Gravitas Protocol is a relatively new interest-free browsing protocol on Ethereum. This decentralized protocol is gaining popularity due to its unique feature that enables users to borrow against their Liquid Securities Tokens (LSTs) without incurring any interest charges.

Compared to traditional lending platforms, Gravitas Protocol stands out as a more secure and transparent option due to its decentralized nature. Users have the flexibility to repay the loan at any time without the burden of accumulated interest charges, as they only need to pay back the principal amount borrowed.

Essentially, Gravita acts as a growth catalyst that aims at reducing concentration amongst Ethereum LSTs for minority projects in this vertical. Moreover, Gravitas Protocol is user-friendly, allowing anyone with an Ethereum Wallet to access its services seamlessly.

What is Gravitas Protocol?

The Gravitas Protocol works upon Liquity’s economic model, which forms the underlying foundation of the protocol. It ensures the efficient borrowing process and timely liquidations of tokens within the ecosystem. While the protocol does not charge interest, users must pay a standard 0.5% borrowing fee upfront for each new debt or debt increase.

Source: Twitter

However, the protocol refunds the borrowing fee if the user repays the debt within six months to incentivize short-term borrowings. There is a minimum fee equivalent to one week’s interest that still applies in such cases.

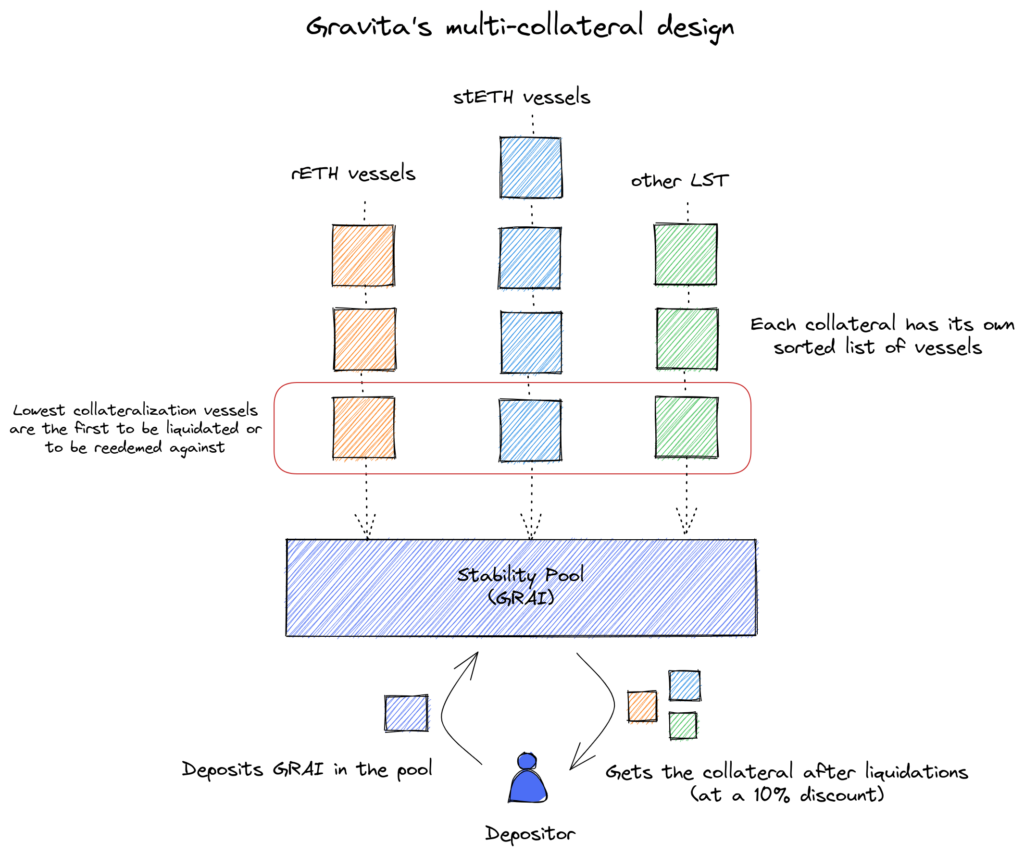

In terms of the multi-collateral design of the Gravitas Protocol, each position is limited to a single collateral type. All collaterals within the protocol are linked to the same stability pool, ensuring consistency and simplicity in collateral management. Furthermore, the loans issued through the Gravitas Protocol are in GRAI tokens, incorporating a volatility-dampening mechanism similar to Liquity’s LUSD.

Borrowers can mint $GRAI tokens by leveraging the value of their collateral. Users can then use these tokens to exchange for other assets, provide liquidity, or participate in the protocol’s stability mechanism.

How does Gravita Protocol work?

Gravitas Protocol uses a collateralized debt position (CDP) model. But how does it work? When users wish to borrow funds, they deposit their LSTs into a CDP, which serves as collateral. The value of the deposited collateral determines the amount borrowable. Once the borrowing process is complete, users are free to invest or use these funds.

The loan procedure in the Gravitas Protocol revolves around a concept called a “vessel.” A vessel represents a mechanism where users can deposit their collateral by opening a vessel and borrowing GRAI tokens against it. Each Ethereum address is allowed to have one Vessel per collateral type.

Source: Gravita Protocol Docs

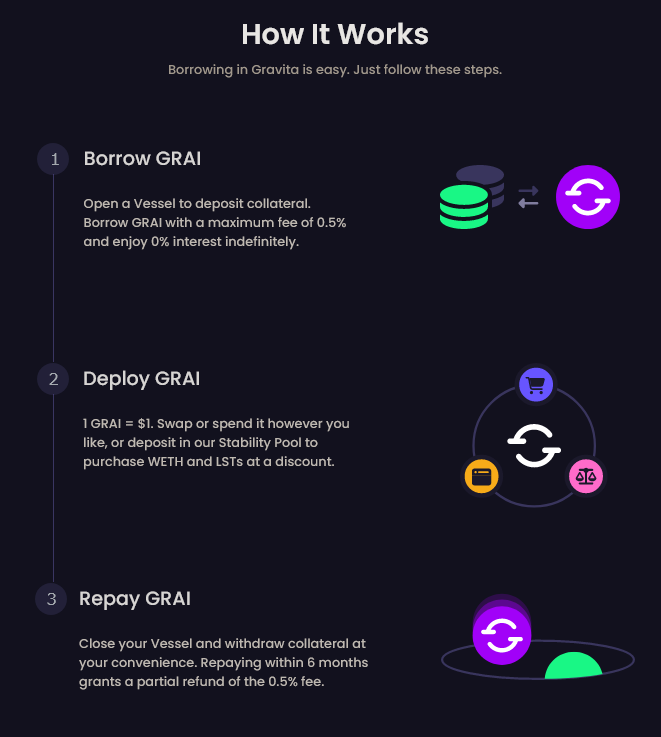

Users can receive GRAI tokens when they deposit collateral into their Vessels. As we discussed before, the amount of GRAI tokens borrowed is determined by the value of the deposited collateral, allowing users to borrow up to 90% of their collateral’s value. Gravitas operates through a simple three-step process:

Step 1: Borrow GRAI

To begin, users can open a Vessel and deposit their collateral. By doing so, they can borrow GRAI tokens with a maximum fee of 0.5%.

One notable advantage is that these loans are interest-free indefinitely. It allows users to leverage their collateral without the burden of accumulating interest charges.

Step 2: Deploy GRAI

Once users have obtained GRAI tokens, they have various options. Each GRAI token holds a value equivalent to $1. Users can choose to swap or spend their GRAI tokens as they prefer.

Additionally, they can deposit their GRAI tokens into the Gravitas Stability Pool, which offers the opportunity to purchase WETH (Wrapped Ethereum) and LSTs (Liquid Securities Tokens) at a discounted rate. This scenario provides users with flexibility and additional utility for their GRAI tokens.

Step 3: Repay GRAI

The borrower can close their Vessel and withdraw their collateral at their convenience. This step marks the repayment of the loan.

Notably, if the borrower repays the loan within six months, they may be eligible for a partial refund of the 0.5% fee paid during the borrowing process. This feature incentivizes timely loan repayments and rewards responsible borrowing behavior.

Source: Gravita

How to Deposit to Stability Pool to Gain Profit?

The stability pool plays a crucial role in supporting GRAI by acting as its primary line of defense. Its purpose is to ensure consistent and sufficient collateral backing for the GRAI token supply.

Gravita achieves it by allowing users to deposit GRAI into the stability pool. The protocol then utilizes GRAI tokens received from users to participate in collateral liquidations.

Upon liquidation of the Vessel, the protocol burns an equivalent amount of GRAI tokens from the stability pool’s balance to repay the debt associated with the Vessel. In return, the Vessel transfers all its collateral to the stability pool. This mechanism enables stability providers to gradually accumulate a pro-rata share of the liquidated collateral, despite experiencing a corresponding reduction in their GRAI deposits.

So, depositing in a stability pool is the best bet for generating profit for the users. Users who act as stability suppliers can profit from liquidations. When the market is favorable, it can potentially benefit by purchasing collateral at a discount to its market value.

For instance, customers can anticipate receiving WETH at a roughly 10% discount when a WETH Vessel gets liquidated. The liquidations ensure that the entire GRAI supply remains fully backed by collateral, and Vessels that exceed the maximum Loan-to-Value (LTV) ratio get liquidated. The Stability Pool assumes the Vessel’s debt, while the Stability Providers share in its collateral distribution, and the Vessel’s owner keeps the entire GRAI borrowed.

How to buy GRAI tokens

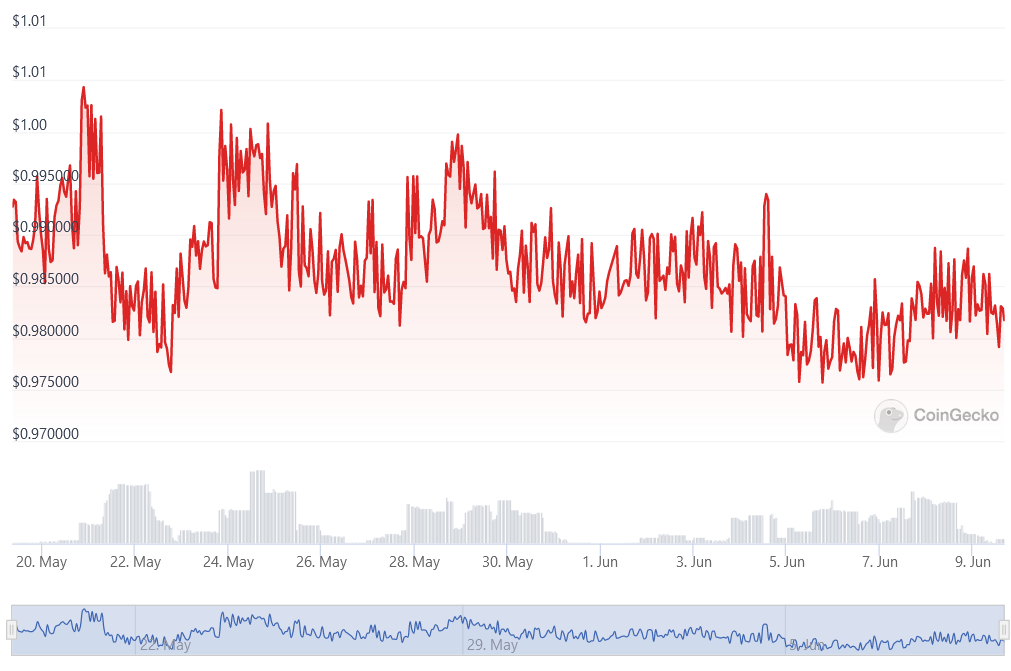

Source: CoinGecko

To obtain GRAI tokens, you can follow these steps:

- Visit a decentralized exchange such as Uniswap.

- Connect your wallet to the chosen DEX.

- Select Ethereum ($ETH) and $GRAI

- Review the transaction details and confirm the transaction.

That’s it! Once the network completes the transaction, you will receive the tokens in your wallet.

Conclusion

Gravitas is making waves in the crypto community, attracting users from all parts of Web3 drawn to its interest-free model. The platform’s expanding presence on social media and its support for multiple LSDs on Ethereum contribute to its increasing popularity and recognition.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.