One of the ways to make money in crypto is to follow the money. VCs are a prime target for this. Coinbase Ventures is one of the biggest players in this field. This is Part 1 of a 4-part series.

The portfolio they manage is around $1.5 billion. Their preference seems to be in Web3 infrastructure and DeFi projects. So, let’s dive into some of the gems that Coinbase Ventures is investing in, in 2023. Their past ATH ROIs were immense. Let’s see if they can repeat this.

🔥 Coinbase Ventures is a Gem Finder@cbventures manages a ~$1.5B portfolio, and the ATH ROI from the last bullrun is mind-blowing 🧠$MATIC x1100$GRAPH x966$FLOW x424$RPL x295

These are their 2023 investments. Let's find out!🧵@brian_armstrong @emiliemc @ShanAggarwal pic.twitter.com/qKNC1fO7V9

— Pink Brains (@PinkBrains_io) October 10, 2023

1) Affine DeFi

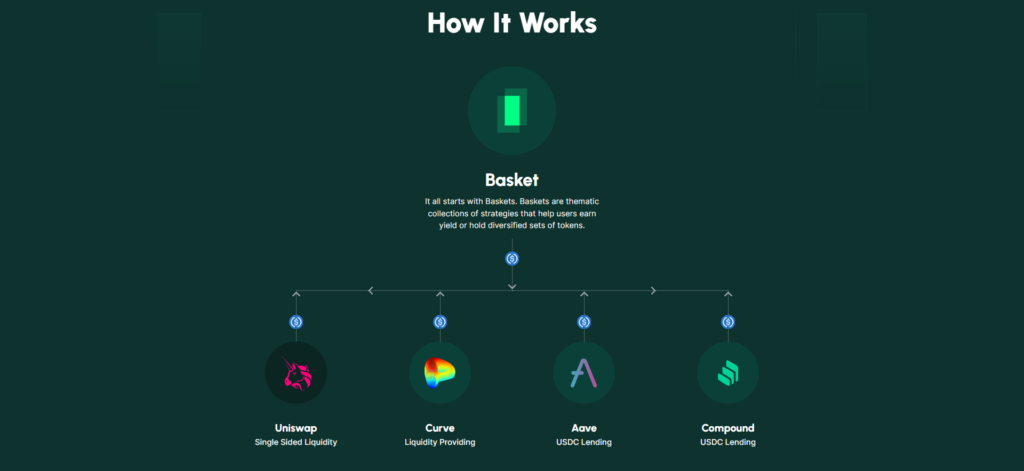

Affine DeFi is transforming DeFi investing. It offers smart yard strategies with cross-chain options. The protocol also allows you to invest in various assets at the same time. This allows for a weighted return average.

You can earn up to 15% APY in a simple, secure, and sustainable way. Strategies the platform offers are, for example:

- Providing liquidity.

- Lending and borrowing

- Spot trading.

- Equity pledges.

All strategies provide price exposure and yield. These strategies look for the most favorable opportunities in DeFi. Its transaction fees are near zero and it has a built-in diversification.

In total, the platform raised $7.1 million to date. Coinbase Ventures took part in the first seeding round of $5.1 million in February 2023. Affine currently has a live Points Airdrop Program! The picture below shows how Affine works.

2) Maverick Protocol

Maverick Protocol has already been around since 2021. The protocol offers DeFi a new infrastructure. It can accommodate the best liquid markets for traders, liquidity providers, DAO treasuries, and developers. Furthermore, it also offers a Revolutionary AMM. For instance, it offers:

- Directional LPing – Follow an asset price in a single direction.

- Unlocks greater capital control. – With price movements, it automates the reconcentration of liquidity.

- Offers higher capital efficiency – this offers more liquid markets. In turn, traders get better prices and LP providers get more fees. There’s also no longer a need to adjust positions. As a result, the gas fees are lower.

In June 2023, it raised $9 million in funding. Coinbase Ventures took part in this round.

New Boosted Pools are live on @mavprotocol + @zksync !

– $GRAI – $LUSD

– $GRAI – $USDCRemember to bridge GRAI inside Gravita's Dapp to leverage our @LayerZero_Labs integration.https://t.co/mwE4lWx5bC pic.twitter.com/2kH2DPSCs0

— Gravita Protocol (@gravitaprotocol) October 4, 2023

3) Connext Network

Connext Network is like the HTTP but for Web3. It offers fast and noncustodial transfers on EVM-compatible chains and its L2s. Their vision is that you can transfer assets between various chains. All this from a single wallet, without needing native tokens for each chain.

Transactions are near-instant and with low fees. It’s also fast and trustless. With its technology, it offers cross-chain transactions between various ecosystems. It uses a bridge for the cross-chain activities. Currently, it serves six chains, including,

- Ethereum.

- BNB.

- Polygon.

- Gnosis.

- Arbitrum.

- Optimism.

To date, Connext raised $12 million. Coinbase Ventures took part in a $7.5 million investment round.

More than a bridge.

Connext is a protocol to build universally accessible, interconnected dApps. It's the public good layer that enables a 1,000 rollup world – the interchain. 🌐

It's what's NEXT for Web3. pic.twitter.com/7LsLOC5P0b

— Connext (@ConnextNetwork) September 19, 2023

4) Socket

Socket powers cross-chain connectivity. It’s a platform built by devs for devs. They offer, for example,

- SDK – integrate Socket in your Dapps.

- API – enabling cross-chain swaps in your Dapps.

- Plugin – Integrate their customizable bridge into your Dapps.

Bungee is their exchange. It connects and bridges to 12 chains. Currently, they run their 400,000 OP Rush program. It allows you to claim up to 20 OP per transaction. This has 300k OP rewards. Another 100k reward is for partners. However, this allocation depends on their volume. This program should run for 3 to 4 months and start in August 2023.

In June, the platform raised $7.5 million. Their total funding stands now at $28.2 million. Coinbase Ventures took part in a $5 million funding round in September 2023.

1/ We're thrilled to announce a $5M strategic investment from @cbventures and @hiFramework into Socket!

With this investment, we expand our collaboration with Coinbase to bring cross-chain primitives to their products like Coinbase Wallet and Base.

— Socket (@SocketDotTech) September 6, 2023

5) MSafe

MSafe is also known as Momentum Safe. The platform offers secure and decentralized digital asset management solutions. It does this with a multi-signature and noncustodial option. MSafe calls Aptos its home. There’s a connection there with its CEO, Wendy Fu. She worked at Meta, on their Novi wallet. The Aptos founders also have a Meta background.

A multisig wallet requires various parties to sign transactions. Each signature has a different private key. This is ideal for corporations or enterprises. Their multisig wallet also offers,

- Lending.

- Yield farming.

- NFT transactions.

Coinbase Venture took part in a funds round in January 2023 that raised $5 million.

(1/n) Welcome to #MSafe – the future of digital asset management, backed by @jump_ and @cbventures.

We provide a multi-sig, non-custodial digital wallet solution, ensuring your assets are safer and more under your control.🧵👇 pic.twitter.com/Pn1dFUnZP9

— MSafe (@MomentumSafe) October 4, 2023

Conclusion

Coinbase Ventures is one of the most active VCs in crypto. To date, they invested in over 400 Web3 start-ups. They managed high ATH ROIs during the last bull run. So, in 4 articles, we will cover other of their current investments.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.