In this 2-part article, You can read the first part here.

Let’s discover more about Bitcoin’s transactions from the IMF.

Data about Bitcoin Cross-Border flows

This aspect of this article focuses on the data used for analysis. We would also point out critical facts about Bitcoin transactions and cross-border flow.

- Bitcoin Cross-Border Flows and Capital flow

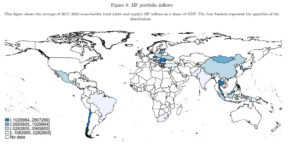

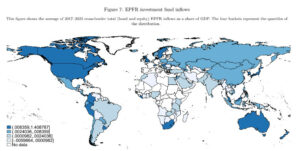

This report uses EPFR and IIF data to compare Bitcoin cross-border flows and capital flow.

EPFR tracks money movement in investment funds, while IIF monitors cash flow in a growing market. EPFR helps understand investor behaviors, while IIF gives insights into investment trends. So, Bitcoin cross-border flows reflect fund movements into the country. Here is the chart for EPFR:

Source: IMF

Source: IMF

Here is the chart for IIF:

Source: IMF

Facts on Bitcoin Transactions and Cross-Border Flows

- Size of transaction

Bitcoin’s on-chain transactions are more extensive than off-chain transactions.

- Location

Bitcoin is efficient for cross-border transactions and is a globally accepted digital currency. It is more prevalent in Argentina, Venezuela, Africa, Asia, and Eastern Europe. The three approaches for getting users’ locations indicate the global adoption of Bitcoin for Cross-Border transactions.

- Scale of Transactions

The volume of Bitcoin cross-border flows differs for every country. Countries with more significant capital flows have less Bitcoin flow. This analysis proves that Bitcoin plays a vital role in cross-border transactions.

Factors Influencing Bitcoin Cross-Border Flows

Let’s analyze global drivers and the broad dollar index to get this information.

VIX is a global driver, and the broad dollar index shows global financial conditions. Researchers reviewed inflation and interest rates compared to the US to understand how they influence Bitcoin’s cross-border interactions. Understanding the economic system will help better understand Bitcoin’s role in this.

We calculate these metrics using Bitcoin-specific drivers, such as the Crypto fears and greed index and the Bitcoin Parallel rate premium.

Bitcoin Fear and Greed Index is 72. Greed

Current price: $66,407 pic.twitter.com/uWGLWBTzFO— Bitcoin Fear and Greed Index (@BitcoinFear) April 24, 2024

To see the link between these factors and Bitcoin’s cross-border flows, we utilized panel OLS estimation by amplifying it with GDP to get country-specific information. The analysis discovered that Bitcoin-specific drivers are part of the cross-border flow process even though traditional drivers influence portfolio flows.

Bitcoin interacts with economic factors to give the best results of its use cases.

Conclusion

Bitcoin has been topping charts globally, raising interest in its cross-border transaction flow. Our analysis shows that Bitcoin is efficient for cross-border transactions but does not substitute traditional capital flows. Understanding how Bitcoin functions cross-border is a continuous process in crypto. More developments make it to the limelight, leading to further research.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

Source:

Source: