DeFi was always completely decentralized. KYC was not done in DeFi projects and platforms. However, it appears that this is coming to an end.

Uniswap is about to introduce a KYC procedure to its platform. Is this good or bad for DeFi? So, let’s dive deeper into this case of Uniswap introducing KYC procedures to its protocol.

IS KYC COMING TO UNISWAP?

The introduction of a Know Your Customer (KYC) hook in Uniswap V4 has triggered debates about the future of decentralized finance (DeFi). This tool allows for KYC verification for users wanting to trade on a pool, and it's optional for developers to… pic.twitter.com/0JCTyGocmi

— The Wolf Of All Streets (@scottmelker) October 15, 2023

What Is the KYC Controversy on Uniswap About?

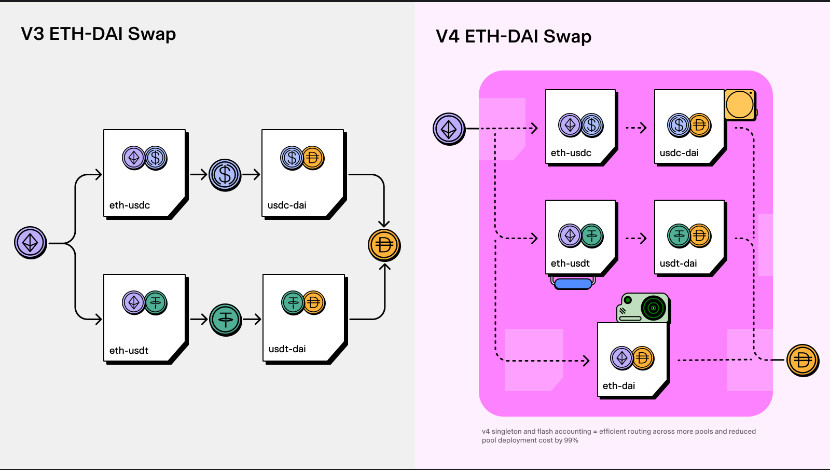

Uniswap expects the release of its upcoming V4 late in Q4-2023 or Q1-2024. This V4 will have all liquidity pools in one contract. This is in contrast to V3. In V3, each liquidity pool has its own contract. So, creating pools or multi-pool swaps is expensive. V4 solves this issue and as a result, will be much more cost-efficient. For example, Uniswap expects the pool creation costs for V4 to drop by 99%.

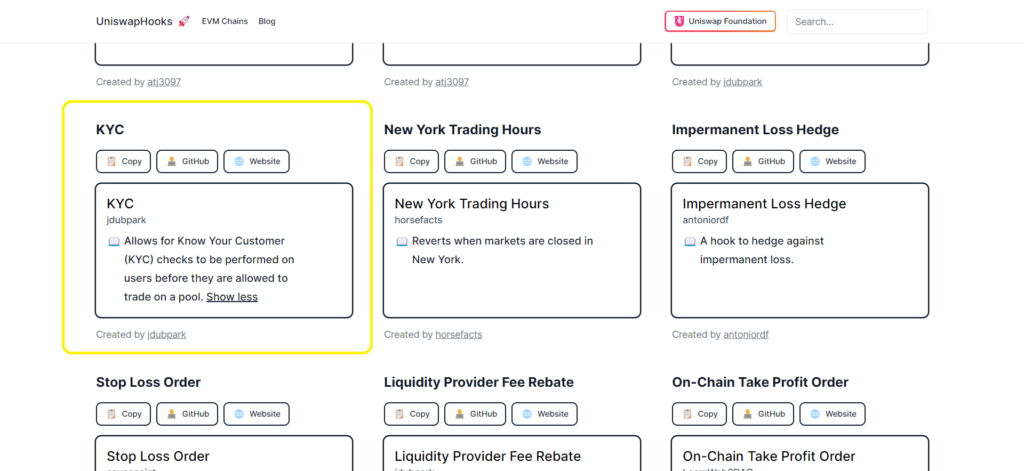

The most important new feature in V4 are the ‘hooks’. These are customizable code snippets. For example, you can add dynamic fee adjustments to a pool. Or add a stop loss order. Currently, there are 74 such hooks. Now, one of these hooks caught the attention and caused all the controversy.

This specific hook allows for a KYC procedure. So, you can add this to a pool. Now, everybody who wants to take part in a pool with this hook must undergo a KYC first. A KYC procedure is the ‘Know Your Customer’ procedure. Among others, it requires you to provide an official, government-issued ID. Currently, this hook seems ideal for US-enabled pools. It allows for KYC or a whitelist application. The latter is for users who want to join such a liquidity pool.

In short, this hook divided the DeFi space into two camps. There’s a camp that sees KYC as being beneficial to DeFi. The other camp sees this as the end of decentralization. So, let’s take a closer look at these pro and con camps. The picture below shows the much-discussed KYC hook.

Source: Uniswap hooks page

Are You in Favor or Against the KYC Hook?

There’s a long list of arguments by people who are in favor and against the KYC hook. There are more governments around the world starting to take a look at DeFi. This makes it also an interesting discussion. It’s also important to point out that this is an optional feature. The pool creators decide if they want to add this to a pool, not Uniswap. At least, not for now. This means that regulations can change and Uniswap may have to reassess their policy on this.

So, let’s start with some points of view against this KYC hook. One of the main attractions of DeFi is that anyone can join. It’s also permissionless. A KYC procedure will change this. Others argue that this may only be the beginning. It could lead to a situation, in which if you’re not KYC’ed, you’re labeled as a terrorist. For example, authorities may see you as a money launderer. In general, this camp sees DeFi drifting towards centralization. The actual KYC certification happens with an NFT. This also shows how NFTs found their place in many Dapps.

In the pro camp, there are other arguments used. Some see this as a logical progression. They argue that regulation is unavoidable. It’s also a means to stop the many scams that plague the DeFi space. They also argue that it is for specific pools, not all pools.

In this context, it’s interesting to see the latest global moves by governments. For example, let’s look at the G20. They gave the green light to set up a crypto regulatory roadmap. Both the IMF (International Monetary Fund) and the FSB (Financial Stability Board) initiated this. The picture below shows the difference between swaps in V3 and V4.

Source: Uniswap blog

Conclusion

DeFi seems to have found a new challenge. How to balance the delicate act of decentralization against global governmental regulations. The latter is by no means a clear-cut and crisp script. In contrast, currently, it’s a rather murky state of affairs. However, change is going to come in this department. Crypto regulation seems unavoidable, and that includes DeFi.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.