Now that Ethereum completed The Merge, you can stake Ethereum. However, there are many unanswered questions about how you can stake ETH. We answer three popular questions about staking ETH here.

So, let’s have a look at how to stake Ethereum works.

Lido is now on L2 🏝️

Bridge your staked ETH to Layer 2 protocols at the click of a button to benefit from lower gas fees and exciting DeFi opportunities.

— Lido (@LidoFinance) October 6, 2022

How Long Do You Stake Ethereum?

Currently, there’s no precise date or time to know how long you need to stake your ETH. First, the upgrade to the new Ethereum needs to fully complete. This can take up to two years.

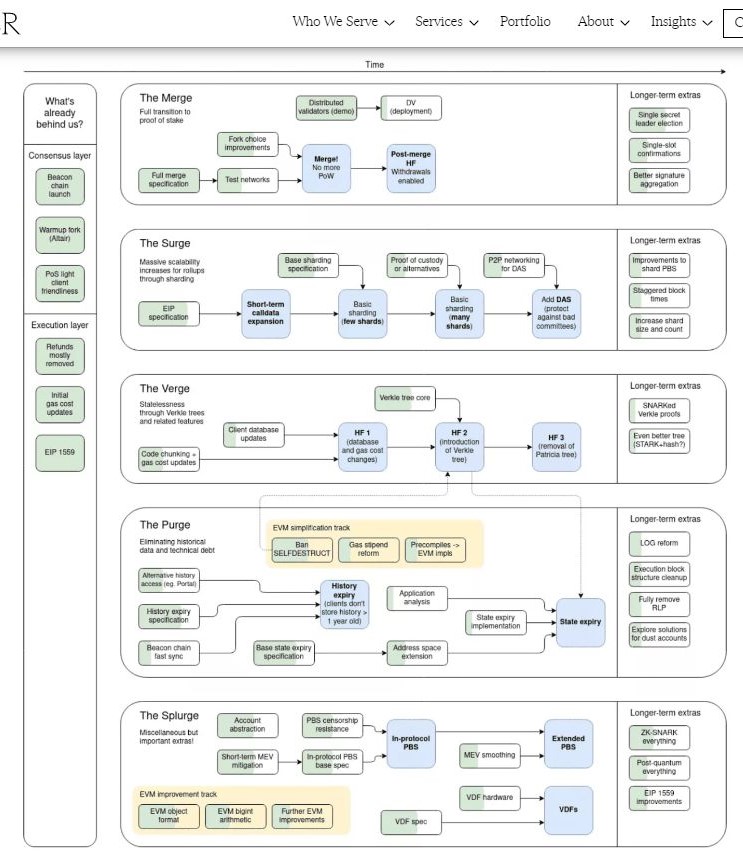

After The Merge, there are four more steps before this upgrade has gone through all its phases. Here are the other four upgrades:

- Surge — This will increase scalability. The team introduces sharding in this upgrade.

- Verge — The introduction of zkSNARKs.

- Purge — This eliminates historical data.

- Splurge — Miscellaneous but important updates and extras.

As you can see, this may take a while. Most certainly if we take into consideration how long it took the team to complete The Merge. However, with liquid staking, you can get around the locking period. You still stake your Ethereum. In the meantime, you can use your liquid-staked ETH in DeFi or sell it. The picture below gives you an idea about the four upgrade steps that still need to be completed.

Source: GSR

Why Stake Ethereum?

There are a couple of reasons why you would want to stake Ethereum. For example:

- Securing the blockchain — The More ETH holders’ stake, the safer the chain will be.

- Passive income — By staking ETH, you generate passive income. Currently, non-custodial staking is at around 3.9%.

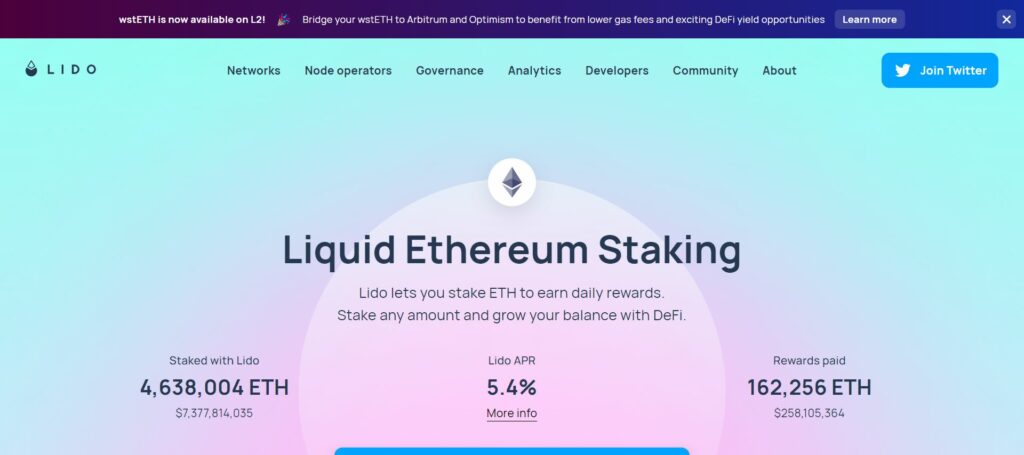

You can also stake ETH in a custodial way. To clarify, now you stake your ETH at a CEX or a staking service. For instance, Lido Finance currently offers 5.4% on staking ETH. They also offer liquid staking. By staking their stETH liquid tokens, you can double your returns. This yield will depend on which pool you can find in the DeFi space. The picture below shows the current yield on staking ETH on Lido Finance.

Source: Lido Finance

How Do You Stake ETH With Less Than 32 ETH?

To become an Ethereum validator, you need to stake 32 ETH. However, that’s not in everybody’s budget. Nonetheless, staking Ethereum is still an option even if you don’t have 32 ETH. You still have a few options here. For example:

- Join a staking pool — With other stakers, you try to reach 32 ETH. This allows you to become a validator. A benefit is that you don’t need big capital to start. Most often, this is also non-custodial. You keep control over your coins.

- Stake at an exchange — Most to all major CEXes offer ETH staking. It’s convenient but custodial.

- Liquid staking — Join a liquid staking platform. For example, Lido Finance. They are currently the biggest in this field. You will stake and lock your ETH and receive yield. However, with the liquid ETH, you have opportunities to get more yield. You can also sell the liquid tokens at an exchange.

New stETH strategy thanks to @oasisdotapp & @AaveAave 🏝️

Recursive ETH staking to grow your stETH exposure in just a few clicks. https://t.co/dLtWSZtQXu

— Lido (@LidoFinance) October 25, 2022

Conclusion

This is our first part of how to stake Ethereum. We answered three popular questions on staking Ethereum. Now you know how long you need to stake ETH and why you should stake it. We also explained how you can stake ETH with less than 32 ETH. For more answers on staking Ethereum, read Part 2 of our article series.

The current ETH price is $1,585.83, with a $191.5 billion market cap. There’s an infinite supply of ETH, but after The Merge, it should become deflationary. The current circulating supply is 120.5 million tokens.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group. And for a limited time, it’s FREE. Just click the link and Try it today.