SteakHut Finance is a decentralized finance (DeFi) yield boosting protocol built that leverages Trader Joe’s veJOE model.

Besides, SteakHut Finance seeks to provide users with an opportunity to get significant rewards by staking on SteakHut’s boosted pools. In this article, we will be looking into details about this platform, benefits from using the platform, some boosted Liquidity Pools (LPs), and the Steak-O-Nomics.

About SteakHut Finance

A crucial factor in understanding the SteakHut Finance protocol is understanding the underlying Trader Joe veTokenomics. The Trader Joe model makes it possible for users to stake JOE in the veJOE system and then earn veJOE over a particular period of time.

Also, users can earn yields up to 150% more than the base Liquidity Pools (LPs). Therefore, the more veJOE a user has, the more the yields from the boosted farms.

Ready to take your @traderjoe_xyz farming to a whole new level? 🚀🌑✨@steakhut_fi's veJOE boosted pools allow you to enjoy insane boosts on your farming yields! 🧑🌾

🔗https://t.co/Afh9Ewj4W6#Avalanche #AVAX #LFJ pic.twitter.com/aoix8HzGTX

— SteakHut🔺 | 🐮+🌊📘 (@steakhut_fi) May 29, 2022

Additionally, SteakHut is designed to allow users to enter the boosted yields without having JOE tokens. In this case, the user will have to leverage SteakHut’s existing veJOE position to contribute the necessary boosted yields.

Moreover, another use case is by zapping their JOE tokens to SteakHut’s Herd Zapped Joe (also dubbed hJOE). Later on, the hJOE token has a 1:1 relation with JOE tokens. Therefore, users interested in swapping hJOE also have access to a liquidity pool that trades the JOE/hJOE pair 1:1. Notably, users that engage this option are rewarded with $STEAK, the emissions of SteakHut’s Token.

Possible Benefits of Using SteakHut

The SteakHut protocol is working integrally with Trader Joe’s veJOE protocol. It also offers:

- The first-mover advantage with Trader Joe’s veJOE protocol. It plans to utilize this advantage in developing the SteakHut Herd. The platform fits in the Trader Joe community as their smart contracts are being audited by Paladin.

- Utilize the large economies of scale. As well as, leverage the veJOE Staking Pool and get the governance of the JOE farming system.

- Concerning the SteakHut Herd, they will also be providing huge boosted yields.

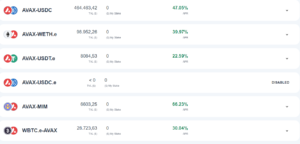

At the time of writing this article, here are some interesting pools on SteakHut are as follows:

- JOE-AVAX pool which has a TVL of $207,213.13. As well as, and a 51.67% APR as of the time of publication.

- JOE-USDC pool with a TVL of $37,754.78 and an 83.08% APR as of the time of publication.

- There is also a BNB-AVAX pool with $6,144.89 in TVL and a 43.68% APR as of the time of publication.

Source: Steakhut Finance

Source: Steakhut Finance

SteakHut Finance Tokenomics

Based on reports, SteakHut Finance is governed by $STEAK, the token also shows ownership within the SteakHut system. The holders of the token are able to vote on any particular subject based on the number of tokens held.

Besides, STEAK holders, as owners of the system, have a share in the profits. They also receive returns through the following:

- The $STEAK stablecoin and pool staking initiative

- The $STEAK Barbecue Burn and Buy-Back program

- Also, the $STEAK special dividend payments

$STEAK Price Analysis

As of the time of publication, SteakHut Finance’s price was $0.3166 with a 24-hour trading volume of $8,999. STEAK price also dropped by 8% over the last 24 hours. Besides, it has a circulating supply of 0 STEAK coins and a total supply of 5 million.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT signs with Altcoin Buzz Access. Join us for $99 per month now.

Source:

Source: