Today we introduce you to Polkadex. They want to offer an ideal trading experience. It combines the best of both worlds from a CEX and a DEX platform. Trading should be safe and enjoyable.

As a result, Polkadex offers a trustless P2P marketplace. As a decentralized platform, they offer:

- Deep liquidity

- Fast transaction speed

- Advanced trading features- high-frequency trading & trading bots

Their main product is the Polkadex Orderbook. However, they offer more features. One is Thea, their token bridge between Polkadex and Ethereum. So in this article, you will learn more about Polkadex and Thea.

What Is Polkadex?

Polkadex is an exchange that combines all the best features of a CEX and a DEX into one platform. Nonetheless, it is a decentralized platform. They built on Polkadot and are working hard to get a parachain, where traders can lock Ethereum assets in smart contracts. This will add liquidity to Polkadex without using a middleman.

Source: Polkadex

Also, the Polkadex Orderbook is a fast layer 2 exchange that has no transaction fees. So for safety, it uses an L2 Trusted Execution Environment (TEE). This eliminates the operator cheating. They are non-custodial.

In short, this gives various benefits:

- Register various on-chain hot wallets: Like browsers, mobile, tablets, or a trading bot.

- Delegate assets to a 3rd party: Earn passive income.

- Institutions can take part: Bring in large orders.

- Leave assets in the exchange: Polkadex claims it is impossible to hack. Saves transfer fees between wallets.

- You can use any trading bot.

- Buy and sell ERC-20 tokens before they have parachain status: After they become a parachain, more token options are available.

They use a decentralized KYC procedure. In other words, they use cryptographic proof and not your data. Polkadex uses zero-knowledge protocols for this. As a result, your data stays safe and in your wallet. Because of the decentralized KYC, they can offer fiat options for buying crypto.

Other features they offer:

- IDO platform: A fair and cheap solution compared to current IDOs.

- Fungible asset creation: For developers and projects.

- NFTs: Gamifying trading on the platform. Introduced after Mainnet launch.

The native PDEX token has a variety of use cases:

- Governance.

- Staking.

- Take part in IDOs.

- Transaction and trading fees.

- Nominating validators and collators.

What Is THEA?

Thea is short for Threshold ECDSA or a Threshold Signature scheme. This works through Elliptic Curve Cryptography. To clarify, we will explain this in an easy-to-understand way.

Meet Thea: a better decentralized token bridge

If Polkadex is designed to be a DEX that feels like a CEX, Thea is the underlying decentralized technology that makes 'deposits' & 'withdrawals' to & from Polkadex feel like they do in a CEX.

🧵 (1/7)https://t.co/0q0cBpZ001

— Polkadex (@polkadex) March 30, 2022

In short, Thea is a bridge. It allows for digital assets to move between blockchains. However, when moving an asset from L1 to L2, the quality of the asset must remain the same.

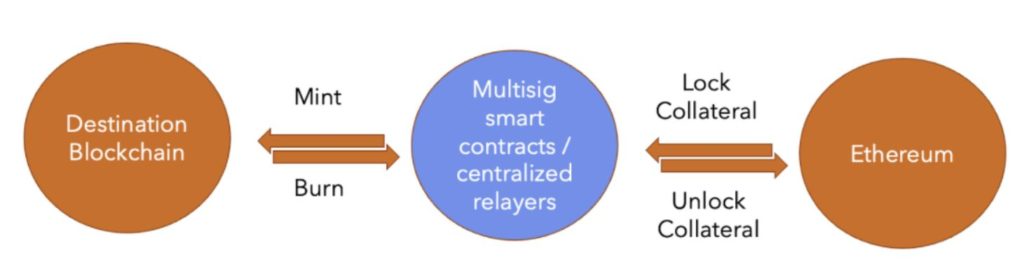

Also, according to the Polkadex team, many bridges are expensive, complicated, slow, and not safe. Furthermore, there are various kinds of bridges. For example, custodial vs non-custodial. In other words, centralized/trusted vs decentralized/trustless. This makes wrapped Bitcoin custodial. On the other hand, the Wormhole is more decentralized. However, the Wormhole also got hacked.

Source: Thea white paper

What is TSS (Threshold Signature Scheme)?

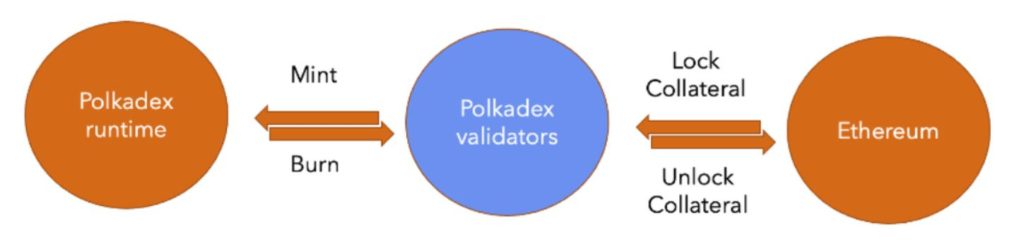

As a result, Polkadex had to come up with a new idea for a bridge. This included the threshold signature scheme (TSS). To clarify, this means that various parties each have a secret share of the private keys. This eliminates the private key being a single point of failure.

Signing transactions works similarly. TSS and multisig achieve the same thing. However, multisig is on-chain, and therefore more expensive. TSS uses cryptography off-chain. Since TSS so far has mainly been active on a small scale, they needed this idea and make it work for large-scale use.

As a result, they came up with Thea, and these are some of the features it has.

- Use any generic wallet for transfers.

- Keep bridging costs at the same levels as on-chain transfers.

- Fast transactions in one operation.

- The underlying mechanism is for the developers, not for you, as a user.

Source: Thea white paper

However, they also needed to solve the verification of transactions. Instead of running a full node, like on layer 1 chains, they use light clients or light nodes. As a result, there is no need to sync a full blockchain.

First, Polkadex uses Thea with Ethereum. Polkadex will add more chains soon. However, Thea will remain the underlying technology. Once Polkadex becomes a parachain, Thea can also bridge to other parachains. Thea is going live within the first half of April 2022.

Conclusion

Polkadex is a DEX. However, it feels like a CEX. With Thea, they have come up with a great idea. This concept can change the whole idea behind smart contracts. The cryptographic solution of Thea has a lot of potential. Polkadex is ready to replace them!

Finally, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by Polkadex. Copyright Altcoin Buzz Pte Ltd.