RWA is the tokenization of real-world assets. This is one of the big verticals for this bull run. For example, BlackRock launched a $1 billion fund to invest in RWAs. This caused a price increase across the board in all RWA projects. Now, Morpheus Labs also allows for tokenization and the creation of digital assets.

So, let’s take a closer look at how Morpheus Labs accommodates tokenization. We investigate the available features and tools.

Reasons to Tokenize Assets

Tokenization of real-world assets has various use cases. One of the most appealing reasons is that you can fractionalize the assets. To clarify, tokenization means that you change RWAs into NFTs. Now, it’s possible to fractionalize these NFTs.

This can have various advantages. For example, you can’t afford a house that’s worth $15 million. However, when tokenized and fractionalized, you can own any part of it that you can afford. Another advantage is that you cut out any middlemen or brokers. So, there’s no need to pay them any commission or other fees. Another result is that an illiquid market, like real estate, becomes more liquid. Because you fractionalize the asset, more people can invest in it. Hence, it raises the assets’ liquidity.

Morpheus Labs sees three major opportunities in tokenizing RWAs.

- Global reach — On-chain, there are no borders between countries. Transactions also happen within seconds or minutes. This depends on which chain you choose.

- Programmability — You can program digital assets. This allows you to add extra functionality.

- Traceability and auditability — On-chain transactions are transparent. It also allows for authentication of the assets. It also helps with regulatory compliance and auditing processes.

You can apply the tokenization of RWAs to various verticals, for example,

- Finance and banking

- Art and creative Industries

- Real estate

- Gaming

So, now that you know why tokenization may be a good idea, let’s look at the tools that Morpheus Labs can provide.

Tokenization is the process of converting a physical asset, such as a product or service, into a digital token that can be traded on a blockchain. Learn more about how this can provide several benefits for businesses below 👇🏻 pic.twitter.com/ueF4LByR8D

— Morpheus Labs (@morpheuslabs_io) December 29, 2022

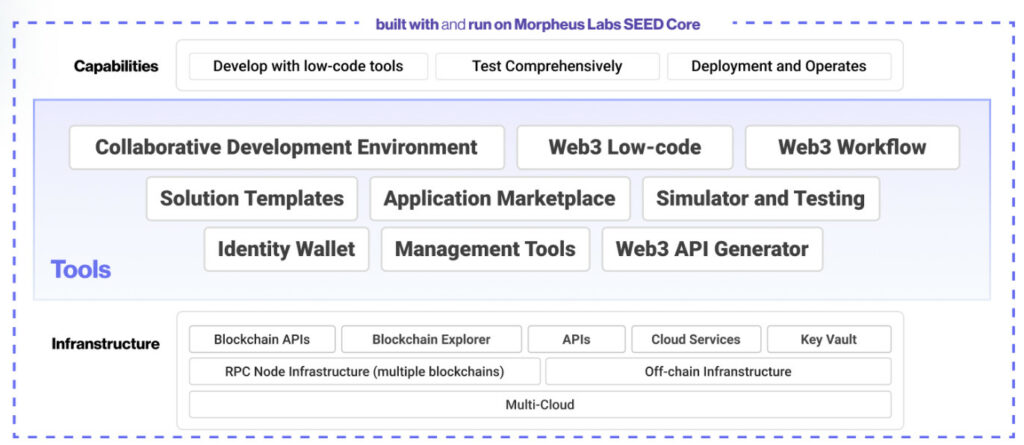

Morpheus Labs SEED

Morpheus Labs’ SEED feature stands for Solution Environment for Enterprise Development. It’s a great tool and helps with tokenization in various ways. To clarify, SEED is at the heart of the transition from Web2 to Web3. It also deploys AI-driven tools. So let’s take a look at how SEED can benefit tokenization of RWA assets. SEED offers four key features.

- CDE or Collaborative Development Environment — This offers a collaborative environment. It allows various individuals or teams to work together on a project. This is perfect when working in remote locations.

- Web3 APIs and SDKs — The toolset for devs to build their Dapps. Using these allows interoperability between chains.

- RPC Node Infrastructure — This offers scalability and enhances resource use and response times.

- Web3 Application Marketplace — Buy and sell digital assets on-chain.

To tokenize RWAs, each part plays its own role. Developers can use ready-to-use templates. It’s a complete blockchain-as-a-service (BaaS) solution. One of the AI-driven tools is the Smart Contract Studio. This is a great tool to help with RWA tokenization. So, let’s take a closer look at this. The picture below shows what SEED has to offer.

Source: Morpheus Labs SEED web page

Smart Contract Studio

The Smart Contract Studio is a crucial tool for tokenizing assets. As we already mentioned, the tokenized assets are NFTs. In turn, NFTs are tokens used in smart contracts. They can’t exist without smart contracts. For example, selling or buying an NFT. Smart contracts execute when they meet pre-set conditions. When an NFT is up for sale for $100, the first person offering this sum will be the new owner. As the smart contract dictates.

Another option is to fractionalize an NFT. You can program the smart contract and tell it how many parts it can fractionalize. You can add further details. Like price, or a time frame during which it is available. Ideal features for tokenized RWAs.

The Smart Contract Studio is AI-driven and offers a low code solution. This makes it also easy to use and fast to deploy. Furthermore, it offers four core features.

- Al-Powered Smart Contract building and testing. — This provides specs for the design and it automates code creation.

- Integrated smart contract audit services — There’s a partner integrated audit service.

- Professional and community support — Devs can choose between various templates. This feature comes with AI and Expert help.

- End-to-end solution — It doesn’t take long before you can run secure smart contracts.

The Smart Contract Studio by Morpheus Labs is crucial for the tokenization of RWAs. It gives you all the tools you need for this. The video below gives an explanation of the Smart Contract Studio.

Conclusion

RWA is an important and big vertical during this bull run. Morpheus Labs has all the tools to tokenize RWAs. We took a closer look at these tools. For example, the SEED platform and the Smart Contract Studio.

The current $MIND price is $0.004144. It has a market cap of $7 million. Out of the 2.1 billion max and total supply, 1.7 billion tokens circulate. You can buy the $MIND token at MEXC and KuCoin.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. This article has been sponsored by Morpheus Labs.

Copyright Altcoin Buzz Pte Ltd.