COTI is a Layer 1 blockchain ecosystem that focuses on payments. COTI does not rely on proof-of-work (POW) or proof-of-stake (POS) to validate transactions. Instead, it uses a consensus algorithm known as proof-of-trust (PoT). The PoT algorithm combines directed acyclic graph (DAG) data structure with PoW. It has the advantage of a lower transaction cost and can also increase throughput to about 100,000 TPS.

COTI (Currency of The Internet) focuses on building a scalable and decentralized payment network to smoothly facilitate global transactions. COTI explores how companies can utilize blockchain to build their own payment solutions. This COTI review will examine how COTI works and its use cases.

The Problem and Need in the Payment Space

Over 1.6 billion individuals use online payment services globally, with over 3.265 trillion dollars in annual transaction volume. Previous studies predicted that the market will grow at a 13.5% annual CAGR between 2018 and 2022, reaching a total value of $5.411 trillion in 2022.

While the claims of this study is yet to be ascertained, it is clear that the market value is increasing, and the payment industry is evolving quickly alongside it. New business models are emerging, and the industry’s power structure is shifting.

Mobile payments volume is also increasing in pace with the rise of mobile devices like smartphones and tablets. Experts predict that they will eventually take up a sizable portion of the online payment market. So, the demand for quicker, simpler, more scalable, and more dependable payment systems has increased due to the industry’s rapid expansion and changes.

Despite the fierce competition that exists within the online payment sector, neither standard electronic payments nor digital currencies have yet to offer a complete answer. Platforms like PayPal and Visa can scale a huge volume of transactions. However, there are significant limitations in terms of transaction fees.

Digital currencies have the potential to serve as an alternative because they can enable payments with higher security and lower transaction costs. However, in reality, several factors hinder their widespread use. For example, they have a very unstable price. And this results in low adoption rates for online payments.

COTI has a system that caters to this problem. It focuses on four key players:

- End-users

- Nodes’ operators

- Mediators

- Merchants

COTI simply tries to combine the advantages of traditional payment solutions and digital currencies.

What’s COTI About?

COTI is a Layer 1 blockchain platform that provides decentralized payment solutions. Its services enables governments and organizations and businesses to issue their own coins. Here’s how it works: users can leverage COTI to build branded stablecoins. This improves the customer’s payment option.

COTI claims to focus on being scalable, reliable, transparent, fast, and simple. Like Airbnb in the lodging industry, COTI built an innovative payment network to solve basic problems in the payment space. COTI seeks to improve the digital payment experience for both sellers and buyers.

Interestingly, COTI integrates standard practices from the traditional financial sectors to the blockchain ecosystem. These standards include DeFi’s fundamental use cases as well as finance, remittance, loyalty schemes, and cross-platform payments.

COTI also offered bank accounts and VISA debit cards to provide a clear and direct link between the fiat world and the cryptocurrency sector. To spread its offering, COTI has also established a couple of partnerships with several crypto firms, including Cardano. Cardano reportedly invested half a million dollars into COTI.

How Does COTI Work?

As previously said, COTI was established with the goal of creating a decentralized payment network that enables companies to operate as efficiently as possible. Different components helps COTI operate. This include:

- The Trustchain

- The MultiDAG data structure

- Node clusters

- Proof-of-trust for consensus

Turstchain and MultiDAG

Trustchain serves as the foundational technology behind the COTI ecosystem and its offerings. It is based on an agreement algorithm that relies on machine literacy. This technology reduces transaction cost and increases transaction speed.

Trustchain is based on a multi-directed acyclic graph (DAG) data structure. MultiDAG helps to achieve scalability. Generally, the COTI platform combines network layers, infrastructure, and services to create a complete, adaptable payments solution.

COTI’s MultiDAG is comparable to that of Ethereum. Different independent DAGs serve varying functions on the network. They all run simultaneously on the same technology, maintaining fully tailored tokens and apps, which increases the effectiveness of the entire network.

We are proud to announce that MultiDAG 2.0 hard fork was completed and is now live on Mainnet!

This milestone heralds the full transition of COTI to a multi-token network, enabling enterprises to launch their own Private Payment Network.https://t.co/1tOUQEJpdE$COTI #CMD pic.twitter.com/1wg5w0TCea

— COTI (@COTInetwork) December 29, 2022

Leveraging COTI MultiDAG 2.0, developers, retailers, and businesses will be able to create tokens. The MultiDAG 2.0 inherits Trustchain features like:

- Scalability

- High throughput

- Low cost

- User-friendly payment mechanisms like COTI Pay Business

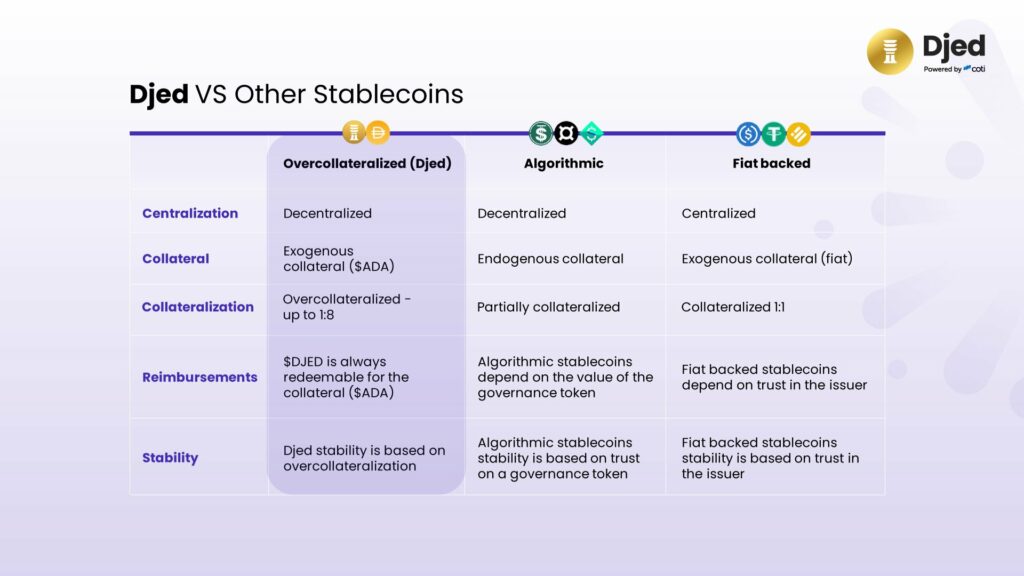

The MultiDAG allows users to produce their own fiat-collateralized, crypto-collateralized, or even non-collateralized stablecoins. For instance, COTI is the official issuer of Cardano’s ADA Pay and Djed stablecoin.

Proof-of-Trust

The proof-of-trust consensus technique developed by COTI combines Trustchain and proof-of-work (PoW) to address scalability concerns. The COTI DAG, referred to as “the Cluster,” is a distributed ledger for documenting network transactions.

It places transactions one after the other in sequence rather than being grouped into blocks. So, new transactions can only be acknowledged when the validating node connects it to two older transactions. As a result, the rate of transaction confirmation rises along with the growth in network users.

Using COTI for Business

COTI focuses on optimizing financial solutions for businesses. Companies can leverage COTI Pay to process different types of payments. COTI handles payments with credit cards and stablecoins. Furthermore, COTI Pay Business also allows users to use the new COTI native asset as a funding mechanism for retail and business transactions.

COTI Use Cases

The payment platform has a couple of applications and offerings to make digital payments easier. They include:

Wallets: COTI offers a multi-currency wallet that supports many consumer payment use cases. This includes peer-to-peer transactions with peers who also have COTI wallets and nearby wallet-to-wallet transfers.

The wallet offers instant and simple access to the COTI payments network. Additionally, COTI wallets can serve as a straightforward “bank account” for the purpose of keeping money (both digital and fiat currencies).

Debit Cards: COTI also offers debit cards that are directly linked to COTI wallets. So, customers can use these cards to make purchases from merchants who have not yet integrated with COTI.

Processing Tools: The COTI platform is also creating the technologies necessary for businesses to begin accepting payments from users of the COTI Pay wallet. Customers who visit COTI-Pay based merchant websites but do not have COTI Pay wallets can receive invitations thanks to these solutions.

Furthermore, merchants will have the option of integrating COTI Pay through an iFrame or API with their websites and payment methods.

Deposit and Earn

Users can deposit $COTI and earn rewards for taking part in COTI’s Treasury, an algorithmic and decentralized pool of $COTI. The pool increases as fees are paid to the Treasury by the entire ecosystem.

So, COTI’s product fees are collected in one place and given to users as incentives from the Treasury. The Treasury’s users and those who consistently contribute to the expansion of the Treasury will receive the governance token. This gives its owners the ability to discuss, suggest, and decide whether to change the protocol.

We are pleased to introduce to you an update to the fees’ structure of the Treasury.

It is our belief that the new structure is fair and will grow the adoption of the Treasury even further.Read about it here: https://t.co/4qIy8daLsn$COTI pic.twitter.com/SXvU2URXS0

— COTI (@COTInetwork) November 28, 2022

COTI Coin

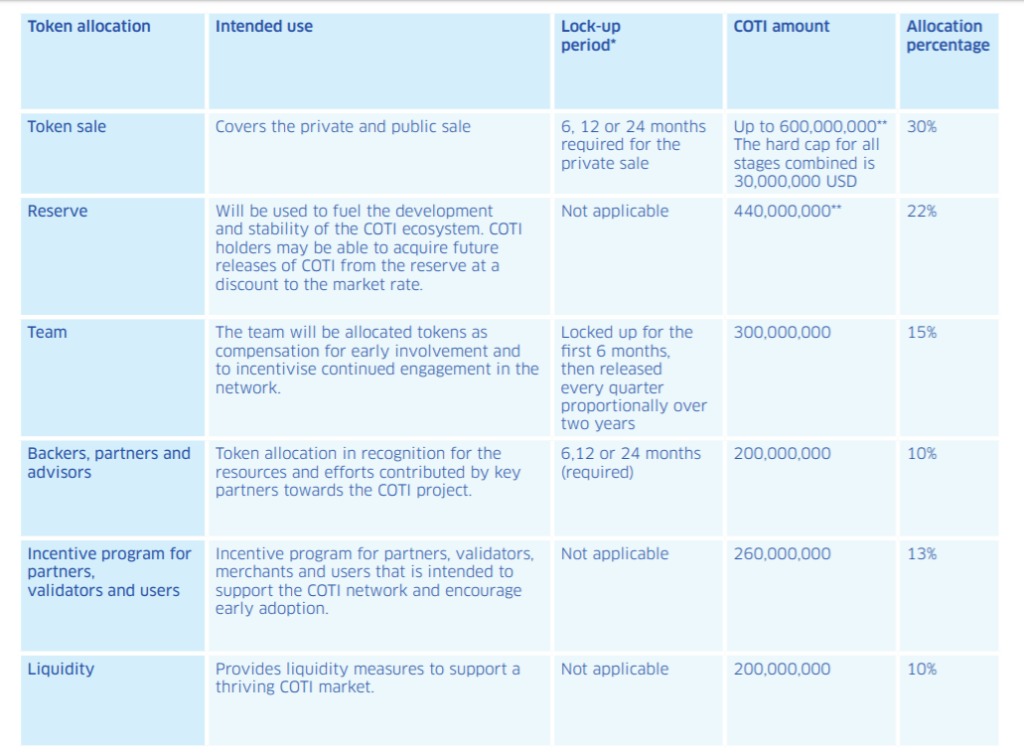

The native token of the COTI ecosystem is the $COTI coin, which features a total supply of two billion coins. COTI does not require PoW mining to secure the network. The COTI coin operates on three mainnets: Trustchain, Ethereum, and BNB Chain.

$COTI currently trades at $0.122029.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.