It has been a long time since we last discussed the macroeconomic situation. US Dollar is facing a monopoly challenge, and the Chinese Yuan is winning the race to become the next global reserve currency.

But, Bitcoin shows enormous determination (and strength) amidst all of this. Let’s dive into the market!

Bitcoin Holds the FUD Level

Let’s be honest. 2022 was not so good for price action. But as a bear market, we knew what we were getting into. However, Sam Bankman-Fried (SBF) took us by surprise, and FTX failed subsequently.

Source: TraidingView

The 27.8k level becomes crucial as the support level for all FUDS has happened since March. Firstly, the infamous Saylor index flashed.

MicroStrategy repaid its $205M Silvergate loan at a 22% discount. As of 3/23/23, $MSTR acquired an additional ~6,455 bitcoins for ~$150M at an average of ~$23,238 per #bitcoin & held ~138,955 BTC acquired for ~$4.14B at an average of ~$29,817 per bitcoin. https://t.co/ALp9VLkTpt

— Michael Saylor⚡️ (@saylor) March 27, 2023

So, Micheal Saylor’s bitcoin buys have triggered bitcoin dips in the past, and the crypto natives consider him as a local top indicator. But this time, Bitcoin had other plans.

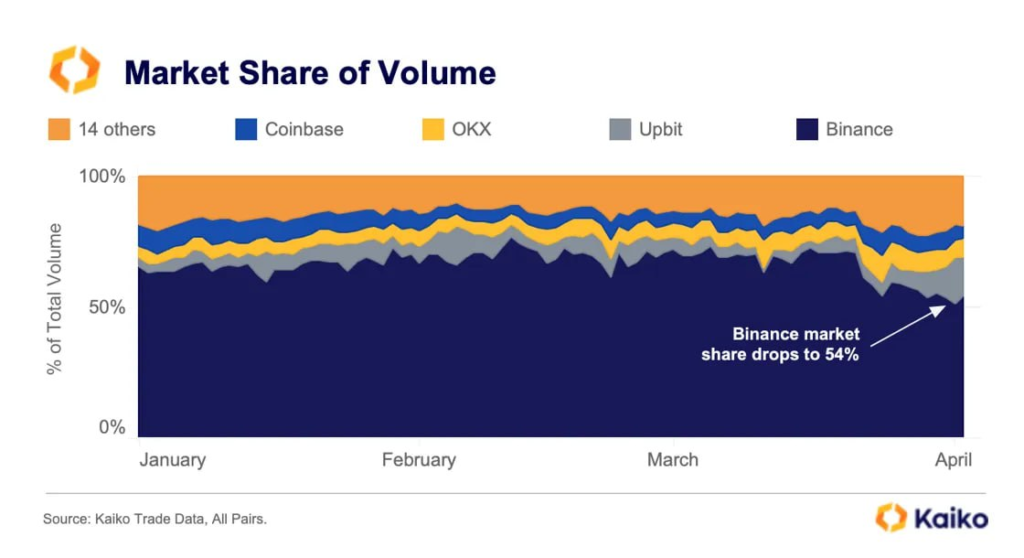

Then, Binance was caught up in the mix of many FUDS. Binance had to pause deposits and withdrawals for an extended period after its maintenance upgrades. Binance was also said to be under investigation by law enforcement agencies. Another cryptic FUD spreads on Twitter that the Binance CEO, CZ, is under investigation by Interpol.

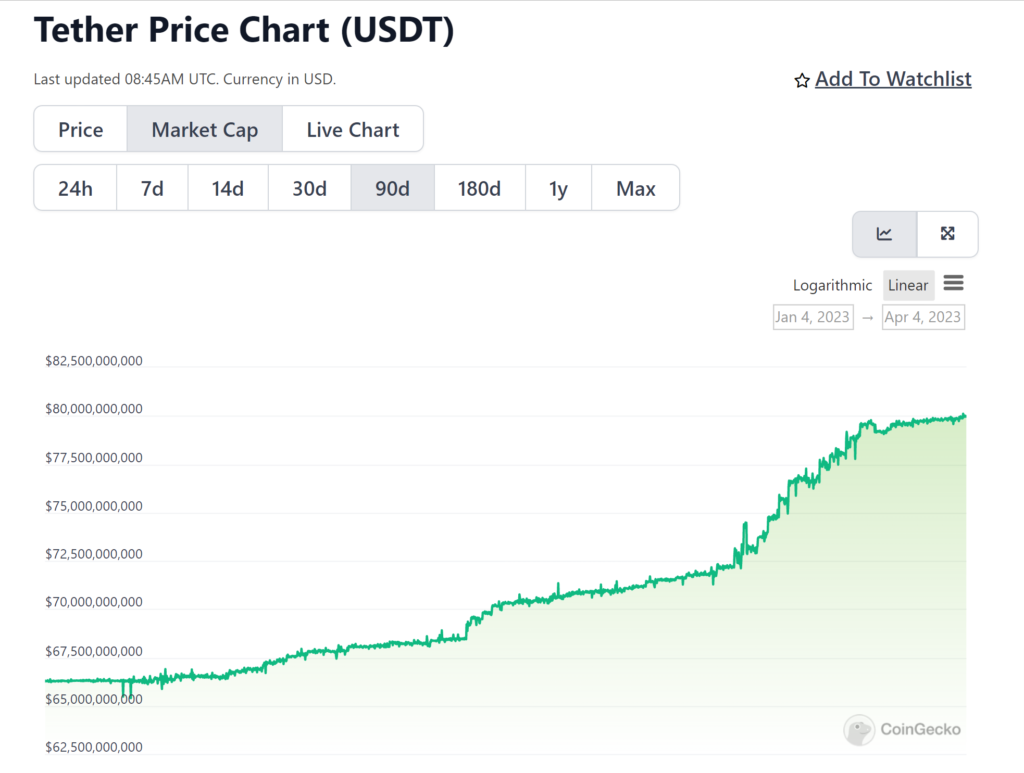

According to Kaiko’s Market Share data, Binance lost around 16% of its market share since the beginning of 2023. It clearly points to decreasing profits for Binance and threats to Binance’s monopoly. Since OKX is the next biggest rival, its $OKB token appears a safe bet.

Nevertheless, the $BNB token, and Binance, are stable even after weeks of a rollercoaster ride. Can crypto survive the crash of yet another big centralized exchange? Of course, the price action would be negative, triggering an extended bear market. Yet, even after the Mt Gox incident, crypto survived and pushed the DeFi narrative. In case of any such FUDs, the best action is to remove funds from centralized exchanges.

However, it is easier said than done. Existing centralized exchanges provide much-needed services to the users:

- Low-cost transactions – Alternative: DEXs (Go for the most liquid dex in any ecosystem) For example: Ethereum – Uniswap, BNB Smart Chain – Pancakeswap, and

Cosmos – Osmosis.

Refer to the AltcoinBuzz guides for the best wallets, decentralized exchanges, and more. - Perpetual Trading – Alternative: GMX, DYDX, Chainge (Limited pairs)

- Crypto deposits and withdrawals – Alternative: Any wallet (Hardware wallets recommended) with a powerful P2P provider or On-ramp solution like Moonpay.

Elon’s New Move and Its Implications

The whole world was surprised when Twitter changed its famous logo (the bird) and replaced it with the logo of Dogecoin. As a result, Doge pumped hard, gaining 35% on the week.

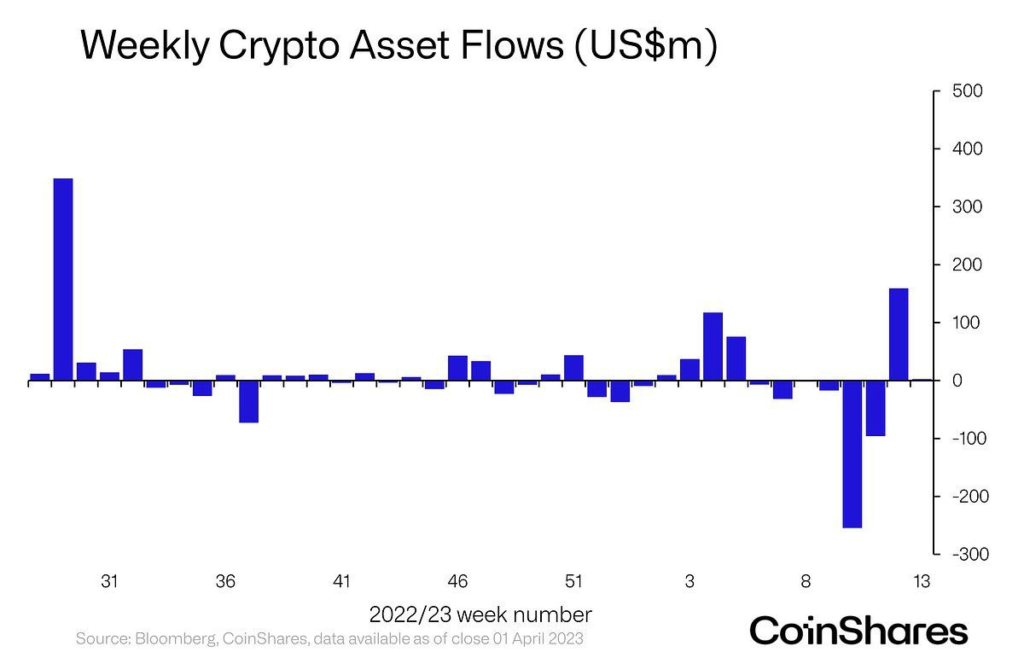

But why did it happen? Earlier in 2023, Elon Musk’s influence on the meme coin pumps was thought to be going down. The answer lies in the Asset flows. In the last week of March, crypto registered the most cash injection over the previous six months.

Now, let’s try and guess who might be behind this liquidity hike. There are four options:

- Whales.

- Miners.

- Institutions.

- New Small Scale Investors.

Whales can’t be behind this move. Why?

Source: CoinGecko

The USDT marketcap was in inflation mode in the last 90 days. Additionally, the inflow (new coins adding to marketcap) was minimal in the last seven days. Currently, the marketcap sits at $80 billion, implying that whales can move the market once they get a macro confirmation. Well, it can’t be Miners, either.

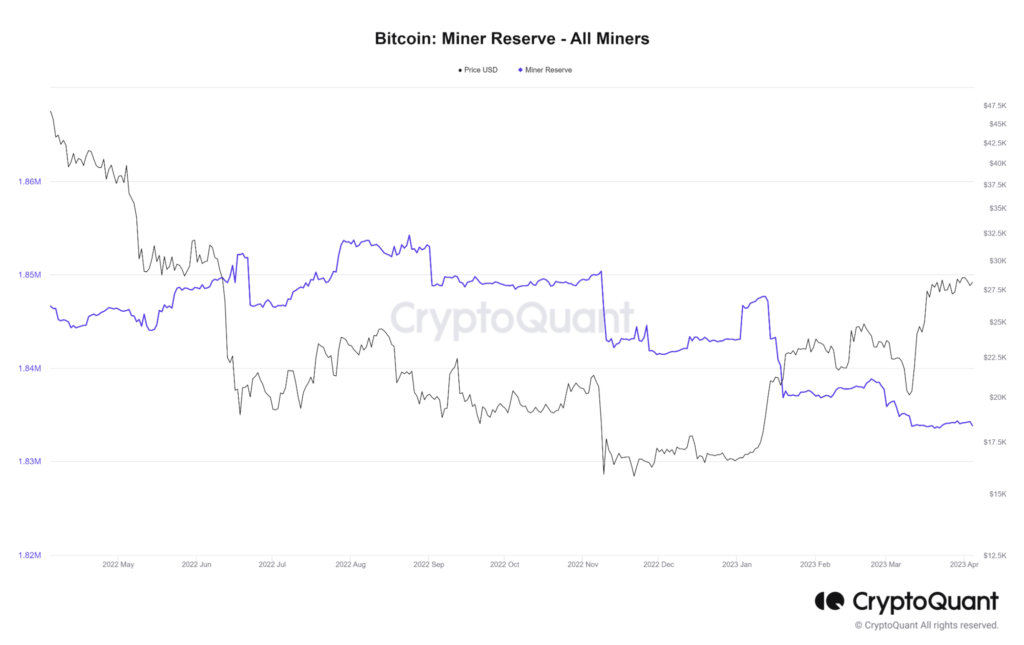

Take a look at the Miner reserves. It keeps reducing, implying Miners were selling slowly into the bullish momentum.

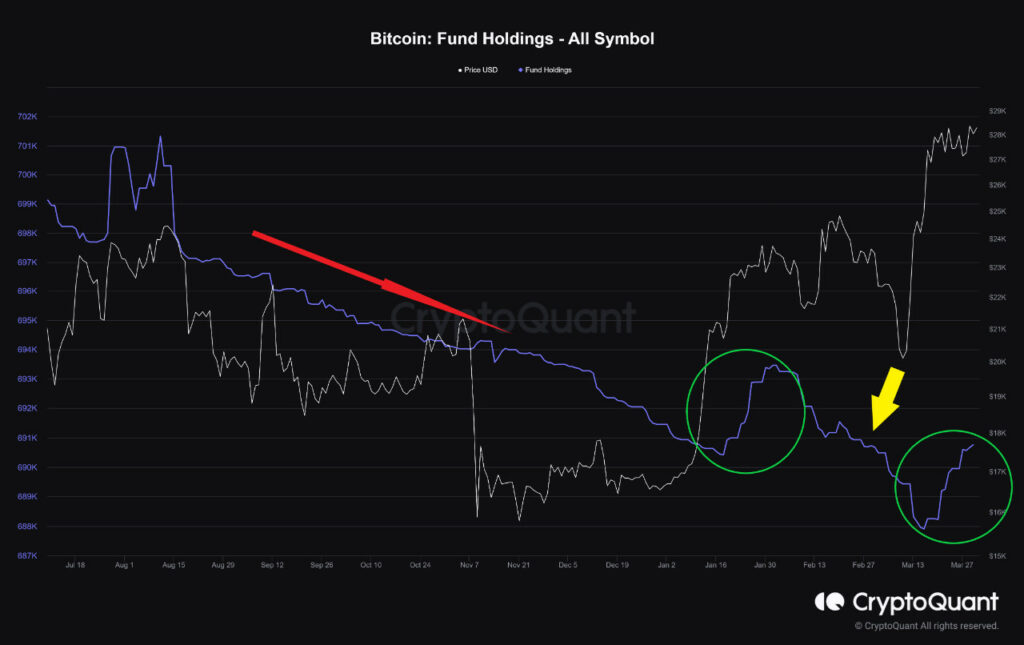

Can it be institutions? Possibly yes. All coins held by the institutions or funds increased after March 15. That means the funds bought the interim dip.

What about retailers, new investors, and seasoned investors? The latest meme coin pump suggests that the retailers are active in the market. Recent pumps in $XRP also point to the resurfacing of retail money.

But the final question remains? Are retail investors wrong to put money in the market? Or the permabears who waited (still waiting) for $10K BTC end up right?

The short answer is that retail might be right this time. After the collapse of regional banks and the struggles of the USD, maybe, just maybe, the new investors have accepted cryptocurrencies as a more robust financial instrument that can generate actual gains.

Fingers crossed! But as long as the tether marketcap stays below $85 billion, deploying capital isn’t a bad idea!

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.