Liquid staking is increasingly coming into view. Each day, new opportunities present themselves. It could well be that liquid staking is the future for staking. In combination with multi-chain options, this is a killer combination. Today we look at pStake Finance, which offers liquid staking on the BNB chain.

What are the opportunities on the BNB chain for liquid staking? How can pStake Finance help you with this? So, without further ado, let’s have a look at pStake Finance. The following video gives a short explanation on what pStake Finance does.

What Is pStake Finance?

pStake Finance is a liquid staking protocol. You can deposit your PoS tokens on the pStake platform. This will give you unstaked tokens wrapped as ERC-20 tokens. For instance, pBNB. These pTokens mint as a 1:1 peg to your original token. Once you stake your pTokens, you receive the stkToken. For example, stkBNB. Once more, pegged 1:1 to the pToken. These are also wrapped ERC-20 tokens. They represent the underlying staked pTokens.

That can be a little confusing so we are going to try to clarify this. When you bridge over to pStake, you get the pToken like pBNB (ERC instead of native BNB). This covers the bridging and the wrapping only. But it’s not staking so you aren’t earning anything yet. When you do stake it through pStake, you get the stkToken or the stkBNB. And it’s the stkBNB that you can use to add liquidity to various DeFi protocols to increase your returns. As they explain in their token model, you are staking your BNB (in this case) and getting your staking rewards in pTokens instead of BNB if you staked it there natively. Now you can sell those pTokens whenever you want. And you can also unwind the process where all of this is redeemable 1:1 as we said before. Then your pBNB is back to being native BNB.

So, now you can use these stkTokens in DeFi. You can earn extra rewards, on top of your standard staking rewards. Let’s have a look at some DeFi samples on the BNB chain where you can use your stkTokens. These include DEXs, borrow/lending protocols, and yield aggregators.

Besides these new liquid staking options on the BNB chain, pStake offers more. They are already active on three networks; Cosmos, Persistance, and Ethereum. Solana is coming soon. A real multi chain opportunity.

💢 @PersistenceOne liquid staking protocol @pStakeFinance is launching Liquid Staking solution for $BNB

💢 Event will goes live this coming August 2022 where rewards on $BNB come from the transaction fees paid by users of the @BNBCHAIN

🔽 INFOhttps://t.co/qgKT3K4Gla#Definews

— 🌐 𝐃𝐄𝐅𝐈 𝐍𝐄𝐖𝐒 🌐 (@Definews_Info) July 31, 2022

DeFi Options for Liquid Staking on the BNB Chain

Various options are available on the BNB chain for liquid staking. You can use your stkTokens in a variety of DeFi strategies. These include DEX’s or borrow and lending protocols. On a DEX, you can be a liquidity provider for a liquidity pool. For instance, with your stkToken and BNB. In a borrow/lending protocol, you can lend your stkToken and earn rewards. On a yield aggregator, you can farm your stkTokens. In the meantime, you already earn passive income on your staked tokens, the pTokens.

For example, have a closer look at these liquid staking platform options.

1. DEXs

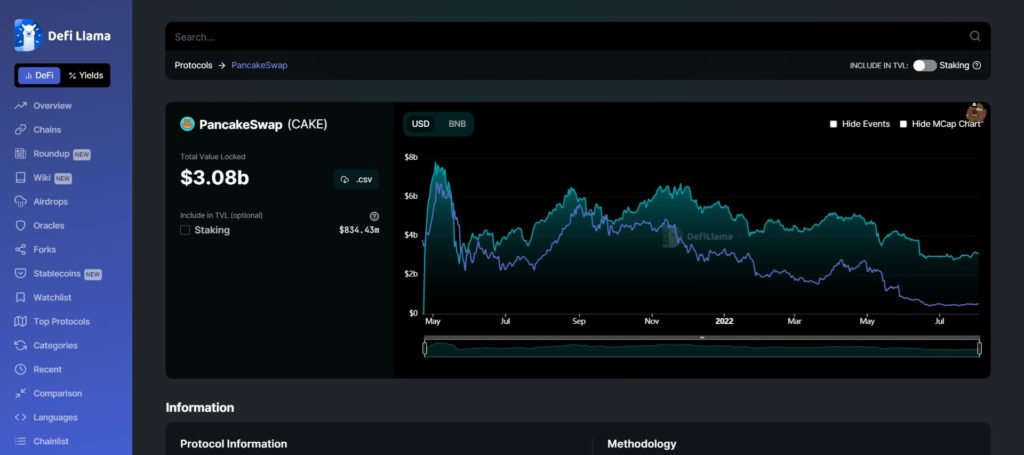

- PancakeSwap

TVL ~$3 billion with a market cap of over $500 million.

Transaction fees are 0.25%, split as follows.

-LPs: 0.17%

-Treasury: 0.03%

-CAKE token buyback and burn: 0.05%

- BiSwap

TVL ~ $290 million with a market cap of over $500 million.

Transaction fees are 0.1%, split as follows.

-LPs: 0.05%

-CBSW token buyback and burn: 0.05%

- Wombat Exchange

TVL ~$11 million with a market cap of over $1.47 million.

Transaction fee: Charged in token withdrawal from pool. There’s a minimum of 0.01%. All fees are currently retained as reserves.

Source: DeFiLlama

2. Lending Protocols

- Venus protocol

TVL ~$692 million with a market cap of ~$75 million.

Users can borrow and use one or various assets as collateral. The collateral ratio is at 80%.

- Alpaca Finance

TVL ~$511 million with a market cap of ~$39 million.

Users can borrow the native $AUSD stablecoin. They can use interest-bearing tokens as collateral.

3. Yield Aggregators

- Beefy Finance

TVL ~$313 million with a market cap of ~$34 million.

Beefy Finance issues mooTokens to vault depositors. For instance, mooBNB, for your stkBNB. They increase in value, and you can burn them at any time to withdraw deposited tokens.

Conclusion

The BNB chain offers plenty of liquid staking options. However, pStake Finance gives you the opportunity to take advantage of this. Liquid staking allows you to get double rewards. Once for your initial staking in pTokens. In addition, you also get the stkTokens, which you can use in the BNB chain DeFi platforms.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.