This article answers the most important question for the next bull rally. Which is a better investment for the next bullrun ETH or MATIC. Take a look at this: ETH’s ICO Price—$0.31 and its ROI in 10 years was 5,277x. On the other hand, MATIC’s ICO Price—$0.00263 and its ROI in 4 years was 376X.

Does this big ROI number for ETH mean that the token has had its run? And for those 10X 50X returns in 2023 we should hold MATIC rather than ETH? To get the right answer, I had to do a lot of ground work. But to make it simple for you, I have compared the 2 most important parameters for ETH and MATIC, as these helped me conclude which one I should finally hold for the next bullrun and why? Before I come to the 2 parameters, let me first update you on what is happening with both these projects in 2023.

What is Happening with Ethereum in 2023?

In March 2023, Ethereum has its next big upgrade coming in the Ethereum’s Shanghai upgrade. This will enable withdrawal of staked ETH to the Ethereum ecosystem.

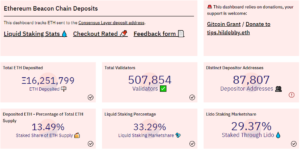

At the time of writing this article, over 13.49% of total ETH supply is staked and from March 2023, a part of it will unlock for withdrawals. This enabling of withdrawal is also likely to have some ramifications on market demand for ETH, and that could have an effect on the price of ETH.

Source: Dune.com

So, I plan to keep a close eye on ETH staking withdrawal schedule to understand its impact on ETH price. Now here is something interesting. Shanghai upgrade will also have effect on Polygon. How and why I will explain in the next section that talks about what is Polygon up to in 2023?

What is Happening with Polygon in 2023?

Polygon killed 2022 with its mainstream partnerships with some of the biggest of the biggest brands: Adobe, Disney, Meta, NFL, NuBank, Reddit, Robinhood, and Starbucks. And in 2023 Polygon is bound to make it big because of these 4 factors:

#2022 wrap-up #onPolygon by Polygon Analytics👇

Active wallets hit a new ATH: 11 mm+ 🚀

Total active wallets: 206 mm (+58% from ‘21) 📈

Range of monthly transactions: 80 mm+ 🤝@LensProtocol & @unstoppableweb saw explosive growth after launch #onPolygon 💥 pic.twitter.com/c1OXO7ymKr— Polygon (@0xPolygon) January 24, 2023

-

Projects Migrating to Polygon

The end of December 2022 saw 3 popular protocols migrate to the Polygon network. For instance, two major Solana NFT platforms, DeGods and y00ts, announced their move to Polygon. More projects mean more users and more token usage.

2. Mastercard Incubator Project

On January 7th, traditional finance giant, Mastercard, announced an incubator program that will teach emerging artists how to use web3 technology. The program is called the Artist Accelerator program, and it is being developed in collaboration with Polygon.

3. NFT Sale Volume Spike

Polygon defied crypto winter with a spike in NFT sales volume

4. Uptick in Users

Polygon also recorded more NFT users than most other networks. All this will undoubtedly translate into price action for Matic.

Now, here is something that most of us don’t know. Shanghai was originally expected to include additional much-anticipated enhancements, including proto-danksharding—a streamlined data sampling process that would make layer-2 transactions like Polygon transaction on Ethereum significantly cheaper and faster. But both updates were postponed to make sure ETH withdrawals could debut by March.

While the world is going nuts about ChatGPT, #GenerativeAI is taking a new leap #onPolygon 🤯@real_alethea and Polygon have launched the world's 1️⃣st AI Collectibles campaign 🤖#AI launching on #Web3?

Whaaaaa?! 🤩https://t.co/VXjtO467j2— Polygon (@0xPolygon) January 19, 2023

However, cheaper and faster transactions on Polygon will attract more users to Polygon and translate into price action. But Ethereum developers have not announced any date about this upgrade yet. Except that it should take place in March.

Pros Ethereum VS Polygon

If we look at the pros of each chain, we see an interesting development. On one side, Ethereum has the most devs and highest TVL of all chains. 60% of all chains, compared to 2.59% on Polygon. That’s $26.7 billion compared to $1.15 billion.

However, on the other hand, we see Polygon with fast and cheap transactions. The other day I wanted to buy a $15 NFT on OpenSea on Ethereum, with $11 gas fees. I’m like, ‘really’? So, it’s no surprise that Polygon has the full support of the Ethereum community. Ethereum has a lot of institutional demand. That’s not bad at all, since that’s where a lot of money is at. As a result, this has a positive effect on the price of ETH. For example:

- ZK solutions

- Optimism

- Layer 2 and Layer 3 solutions building on Ethereum. Layer 2 deals with scalability and cheap & fast transactions. The layer 3 chains deal with interoperability. The IBC on Cosmos or Quant are samples of layer 3.

Polygon vs. Ethereum, which is better for NFTs? 🥊

Here's a side-by-side comparison of their TVL, consensus mechanism, transaction per second, gas fees and tokenomics! ⬇️https://t.co/QcMR6ls4bR

— CoinGecko (@coingecko) January 21, 2023

On Polygon, we see mostly retail demand. However, their list of Web2 partnerships is impressive. They partnered recently with seemingly every big name in the Web2 world. They all want an entrance into Web3, and choose Polygon for this. For example:

- Disney

- Starbucks

- The NFL

- Adidas

- Stripe

- Or Meta

If you are keen to know more about Polygon in detail, I recently did a deep dive video. It tells you all about the ZKs and rollups and about their partnerships. Coming back to the point and comparing the upcoming narrative.

Comparing the Upcoming Narratives

On the narratives, we see that Ethereum’s staking is very successful. Although you need to invest 32 ETH to become a validator, many people simply delegate their ETH. In other words, they hand over their ETH to a validator. Yield is around 4% in average.

Soon, you will be able to unlock your staked ETH, with the Shanghai update. This is due in March 2023. Currently, holders stake over 16 million ETH. The withdrawal option for ETH is the main narrative for the Shanghai update.

Ethereum also turned deflationary after the Merge. Shortly after the Merge, the circulating supply of ETH is declining. This is due to a new burning mechanism of fees. Now let’s have a look at Polygon. 5 They just completed a hard fork on 17th January. This took care of gas fee spikes. It also reduced the time for making a new block. In other words, transaction finality improves.

Furthermore, Polygon is a prime mover with ZK solutions. This is a technology that improves scalability. Ethereum has a TPS (transactions per second) of 11-15. ZK rollups can change that to up to 5000 TPS or more. Polygon also has the zkEVM Rollups coming. This is the first ZK technology that is completely compatible with Ethereum. It will reduce transaction costs even more and allow for higher throughput. Being Layer 2, it’s built on top of Ethereum. As a result, it benefits from Ethereum’s security.

Polygon zkEVM: Now with more throughput and less latency. But how?

Recursion makes proofs smaller. Aggregation makes them correct. Batches of proofs are also 150% larger. pic.twitter.com/3Hi9H2uasT

— Polygon ZK (@0xPolygonZK) January 13, 2023

Demand Drivers and Buy Walls

Ethereum attracts mostly institutional demand. Both from Web2 and Web3. On the other hand, Polygon is more for retailers. They attract some Web2 institutions, however, not as constant investments.

We also see a strong ETF demand for ETH. That’s an exchange-traded funds. In other words, you can trade in BTC or ETH on a traditional exchange. So, you don’t have to go through a crypto exchange. Ethereum also offers a multitude of Layer 2 and ZK solutions. Companies and firms will also put Ethereum in their balance sheets.

The number of dApps in the Ethereum ecosystem is great, with around, 3750 dApps. However, Polygon hosts no less than 53,000 dApps. The ETH gas fee will remain high, and people will see Polygon’s gas as a perfect alternative.

⚡️ Look at this integration of #Dapps in popular #blockchains in 2021 and 2022. Btw, the leaders are #BNB , #Polygon and #Ethereum.

Data by @DappRadar pic.twitter.com/VUFIxAx4i8

— Gorbunov Vladimir (@gorbunov_vl) January 23, 2023

The Verdict

So, with all the information at hand, many expect that Polygon might take this one. However, I’m going to give you a potentially less popular opinion. I think that Ethereum will outperform Polygon. And here’s why, for example:

The deflationary dynamics and buy walls ensure ETH dominance over Polygon. Buy walls are when a large group of traders, sometimes whales, try to control an asset’s price. This will, of course, suit their best interest.

We also see rising competition in L1 space, which is not benefiting Polygon in the long run:

It is a clear sign that Polygon is overvalued at this price for a bear market entry. It’s best to accumulate Polygon in the range of $0.5-0.7 and ETH in the $900-1k range.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.