This insight comes from Visa’s comprehensive dashboard, which tracks cryptocurrency transactions across multiple platforms.

It highlights how Solana is increasing prominence in the blockchain ecosystem. Let’s explore more about it.

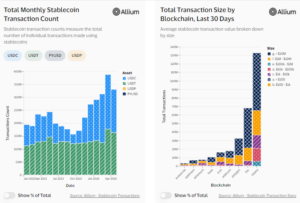

Solana: Ascending Leader in Stablecoin Transactions

Visa’s data shows that Solana’s total stablecoin transaction size has exceeded that of other prominent blockchains. This marks a significant milestone in Solana’s path to wider adoption. So, the growth in stablecoin transactions reflects a maturing market where digital currencies are increasingly used for everyday business.

new @visa dashboard shows that @solana has significantly more stablecoin transactions than any other blockchain pic.twitter.com/swCM8C2DGy

— Mike Dudas (@mdudas) April 26, 2024

Visa has entered into a strategic partnership with Allium Labs to refine the way stablecoin transactions are measured. Recognizing the challenges posed by misleading volume data due to inorganic activities, they have developed an “adjusted stablecoin transaction metric.” This new metric is designed to provide a clearer, more accurate representation of genuine stablecoin usage.

Users can now switch between viewing adjusted and unadjusted transaction volumes and count on Visa’s platform. This flexibility enables a more detailed analysis, providing insights free from distortions caused by artificial inflationary tactics.

More About VISA’s Dashboard

The adjusted metric introduces a couple of sophisticated filters to enhance the accuracy of transaction data. One significant filter is the “Single directional volume filter.” This filter counts only the largest stablecoin amount that is transferred within a single transaction. It effectively eliminates the volumes of redundant internal transactions that frequently occur within complex smart contract interactions.

Source: Visa

Another crucial aspect of the new metric is the “Inorganic user filter.” This filter is applied to exclude transactions from any account that has initiated more than 1000 stablecoin transactions. It also excludes accounts that have transferred more than $10 million in volume over the last 30 days.

Such parameters are typically indicative of bot activity or automatic transactions from large entities like centralized exchanges, which can greatly skew the perception of market activity. By setting these thresholds, Visa and Allium Labs aim to isolate and highlight transactions driven by regular users and smaller institutional players, thereby providing a more realistic view of the stablecoin landscape.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.