Bitcoin seems to be getting out of its recent sideways action. It’s now testing the $48k price range.

So, when BTC does well, the rest of the market tends to follow. But how about adding $10,000 to your crypto portfolio without adding capital? Instead, use your already deployed capital and make that work.

Maximizing Your Crypto Earnings: A Simple Guide

In our dedicated Alpha group, you can subscribe here, we show you how to do this. It’s our flagship service. You can be part of this as well. In this group, we mentioned all the opportunities that I’m about to show you. Plus, a lot more.

Currently, the DePin, RWA, and AI narratives have been hot for some time. I expect them to do good during the upcoming bull run. They will look good in a crypto portfolio. However, there are other narratives making waves. It’s a good idea to look into infrastructure projects. For example, they are some of the most fundamentally strong ones and the probability of failing is low.

1) The DYM Airdrop

Two main events that recently took place were:

- The Dymension airdrop. The Alpha group received an 800 $DYM token drop worth $5,000.

- EigenLayer unpaused its restaking for a while. Now it has 2.45+ million ETH restaked.

So, why are these events of importance to me and you? There’s a connection between the two, and I will show you what it is. Now, first, let me explain how Alpha members got the 800 $DYM airdrop. You could be eligible by using various chains. However, Alpha’s main reason for qualifying was simple, staking ATOM. That was their initial investment. Now they made it work for them. For example, you could get $DYM by:

- Using Arbitrum, Optimism, Base, and Blast.

- Staking ATOM, TIA, or OSMO in the Cosmos ecosystem.

- Hold 1 SOL or more over various protocols. Using Drip Haus was another option to qualify.

Dymension is much more than just an airdrop.

It's the Lego kit for modular blockchains and could be one of the biggest projects of the year.

Here's your February 2024 research report on DYM.

Make sure you read to the end to find my overall project ranking.🧵 pic.twitter.com/CleDGSoIQT

— Jake Pahor (@jake_pahor) February 14, 2024

Holders of the Pudgy Penguins, Mad Lads, Tensorians, or Bad Kids NFT collections. Alpha members qualified for staking ATOM, TIA, and using Drip Haus. Pending on the price of $DYM, the allocation is worth anything between $5k and $6k. So, now it’s time to connect some dots:

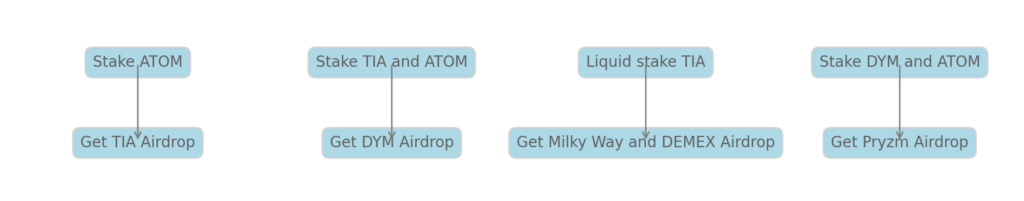

- Stake Atom and you received the Tia airdrop.

- Stake Tia, you got the DYM Airdrop.

- Liquid stake Tia on MilkyWay and get milkTIA. Lend your milkTIA on the Demex exchange and get the Demex Airdrop.

- Stake DYM and you will receive the PRYZM airdrop.

This didn’t cost anything, since we had the initial investment of 150 ATOM in place. Everything snowballed from there.

2) The Common Denominator Between the DYM Airdrop and EigenLayer

Now, the current TIA and DYM prices are great. There’s even some room for more growth. However, if we look at their tokenomics, we can also see that they’re overvalued. Now, hold your horses, there’s no reason to sell right now. Until the end of the year, their respective prices should be fine. There are no major token unlocks until we get to October.

That’s when TIA will have its first major token unlock. It’s mostly funded by VCs, so this is the first opportunity they can sell. In other words, there will likely be a massive token drop on the market. On the other hand, a $7 billion FDV (fully diluted valuation) for DYM is also not sustainable. Especially for a new token.

But now there’s a new kid on the block. It’s called restaking. If you already own ETH, you can make that work for you. Like how Alpha members made ATOM work. And that’s the common denominator. You use funds that you already have, like ATOM and ETH. There’s no need for new investments.

3) Restaking

By restaking ETH, you could earn the AltLayer (ALT) airdrop. Like staking ATOM getting you the TIA airdrop. EigenLayer is the restaking protocol that started this whole narrative. However, what you want to do is to restake your ETH on other platforms. For example, like:

By doing this, you also qualify for the airdrops of these protocols. So, both AltLayer and Dymension have one thing in common. They’re both RollApps. These RollApps help users deploy Apps with specific business logic or capability.

1/11 Restaking is the fastest-growing crypto sector right now.

A big wave of protocol launches using EigenLayer is coming our way. AltLayer was just the first one.

Here are the top protocols to watch: ↓ pic.twitter.com/ruYuqZQNjY

— Ignas | DeFi Research (@DefiIgnas) February 7, 2024

Here’s another feature that makes RollApps interesting. These RollApps do not compete for block space. They only produce blocks whenever needed. That’s in contrast to other blockchains. They produce blocks at constant intervals.

In other words, AltLayer is an alternative to ATOM, DYM, and the Cosmos ecosystem. But in this case, especially to DYM. Do you have any of these tokens in your crypto portfolio? So, restaking is a big narrative for this year. It is a new and innovative concept. However, it’s not without potential drawbacks. So, let’s take a look at them.

4) Restaking Risks

Here are some potential restaking risks. For example:

- Slashing — you can end up with slashing penalties from two sides. From ETH but also Actively Validated Services (AVS). These are sidechains, new virtual machines, or Oracle networks. They need their validation services.

- Yield risk — EigenLayer aims to help protocols in leveraging Ethereum for security. However, restakers may go where the highest yield is. They may see this as a quick and easily leveraged financial product. This can impact the L1 network.

- Centralization and collusion risk — I explained this in a different video. Check the ‘Staked ETH and the BIG Risk Threatening Ethereum’ video below.

- Lack of liquidity because you both stake ETH and the LSTs.

- EigenLayer Smart Contract Risk.

In short, you leverage a token that’s already susceptible to risks inherent in staking. There are overlaying extra risks as well. These result in layered vulnerabilities. Further development of primitives atop this framework would introduce heightened complexity.

So, there you have it, some information we share in our Alpha group. Are you familiar with any of the protocols mentioned? How many of the tokens mentioned today are in your crypto portfolio?

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.