on this.

9/12

-Gives depository institutions the right to issue stablecoins which is good.

-Gives clear compliance requirements and penalties. They are all higher than we'd like but at least it is clear and not rules via enforcement.

— Adam Cochran (adamscochran.eth) (@adamscochran) June 7, 2022

More Insights on the New Bill Proposal

- Once this bill passes, there’s a 90-day window to check how it works. This can lead to more regulation. This is after it passes both houses and the President signs it.

- Depository institutions have the right to issue stablecoins. Cochran sees this as a good development.

- Compliance requirements and penalties are clear. Most likely higher than anticipated.

- It would unify some money transmission laws across states. For the US, a plus. This would also lead to expanding information sharing. That includes agencies on both state and federal level.

Cochran continues to express that he likes the general idea of this proposed bill. It clarifies that the powers that be, approve of crypto in the US. However, there’s also a downside. Legislation seems stricter than, compared to banks. The same goes for other financial services providers. DeFi seems to draw a short straw at the time being.

He sums this up by stating that is not the definite bill. Instead, it is something the lobby groups will have a go at first. They will try to smoothen the rough edges.

According to Cochran: “I would say if it is though, and if it passed in this form it’s good *LONG* term for big entities. However, super painful near term for 99% of crypto.”

However, he thinks the intent is good.

Conclusion

As Sam Cooke already knew in 1964, ‘A change is gonna come’. This time for crypto. Many times, there was already a mention of this regulation. This is the first time that we see an actual bill proposal. It’s not the final version and turning this into a real bill, will take time. There will be more crypto legislation coming, in other territories as well. Crypto needs some form of regulation, this is a start.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.