During a bear market, it’s harder to find a good investment strategy. There are a couple of options out there. Dollar cost averaging, or DCA, is such an option. It’s also not difficult or complex.

DCA gives peace of mind because it reduces risk and volatility. It is easy to execute. So, let’s have a look at what dollar cost averaging is all about.

Most people will be in the exact same place next bull year as they are today.

Don’t be most people.#DCA

— HunterX | SpykeFast (@realsch1) August 1, 2022

What Is Dollar Cost Averaging?

Dollar cost averaging is when you invest a fixed amount of money during a certain period. With this strategy, you don’t need an entry or exit point. To clarify this, you don’t enter the market with a lump of money. In contrast, you break this lump up in smaller parts and invest over time. Regardless of what the price is. It’s not meant as a quick profit-making strategy.

The idea is that you invest for a longer period. Your return is most likely better than a lump investment. Unless you’re lucky and invested at just the right moment. By doing so, you reduce your risk and volatility. On the other hand, dollar cost averaging helps you to avoid FOMO or emotional trading. You don’t panic sell during a downturn or buy at the ATH. As you can see, it does ask for determination, and you need to stick to your plan.

There’s also no need to time the market. With this strategy, the price of your asset is irrelevant. Whether it went up or down, you keep steadily adding money to your chosen asset. It works for all kinds of budgets. Even with a small budget, you can add a small amount each week or month. As a result, your portfolio keeps growing.

How to Schedule It?

You can decide to do this on a daily, weekly, or monthly schedule. Whatever schedule suits you best. In addition, it gives peace of mind. You don’t have to worry what the price is, you just follow your plan.

Furthermore, you can use this strategy when you invest, but also when you want to take money out. Your profit may not be as big as with a one-off trade. On the other hand, your losses, if at all, are also smaller. So, let’s look if any exchanges offer a DCA strategy. All mentioned options are accessible for U.S. citizens.

Binance and Dollar Cost Averaging

Binance offers a dollar cost averaging strategy. However, it’s called “Recurring Buy.” But the principle remains the same. Both their website and app have this “Recurring Buy” function. The advantage is that it is an automated process. You set a fixed amount of money at set intervals. Thereafter, you’re done and can forget about it. Just make sure that there’s enough funds each period to take part. As a result, your portfolio keeps growing.

This makes your strategy hassle-free. It is easy to set up, and it runs by itself. Furthermore, “Recurring Buy” supports well over 50 cryptocurrencies. Binance lists new coins on a regular basis.

Over time, you can use the gains you made to dip into the Binance ecosystem. They offer plenty of other services that you can take part in. For example, staking, yield farming, trading, or launchpads. You can also buy an NFT.

Binance US

There’s good news for U.S. citizens. Binance US also offers the “Recurring Buy” option. However, as we know from Binance US, it has a few limitations. They offer 20+ coins instead of 50+. It’s easy to set up; just follow their instructions. Trading fees are up to 0.5%.

https://t.co/AZwoBOy3iq offers:

– Lowest fees in America

– FDIC insured for USD deposits

– Ability to DCA w/ Advanced technical overlay

– Access Bitcoin, and 29+ other Cryptos

– Ability to stake and earn interestThere are no opinions, only https://t.co/AZwoBOy3iq. https://t.co/QZiwdFEbPI

— Binance.US 🇺🇸 (@BinanceUS) March 11, 2020

Coinbase and Dollar Cost Averaging

Coinbase is a CEX based in the United States. As a result, U.S. citizens can use this exchange. They also offer a DCA program. They see this as “turning the market volatility into an opportunity.”

Coinbase is available as a browser extension and as a mobile app. They also call this a “Recurring Buy” option.

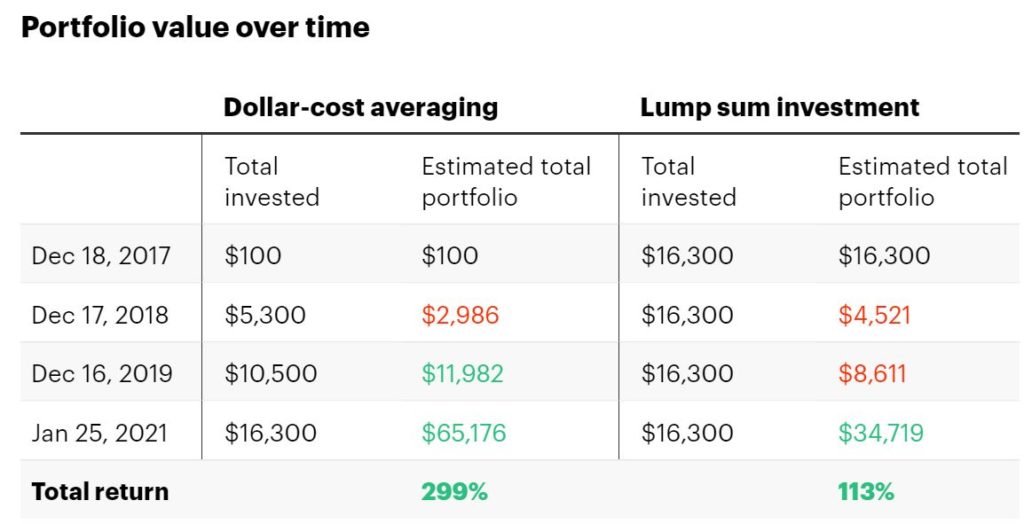

In a blog, they give a couple of good examples on how DCA could be beneficial versus a lump sum. However, they also use this sample to show you that a lump sum can be more profitable. Although, it is at a higher risk and can even lead to you selling your investment with a loss. See the picture below. Coinbase has some of the highest fees. However, you can upgrade for free to Coinbase Pro. Here the fees are lower, starting at 0.6% for takers and 0.4% for makers. Pending on the amount, you pay another $0.99 to $2.99 per transaction.

Setting up your “Recurring Buy” option is straightforward. They explain this in their tutorial.

Source: Coinbase

Robinhood and DCA

Robinhood is another option for U.S. citizens. However, this is not a CEX, but a registered broker dealer. Besides a limited number of seven cryptocurrencies, you can also buy stocks there. In contrast to a CEX, you can’t withdraw crypto from Robinhood. You will need to sell your assets and send them to an external wallet.

Robinhood only announced in April 2022 that they will offer crypto wallets. Currently, there’s a waiting list. In the meantime, Robinhood does offer DCA. They call it “Crypt Recurring Investments.” However, be aware of the fact that you don’t buy actual cryptocurrencies at Robinhood. They give you IOUs instead for Bitcoin’s dollar price. We don’t recommend you get involved with the crypto offerings at Robinhood. That includes their DCA program. This article in Nasdaq gives a good explanation. For a good comparison between Coinbase and Robinhood, read this Investopedia article. Robinhood doesn’t have any commission fees. However, they have an order flow fee that varies by trade.

Swan and DCA

Another crypto trading app accessible for U.S. citizens is Swan Bitcoin. They’ve been around since 2019. Their DCA package is interesting. They offer to buy Bitcoin at the cheapest possible price on your behalf. They call their program “Swan Bitcoin automatic.” Once you reached a certain threshold, you can withdraw that amount to your bank account. All this is an automated service and easy to set up. They also offer low transaction fees of 0.99% to 2.99% and free withdrawals. This is one of the best DCA options in the United States.

Get paid in #Bitcoin! https://t.co/qe3YCVzZMZ lets you set up automatic recurring buys with funding by free bank transfer. Just decide how much of your pay you want to save in Bitcoin each week or month. No need to talk to your employer, no need for a second bank account.

— Swan.com (@SwanBitcoin) August 8, 2022

Kraken and DCA

Kraken is accessible for U.S. citizens. However, they don’t offer an automated DCA process. You can set up bots, like 3Commas or other reputable bots. It’s not as easy to set up as an automated program. The bots have various commission options. Most of them offer a variety of plans with monthly fees.

Other big CEXes like KuCoin and Gate.io also offer DCA programs. Unfortunately, they are inaccessible for U.S. citizens.

Conclusion

Dollar cost averaging is an effective and easy way for a long-term crypto investment plan. With a fixed amount over a certain period of time, you can grow your portfolio. Some advantages are reduction of risk and volatility. Many CEXes offer automated programs, which are easy to set up.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.