Tokenizing of various asset classes is in the making. Real estate is just one of them. In the future, we will tokenize a wide range of assets. However, real estate is the one we will concentrate on in this article.

There are many reasons why this will happen. We will cover them and give some samples as well. So, let’s have a look at what tokenizing real estate is about.

Here’s an infographic that shows the estimated size of various asset classes.

Crypto is only $2.5T

All these assets combined are > $500T.

Most of these assets will get tokenized over the next decade or two, and the protocols that tokenize them will capture a lot of that value. pic.twitter.com/6Qj3QbzeZE

— shivsak (@shivsakhuja) December 17, 2021

What Is Tokenization, and Why Do We Need It in Real Estate?

Tokenization is still in its early stages. Shivsak wrote a thread about real estate tokenization. He is one of Crypto Twitter’s influential DeFi writers. As a co-founder of Magik Invest, he’s active in DeFi as well. He sees tokenization in general happening within 10 to 20 years.

Tokenization is when you turn a real-world asset into a digital asset. In our case, a house or other real estate asset. Real estate and NFTs have one thing in common – they are both unique. This gives NFTs already a head start to represent real estate.

Reasons to tokenize real estate include the following;

- Fractionalized investing — This means that you split the NFT up in 100, 1000, or more parts. This way you can have many owners.

- Worldwide accessible and tradable 24/7/365 — Just like crypto markets, they are always active.

- Liquidity of real estate — It cuts out middlemen. Ownership and money transfers are between buyers and sellers.

- Proof of ownership — The NFT clearly represents undeniable proof of ownership.

- Improvement of market security and transparency — Each transaction is transparent. Blockchain technology backs security.

- Diversification through bundling — You can diversify your investment by investing in pieces of many properties. For instance, instead of $150,000 tied up in one house, you diversify. Like 10 properties at $15k each. You can also invest in different types like this. For example, in industrial, commercial, or residential properties.

- Reduced friction of transactions — Real estate transactions involve lots of paperwork. There are also plenty of costs. But you can also digitize this process. You can also include ownership. Now it becomes a simpler, faster, and easier process.

You can plug the NFTs now into smart contracts. This opens up a whole new can of opportunities. So, we are going to have a look at them.

Source: Twitter

How Do You Use Your Tokenized Real Estate NFT?

There are various ways you can use your tokenized real estate NFT. We will show you a few options.

For a Mortgage or Refinance

If you need a mortgage or want to refinance your asset in real life, there are a few hoops to jump through. Your average mortgage takes months to get cleared. You also need a lot of documentation. To top this off, you need a good credit score. This is a biased and unfair system.

On the other hand, in DeFi, you can secure a loan in no time. The only thing you need is collateral to back it up. In this case, your house is the collateral for your mortgage. In other words, your NFT that represents your house.

This may need to be some kind of conditional transaction with a few steps in it for it to succeed. The reason is that, in this case, you don’t own the token.

Real Estate Investment

This has a few limitations in TradFi. In general, it boils down to two options.

- You can buy a property — This requires a lot of money/capital. You also need physical access and management. It doesn’t allow for any diversification.

- Real Estate Investment Trusts (REITs) — They give you limited options. It requires trust in their managers. On the other hand, in general, there are few details available.

However, if we compare this with DeFi, we see a different story. For example, you can invest:

- From anywhere in the world.

- With a small amount of capital.

- In a specific property.

- In index tokens that represent a neighborhood, city, state, or country. This can be a potential option.

There are many other options available in this field. As a result, we already see many companies that offer tokenized real estate.

Finding Liquidity

Let’s say you have real estate tokens worth $500,000. However, you need $100,000 quickly. DeFi gives you two options for this.

- You can set up a credit line of $100,000 in no time.

- Sell $100,000 worth of your real estate tokens. The open market has a variety of interested parties for this.

Source: Twitter

So, this showed us a few use cases for tokenized real estate NFTs. This leads, however, to another question. What if 1,000 different people own a property? Who owns it and who can live there? Let’s have a look at this. Because this files under the legal aspects. That’s the biggest issue at the moment with tokenized real estate.

The Legal Situation of Tokenizing Real Estate

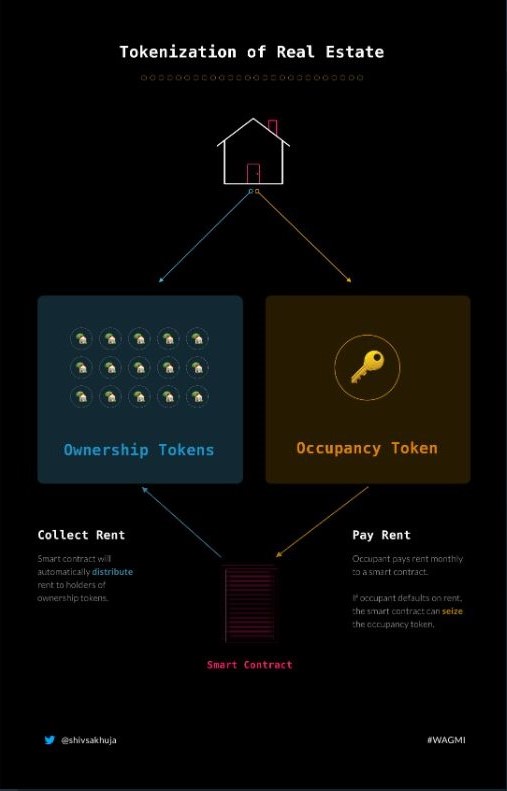

For the situation described above, Shivsak has a solution in his thread. He suggests splitting the property into two tokens. For instance, a token that:

- Represents ownership — This gives owners the benefits of cash flow from rent. They also get to enjoy any price appreciation. The owner also pays for taxes and maintenance. The smart contract can include this in its code.

- Represents occupancy rights — These token holders can live in the property. They pay rent to a smart contract. If they default, the owner can seize the Occupancy token. It’s also possible to evict the occupant via a court order.

It’s just an idea by Shivsak, but it might just work. Likewise, it would take for granted that we are already a few years down the line. By that time, standardized smart contracts for lease agreements should be common. Developers can add a variety of details into them. However, it may take a few years before the legal system allows this kind of contract.

As a result, Shivsak sees some form of hybrid contract first that tie to a title. Once the legal system recognizes tokens as property, a new set of smart contracts is due.

Conclusion

We saw that tokenizing of assets is in the making. Especially the real estate market is of interest. It’s a big market with over a $300 trillion share. You learned what tokenization is, and we showed you some good use cases. We also discussed why tokenizing real estate matters. For example, more people can take part at lower entry prices. Fractionalization offers this.

On top of this, there are plenty of ways how DeFi can give a helping hand with securing loans or making tokens liquid. Currently, the biggest issue seems to be the legal aspect. It may well take a few years before tokenizing real estate can hold up in a court of law. That didn’t stop plenty of firms that already offer tokenized real estate.

⬆️Moreover, win $6,699 worth of bonuses in the exclusive MEXC & Altcoin Buzz Giveaway! Find out more here.

⬆️Also, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.