Samsung is a household name in electronics. It’s one of the big multinationals. You know them for their appliances and consumer electronics.

Or maybe because of their phones. Most likely, you own or own a Samsung product. However, did you know that they also have an asset management firm? They listed a Samsung Bitcoin Futures Active ETF in Hong Kong, back in January. So, let’s find out what this Samsung Bitcoin Futures Active ETF is all about.

What Is the Samsung Bitcoin Futures Active ETF?

Samsung sees itself as a pioneer in the South Korean ETF market. They specialized in futures-based Exchange-Traded Funds or ETFs. In 2002, they launched their first ETF in South Korea. Now they are moving into the rest of the Asian market.

This resulted in, among others, their January Bitcoin Futures Active ETF. Now, don’t get sidetracked by the ‘Active’ addition. It means that they actively manage the funds. For this, they take a 0.89% yearly fee.

#CryptoNews: Samsung launches Bitcoin ETF

On January 13, #Samsung Asset Management Hong Kong (SAMHK), a subsidiary of Samsung Asset Management, will launch the "Samsung Bitcoin Futures Active ETF" in Hong Kong.

(1/3)

— Cryptoforce India (@cryptoforce_in) January 14, 2023

AN ETF mimics the price action of an asset. You don’t own the actual asset. In this case, that asset is Bitcoin. So, Bitcoin which you can buy on a crypto exchange, is not regulated by the SEC or the CFTC. That’s the Commodity Futures Trading Commission. However, the CTFC does regulate a Bitcoin futures contract. In the same way, they regulate corn or gold futures. Only companies, regulated by the SEC, can issue ETFs. Here’s a description of a Bitcoin Futures ETF by the CFTC. Find an in-depth explanation of an active ETF here.

The listing of this Samsung Future ETF was on the Chicago Mercantile Exchange or CME. However, trading is on the Hong Kong exchange, on their main board. Its stock code is 3135.HK, this makes it easily identifiable. So, if you buy a Bitcoin ETF, you don’t need to have a crypto wallet. You also don’t need to deal with a crypto exchange. What is of interest, is that the Bitcoin futures price follows the Bitcoin spot price almost to the dot. See the picture below.

Source: Samsung

Why Are Bitcoin ETFs in the Picture?

Bitcoin ETFs are currently in the picture. The most eye-catching narrative is the Bitcoin spot ETF. To clarify, with a spot ETF, the broker must hold the actual underlying asset. So, in the case of Bitcoin, anybody offering Bitcoin spot ETFs must hold Bitcoin. However, the buyer doesn’t hold Bitcoin. The price of a Bitcoin spot ETF follows the Bitcoin spot price on the dot. These are significant differences compared to a Bitcoin ETF.

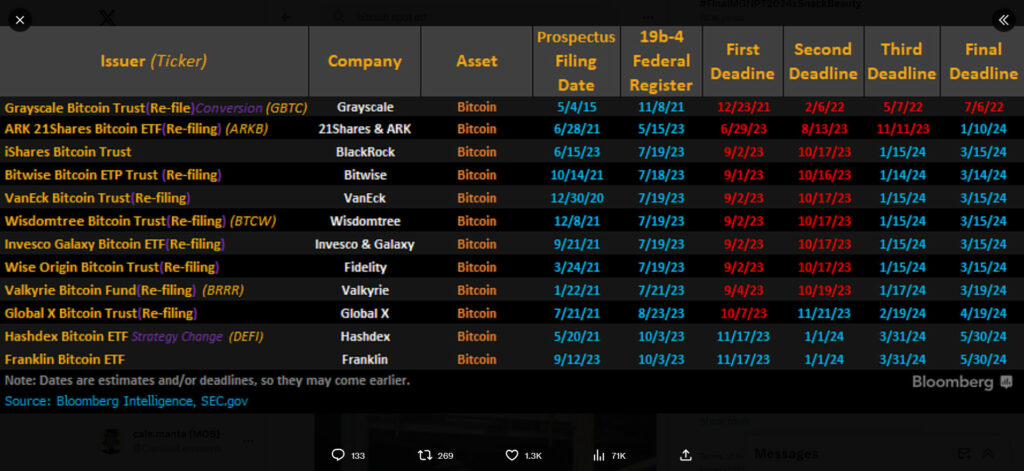

In case the SEC approves the current Bitcoin spot ETF applications, we can expect a BTC price jump. This would open the gateways to institutional money into Bitcoin. Currently, there are 12 Bitcoin spot ETFs waiting for approval in the US. See the picture below.

Source: X

According to Samsung, already 11% of all investors own cryptocurrencies. The current global market cap for crypto is around $1.45 trillion. However, only around 1% of the world’s population currently owns a crypto wallet. We also see an increase in Ethereum ETF applications. However, Bitcoin is the crypto OG with the highest market cap. It’s the most attractive coin for institutional money.

There’s not only the possible Bitcoin spot ETF approval coming up. The Bitcoin halving is another big event that can have a positive influence on the BTC price. This should take place around 19th April 2024. It’s an event that happens every 4 years. So far, each halving saw a massive price jump for Bitcoin. For Samsung’s explanation on their future ETF, see the following video.

Conclusion

The Samsung Asset Management company issued a Bitcoin Futures Active ETF. It shows the interest that mainstream and institutional money has in Bitcoin. It’s a step closer to mass adoption for Bitcoin and crypto. Bitcoin ETFs are currently in the spotlight. There are 12 Bitcoin spot ETFs waiting for approval by the SEC. This could have an explosive impact on the Bitcoin price.

The current Bitcoin price is $37,504. Its market cap is $733 million. Out of a max supply of 21 million BTC coins, 19.5 million already circulate.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.