The cryptocurrency industry is in turbulent waters as the U.S. SEC strengthens its control, initiating legal proceedings against prominent crypto exchanges Coinbase and Binance. But despite facing regulatory obstacles and liquidity concerns, Bitcoin demonstrates remarkable resilience.

What an eventful week! U.S. regulators have intensified their efforts against Bitcoin, targeting major cryptocurrency exchanges and classifying several significant altcoins as securities, a scarlet label in the crypto world.

Nevertheless, the crypto market is displaying resilience. Bitcoin’s support at $25,000 remains relatively strong, although the release of upcoming Federal Open Market Committee (FOMC) minutes could potentially impact its stability. Currently, the presence of buying pressure is preventing Bitcoin from experiencing further declines. Let’s discover more about these circumstances.

Macro Scene

Investors are presently factoring in a pause, but the unexpected rate hikes by the Bank of Australia and the Bank of Canada have led to speculation that the Federal Reserve might similarly surprise the market on Wednesday. The outcome largely hinges on the inflation data released the day before, specifically the Consumer Price Index (CPI) scheduled for Tuesday. If the CPI reading resembles the previous month’s Personal Consumption Expenditures (PCE) data, we cannot rule out the possibility of another rate hike.

Source: Twitter

However, even if there is a high CPI reading, it is conceivable that the Federal Reserve may choose to pause. It is due to the Treasury’s gradual replenishment of its account at the Federal Reserve, which is slowly draining liquidity from the markets. Moreover, the Bank of Japan has considered selling stocks, adding to the potential market impact.

Concerns of Market Crash

Well, talking about stocks, there are reports that U.S. politician Nancy Pelosi and her husband have allegedly sold one million dollars worth of Apple stock- though, it appears she has donated.

It is worth noting that Nancy Pelosi has a reputation for alleged insider trading, to the extent that there are multiple Twitter profiles dedicated to tracking her trades. This recent sale comes after Apple stock reached its all-time high, providing important context to the transaction.

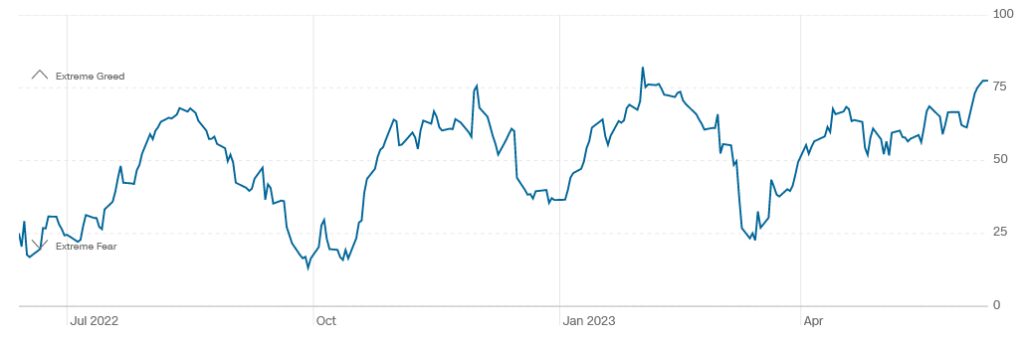

Source: Fear and Greed Index – Investor Sentiment | CNN

There is a growing concern that the markets could be heading toward a crash, and various indicators reinforce this sentiment. The stock fear and greed index recently reached its highest level in years, suggesting heightened investor fear and greed levels. Despite their already low sentiment readings, this implies potential downside risk for cryptocurrencies. After all, extreme greed in the markets often precedes a market crash.

Black Swan Event Looming for Ethereum

Continuing the discussion on insider trading, one of Ethereum’s co-founders has allegedly sold over 10% of their ETH holdings. Interestingly, the Ethereum Foundation has also sold some ETH recently. While such transactions may seem insignificant in normal circumstances, there is a potential black swan event looming for Ethereum this Tuesday.

The long-awaited release of the Hinman documents is scheduled for that day, and they have the potential to reveal concerning information about Ethereum and its relationship with the U.S. SEC.

The SEC’s recent mysterious removal of Bill Hinman’s profile from its website supports this likelihood. Speculation suggests that the SEC might be preparing to distance itself from or potentially implicate him.

Shifting Landscape of U.S. Crypto Exchanges

Simultaneously, there is a noticeable shift occurring among U.S.-based exchanges that offer cryptocurrencies to retail investors due to the recent legal actions taken by the SEC against Coinbase and Binance. It has led to CEXs reevaluating the coins and tokens they make available.

Many exchanges have delisted Filecoin’s token, FIL, due to regulatory scrutiny in recent weeks. What is concerning is that these exchanges have also started delisting DeFi tokens. It may be due to the SEC’s ongoing efforts to establish regulations enabling them to take action against DeFi protocols.

Source: Twitter

However, it is worth noting that truly decentralized protocols remain beyond their reach. Regrettably, the anti-crypto sentiment witnessed in the U.S. has spread to other parts of the world. The crypto crackdown in the U.S. has reportedly sparked renewed debates in the EU regarding the classification of coins and tokens. Furthermore, a leading Australian bank has decided to cease processing certain payments made to crypto exchanges.

Positive Development on the Horizon

Nevertheless, we may soon witness a positive development, a “white swan,” so to speak, emanating from the Middle East.

Saudi Arabia’s sovereign wealth fund has diversified its investments to supplement its oil income. Given that the central bank of the Kingdom is already exploring crypto regulation, there is a possibility that Saudi Arabia may turn to cryptocurrencies as part of its diversification strategy. Exciting times lie ahead!

Regulatory Scene

The crypto industry in the United States is facing a significant assault, with unprecedented hostility brewing between regulators and the technology sector.

This week, the U.S. Securities and Exchange Commission (SEC) filed lawsuits against Coinbase and Binance while targeting several prominent project tokens such as SOL, ADA, and MATIC, categorizing them as unregistered securities.

The announcement resulted in users withdrawing approximately $4 billion from the affected exchanges. While the SEC accused both exchanges of engaging in unregistered securities transactions, it escalated allegations against CZ’s empire, claiming fund commingling and self-dealing practices.

Accompanying the lawsuits were statements from SEC Chair Gary Gensler, who made strongly worded remarks questioning the fundamental functionality of cryptocurrencies during a CNBC interview shortly after announcing the regulatory actions.

Following the SEC’s lawsuits against the exchanges, other platforms not mentioned in the suits swiftly took action to avoid similar regulatory repercussions.

For instance, Robinhood announced on Friday that it would no longer support Cardano, Polygon, and Solana tokens, which had been flagged by the SEC as unregistered securities in the lawsuits. Robinhood users holding these tokens in their exchange accounts will have until June 27 to withdraw or sell these assets before they are automatically sold at the market price.

Source: Twitter

The announcement by Robinhood dealt a significant blow to the prices of the affected tokens, which were already reeling from the SEC’s classifications.

The aggressive actions by these platforms demonstrate the deep concern within the cryptocurrency industry that the SEC’s regulatory crackdown may expand to encompass other market participants.

Parallels between FTX and Binance

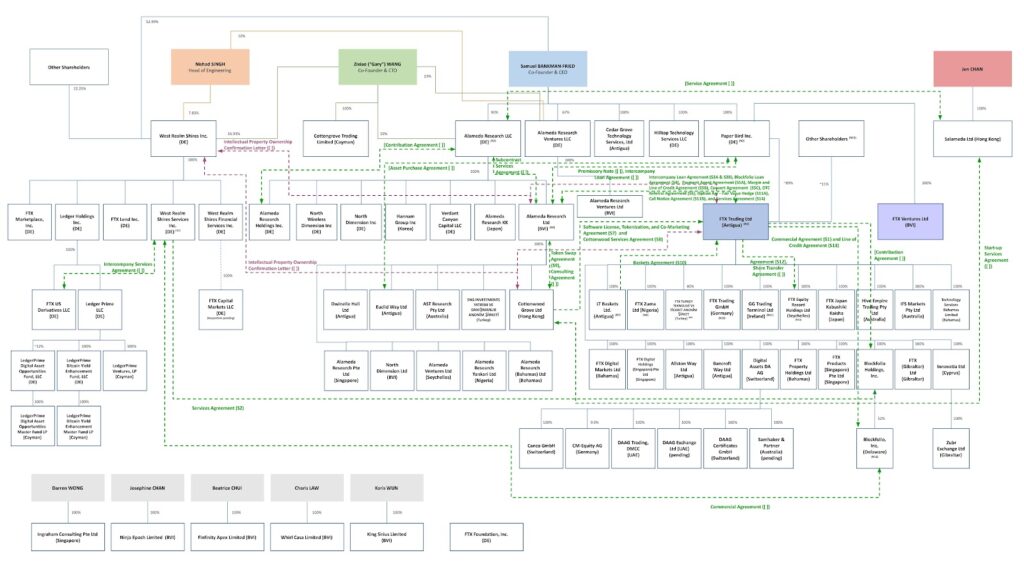

During the initial stages of FTX’s bankruptcy proceedings, its restructuring team unveiled a corporate structure chart that shed light on the complexity of Sam Bankman-Fried’s former empire. Despite having 300 employees, FTX controlled 130 companies when it filed for bankruptcy in November 2022.

While it is common for companies to have subsidiaries, a corporate structure with many such subsidiaries indicates significantly more complex operations. To put it into perspective, General Motors, a multinational corporation with numerous international partnerships and diverse product lines, has 455 subsidiaries, supporting its $156.73 billion in revenue and 167,000 employees.

To be fair, some of FTX’s subsidiaries served legitimate purposes. For instance, it was necessary to separate its licensed derivative business from the corporate headquarters, and specific markets, such as Japan, required separate entities due to market intricacies. Some have attributed the complexity of the FTX structure to Sam Bankman-Fried’s father, Joseph Bankman, a taxation specialist and a professor at Stanford Law.

FTX has relatively faded from the spotlight as Bankman-Fried’s trial is still months away. Instead, Binance faces dual cases from the CFTC and SEC. SEC Chair Gary Gensler drew parallels between FTX and Binance, stating that both allegedly have done commingling, among other things. Furthermore, there are similarities in the corporate structures of Binance and FTX.

The Need For A Simpler Corporate Structure

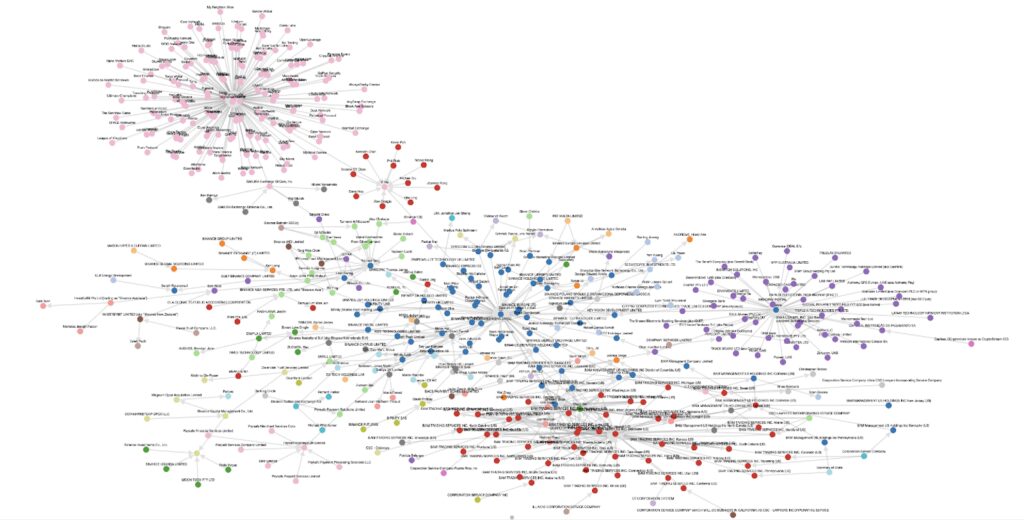

In recent legal actions against Binance, the SEC provided a list of numerous corporate entities controlled by Changpeng ‘CZ’ Zhao in a court filing. Inca Digital, a crypto forensics company, also published an extensive list demonstrating the network of firms connected to CZ and top Binance associates.

While there may be legitimate reasons for maintaining many companies, the comparisons between FTX and Binance, as highlighted by SEC Chair Gensler, extend to their complex corporate structures.

Inca Digital noted that CZ often utilizes his personal name and personal accounts in Binance operations. The SEC also mentioned this in its complaint against Zhao, alleging commingling (though Binance has denied any wrongdoing).

This scenario calls for more superficial corporate structures within the crypto industry. FTX’s restructuring team is incurring high costs and investing countless hours in unraveling its complex corporate web.

Binance’s assertion that CZ did nothing wrong would be more credible if their transactions appeared more straightforward to trained professionals. If Binance relied less on companies controlled by CZ, it would not give the impression of commingling to the SEC’s accountants.

For comparison, Coinbase, another major crypto exchange, has 15 subsidiaries, according to a filing with the SEC in February 2023. It demonstrates that an extensive crypto exchange can have a corporate structure that can fit on a single A4 piece of paper. Now let’s look at the on-chain data.

Have We Reached The Bottom?

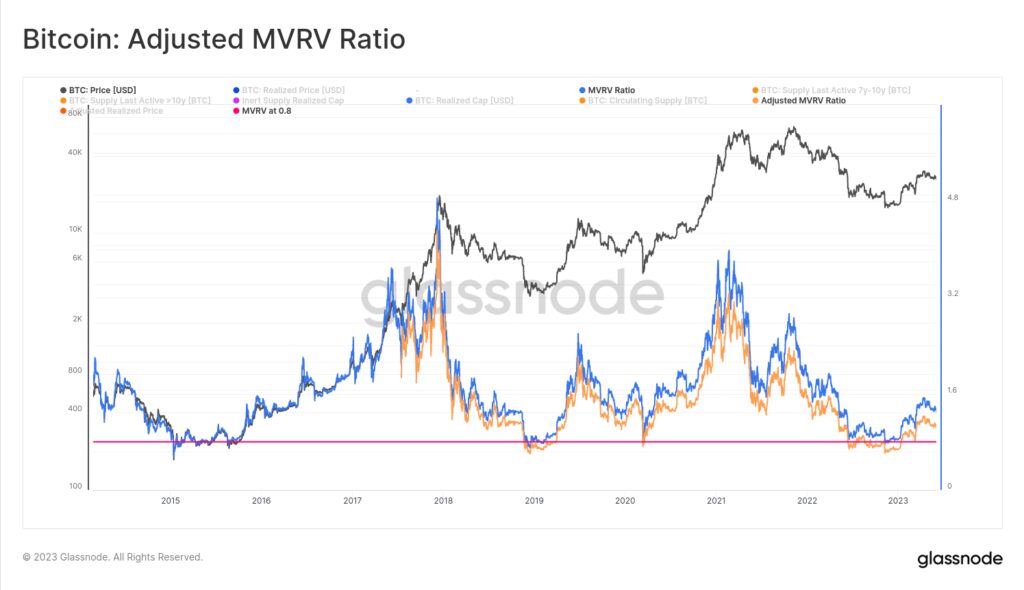

The latter part of the previous year brought significant transformations in Bitcoin’s on-chain data landscape, particularly following the FTX market crash in November. This period witnessed a notable realization of losses, indicating a widespread capitulation event.

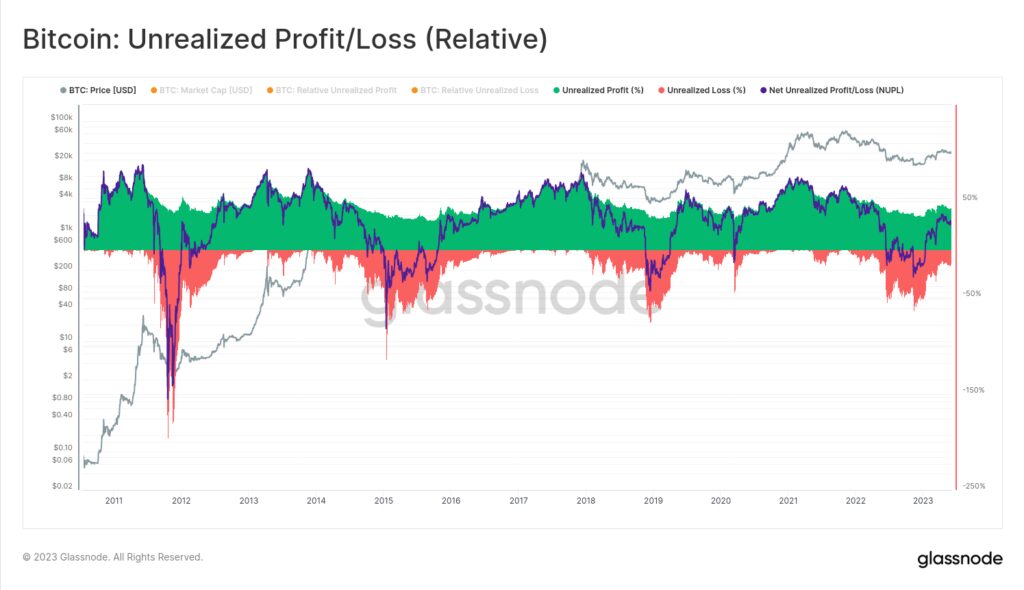

Source: Glassnode

One key metric, the Adjusted MVRV Ratio, which measures unrealized losses in the active market, plummeted to an all-time low. This level was only comparable to previous market bottoms observed in December 2018 and January 2015.

Source: Glassnode

Additionally, the Relative Unrealized Loss, which gauges the aggregate loss concerning the total market capitalization, reached a peak of 56%. This value is reminiscent of levels seen during previous bear market lows. These combined on-chain indicators strongly suggest that the FTX crash in November likely marked the bottom of the market.

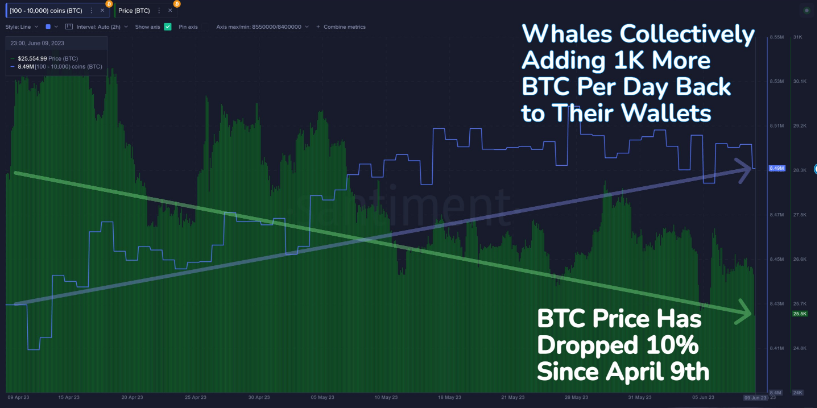

Whales Continue To Accumulate

Since April 9th, the price of Bitcoin has experienced a 10% decline. Interestingly, whales holding between 100 and 10,000 BTC have accumulated an additional 57,578 BTC during this same period.

Source: Santiment

This current trend of large holders increasing their holdings while the price of Bitcoin is trending downwards deviates from previously observed patterns. Typically, whales would buy during an upward trend. However, since mid-April, when Bitcoin reached its year-to-date high, whales have been actively stockpiling.

Historically, intensified whale accumulation has often coincided with bull runs or followed market lows. Are these wallets buying at the top for the first time, or is the current downtrend merely a precursor to a more significant upswing?

It is worth noting that if the rate of whale accumulation continues to rise, it will impact the demand for BTC, potentially driving up the price.

Surge In BTC Dominance

In addition to whale accumulation, there has been a recent surge in Bitcoin dominance, indicating its status as a safe haven for investors during times of market volatility.

Source: TradingView

Bitcoin dominance currently stands at over 49%, its highest level since April 2021. This scenario means that nearly half of the total value locked in the cryptocurrency market is Bitcoin.

One contributing factor to this recent surge is the simultaneous decline in the prices of major altcoins. Tokens like Solana and Polygon’s MATIC experienced significant drops of over 20% during a severe crash on a Saturday morning. In comparison, the relatively stable price of Bitcoin offers a refuge from more substantial losses in the market.

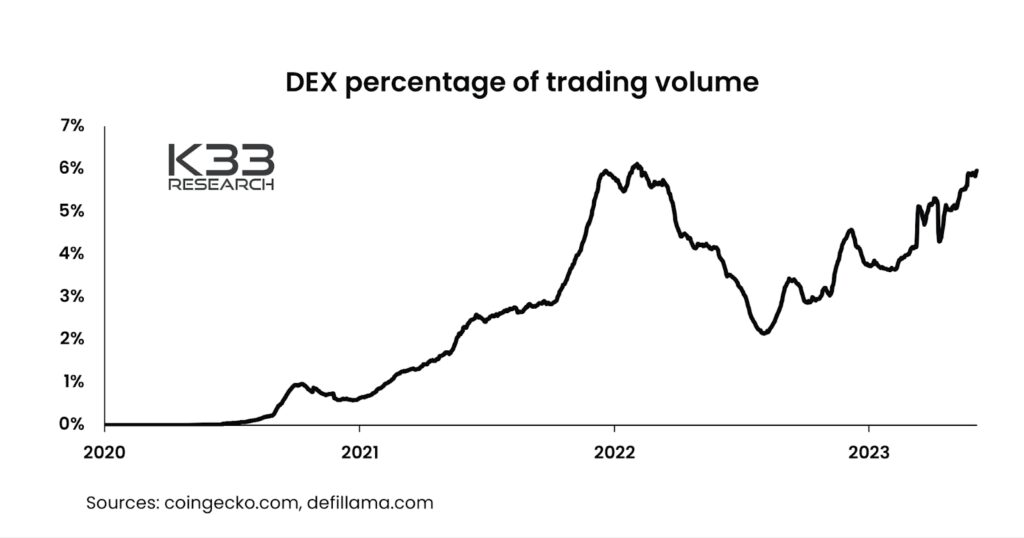

CEX to DEX: Shifting Landscape

The recent lawsuits initiated by the SEC against well-known exchanges have introduced legal uncertainty within the crypto market. As a result, there is a noticeable shift in user behavior as individuals increasingly gravitate towards decentralized exchanges (DEXs).

Source: K33 Research

The trading volume on DEXs, as a percentage of the overall trading volume, is approaching the levels witnessed during the peak excitement of late 2021 and early 2022. This transition towards DEXs is a form of regulatory arbitrage, where users seek platforms outside the purview of centralized exchange regulations.

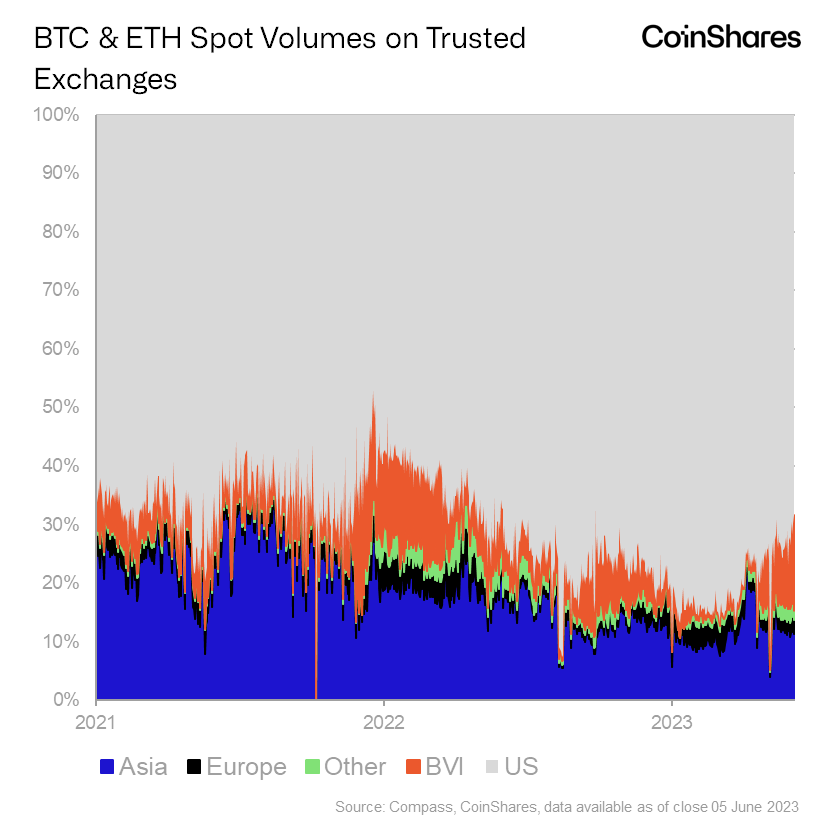

Source: CoinShares

Moreover, the US crypto market’s declining market share, which decreased from 85% at the beginning of 2023 to 70%, reflects this trend. Given the recent regulatory events, it is reasonable to expect that this market share could continue to decline.

Bitcoin’s Potential for Continued Price Growth

Bitcoin has experienced various price cycles characterized by different emotions, from excitement to disappointment. Typically, these cycles involve short-term holders, but it is the long-term holders who contribute to sustained upward trends in the cryptocurrency’s price.

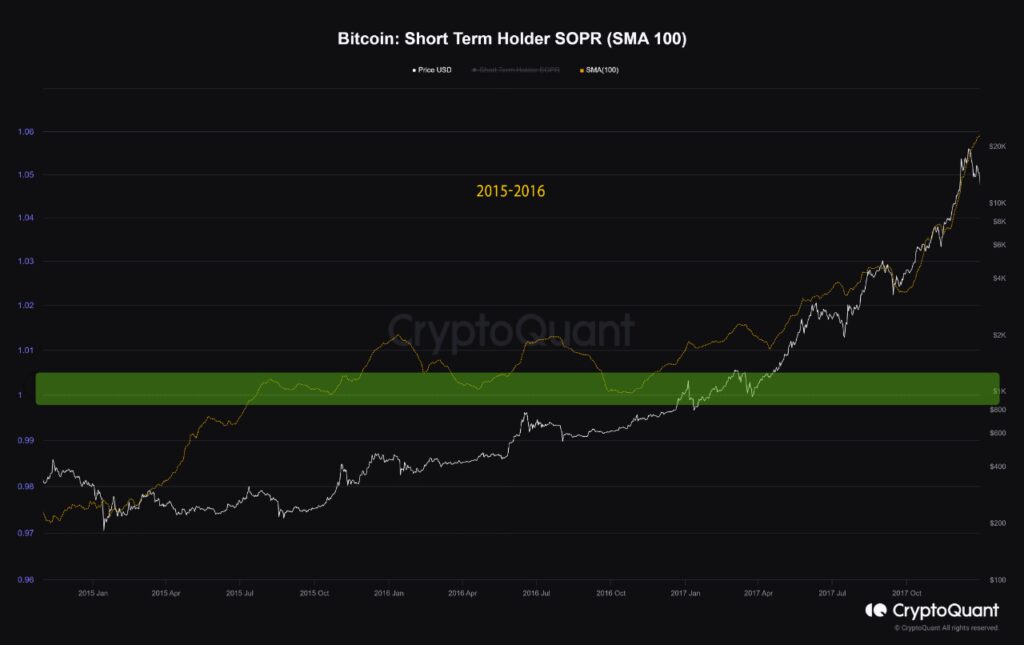

Source: CryptoQuant

The short-term holder SOPR metric plays a crucial role in identifying the strength of interest among short-term holders. When the SOPR metric consistently maintains a value of 1 over consecutive months and the pocket value of these holders surpasses this threshold, it indicates a strong desire to remain in the market and achieve profitability. Previous price cycles, such as those in 2015 and 2019, illustrate this phenomenon.

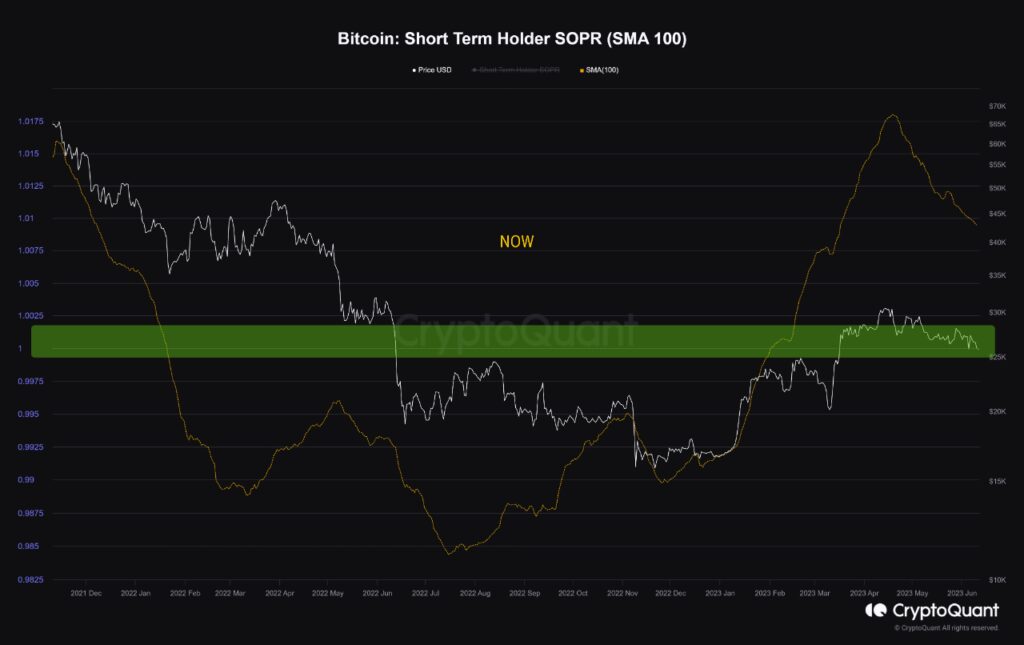

Source: CryptoQuant

In comparison to the 2019 cycle, the profitability of both long-term and short-term Bitcoin holders has not reached levels that generate significant selling pressure. As a result, Bitcoin has the potential to continue its growth trajectory with the emergence of another wave of demand.

Source: CryptoQuant

Despite fluctuations and market dynamics, Bitcoin’s price growth potential is not yet exhausted. Long-term holders and a lack of heavy selling pressure suggest that Bitcoin may experience further growth as demand increases.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.