The average crypto user believes they need more capital to trade, farm airdrops, or generate profit. But that’s not always the case. Your existing crypto assets can generate the needed cash flow if you learn to maximize them.

How do you maximize your crypto assets? That’s what this article is about. This article will show you four good strategies to maximize your crypto assets as well as some protocols to leverage.

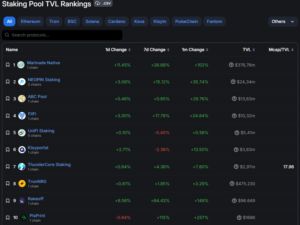

1) Staking

Staking is one of the best ways to put your crypto to use. It simply means committing your asset to a certain protocol for some time. So, the protocol uses your assets to verify transactions and gives you rewards in return. Different protocols offer different rewards.

If you’d like to stake, EigenLayer and Blast are two of the best Ethereum staking destinations. Furthermore, staking is pretty ideal if you currently hold ETH or SOL. EigenLayer has huge potential for an airdrop. So, you might want to keep a close eye on them. Here are the most important staking platforms:

Source: DeFillama

Blast is another platform with big expectations for 2024. Currently, Blast runs a points system that lets you invite more users to participate and deposit ETH (which cannot be withdrawn before February 2024) to earn more airdrops. However, there are many negative opinions about this platform, so we recommend doing your research too.

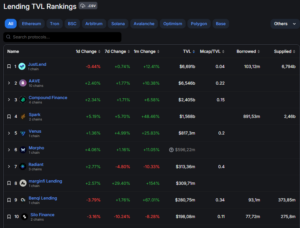

2) Lending and Borrowing

Lending and borrowing protocols are often underestimated. Quite a few know the significance of such platforms. However, if you’re searching for a lending protocol, Solana and Sui are more reputable networks to consider.

For example, The Marginfi Protocol on Solana uses a point system for both lending and borrowing. Authors on Marginfi lend SOL in exchange for APY+ points and the possibility of airdrops. Here are the most important lending platforms:

Source: DeFillama

Meanwhile, on the SUI Network, you can borrow stablecoins via the Scallop protocol. You can take out a USDC loan and still earn 10% APY. The good part is that you can farm the Wormhole airdrop by transferring your assets to the SUI network via the Wormhole Crypto Bridge.

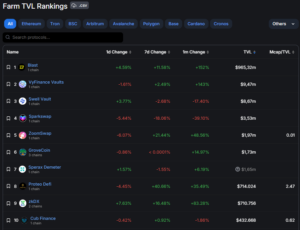

3) DeFi Farming (High Yields Only)

Here’s the part where you search for extremely high-yield airdrops that fit your risk tolerance (if any). Twitter user Tindorr suggested the following:

- Stella: 95% APR on leveraged wstETH on Arbitrum with near-0 IL

- Cega: It has an APR of 48.32% for USDC options. Cega reportedly has the potential for an airdrop.

- IPOR Labs: 40% APR on average on ETH and stablecoins (USDC, USDT, and DAI) with no IL.

You can see the most important Farming platforms:

Source: DeFiLlama

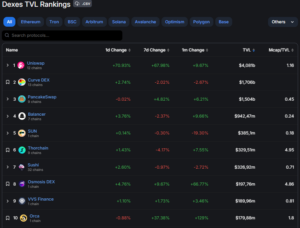

4) DEX – CEX Transactions

Some experts advise that you move to DEX and trade on the chain if you are currently trading on CEX. While most are used to CEXs, DEXs come in handy when you qualify for an airdrop. Here are three DEXs to consider:

- Drift Protocol: Solana’s derivatives exchange has an increasing trade volume.

- Hyperliquid: Perps with a strong team on the Arbitrum network and experience with CEX

- Derivio: zkSync’s top derivatives ecosystem.

These 3 platforms could have airdrops pretty soon. Furthermore, most Perps and DEX are account-based protocols, which allows you to utilize them both with the same account. For instance, you can deposit assets like SOL and ETH as collateral and trade Perps on these accounts. Here are the most important decentralized exchanges (DEXs) nowadays:

Source: DeFiLlama

Conclusion

DeFi isn’t ABC. This means you should always do your research, as nothing is ever guaranteed. However, 2024 is bound to be a huge year for the DeFi space. So, taking advantage of these strategies could boost your capital. This article was inspired by this tweet.