The Francium Protocol has recently generated significant attention as a promising DeFi protocol on Solana’s blockchain. Its focus on enhanced security and efficiency sets Francium apart from other protocols on the DeFi landscape.

Let’s dive deeper into the unique characteristics and potential of the Francium Protocol.

What Is Francium Protocol?

The Francium Protocol is a decentralized finance (DeFi) platform built on the Solana blockchain. It offers unique yield strategies and a decentralized infrastructure tailored to the needs of DeFi users.

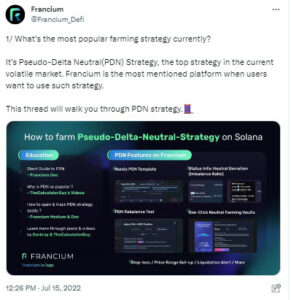

Source: Twitter

Francium addresses these concerns by introducing Correlate Assets LP and Perpetual/Option Hedged Farming, providing solutions to mitigate these risks. By expanding the range of options available, Francium enables users to target various crypto yield opportunities, including Yield Farming, Crypto Native assets, and Synthetic Assets.

In addition, Francium aims to close the gap between centralized and decentralized exchanges. While centralized exchanges (CEXs) offer advanced trading tools and analysis features, decentralized exchanges (DEXs) often lack such functionalities. These tools include financial instruments, DeFi composability, a classic trading system, and an AI-based trading system, making it an innovative DEX platform that combines the best of both worlds.

With its focus on security, efficiency, and a wide range of yield strategies, the Francium Protocol presents an exciting opportunity for users seeking innovative DeFi solutions on Solana.

How Does Francium Protocol Work?

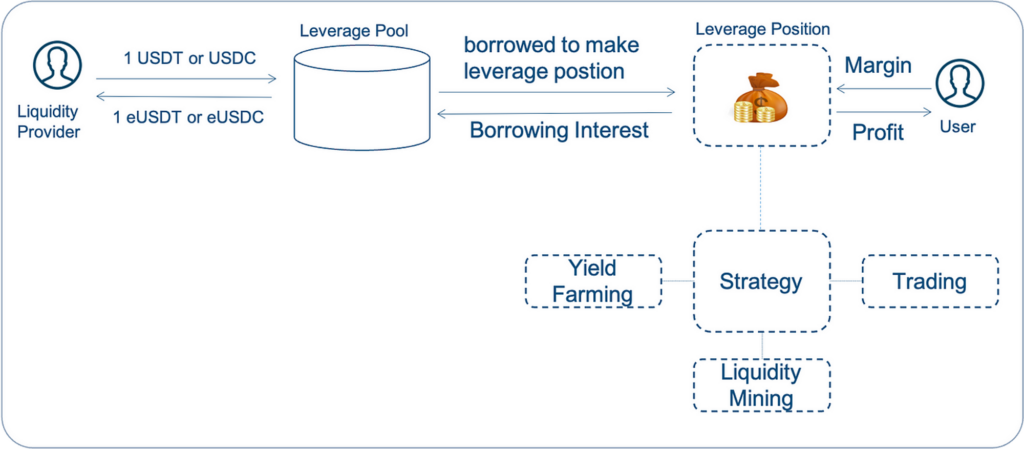

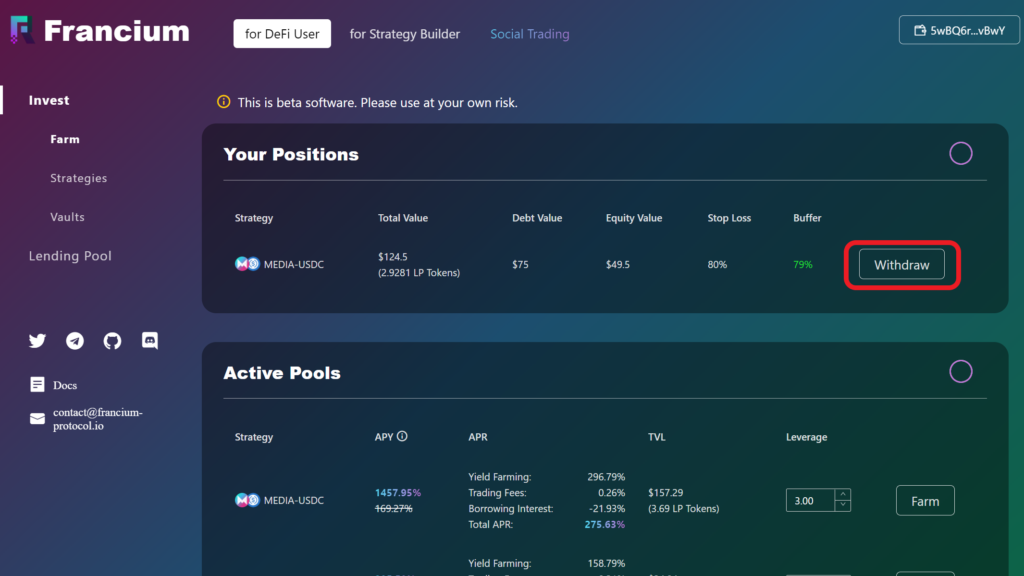

The protocol introduces an efficient leverage module that allows users to optimize their fund utilization. Lenders can deposit their cryptocurrencies into a liquidity pool, earning interest in return and receiving LP tokens that are tradable on DEXs.

On the other hand, borrowers can leverage their positions within the yield aggregator, employing efficient strategies to magnify their profits and take advantage of income opportunities.

Source: Francium

Moreover, Francium Protocol incorporates a creative yield aggregator module to provide diverse yield strategies. Users can create and develop strategies using Francium APIs, including portfolio tracking, yield farming, liquidity mining, etc.

Additionally, users can share their strategies with the community, fostering collaboration and knowledge sharing.

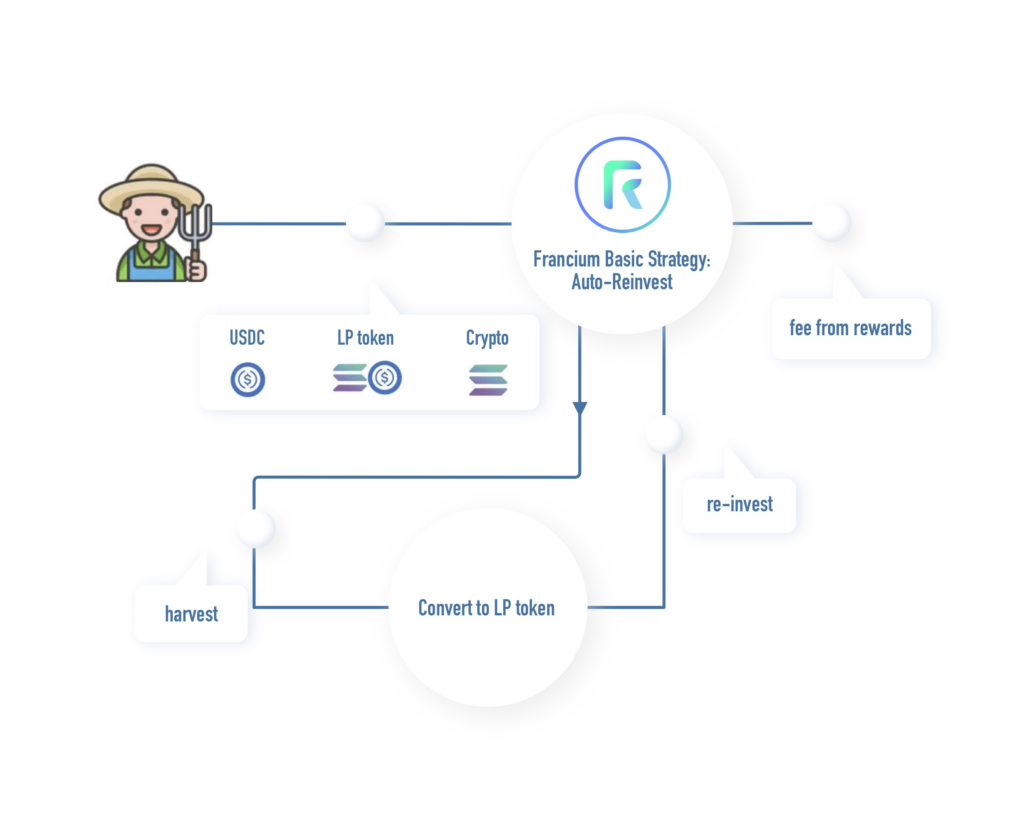

Source: Francium

Features of Francium Protocol

The protocol also features selected strategies that are verified and voted on based on community governance. This scenario ensures that high-quality strategies are identified and approved by the community.

Strategy contributors are evaluated based on various factors, including performance, user adoption, and value generated. So, contributors with higher rankings enjoy greater voting weights and rewards during governance.

Community governance is a cornerstone of the Francium Protocol. Users have full control over protocol management and decision-making.

They can actively participate in voting mechanisms to shape the direction of the protocol, such as determining product updates and parameter changes. The ability to mark strategies as selected empowers the community, providing a straightforward choice of trusted strategies. Besides, NFT integration plays a role in incentivizing strategy development and fostering engagement within the community.

Francium bonds each yield strategy to a unique NFT. When users publish a strategy, they receive a corresponding NFT, which helps accumulate fee income and contributes to their long-term reputation within the ecosystem.

Source: Twitter

Furthermore, NFT holders can enjoy free returns from the associated strategy and have the option to trade their NFTs on strategy markets, further enhancing liquidity and participation.

Francium Protocol provides generous incentives and an intuitive, visual strategy development toolbox to encourage continuous innovation and incubation of high Annual Percentage Yield (APY) strategies. It ensures that users can access diverse income opportunities that suit their preferences and risk appetite.

Through efficient leverage, diverse yield strategies, community governance, and NFT integration, Francium Protocol aims to empower users, optimize fund utilization, and offer various income opportunities within the Solana DeFi ecosystem.

Francium Protocol Use Cases

Here are 5 use cases of this protocol:

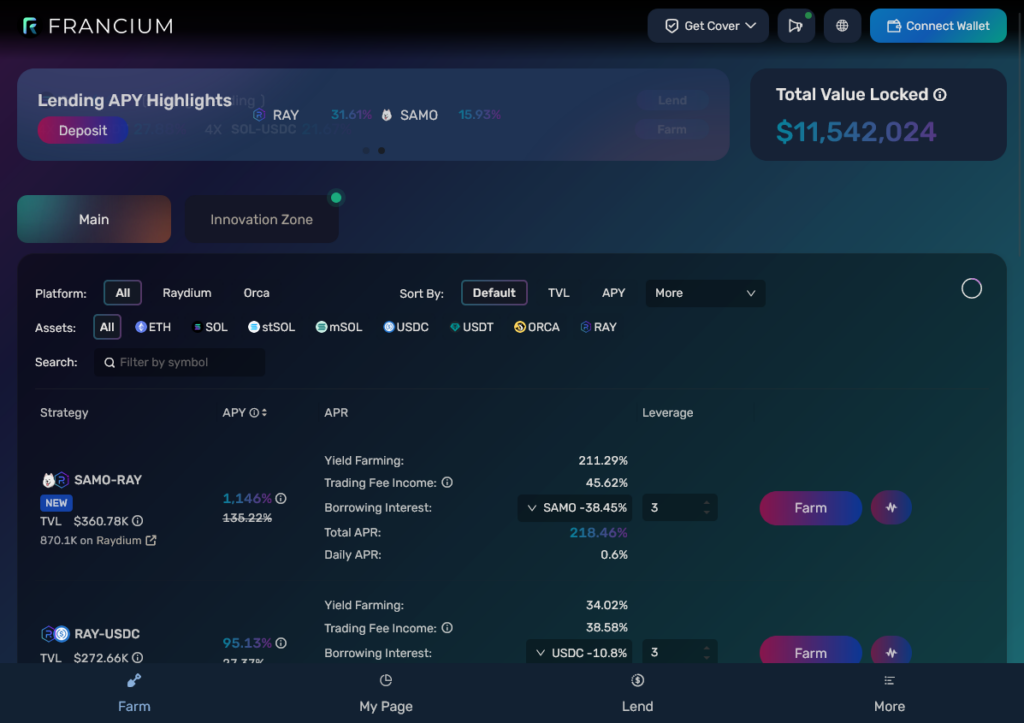

Source: Francium

- Francium Protocol allows users to optimize their DeFi income by leveraging various yield strategies. Users can access diverse income-generating opportunities such as yield farming, liquidity mining, and algorithmic trading strategies.

- The efficient leverage module provided by Francium Protocol enables users to make full use of their funds. Lenders can deposit cryptocurrencies into the liquidity pool and earn interest. While borrowers can leverage their positions in the yield aggregator to amplify their potential returns.

- Francium Protocol empowers users to create, develop and share their yield strategies using the platform’s APIs and visual strategy development toolbox.

- The NFT integration allows the holders to accumulate fee income, enjoy free returns from the associated strategy, and offer the ability to trade their NFTs on strategy markets.

- Through its yield strategy incubation mechanism, the protocol incentivizes strategy contributors to develop and share strategies with generous incentives, offering lucrative APY strategies to users.

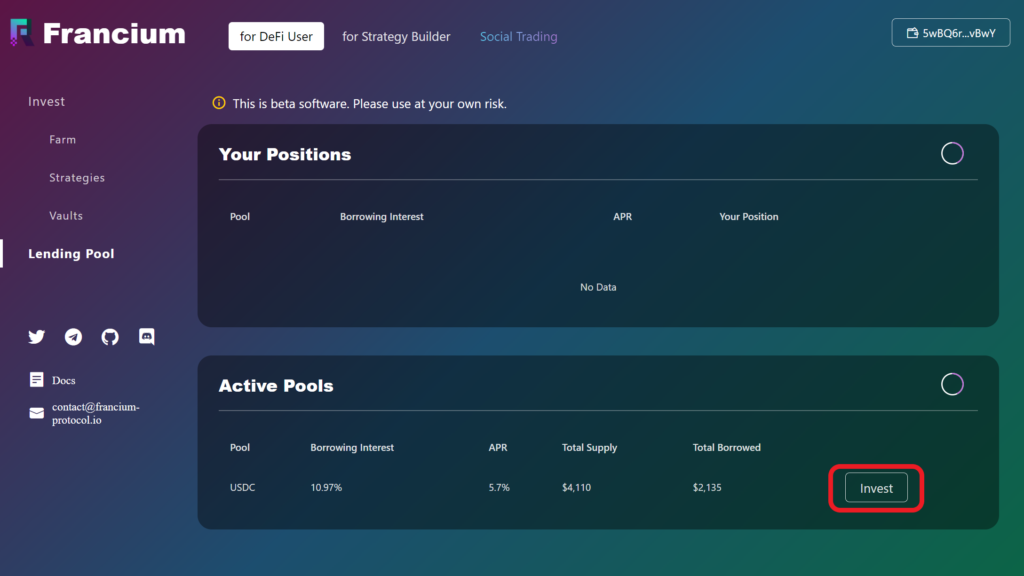

How To Lend In Francium Protocol?

Users can deposit their assets into the lending pool to generate interest on Francium Protocol. Here’s a step-by-step guide on how to lend:

- Log in to your Web3 wallet, such as Sollet or Phantom.

- Select the asset you want to deposit and click the “Invest” button.

Source: Francium

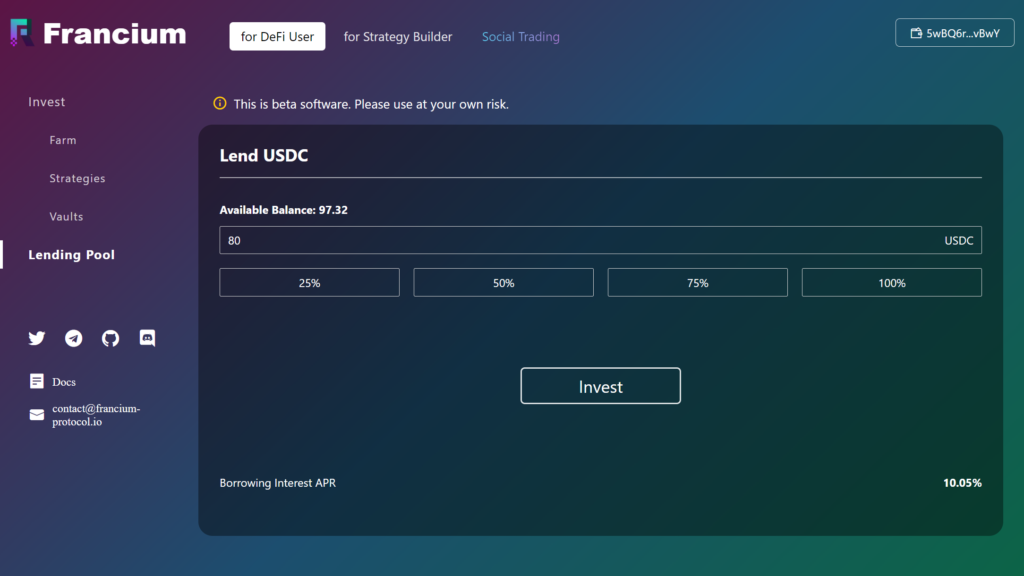

- Let’s take USDC as an example. After clicking “Invest,” you can specify your deposit amount.

Source: Francium

4. Click “Invest” and wait for confirmation from the Solana blockchain. You must approve the transaction in your wallet or choose to automatically allow transactions in Francium on your first wallet connection.

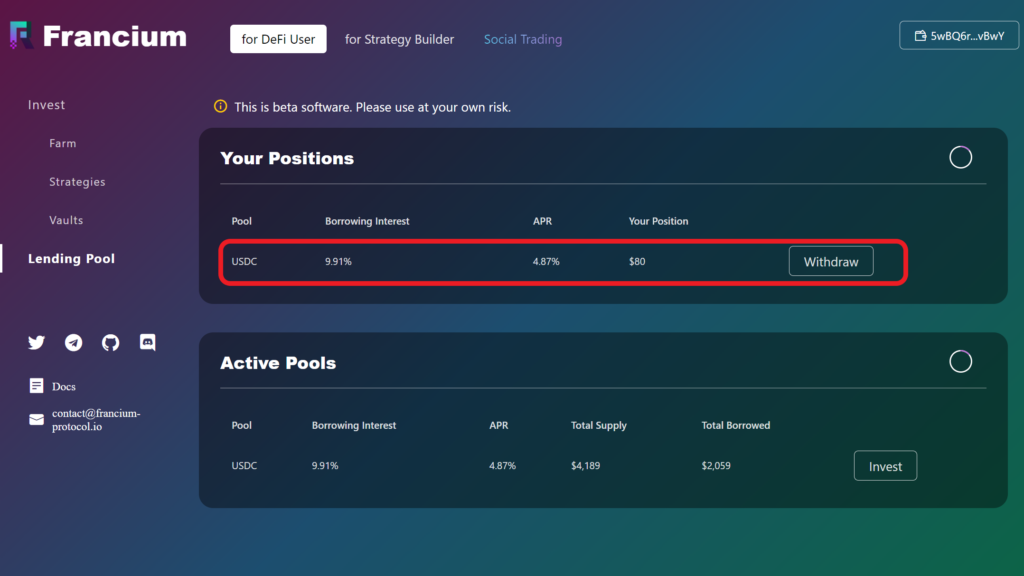

5. You can view your investment details under the “Your Positions” section.

Source: Francium

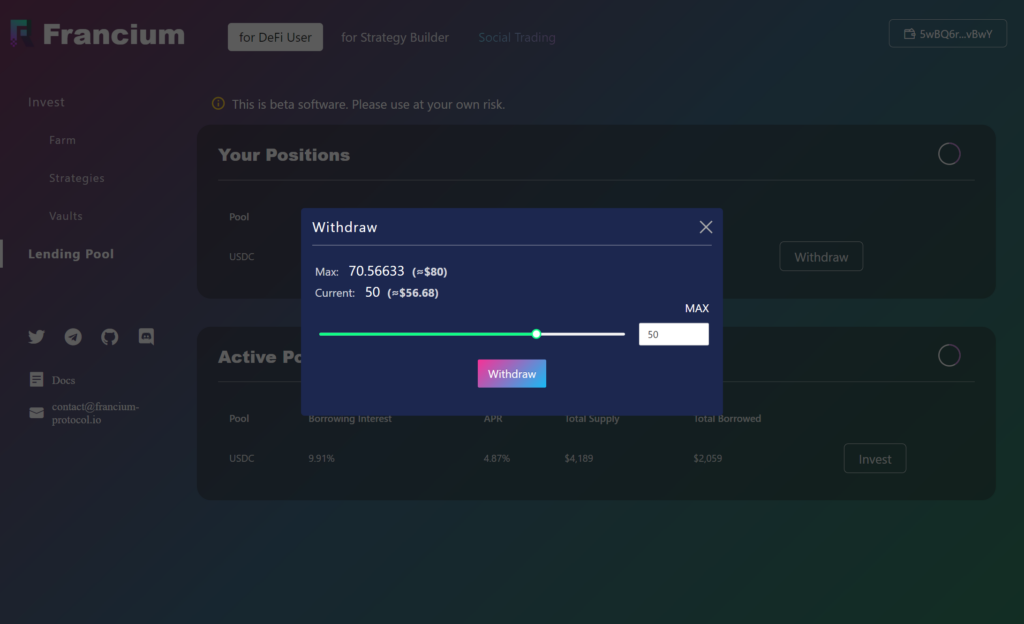

If you want to withdraw your funds, follow these steps:

- Choose the position you want to close and click the “Withdraw” button.

Source: Francium

2. You have the option to specify the amount you wish to withdraw.

Source: Francium

3. Wait for confirmation, and that’s it!

Following these instructions, users can easily deposit their assets to earn interest and withdraw funds when desired. Undoubtedly, Francium Protocol provides a seamless and user-friendly experience for managing lending positions.

How To Build A Defi Strategy With Francium Protocol?

Francium Protocol offers a powerful platform for users to implement their preferred DeFi strategies across various assets. By fostering decentralized collaboration between DeFi developers and users. So, Francium aims to create attractive income opportunities for both strategy providers and users alike.

To maximize profits and minimize losses, Francium provides a range of yield strategies, including:

- Crypto-Native Strategy: focuses on yield farming and capital efficiency, allowing users to leverage assets from lending pools for increased gains.

- DeFi Composability Strategy: integrates multiple protocols, enabling users to seamlessly perform lending, DEX trading, and yield farming operations.

- Trading System-Based Strategy: leverages traditional trading market strategies, including AI-enabled versions, to identify yield opportunities in the crypto market.

Source: Twitter

Source: Twitter

In addition to predefined strategies, Francium offers a robust strategy-building infrastructure to support community and individual strategy implementation.

Individual Strategies

This infrastructure includes essential components such as:

- Financial instruments: encompass leverage provision protocols, options, futures, and order systems, ensuring strategy builders have the necessary tools for implementing their strategies.

- Automation: features enable off-chain calculations, trigger-based contract executions, LP position management, and more.

- Enriched Targets: Strategy builders can invest directly in a wide range of assets and their derivatives on the platform, leveraging rich Oracle data for asset valuation and security inspections.

- Visual Tools: Francium further simplifies strategy creation with a graphic and drag-and-drop strategy creation toolbox, reducing technical barriers and enabling quick and convenient strategy implementation.

Moreover, Francium Protocol will provide a comprehensive DeFi automation toolset for strategy builders to streamline the strategy development process. This toolset comprises the following components: DeFi Automation Framework, Strategy Dev Toolset, and Standard SDK.

However, it’s important to note that at the time of writing the article, the official website lists the “Build DeFi Strategy” option as “coming soon,” indicating that the feature is currently under development.

Once released, strategy builders can access the build DeFi strategy functionality and leverage the robust automation toolset provided by Francium Protocol to create and deploy their strategies on the platform.

Conclusion

Francium Protocol, built on the Solana blockchain, is a pioneering leveraged yield aggregator with various innovative features. In this article, we have highlighted some of its key attributes, including its dynamic leveraged yield farming strategy. The protocol’s commitment to security, composability, and user experience is truly commendable.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Source:

Source: