Binance DeFi staking program added a new asset to their already popular program.

The Binance DeFi Staking ETH high-yield activity starts March 15th, 2022 at 12:00 PM (UTC). The flexible staking option had already sold out before. In this article, you will discover more about this new program.

Stake ETH In Binance to Get 10%APY

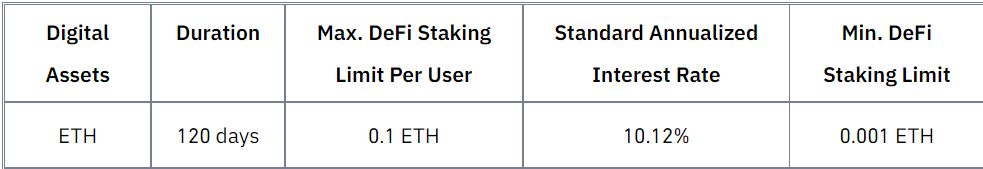

There already are 13 different coins and tokens up for DeFi staking. Now, Binance added high-yield ETH staking. The yield is up to 10.12%, for a pre-defined locked staking period of 120 days.

#Binance DeFi Staking launches $ETH high-yield activity with up to 10.12% APY.

➡️ https://t.co/XXHp8OcF7C pic.twitter.com/dnSvbcFKb6

— Binance (@binance) March 15, 2022

Moreover, you can take part in this high-yield staking option:

- The DeFi staking format is on a first-come, first-served basis.

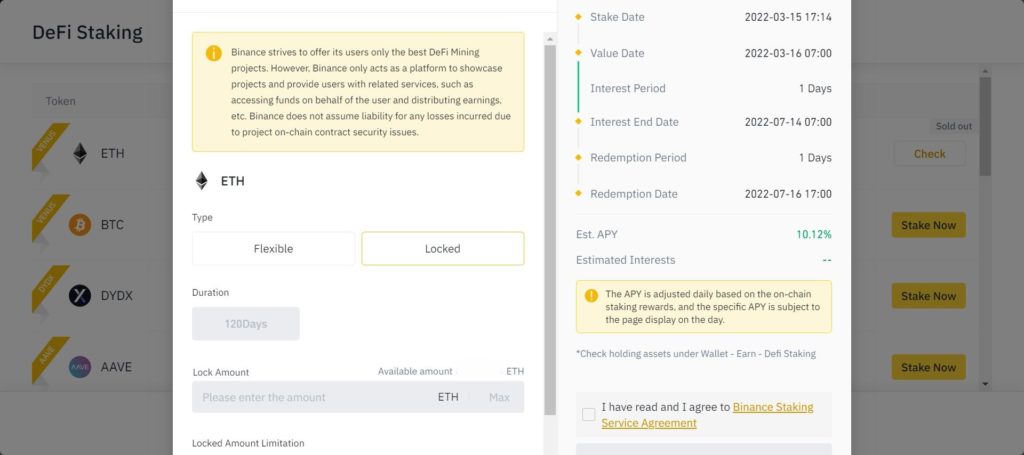

- The reward calculation period starts at midnight (UTC). The period runs from the day after Binance confirms the staking until redemption. The staking period needs to cover at least one day. If staked for less than a day, this will not count in the reward distribution.

- The reward payout time happens on a daily basis.

- Max DeFi Staking limit is 0.1 ETH

- Min DeFi Staking limit is 0.001 ETH

Source: Binance.com

On the other hand, Binance will unlock your staked ETH and send it the next day to your Spot Wallet. This can take up to 24-48 hours due to different time zones. There is also the fact that DeFi staking takes place on-chain. This may add to the delivery time in your Spot Wallet.

Also, the fact that your staked assets are on-chain, means that you can’t access them. During the staking period, it is not possible to perform any transactions. Let alone withdraw the staked fund. Therefore, Binance recommends choosing the staking period wisely.

Furthermore, according to their website. “The APY is adjusted daily based on the on-chain staking rewards, and the specific APY is subject to the page display on the day.”

Source: Binance DeFi Staking

What Other Coins Are in the DeFi Staking Program?

Besides the new high-yield ETH option, there are a few other options as well:

- Bitcoin (BTC) offers a 60 lock-up period at 8.19%

- DYDX offers no less than 25.12% over a 30-day period.

- AAVE offers 6.49% over a 30-day period.

Apart from this, there are also many flexible staking options. This includes:

- ETH (sold out)

- BTC

- BNB

- USDT

- BUSD

- USDC

- SXP (sold out)

- LINK (sold out)

- HARD

- XVS (sold out)

- DAI (sold out)

To summarize, the Binance DeFi staking program has some interesting options available. Many options are available. Both inflexible and locked staking. However, be cautious when locking up your crypto assets. Binance is not responsible for any trading losses that may occur.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.