The current bear market has affected many projects. In particular, Solana had a rough time. For example, they had regular platform outages. However, what almost did them completely in, was the FTX collapse.

From an ATH of $259 in November 2021. SOL nosedived to under $10 in December 2022. Their TVL plummeted by 96%. However, Solana managed to turn things around. So, let’s take a look at what Solana now has to offer.

Time to get bullish on Solana?

We're putting the network under a microscope to find out 🔬

A THREAD 🧵: pic.twitter.com/fkGc31wsTt

— Bankless (@BanklessHQ) September 22, 2023

How Is the Current Solana Network Status?

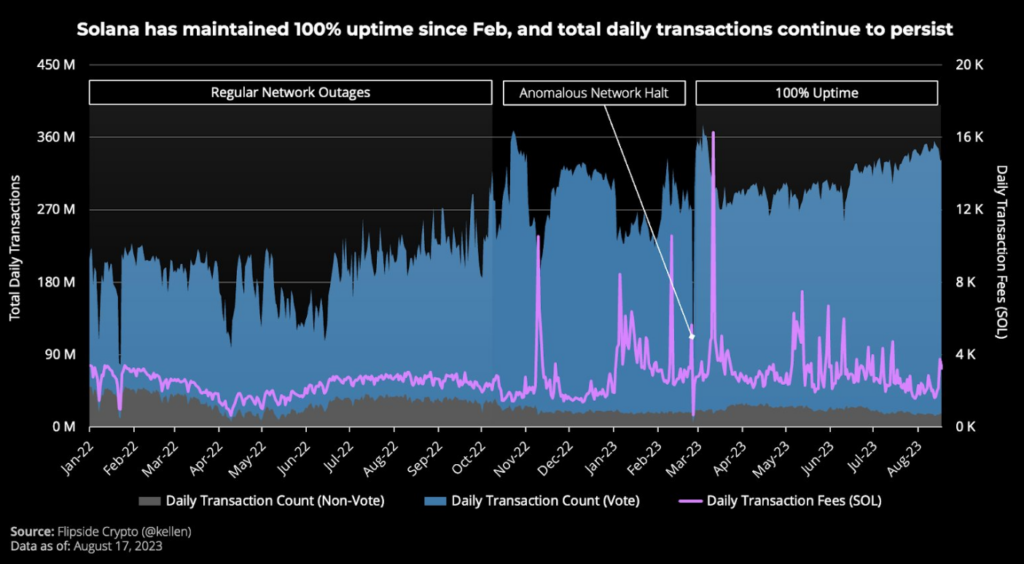

In 2023, Solana hardly had any network outages. Only February saw a bump in the road. There was an almost 19-hour outage caused by an abnormal consensus bug. Here’s where you can check Solana’s uptime. In previous years, outages were unfortunately the norm. Since this year, they’re an exception.

Was this the explanation behind the uptrend in daily transactions? It did realize a 42% increase in revenue for the protocol compared to 2022. In particular, the priority fees have contributed to this. So, overall, we see an increase in value for the chain. Solana also burns 50% of all their transaction fees. Thus, priority fees add to the increased chain value. In 2022, Solana experienced a 92% decrease in market capitalization.

To go back to the outages. They resulted from Gulfstream. That’s how the platform handles pending transactions by not using a mempool. The Solana devs managed to get a better grip on this. As a result, the outages have almost disappeared. It amended this in 2023, so far, there has been a 111% rally.

Source: X

Solana’s DeFi Corner

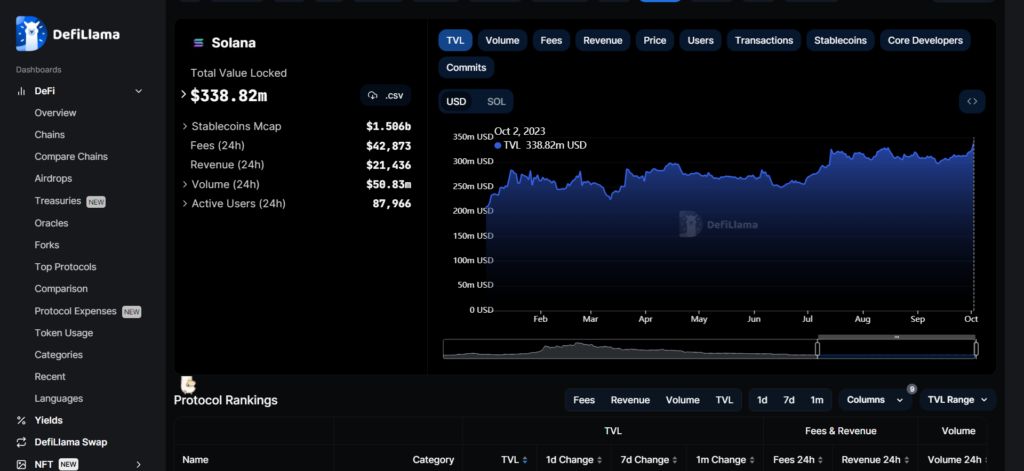

In DeFi, one important metric is TVL. That is the total value locked on a platform. So, if we look at TVL in USD, we see a growth of 41%, year-to-date. However, when we look at TVL in SOL, it declined by 21%. According to DeFiLlama, Solana ranks at #9 compared to all chains. See the picture below of Solana’s TVL for 2023.

Source: DeFiLlama

Liquid staking plays a significant factor in boosting Solana’s DeFi space. Three platforms stand out here. They managed to get triple digits for increasing their respective TVL on Solana. These platforms are Marinade Finance, Lido Finance, and Jito.

Solana’s DeFi ecosystem has also grown. You can observe that users are not only involved in DeFi. There’s a much broader spectrum of platforms they use. For example:

- NFTs.

- Gaming.

- Consumer-oriented platforms.

So, let’s take a look at these platforms.

NFTs on Solana

Solana has a thriving NFT community. In April, it introduced state compression. With this, you can verify off-chain data and secure it on-chain. Here you can verify it.

Soon after this, we saw compressed NFTs (cNFTs). These reduce the costs of storing NFTs. Two projects lead the way for this, Dialect and Access Protocol. Adaption happened fast. We witness hundreds of thousands of monthly transactions for cNFTs. Tensor, an NFT marketplace, was quick to start offering cNFTs. This secured them a 40% market share in cNFTs. Other popular NFT projects on Solana are, for example:

⚛️ ⚡COMPRESSION IS HERE ⚛️ ⚡

TENSOR COMPRESSED NFT MARKETPLACE IS NOW LIVE (BETA)

✅ Trade, List & Bid Compressed NFTs on Tensor ✅ Enjooooy the Tensor speed & UI you know & love 😏 ✅ Manage your Compressed NFT portfolio in seconds

Lets dive into the details👇⚡ pic.twitter.com/IcO9EK15L8

— Tensor | Trade NFTs on Solana ⚛️⚡️ (@tensor_hq) June 2, 2023

New Projects on Solana to Keep an Eye Out For

New projects surface on Solana all the time. Here are some projects to keep an eye out on. They may have a positive on the chain’s health.

- Neon EVM – Deploy EVM Dapps on the platform without changing the codebase.

- Hyperledger Solang – Instead of the Rust or C coding languages, you can now also use Solidity on Solana.

- Eclipse – An Ethereum Layer 2 that uses the Solana execution environment.

The platform also introduced convertible grants. This means that projects need to meet milestones before they receive the grant. Another grant is their AI grant, worth $10 million. A great move to capture this interesting pillar into the ecosystem.

Another positive news for Solana is about the assets on the balance sheet of FTX funds. The courts ruled in favor of Solana, meaning that the markets won’t flood with SOL. Recently, Solana Pay also Integrated with Shopify. This allows for new payment options.

1/ 🦾 The @SolanaFndn is now allocating grants to ecosystem teams building AI tools that use Solana. Learn more 👉 https://t.co/ntXoQgwJxC https://t.co/PEQZyqIawv

— Solana (@solana) April 25, 2023

Conclusion

Solana had a rough time. The FTX crash affected the chain in the wrong way. However, the chain managed to turn things around. This year saw almost no downtime in performance. There are also priority fees that add value and an ecosystem with cutting-edge tech. The future looks a lot brighter again for Solana.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.