Israel and the Palestinian group Hamas have been engaged in an extensive conflict since October 7. Financial markets have reacted strongly to the ongoing escalation between both parties.

The war, which is currently in its fifth day at the time of publishing this article, it has left hundreds injured and thousands dead and caused major destruction. While the world hopes for an early resolution, experts are concerned about the possible implications this war could have on the crypto industry. Let’s discover how this war is influencing the crypto sector.

The Consequences of the Israeli-Palestinian War

In general, once a war breaks out, the economy is often the first casualty. Wars usually cause stagnation in production and the economy. It is important to note that different sectors react differently to war. For example, the engineering and military sectors have seen some gains in the last few days.

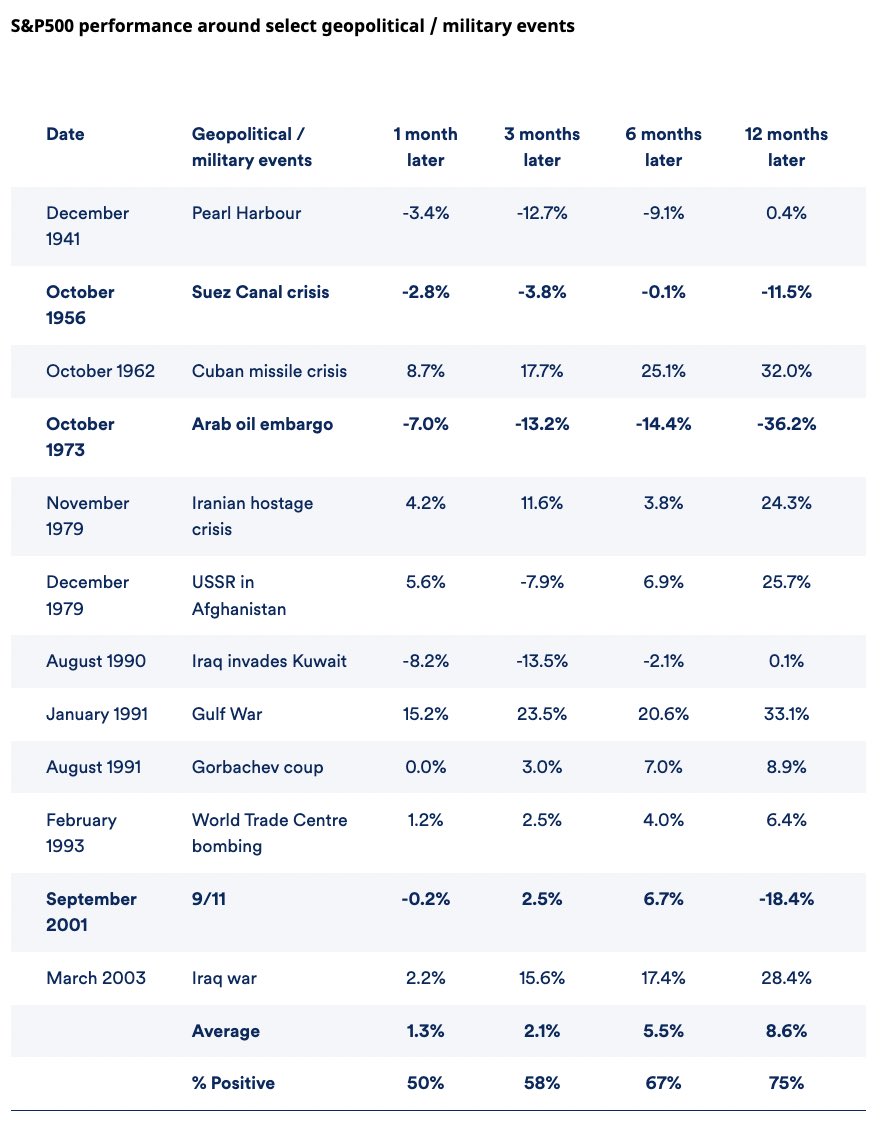

Meanwhile, the aviation industry saw a decline as multiple airlines canceled Israeli routes. So far, Bitcoin has remained unaffected by the war. The price of the cryptocurrency fluctuated less than many thought it would. Here is a list of things that caused different important events since 1940:

How did the Crypto Sector Reacted?

The broader crypto market slumped 2% on Monday. The crypto market is showing signs of early resilience. And that remains a source of confidence for enthusiasts.

The Israeli war situation has not yet provoked a significant reaction from Bitcoin. Its price action has remained stable around the $27,000 to $28,000 region. But we do not know how long this conflict will last or the long-term implications for crypto.

More than 700 israeli nationals lost their lives during the recent attack. Crypto investors have been closely watching the geopolitical tensions between israel and hamas as a full-blown war broke out over the last weekend.

— Stella Tucker (@StellaT76322105) October 10, 2023

The effects of war on the financial sector are complex and dynamic. Also, the impact of war will continue to overlap with the cryptocurrency sector as Bitcoin continues to gain public acceptance. Therefore, while the short-term effects on crypto assets are minimal, investors with diverse portfolios still need to be aware of the conflict process and its effects.

Israel Hunts Hamas Crypto Accounts

According to a statement, the Lahav 433 cyber division of the Israel Police has frozen cryptocurrency accounts linked to Hamas. The police spokesperson’s office claims that Hamas has sought funding via cryptocurrency since the conflict. Israeli authorities are seeking to stop Hamas from receiving crypto donations.

🚨BREAKING: ISRAEL FREEZES CRYPTO ACCOUNTS SEEKING HAMAS DONATIONS

“According to suspicions, with the outbreak of the war, Hamas’s terrorist organization initiated a fundraising campaign on social networks, urging the public to deposit cryptocurrencies into their accounts,”…

— Mario Nawfal (@MarioNawfal) October 10, 2023

Lahav 433 collaborated with UK law enforcement to freeze a Barclays bank account. Meanwhile, the Israeli crypto community has launched a crypto-aid platform to assist Israelis who have been affected by the war.

In conclusion, crypto will play a major role in the ongoing conflict. Both parties will rely on cryptocurrencies for funding. But it remains to be seen if this demand will lead to a price surge for some cryptocurrencies.