One such pivotal moment is the hypothetical scenario where the FTX scandal never occurred. FTX, a prominent cryptocurrency exchange, was embroiled in a scandal that rocked the industry.

In this article, we explore how the crypto landscape might have looked if the FTX scandal had never happened. From its influence on regulatory approaches, market dynamics, and investor confidence.

Simulating What We All Wish Would Never Happen

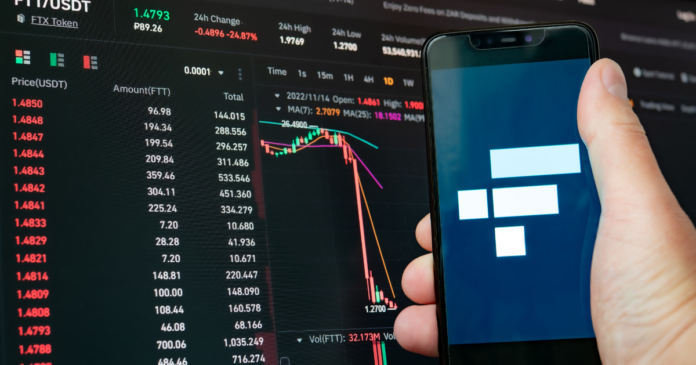

In our hypothetical scenario, let’s briefly outline the FTX scandal to provide context for the impact it might have had if it never occurred. FTX found itself entangled in a significant controversy. When it was revealed that the exchange had been involved in illicit activities.

If you had told me at the start of last year, that:

• LUNA would go to 0

• 3AC (crypto's biggest VC) would subsequently collapse

• BlockFi, Celsius and Voyager would all go under

• FTX would implode, with SBF being exposed as one of the biggest frauds in financial history…— Miles Deutscher (@milesdeutscher) October 5, 2023

Including market manipulation, money laundering, and lack of security measures. These revelations led to regulatory investigations, asset freezes, and a severe loss of trust from investors. Here I analyze what would have happened in 3 important sectors of the crypto industry:

1) Regulatory Environment

- Stricter Regulations: In a world without the FTX scandal, the regulatory environment for cryptocurrencies might have been even more stringent. Regulators, witnessing a major exchange’s fall from grace due to unscrupulous activities, may have been prompted to introduce stricter measures. The idea is to ensure the security and integrity of the market.

This could have led to more thorough KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements for crypto exchanges. Raising the bar for entry and oversight.

- Increased Regulatory Clarity: The FTX scandal highlighted the need for clear regulatory guidelines in the cryptocurrency space. In an alternative reality where FTX remained scandal-free, regulators may have worked more proactively to provide comprehensive rules. Improving investor protection and fostering industry growth.

This regulatory clarity could have attracted more traditional financial institutions and larger investors to the crypto market.

2) Market Dynamics

- Enhanced Trust: The absence of a major exchange scandal would have likely maintained or even enhanced investor trust in the cryptocurrency market. This trust is critical for the industry’s growth. Institutional and retail investors would have felt more secure in their crypto investments. Knowing that a major exchange had not been involved in unethical practices.

- Greater Innovation: A trustworthy FTX would have continued to lead. Without the shackles of a scandal, the exchange might have expanded its product offerings and partnerships, inspiring other exchanges to follow suit. The crypto industry might have seen even more creative and accessible financial products, such as tokenized stocks, commodities, and derivatives.

- Market Competition: A scandal-free FTX could have further intensified competition among crypto exchanges. The absence of a major player falling from grace would have encouraged others to strive for excellence in customer service, security, and innovation. Benefiting users with better options and services.

Imagine what happened if FTX did not went down and SBF kept going

He would have been a considerable danger for humanity

— Algod (@AlgodTrading) October 12, 2023

3) Investor Confidence

- Widespread Adoption: The FTX scandal had a significant impact on public perception. In a world where FTX remained scandal-free, investor confidence would likely have soared, leading to a more widespread adoption of cryptocurrencies and blockchain technology. Businesses and consumers would have been more inclined to explore crypto solutions, from decentralized finance (DeFi) applications to non-fungible tokens (NFTs).

- Reduced Volatility: Improved investor confidence resulting from a scandal-free FTX might have led to reduced price volatility in the cryptocurrency market. A broader base of confident investors could have stabilized the market to some extent, making cryptocurrencies more attractive to risk-averse investors.

- Institutional Investment: The trust garnered by the industry in this scenario could have attracted more institutional investors. Without a major exchange scandal, institutional players may have entered the space earlier, increasing liquidity, and bringing more traditional financial instruments to the crypto market.

🚨 Day 6 of the SBF Trial! It’s getting spicier than ever. 🧨

Caroline Ellison, former CEO of Alameda Research, spills the tea on Alameda's financial missteps and, like FTX cofounder Gary Wang, points directly at Sam Bankman-Fried.

Get the full scoop on this video 👇 pic.twitter.com/acnFV2pj63

— Laura Shin (@laurashin) October 12, 2023

Conclusion

The hypothetical scenario of a cryptocurrency industry without the FTX scandal presents a fascinating glimpse into a more positive and potentially more mature market. Enhanced regulatory measures, greater trust, and increased investor confidence could have been the hallmarks of this alternate reality.

However, it is important to note that the cryptocurrency industry’s evolution is influenced by numerous factors, including technological developments, market dynamics, and unforeseen events. While the absence of the FTX scandal may have had a significant impact, the crypto industry remains highly volatile. And its trajectory will be shaped by a complex interplay of factors.

In the real world, events like the FTX scandal serve as lessons for the industry. Emphasizing the need for robust regulatory oversight, transparency, and ethical conduct. Regardless of hypothetical scenarios, the cryptocurrency industry will continue to evolve and adapt to the changing landscape, driven by innovation and the demands of its ever-growing user base.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.