Frax Finance has come a long way. It started out in 2019. We knew it under a different name first, Decentral Bank. The team combined the best of stablecoins worlds into the FRAX stablecoin.

FRAX is a fractional-algorithmic stablecoin. So, it combines collateral and algorithmic backing. However, it’s now fully collateralized. But the platform wants more. So, let’s take a closer look at Frax Finance and what it does.

Thanks to exceptional MEV performance & the Frax Ether two token design, sfrxETH holders still earn APRs near 5% while other major LSDs yield significantly below 4%. That’s 20% more annual revenue to sfrxETH users 💪

stake: https://t.co/ilNiotBs9k

stats: https://t.co/GYJlnz6Ule pic.twitter.com/dWr0B5S161— Frax Finance (¤, ¤) 🦇🔊 (@fraxfinance) September 17, 2023

1) What is FRAX Stablecoin?

First, let’s explain what we have at Frax Finance. There are two tokens.

- FRAX, their stablecoin. This is their flagship product.

- FXS is the Frax Share token. It’s their utility and governance token. As long as the FRAX demand grows, this is a deflationary token.

The team changed the stablecoins backing. They did this after seeing what happened with the LUNA-Terra ecosystem. It’s now 100% collateral-backed and not algorithmic anymore. This happened after a community vote in February 2023. As a result, the FRAX stablecoin is now backed 1:1 by USDC.

For this, the team started an algorithmic market operations controller or AMO. This makes sure that FRAX stays pegged to the USDC. However, this controller can’t start minting FRAX at free will. Otherwise, the peg can break. So, this AMO is important to maintain the peg. There are five AMOs and they dynamically adjust the collateral ratio.

It proves that this team is one of the more innovative builders in DeFi. They make sure that they cover all aspects of the DeFi space. This gives more stability and various avenues of revenue. So, let’s take a look at the various features of Frax Finance and what they do.

1/4

A member of @fraxfinance's Core Team has proposed the introduction of staked Frax (sFRAX). Much like the DAI savings rate, it allows users to deposit Frax (pegged to $1) and earn interest in the form of FRAX stablecoins providing a low-duration savings option for users. pic.twitter.com/mhUuaegrAI

— ASXN (@asxn_r) September 5, 2023

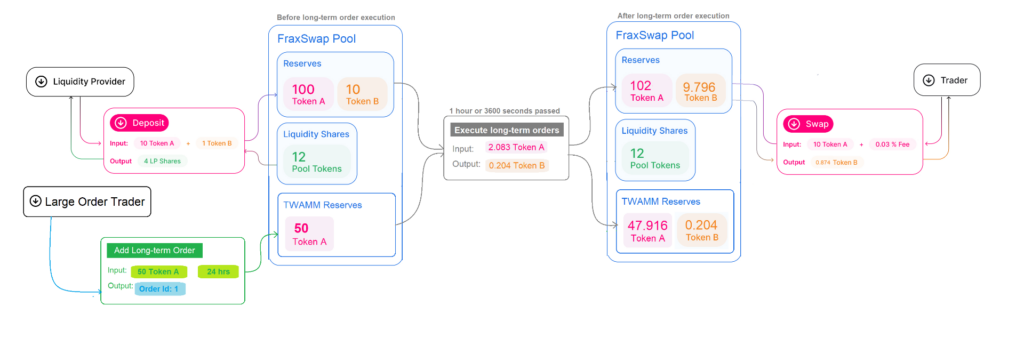

2) What is FraxSwap?

FraxSwap is their native DEX. It launched in June 2022. This DEX became the first Time-Weighted Automated Market Maker (TWAMM). It is 100% permissionless and based on Uniswap V2. This DEX caters mainly to large orders. By processing these orders over time, it prevents price fluctuations. The protocol uses FraxSwap for various interactions:

- Buying back and burning FXS with AMO profits.

- Minting new FXS to buy back and burn FRAX stablecoins to stabilize the price peg.

- Minting FRAX to buy hard assets through seigniorage.

- And many more market operations that are still in development.

Once more, it proves their innovative drive. See a picture of the schematic version of the TWAMM below.

Source: FraxSwap docs

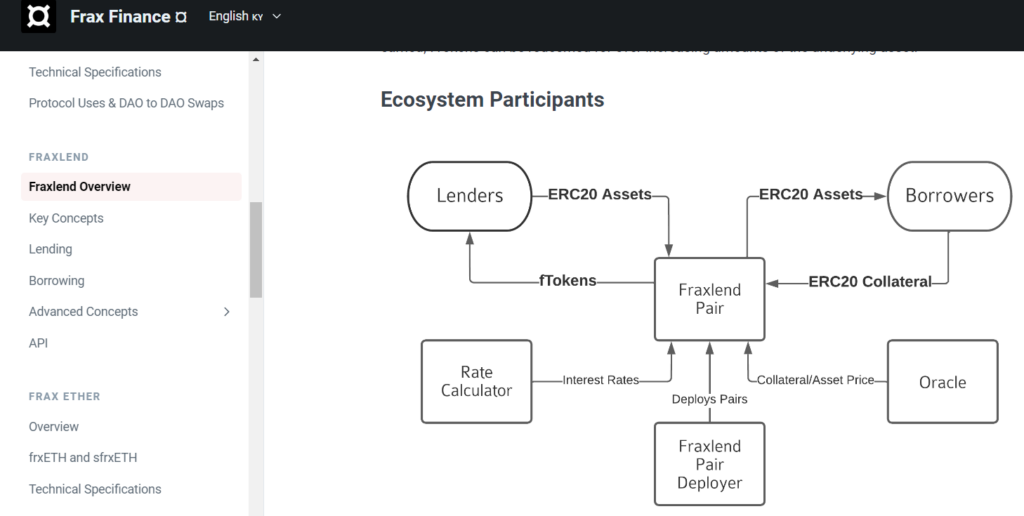

3) What is Fraxlend?

Fraxlend increases the adoption of their stablecoin. It’s a lending market between a pair of ERC20 assets. By doing this, each pair becomes an isolated market. Now anyone can lend and borrow in this market. It allows you to borrow FRAX against collateral. Currently, there are 15 pairs available.

The platform also took part in the Curve Wars. They put the rewards towards FRAX pools. This, in turn, attracted more users. The picture below shows how Fraxlend works.

Source: FraxLend docs

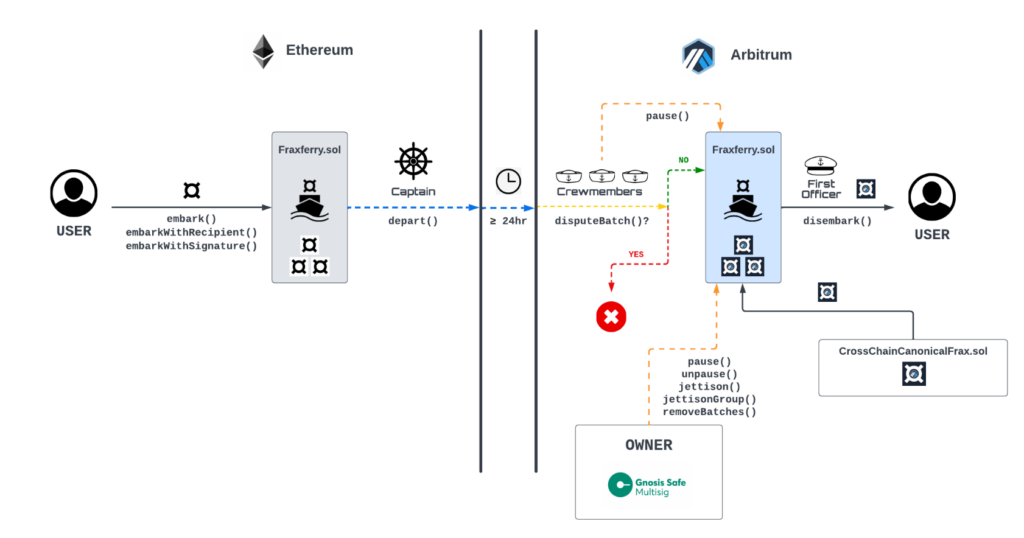

What is FraxFerry?

FraxFerry makes interoperability possible. It allows you to transfer native Frax tokens across various chains. There’s no need for bridges or other third-party apps. It may be a slower option, but it is also much more secure.

It eliminates any bridge hacks or infinite mints. Some bridges, like Arbitrum or Optimism, can also be slow. Team members can also stop transactions if required. This opens up the opportunity to investigate suspect transactions. The picture below shows how this works.

Source: FraxFerry Docs

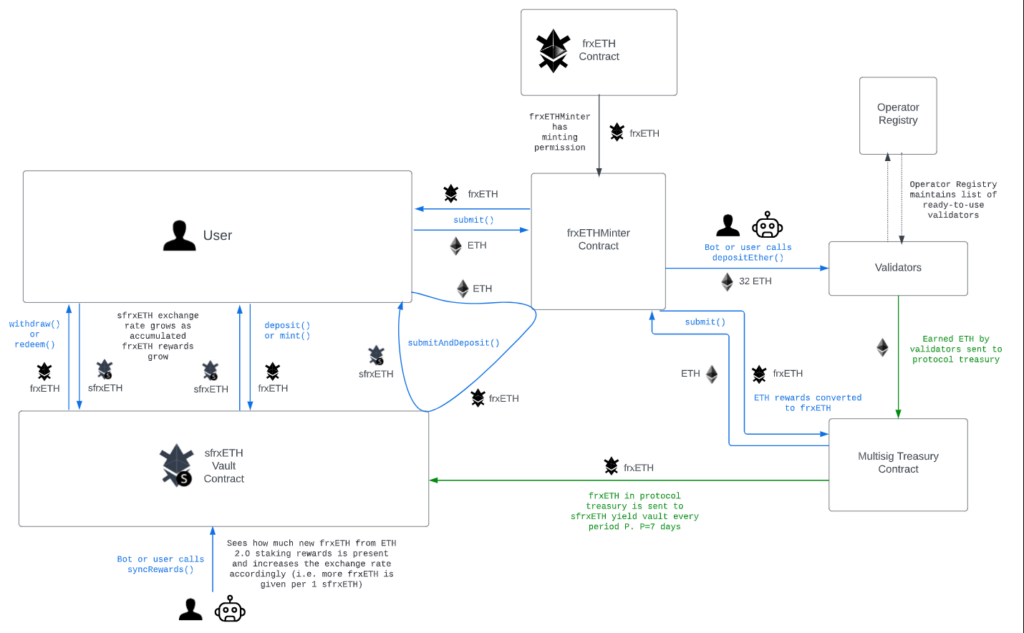

What is Frax Ether?

Frax Ether is the liquid staking derivative. It’s also a stablecoin system that maximizes staking yield. It makes the Ethereum staking process easy and straightforward. Furthermore, it has three main parts:

- Frax Ether (frxETH) is like a stablecoin, loosely pegged to ETH.

- Staked Frax Ether (sfrxETH) accrues staking yield. The profit that Frax Ether validators make, goes to sfrxETH holders. Once you swap frxETH for sfrxETH, you receive a staking yield. You collect this, once you swap back from sfrxETH to frxETH.

- Frax ETH Minter allows swapping ETH to frxETH.

The picture below has a scheme of how this works.

Source: Fax Ether

What is Fraxchain?

FraxChain will be the Frax Finance layer 2 chain. It uses a hybrid of Optimistic rollups and zk-rollups. However, to pay gas fees, you need frxETH instead of ETH. These gas fees go back to veFXS holders. This is a token you receive when you lock FXS. So, this adds more value for FXS stakers. They already profit from FXS buybacks. FraxLend and FraxSwap fees fund these buybacks.

So, it proves that the various elements all contribute to the overall prosperity of the platform. Their ecosystem as a whole profits. The introduction of the FraxChain may increase the protocol’s market cap significantly.

Frax Finance is one of my top investment convictions for 2023-2024.

To help you understand why I'm so bullish on $FXS, I've summarized everything you need to know:

❯ Ecosystem flywheel

❯ Future upgrades

❯ Long-term confidenceLet's go!@fraxfinance is undoubtedly one of… pic.twitter.com/3uelije5JK

— Stacy Muur (@stacy_muur) September 12, 2023

Conclusion

We looked deeper into the Frax Finance ecosystem. It offers many features, and they all benefit the growth and health of the ecosystem. This platform is an innovator in the DeFi space.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.