On December 3rd, the crypto market of Bitcoin dragged below $50K. The question on everyone’s mind – is this the Bear market? Do you remember the DotCom Crash? During that crash, Amazon stock dropped from $107 to $7. The Priceline decreased by 99%.

If crypto follows this trend, the pressing question becomes — which are these crypto projects? And why could this be the right time to add these to your bags. Therefore, in this article, you will discover how to take advantage of this situation from the Top Coins.

1. Ether

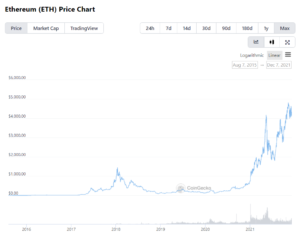

First on our list is Ether ($ETH), the king of smart contracts. Because of being the first programmable blockchain, Ethereum has its feet fixed at #2 based on its market capitalization, which is over $477 Billion at present.

Source: Ethereum

At one point, the Ethereum ecosystem was considered a dead end. But, the relative longevity of the network and the ability to create smart contracts proved functional enough for the current purposes of DeFi.

Take a look at this almost 70% of the total value locked in DeFi is on the Ethereum blockchain. This percentage indicates that instead of facing severe competition from smart contract blockchains like Solana, BSC, Cardano, Ethereum is rock steady in its place.

During the recent Friday crash, the price of $ETH plunged 17.8% and has struggled to recover since then. But this is not something new for Ethereum. The token has a record of recovering from massive dips in the past. It healed well from its 56% price drop in May 2021 and touched a new ATH just ten days back.

Source: CoinGecko

We feel good about ETH being a good buy during this market dip. There are two reasons for it:

- Reason 1: Almost 5 billion ETH has been burned and taken out of circulation. If you see the burn rate has been going up, this could lead to further pumps.

- Reason 2: Beacon Chain, the core of faster scalable ETH2.0, just completed a year, and by Q2 of 2022, the merge with ETH 1.0 might happen soon. This will be a big event, and such events tend to drive the price up.

2. Binance Coin ($BNB)

Moving on to the next coin in our list, $BNB, the choice is very obvious. As the native token of Binance, one of the leading crypto exchanges, BNB marketcap quickly climbed to #3 when Binance launched Binance Smart Chain, a DeFi platform, in September 2020.

Source: Binance

Since then, Binance has made huge strides in catching up with Ethereum in terms of the trading volume. At present, its marketcap is over $93 billion, and the TVL on BSC is close to 10% of the entire DeFi TVL ranking 2nd after Ethereum.

If you look at Jan 2021 BNB charts, you will notice BNB has been up 1133% since then. That too after witnessing two significant drops. One in May 2021 and another in Sep 2021. Impressively, the token recovered well from each drop. It has more than doubled from its May 2021 drop. This clearly shows that BNB holds the potential for rapid recovery.

Source: CoinGecko

Moreover, BNB would have soared even higher this year had it not received multiple regulatory setbacks. As per the recent news, Binance aims to become a registered crypto-asset firm in the U.K. in six to 18 months. With approval from the FCA, Binance could offer products such as futures and derivatives in the U.K. This could prove to be good for the BNB price.

Also, with regular burns BNB and the growing DeFi ecosystem, BNB price is expected to pump harder if the market moves upwards.

3. DOT

$DOT is the native token of Polkadot, which is one of the blockchains with the most potential in the ecosystem in terms of security, interoperability, and scalability because they’ve developed parachains that make up a varied ecosystem of autonomous platforms, communities, and economies that are transforming how we communicate on the internet.

Source: Polkadot

Polkadot is a network protocol that allows arbitrary data—not just tokens—to be transferred across blockchains.

Polkadot’s native BEP-20 token is called $DOT, with a marketcap of USD 27.5 billion and a 24-hour trading volume of USD 1.3 billion. $DOT has a circulating and total supply of 987 million and 1.1 billion tokens. Therefore, $DOT has three distinct purposes: governance over the network, staking, and bonding.

Source: CoinGecko

The behavior of the $DOT price had two big parts: before the parachains and after the parachains because this milestone gives the real potential to the blockchain. The Polkadot ecosystem just started with the launch of its parachains, where Moonbeam, Acala, and Astar guaranteed an auction (slot) with more than 78 million of $DOT.

Finally, according to Enjin, the initial draft of the Paratoken Standard for polkadot has been committed. This is the ultimate standard for cross-chain NFTs.

4. MATIC

$MATIC is Polygon’s native token, an Ethereum-compatible blockchain network where devs can build and link protocol and architecture, integrating scalable Ethereum solutions to support a multi-chain Ethereum environment.

Source: Polygon

Therefore, Polygon combines the best of Ethereum and sovereign blockchains into a full-fledged multi-chain system. Also, Polygon solves pain points associated with Blockchains, like high gas fees and slow speeds, without sacrificing security.

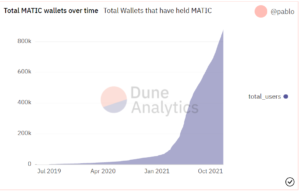

As you can see, Polygon it’s one of the best L2 alternatives to Ethereum’s scalability and high-cost fees. That’s why the price of $MATIC exploded since April 2021 because the blockchain started to have massive adoption, which is expressed in a boost in the number of matic wallets that are used.

Source: Dune Analytics

This multi-chain system is akin to other ones such as Polkadot, Cosmos, Avalanche, etc. but with at least major upsides:

– ETH Compatibility

– Scalability

– Security

– Sovereignty

Finally, Polygon has crossed 15,000 transactions and USD 30 million in volume.

🎉 Today, we crossed the 15k transactions and $30M of volume on @0xPolygon.

The numbers of transactions follows also a nice uptrend. pic.twitter.com/eqOwsIxa6E

— Jarvis Network 🧪🦇🔊 (@Jarvis_Network) December 3, 2021

4. ENJ

$EJS is the native token of EnjinStarter, which is the world’s first dedicated Blockchain Gaming launchpad focusing on helping Game Development studios.

Source: EnjinStarter

EnjinStarter’s native ERC-20 token is called $EJS, which has a 24-hour trading volume of USD 1 million with a total supply of 4.9 billion tokens.

The token distribution is planned with the long-term evolution of communities and ecosystems in mind. This will allow users to operate more efficiently as a platform and attract and stimulate long-term quality projects and infrastructure development.

Since March of this year, the performance of this coin has always been stable over the long term. Why? Because EnjinStarter robust platform supports gaming and metaverse projects with substantial potential every week.

Source: CoinGecko

Moreover, EnjinStarter has its blockchain called Jumpnet, which has no gas fees, carbon-negative NFTs, and smart contract support. In this blockchain, EnjinStarter has developed:

- Launchpad

- Campaign Management

- Marketplace

- Token Management

Finally, according to CryptoRank, EnjinStarter supports projects built in the Ethereum, Polygon, and BSC with a current 7.68x ROI. They’ve already raised more than USD 900,000 and a 24-hour trading volume of USD 6 million with a marketcap of USD 47.68 million.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.