If FTX owns a ton of your tokens, then your project MUST be in trouble right? Or your project is a piece of trash, right? WRONG. FTX holds a big stake in Solana. And even with all the potential sale pressure on those 57 million tokens, Solana’s price isn’t tanking.

In fact, it’s UP 17% just in the last 3 months. By the way, if you are a concerned holder, the average token unlock for these is near the end of 2025, according to Messari. So, this is just one more piece of evidence that we think the worst is over for Solana. It has the potential to grow more than ETH and many other projects in the next year. Come find out why!

Why SOL Will Outperform ETH?

As many of you know by now, SOL is a VC chain. There’s A LOT of money behind it. We have mixed feelings about VC chains. They are in no way decentralized.

But that does not mean they aren’t useful. For one thing, you can do lots of transactions fast and cheap there. That’s good on many levels esp when trying to increase adoption for crypto around the world. So specifically, why will it outperform Ethereum?

-

NFT Growth

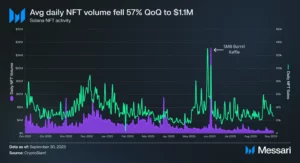

If you believe in the future of NFTs, whether it’s collections, games, or tokenizing assets, then you should be looking at Solana. The amount of ETH used to pay for NFT sales has dropped down to 2021 levels. Not only is the market for NFTs not growing on Ethereum. It’s shrinking.

You NFT lovers know that for most of this bear market, it’s been the same pool of NFT buyers and sellers selling to each other. Now that pool is even smaller. But not so on Solana.

Source: Messari Report

Here the market is growing fast. In Q3, Messari reports that Solana minted 45 million NFTs. That’s a 316% increase from Q2. And while most of the mints are free collections, it’s still significant.

Big ETH NFT projects could add a free mint or a side project if they wanted. But they aren’t. Because there’s no interest there. Solana’s NFT community is growing while Ethereum’s is shrinking. Plain and simple.

Which one do you think will be stronger in a bull market? The one that’s growing during a bear market? Or one that’s shrinking?

-

DeFi TVL Growing

And it’s not just NFTs. DeFi TVL is growing on Solana too. All while TVL is shrinking on Ethereum. In the last 90 days, SOL’s TVL is up 32% to $368 million. That puts them 8th of all chains. Ethereum is still the undisputed leader.

But ETH’s TVL is shrinking. In the last 30 days, as you can see in this DeFiLLama chart, Ethereum’s TVL is down 10.31%. That’s almost $2 billion dollars. And you can’t put all that on a drop in ETH’s price. ETH’s price is down only 1.7% in the same 30 days.

How did @solana perform Q3'23?

Solana tech is continuing to gain mindshare, with market cap growing 17% QoQ and revenue for SOL up 10% QoQ.

DeFi TVL also grew 32% QoQ to $368M, thanks to protocols like @marginfi, @cypher_protocol, and @solendprotocol. pic.twitter.com/UN6ywL8NiK

— Messari (@MessariCrypto) October 18, 2023

And Solana, DeFiLLama tells us their TVL is up 6.12% in the last 30 days. This last month is a positive contributor to the overall 32% growth in the last quarter. Marinade, Jito, and SoLend are benefitting the most but every DeFi platform on Solana is up in recent weeks. The entire ecosystem is growing.

- Super Low Transaction Costs

Back to the Messari report again. For Q3, the average transaction cost on Solana is $0.0002. That’s 2/100ths of a cent. There’s no lower transaction cost anywhere in crypto.

It’s easy to think if you are in the US, Canada, or Western Europe that things like transaction costs don’t matter. Especially if one L1 is 3 cents while another is 15 cents. Both are much cheaper than bank wire fees so we’d take either one.

But what’s the biggest potential market for crypto in the world now? India. And where is crypto growing the fastest? Sub-Saharan Africa. In these regions, due to their weak currencies, even paying 10 cents for a transaction could be expensive for them based on income and currency value.

Source: Messari Report

But everyone can afford 2/100ths of a cent. This is why low transaction costs are so key to increasing global adoption.

And low transaction costs are something Ethereum will never, ever have.

-

Ethereum’s Central Bank Mentality

Yes, I’m serious here. Have you noticed that the rules that govern Ethereum keep changing? And not in a community adoption of new proposals way like you see on Cosmos.

More like Federal Reserve central bankers. Vitalik, Joseph Lubin, the Ethereum Foundation. Consensys, and those who got the 70% premine of Ethereum keep changing the rules in ways that benefit them. And not just the move to Proof of Stake, either.

And people are starting to notice. If you were in the early ETH club, then congratulations. But for the rest of us, they don’t care at all what you think. They just change the rules so they benefit more while doing nothing to make transacting easier, faster, or cheaper. Even some crypto influencers like DU09BTC, who is not a Bitcoin maxi, agree.

I've been following Ethereum closely. Vitalik and the early insiders continue to change the rules and modify the code. Now some are threatening to abandon the project altogether in the face of government intervention. I'm not waiting any longer.

Today, I am selling all my ETH.

— Duo Nine ⚡ YCC (@DU09BTC) October 19, 2023

Those sound like some bankers we already know. Solana has its faults, especially with its heavy VC ownership. But it’s not doing this and it seems to care more about its community.

Why SOL Will Outperform MATIC

Now Polygon is a different story. While it has its own chain, most of its work is in Layer 2 solutions. That means faster, cheaper, and more scalable transactions. Here they are more competitive with Solana than Ethereum is.

- DeFi

Polygon’s DeFi has grown recently too. But not as fast as Solana’s. And in the last month, like Ethereum, Polygon’s TVL is down 15% while Solana’s is up 6%.

- Transaction Fees

Fees on the Polygon network can go as low as 5/100ths of a cent up to as high as 20-ish cents. And that’s both reasonable and fair. Especially since the base fee on Polygon is burned and validators only earn the gas portion of the fee. But that’s still higher than Solana.

In 2 emerging markets for crypto like Cameroon and Colombia, the average monthly salary is under $300. FOR THE MONTH. So, even if inflation is low, the difference between a 10c transaction fee and 2/100ths of a cent is a big deal.

#Polygon taking over the mint game?! 🤯

What does everyone else think of these stats?

Is polygon owning the NFT space right now?

Let me know what yas think 🥳#Arbitrum / #Optimism / #PolygonNFTs / #Base / #Ethereum / #NFTs / #NFT / #Web3 / #Crypto #CryptoNews / #Blockchain pic.twitter.com/NmQRU8hSZR— Nubis Project (@TheNubisProject) October 17, 2023

We love Polygon as you know. But right now, Solana is in a position to outperform it in the next bull market.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.