Although we’re in a bear market, the crypto space is constantly innovating. One of these recent innovations is Friend.tech. This Decentralized Application (dApp) was launched in August this year.

And already, it’s got a ton of users on its platform. But, is this growth really sustainable? Before we answer this question, let us do a quick re-cap on what Friend.tech is.

What Is Friend.tech?

In a nutshell, it’s a decentralized social network platform. Its main feature is that it allows creators to “tokenize” themselves. In turn, creators now have “keys” to themselves. Said keys can be traded amongst users on the Friend.tech platform.

Of course, these keys have their own use cases. The creator mostly determines these. For instance, a creator’s key owner could get special access to chatrooms or content, and so forth.

🔵FRIEND TECH EXPLAINED🔵

Everything you need to know about the hottest @BuildOnBase network application, @friendtech condensed by Tom into just 60 seconds… #FriendTech #BaseNetwork #Coinbase #CryptoNews #NFA #NotFinancialAdvice pic.twitter.com/TrHDhjJv5e

— BSC News (@BSCNews) September 29, 2023

For a deep dive into Friend.tech, you can refer to our previous research here. And if you would like to try out the dApp, the link’s right here too!

Friend Tech’s Sustainability

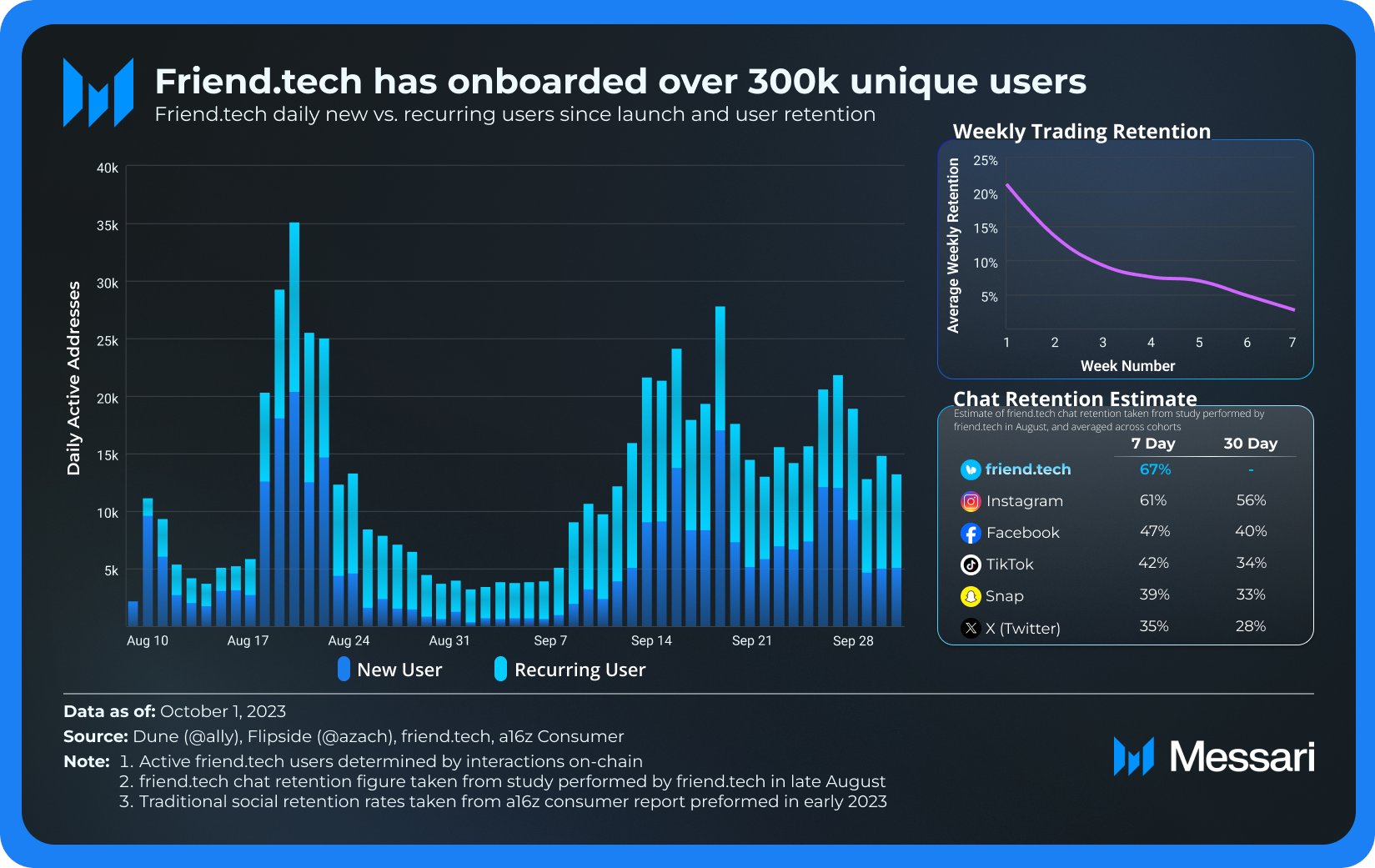

Within 2 months, the dApp has onboarded over 300,000 users! That’s pretty amazing! But will this trend continue? Despite its meteoric launch, user activity is showing signs of stability. On a daily basis, the platform has about 6,000 new users and 9,000 recurring users. This shows that the dApp is experiencing healthy and sustainable growth.

#1 – Average Weekly Trading Retention

Yet, the average weekly trading retention fell from 22% to 5%. This means that on a week-to-week basis, there are fewer users actively trading on the platform. This could be due to the platform’s features. Much of Friend.tech’s platform is not yet optimized for user experience and content consumption.

However, this metric addresses only the trading of keys. There could still be many users on the platform using its other features. Hence, this metric is not conclusive in addressing the platform’s sustainability.

#2 – Total Value Locked (TVL)

At the end of September 2023, the platform set a new All-Time High (ATH) for its TVL at $50 million. That’s a pretty impressive result considering Friend.tech is only 2 months old! In fact, this TVL trumps many other DeFi projects in the crypto space.

#3 – Daily Revenue From Fees

On top of that, Friend.tech has been making about $320,000 in fees daily from users. That’s another testimony to its success. In fact, this amount of revenue compares well with today’s top DeFi protocols. Let’s look at some of these comparisons below.

#4 – The Daily Revenue / TVL Ratio

The daily revenue / TVL ratio measures business efficiency for a crypto project. Simply put, it measures how much revenue you can earn from a certain amount of TVL in the project. So, a high ratio means a project earns more money from less TVL. This means the project is efficient in terms of earning revenue. And vice versa if the ratio is low.

7/ For even more perspective, FT has outpaced DeFi majors like Lido, Maker and Aave in daily rev/tvl since launch by a factor of over 100 pic.twitter.com/IrKVPNXcpb

— Ally Zach (@0xallyzach) October 6, 2023

By looking at the above chart, it’s clear that Friend.tech is much more efficient compared to many top DeFi projects like Lido, Maker, and Aave. Again, that’s a bullish sign for the platform’s sustainability. Much of this revenue comes from the dApp’s trading fees (10%).

Future Concerns about Friend Tech

Looking at the above 4 metrics, it’s clear that Friend.tech’s performance is stellar. Yet, no one can really tell the future. There are still many challenges that the young platform will face. These challenges include:

- Maintaining incentivization of its creators.

- Improving the project’s prominence in the SocialFi space.

- Increasing user adoption for its platform.

Indeed, the dApp’s current pricing model for creator keys limits the amount of users. The prices rise too fast and soon, users who want to buy are priced out. That could limit the amount of reach that creators will have on Friend.tech.

Conclusion

It goes without doubt that Friend.tech’s launch is a resounding success. But, whether it can achieve long-term success remains a mystery. Will it be able to overcome the challenges that plague each and every crypto project? Only time will tell.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.