The crypto market is unpredictable. In a nutshell, asset prices can rise or fall dramatically in a short period of time. To be a successful trader, you must have strong technical and analytical skills.

Another way to make money is by trading cryptocurrency pairs such as BTC/USDT based on market trends and technical analysis. This involves studying charts and using indicators to predict future price movements.

5 Ways to Make Money with Crypto Trading

Day trading offers an alternative to long-term investing. As the process requires the trader to actively buy and sell digital assets to take advantage of market volatility. In fact, the trader will likely enter and exit several positions throughout the day, and avoid keeping a trade open past standard market hours.

To make a profit with crypto day trading, the concept is to make small returns on a frequent basis. The approach should follow:

1) Identifying a Trading Opportunity

Consider a scenario where a day trader notices that the price of Bitcoin (BTC) has been steadily rising over the past few hours. Upon analyzing the market trends and technical indicators, the trader identifies a potential breakout pattern. Suggesting that the price of BTC could surge even higher in the short term. The trader decides to open a long position on BTC/USDT, anticipating a profitable move.

While the concepts of technical analysis are the same across different markets, #crypto fundamental analysis is different from the stock market. 🧐

If you’re new to #crypto trading, this guide is for you! 😉https://t.co/uJMt80W1Tx

— CoinMarketCap (@CoinMarketCap) October 13, 2023

2) Utilizing Technical Analysis

A day trader observes that the Relative Strength Index (RSI) for Ethereum (ETH) has dipped below 30. Indicating that the cryptocurrency is oversold and potentially poised for a rebound. The trader also notices that the MACD (Moving Average Convergence Divergence) indicator is showing signs of a bullish crossover. Further supporting the possibility of an upward price movement. Based on these technical signals, the trader decides to buy ETH/USDT, expecting a price reversal.

3) Navigating Market Volatility

Imagine a situation where a day trader is holding a long position on Litecoin (LTC/USDT). Suddenly, the market experienced a sharp downturn, causing the price of LTC to plummet. The trader, having established a risk management strategy, decides to exit the trade to minimize losses. Demonstrating the importance of adapting to market volatility.

4) Employing Copy Trading

A novice trader decides to utilize the Copy Trading feature on a regulated crypto auto trading platform. So, the novice trader can gain exposure to the market and potentially profit from their expertise.

Hi there!

For beginners, we believe the below materials are for you!🟠A Complete Guide to Cryptocurrency Trading for Beginnershttps://t.co/dS4PaGjdqP

🟠A Beginner's Guide to Cryptocurrency Trading Strategieshttps://t.co/WMlrEHN720

🟠How to Trade Crypto Responsibly…— Binance Customer Support (@BinanceHelpDesk) October 17, 2023

5) Diversifying Crypto Holdings

An investor decides to diversify their cryptocurrency portfolio by investing in a range of altcoins, such as Ethereum (ETH), Solana (SOL), and Cardano (ADA). This diversification strategy aims to mitigate the risk associated with relying solely on Bitcoin (BTC) and potentially capitalize on the growth potential of other promising altcoins.

For example, day traders will buy and sell pairs, such as BTC/USD or ETH/USDT. To determine whether the pair should be bought or sold, the trader will perform a technical analysis. This means looking for trends and how current pricing levels might dictate the pair’s future direction. This can be achieved through economic and technical indicators, like the MACD or RSI.

The State of the Crypto Market

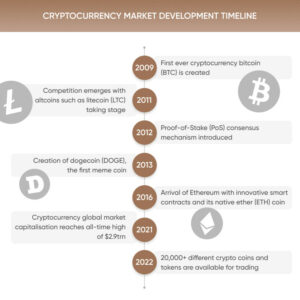

The total market capitalization reached an all-time high of $2.954trn in 2021. Spreading over 9,929 digital tokens available for trading. By November 2022, the number of coins grew to 21,612.

The success of Bitcoin paved the way for many other alternative cryptocurrencies. Known as altcoins, which look to improve on Bitcoin’s weaknesses. Such as its energy-intensive mining and high usage costs, reduced transaction fees, and competition.

Naturally, this isn’t something that can be mastered overnight. On the contrary, being proficient at technical analysis and chart reading can take many months or even years. A notable shortcut in this regard is to opt for the Copy Trading feature at a regulated crypto auto-trading platform.

Be Mindful of Crypto Regulations

Traders can be resistant to the prospect of the industry becoming regulated by government bodies. Reducing their interest in buying coins and tokens if they expect regulations to be introduced.

Strict regulatory rulings in China have caused crypto prices to crash several times in recent years as they have restricted trading. They have also seen mining capacity shift to other countries such as the US.

The price of XRP, for example, has been severely affected by the ongoing lawsuit with the SEC. The regulator accuses Ripple of misleading XRP investors, something XRP contests.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.