Whenever Andre Cronje, Founder Yearn Finance tweets about a coin, crypto users rush to buy that coin. This is what is happening to Hegic right now. It seems Hegic technology stack has impressed Andre. According to his tweet, he and Molly Wintermute, Hegic’s anonymous developer have come up with exciting ways to create generic call/put options for any Uniswap protocol pair. To take it a step further, Andre bought a Curve call using Dai using the Hegic Options tech stack. Meanwhile, Hegic price has soared by over 34% in the last 24 hours.

Hegic is an on-chain peer-to-pool options trading protocol. Built on Ethereum it acts as an automated market maker (AMM) for options. Moreover, it offers its users a simple and intuitive interface to trade non-custodial on-chain call and put options. Currently, Andre, the YFI founder is testing and auditing the protocol.

.@CurveFinance CALL bought at $0.046 with DAI for next 24 hours thanks to @HegicOptions tech stack. Will do medium write ups and UIs after some more testing & audits.

Options purchasable in DAI, USDT, and USDC. Denominated/settled in DAI.@iearnfinance vaults as LP pic.twitter.com/DZfcCWG5MH

— Andre Cronje (@AndreCronjeTech) November 9, 2020

Liquidity deepens

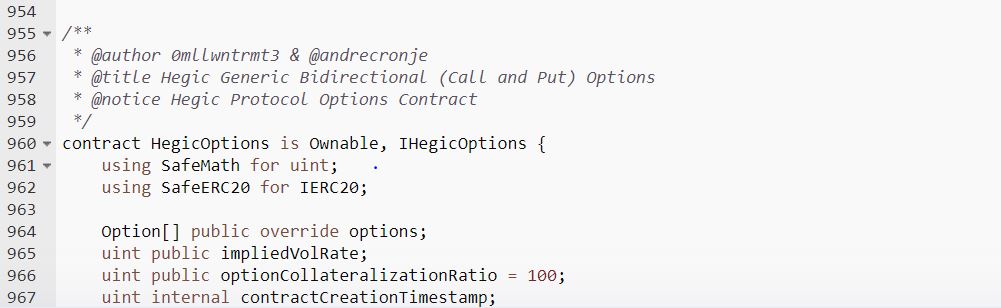

According to YFI designer @WrongNebula, while the world was shouting DeFi is dead, Molly and Andre were busy coding the Hegic Generic Bidirectional Options contract. He even shared a code snippet of the contract.

Source: @wrongnebula

Interestingly, on 8 November, a whale deposited wBTC worth $6,000,000 into Hegic $WBTC pool in a single transaction.

🤯🤯🤯 $6,000,000 deposit 🤯🤯🤯 into the Hegic $WBTC pool in a single transaction:https://t.co/k1On2wtZcb 😳

🤔 Does any Hegician OG remember when Hegic’s liquidity pool with $30K of $ETH were “pretty good” back in spring?

cc @DeFi_Dad @DegenSpartan @Mariandipietra @3xhuman https://t.co/KTndYgDxle

— Hegic 🌖 (@HegicOptions) November 8, 2020

Right now, the Hegic supporters like @degenSpartan are pretty excited about the deepening liquidity.

i think it's easier to think about investing in something when you are also a user

i LP for the @HegicOptions pools

i own $HEGIC

i provide liquidity for hegic on @UniswapProtocol

i buy options for protection and speculation pic.twitter.com/ynNGaQ1KfT— 찌 G 跻 じ ⚡️ 🔑 (@DegenSpartan) November 9, 2020

The Good, the bad, the ugly

According to YFI super-bull @krugman25, Hegic Options are grossly overpriced and this might impact its popularity. However, he does mention that Hegic offers its users an exceptionally simple user interface and deeper liquidity.

I've been digging into #Hegic options and so far I'm not impressed. The options are grossly overpriced.

You can have all of the liquidity you want but if you don't have buying then all you will end up with is a glorified wallet for LP's.#DeFi $HEGIC

— 아론 | 🦸♂️ ΞtherMan | 🍠 Chad | 🐢 $NXM SuperBull (@krugman25) November 8, 2020

Could this be a rug pull?

Waronrugs, a community movement against rug pulls is already issuing Warning Advisory. According to the tweets, trading Hegic on Uniswap is very dangerous right now. This is because anyone who owns more than 1 million $HEGIC can dump them and pull the rug.

Currently, the total Hegic supply is 3 billion which is 3000x the amount currently pooled on Uniswap. Additionally, the liquidity is not locked on Unicrypt thus the likeliness of losing funds is high.

However, Waronrugs has not issued a Scam Advisory against Hegic. That’s because the project is solid and Andre endorses it.

⚠️Warning Advisory #1 – Hegic $HEGIC (0x584bc13c7d411c00c01a62e8019472de68768430)

Reason: Total supply is 3 billion, that's 3000x the amount currently pooled on Uniswap. Liquidity is not locked on Unicrypt.

Likeliness of losing all funds: High

DYOR. #WARONRUGS❌ #CryptoRedFlag

— #WARONRUGS❌ (@waronrugs) November 9, 2020

Hegic Price

In the last 7 days, Hegic price is up by almost 124%. Interestingly, the pump started a few weeks ago when Hegic v2 yVault testing and audition started.

For more crypto-related updates do check out the Altcoin Buzz YouTube channel.