There are different types of lending platforms such as Decentralised lending platforms (DLP), Centralized, and Peer-to-Peer (P2P) Lending.

The best option on the table is likely to be yield farming or lending. Let’s start with the former, which offers a way to generate passive income by lending idle cryptocurrencies to a decentralized exchange. In this article, you will learn how to earn crypto with yield farming and crypto lending.

🌾 🌾 What is yield farming?

Yield farming is the idea of earning interest on crypto in #DeFi markets. And how do liquidity pools, swaps, and lending come into play?

Get the full explanation here! 💡 💡 https://t.co/l6LsPDQIdO pic.twitter.com/oLJ7GbhdhV

— CoinMarketCap (@CoinMarketCap) September 16, 2020

Ways to Earn Crypto With Crypto Farming & Lending

For those unaware, decentralized exchanges utilize an automated market maker (AMM) model as opposed to conventional order books, as found on centralized platforms. This means that in order for traders to buy crypto without a seller on the other end of the exchange, the AMM requires sufficient levels of liquidity.

Now, this is where the investor comes in, as idle crypto tokens can be lent to the decentralized exchange for the purpose of liquidity provision. In turn, the investor will be paid a share of any trading fees that are collected on the respective tokens. Importantly, yield farming requires investors to provide tokens for a specific pair, at an equal amount. Here are some examples:

For instance, let’s say that the investor wishes to add funds to a DAI/ETH liquidity pool. At the time, ETH is trading at $1,500, and DAI is pegged to the US dollar, at $1. As such, if the investor deposits 2 ETH into the liquidity pool ($3,000), they must also provide 3,000 DAI ($3,000).

One of the best platforms in the market for those interested in yield farming is OKX. Alternatively, investors might also consider DeFi Swap, which is in the final stages of launching its much-anticipated decentralized ecosystem for trading, yield farming, and staking.

Those who do not wish to provide liquidity to exchanges might instead consider a crypto interest account. The investor will deposit tokens into a platform which will then be used to fund third-party loans. Borrowers will pay interest on the crypto assets which are subsequently forwarded to the investor. Yields will vary in the same manner as staking, based on terms and the respective coin.

Top 5 DeFi Platforms for Yield Farming and Crypto Lending

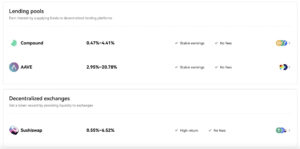

Here are five platforms that were popular for yield farming and lending:

- Compound Finance (COMP): Compound Finance is a decentralized lending platform that allows users to lend and borrow various cryptocurrencies. Users can earn interest by providing liquidity to the protocol.

- Aave (AAVE): Aave is another decentralized lending and borrowing platform. It offers a wide range of assets for lending and borrowing and provides a unique feature called “flash loans.”

- MakerDAO (MKR): MakerDAO is known for its decentralized stablecoin, DAI. Users can earn by providing collateral in the form of Ethereum and generating DAI, which can be used for lending.

- Yearn.finance (YFI): Yearn.finance is a yield aggregator that automatically moves funds between different lending protocols to maximize yield. Users can deposit funds into Yearn’s vaults to earn yield without actively managing their assets.

- Synthetix (SNX): Synthetix is a platform that allows users to mint and trade synthetic assets. While it’s not primarily a lending platform, it offers staking opportunities that can provide rewards to users.

Looking to optimize your crypto assets to have passive income on the @zkSync ecosystem 💹

If so, these farming pools with juicy APRs on @SyncSwap are things that you should keep an eye on 👀

Let's check these opportunities below 👇#zkSync #zkSyncEra #DeFi #Farming pic.twitter.com/IKxZtf2Opj

— zkSync Insider ∎ (@insider_zksync) October 26, 2023

Conclusions

Yield farming and lending can be profitable but come with risks. It’s crucial to do your research, understand the risks involved, and use platforms that have a good track record for security and transparency. Diversification and staying updated with the latest developments in the DeFi space are key to a successful and safe experience in crypto yield farming and lending. Always consider seeking advice from financial experts and only invest what you can afford to lose.

Additionally, the risk associated with yield farming and lending is substantial. Factors like smart contract vulnerabilities, market volatility, and the possibility of losing assets should be considered carefully.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.