Bitcoin (BTC) was the most sold digital asset by a wide margin, accounting for 85% of all institutional activity. And marking $45 million worth of outflows.

The most important asset on Altcoin Buzz Alpha’s holdings is Bitcoin. If you want to see more analysis, you can join here. Let’s discover the latest analysis of Bitcoin.

Bitcoin’s Performance

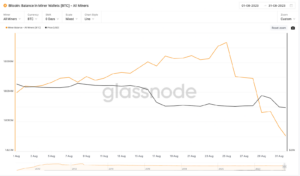

BTC seems to be the most-loved investment(obvious!) product. It drew inflows worth $12 million over the past month. While the supply of Bitcoin in long-term holders’ wallets is nearly at its all-time high. Miners have been selling because the production cost is nearly equal to the market price of Bitcoin.

Source: Glassnode

The data from Glassnode shows that the Bitcoin balance in the miner wallet has plummeted sharply since Aug. 25.

Source: Glassnode

Bitcoin Is The Ultimate ESG Asset?

Daniel Batten, a leading BTC environmentalist and co-founder of CH4 Capital, presented a compelling case for the cryptocurrency. With the help of four distinctive charts, Batten highlighted Bitcoin’s sustainability compared to other major industries. “4 charts, 4 tweets, 4 reasons Bitcoin is the ultimate ESG asset,” stated Batten.

1/4

4 Charts

4 Tweets

4 Reasons Bitcoin is the ultimate ESG assetSo what does the data tell us?

1. This chart tells us that Bitcoin mining is now the single most sustainably-powered global industry in the world pic.twitter.com/bSwXgL5XmP

— Daniel Batten (@DSBatten) September 25, 2023

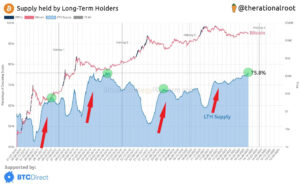

Bitcoin Halving 85% Complete:

Bitcoin has already passed 85% of the time since the previous halving in May 2020. At the same time, supply held by long-term holders (LTHs) is close to its all-time high (ATH) nearly the all-time high of 2015. In previous cycles, this was a signal of the vicinity of a macro bottom, followed by the early phase of a new cycle.

The analyst Root published a chart of Bitcoin supply in the hands of long-term holders and superimposed each halving Bitcoin on his drawing. In his chart, we notice the BTC supply ratio in the hands of LTHs is close to its ATH near 76%. This was set at the end of 2015 when the BTC price ended the accumulation phase before the second halvin.

If history were to repeat itself, then:

- In the grand scheme of things.

- The cryptocurrency market could face a roughly one-year sideways trend.

Bitcoin halving, scheduled for mid-April 2024, may not immediately impact the price of BTC. Its effects may become apparent only in the last quarter of 2024 and throughout 2025. Read the second part here.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.