Now, an ex-employee of FTX claims that much more was going on than we know. According to his story, Alameda Research might have started the end of the 2021 bull run.

So, let’s take a closer look at what was going on at Alameda Research.

What Happened at Alameda Research?

So, the former employee goes by the X (former Twitter) name of Aditya Baradwaj. He was an Alameda Research engineer. You can find interesting threads on his channel about his time at Alameda.

He claims that the following incident happened shortly after he joined Alameda. He was figuring out how Alameda worked and saw two trading modes at a high level. Not only that, but he discusses the one model, that did upset the markets.

PART 2: THE FAT-FINGER

or

The story of how a misplaced decimal point at Alameda Research caused a market crash that echoed around the world.

(1/n) 🧵#SBF #FTX pic.twitter.com/jCykh6rg1o

— Adi (e/acc) (@aditya_baradwaj) September 20, 2023

This is the semi-systematic strategy. Here, traders can set model parameters that control a complex automated trading system. However, this is not for placing actual trades. Instead, it fine-tunes an algorithm. This algorithm decides how it can execute trades at high frequency.

Although it’s an automated service, sometimes it requires manual involvement. For example, when the automated trading systems are buggy. This can happen during market volatility. Or, when there is an arbitrage opportunity where the system hasn’t deployed yet.

So, this automated system was responsible for almost all the trades on Alameda. Of course, there were also some checking systems in place. For example, they checked if the placed orders aligned with current market conditions. However, manual trades were not included in these checks. The team considered them to be discretionary.

So, all was dandy, until it wasn’t. The ‘invisible’ risk factor reared its ugly head and was in their face, so to speak. This is what happened.

October 2021

On October 21st, 2021, the Alameda system broke down. As a reaction to some news, a trader tried to sell a block of BTC. He did this manually. So, the order was sent via Alameda’s manual trading system. This is where and when something crucial happened.

The trader misplaced the decimal by a few spaces. He didn’t offer his trade to market conditions, but at a super cheap price. For ‘pennies on the dollar’ as Baradwaj states.

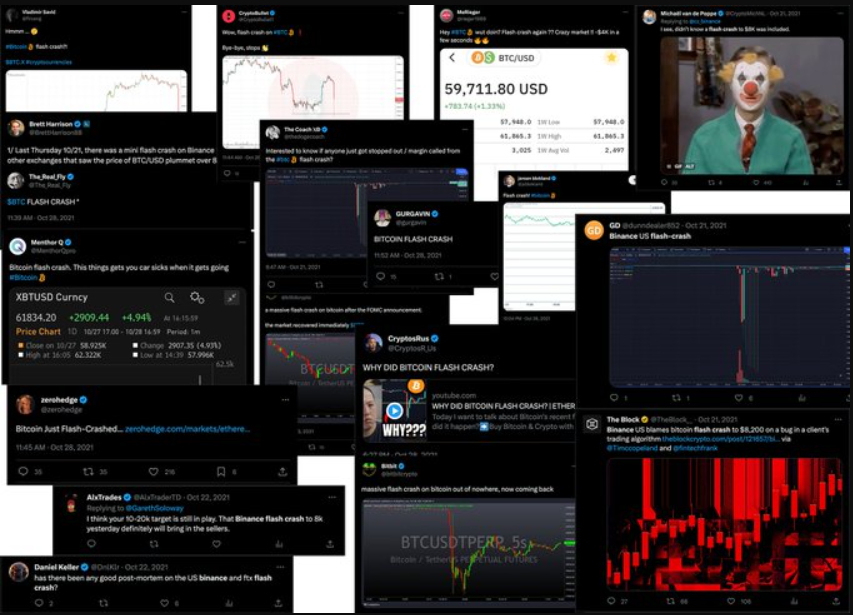

This saw an immediate market response. On some exchanges or markets, the BTC price went from around $65,000 to as low as $8,000. However, you can count on the arbitrageurs to straighten this out quickly. Crypto Twitter lit up as if you threw dry wood on a fire. See the picture below.

Source: X (former Twitter)

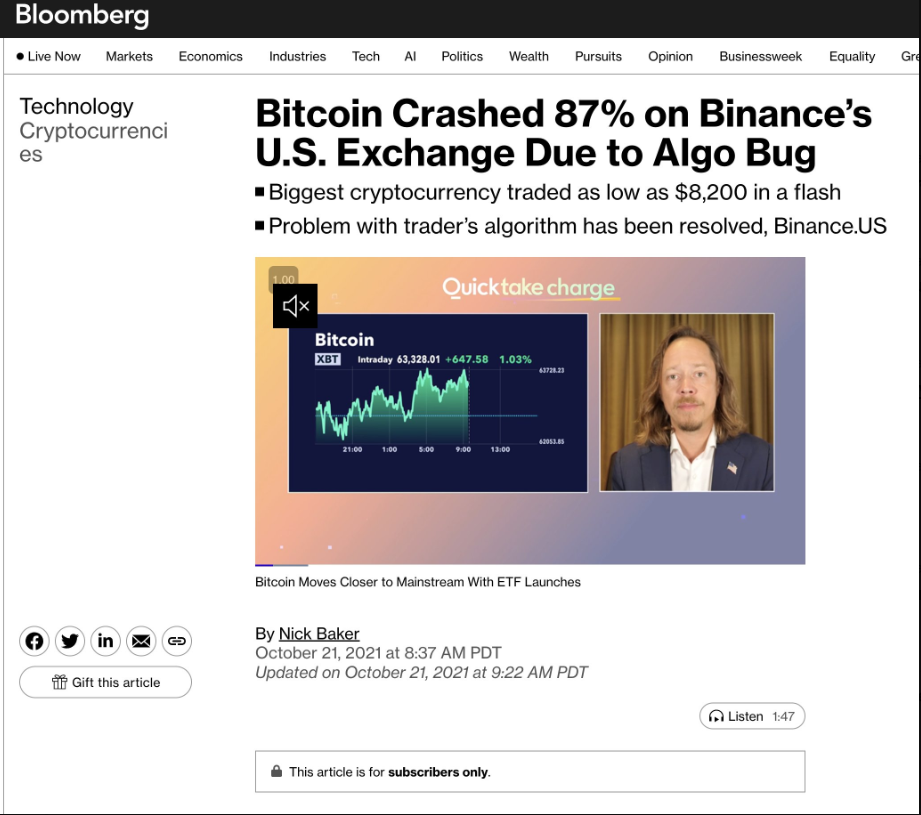

Traders and the like were trying to figure out what the heck just happened. News outlets also got involved. Binance was spot on in the middle of all this. They released a statement that mentioned that this originated from: “one of their “institutional traders” who had a “bug in their trading algorithm”.

Or, as Baradwaj implies, Caroline (Ellison) was trying to dampen the impact and had made some calls. See the picture below.

Source: X (former Twitter)

The Impact

According to Baradwaj, Alameda’s losses were immense. He even mentions tens of millions. However, there was no mechanical issue at hand, only human error. So, the only thing the team could do was to add extra checks for manual trades. Which they indeed added.

Alameda didn’t have measures in place that prevented issues. Baradwaj claims that this was almost SOP at Alameda. Instead, they waited until something broke. Once something broke, it was all hands on deck to fix it. He states that other ‘traditional’ firms would have these checks in place before they start operating. Unlike Alameda.

To sum up, it was quickly ‘business as usual’ again. He states that SFB preferred to move fast. This would outweigh any cost Alameda had to cough up caused by hacks or poor risk checks. This seemed to be part of SFB’s work philosophy. It was a big part of how Alameda and FTX functioned. Baradwaj claims this is the first time there is any insight into what happened on that October day back in 2021.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.