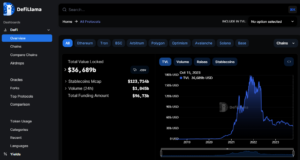

By March 2021, the DeFi sector started to gain momentum. With a total value locked (TVL) that was growing rapidly. However, more than two years later, the TVL decreased consistently. Leaving many to wonder what needs to happen for the DeFi sector to grow sustainably.

In this article, we’ll explore why the DeFi sector’s TVL has stagnated and outline the key elements required for its sustainable growth.

The DeFi TVL Stasis

To understand the stagnation in the TVL of the DeFi sector, it’s crucial to revisit its rapid ascent between 2021 and 2022. At that time, DeFi protocols like Compound, AAVE, and Uniswap were experiencing tremendous growth, attracting a wave of liquidity.

As a result, the TVL in this sector swelled to over $176 billion by November 2021. However, this astronomical rise also came with challenges.

- Market Overheating: The DeFi sector’s meteoric rise raised concerns of a speculative bubble. Many DeFi projects were untested, and their high yields attracted investors without a full understanding of the associated risks. This excessive exuberance eventually led to a market correction.

- Security Issues: DeFi platforms, while innovative, were not immune to security vulnerabilities. High-profile hacks and exploits, such as the one that occurred on the Poly Network in August 2021, eroded confidence in the sector’s safety and security.

- Regulatory Uncertainty: The decentralized nature of DeFi often places it in a regulatory gray area. The lack of clear regulatory guidelines or oversight created uncertainty for both investors and projects. Discouraging many from further involvement.

- Ethereum’s Scaling Woes: A significant proportion of DeFi projects are built on the Ethereum blockchain, which faces scalability challenges due to high gas fees and network congestion. This hindered the sector’s ability to grow.

Source: DeFillama

So, what should the DeFi sector do to change its current status? These are my thoughts.

The Path to Sustainable Growth in DeFi

For this sector to achieve sustainable growth and unlock its true potential, several critical factors need to be addressed:

- Enhanced Security Measures: Security breaches and hacks have been detrimental to DeFi’s reputation. DeFi projects must prioritize rigorous security audits and adopt the best practices to protect users’ funds. This will help rebuild trust and attract more participants.

- Improved User Experience: DeFi platforms should aim to make their user interfaces more user-friendly and intuitive. A smoother onboarding process and better user experience will encourage wider adoption.

- Regulatory Clarity: Regulatory compliance is essential for the long-term sustainability of the DeFi sector. Clear, balanced, and well-defined regulations will help foster trust among institutional investors and protect retail users. Industry self-regulation can also play a role in shaping responsible practices.

- Interoperability: DeFi projects should explore ways to work together and create cross-chain compatibility. Interoperability between different blockchains can help mitigate congestion and high transaction fees while expanding the user base.

- Scalability Solutions: Ethereum’s transition to Ethereum 2.0 is expected to alleviate many of the network’s scalability issues. In the meantime, Layer 2 scaling solutions and alternative blockchains that offer fast and cheap transactions can contribute to the sector’s sustainable growth.

- Diversification of Use Cases: Beyond decentralized lending and trading, this sector should expand into other financial sectors, such as insurance, derivatives, and asset management. This diversification can attract more participants and reduce the sector’s reliance on a few key platforms.

- Decentralized Governance: dApps (decentralized applications) should continue to emphasize decentralized governance models that give the community a say in decision-making processes. This ensures that the sector remains true to its principles of openness and inclusivity.

- Educational Initiatives: Educating users and investors about the DeFi ecosystem is vital. DeFi projects and the broader community should create resources and initiatives that help individuals better understand the risks, benefits, and mechanics of DeFi.

- Financial Inclusion: To drive sustainable growth, DeFi must continue to focus on providing financial services to underserved populations worldwide. This aligns with the original ethos of DeFi and can expand the user base significantly.

DeFi Bear Market Decline ? The TVL of The Entire Network Has Fallen Below $36 Billion, And The Profit Margin is Not As Good as Traditional Finance !!!

When #DeFi emerged during the period known as “DeFi Summer” in 2020, many people believed that this type of financial product,… pic.twitter.com/Rsays2Gzj4

— Nathann.eth (@Nathan0xx) October 14, 2023

Conclusion

This sector has faced stagnation in its total value locked since March 2021. This stagnation is a result of various challenges, including security issues, regulatory uncertainty, scalability problems, and market overheating. For this sector to achieve sustainable growth, it must address these issues.

By focusing on enhanced security, regulatory clarity, user experience, scalability solutions, diversification of use cases, decentralized governance, education, and a commitment to financial inclusion and sustainability, the DeFi sector can regain momentum. The potential of DeFi as a disruptive force in traditional finance remains undiminished, and with concerted efforts to overcome these challenges, it can continue to revolutionize the world of finance, ensuring a more inclusive and decentralized financial future.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.