An ETF is an investment vehicle that is publicly traded, like a stock, but tracks the performance of an underlying asset or index, rather than that of a single company. Also, an ETF provides investors a way to gain exposure to the value of its underlying asset, such as gold or oil.

In this article, we’ll discover a lot more about Bitcoin ETFs.

What is a Bitcoin ETF?

An ETF is an investment product of underlying assets that can be bought + sold on an exchange. It can comprise Equities, bonds, funds, or even crypto.

So, a Bitcoin ETF is an exchange-traded fund that tracks the value of Bitcoin. It is a publicly-traded investment vehicle. The shares in a Bitcoin ETF would be tradable on a traditional stock exchange, and their value should rise when the asset, here BTC, increases in price, and fall when it decreases.

The ETF tracks the performance of an underlying asset or index, rather than one company.

However, the SEC has repeatedly rejected proposals for Bitcoin ETFs in the U.S., citing a lack of surveillance on the platforms where Bitcoin trades and the potential for fraud and market manipulation. But, fund companies have reason to believe the agency might need to soon give in, whether or not it wants to.

Get this, a Bitcoin ETF works in much the same way as any other ETF. Investors buy shares in the ETF through whatever brokerage they buy stocks from and can trade them the same way they’d trade shares in Apple or Tesla. Bitcoin ETFs track the current price of Bitcoin and should act in lockstep with Bitcoin’s price swings.

Source: Twitter

Why the Need for a Bitcoin ETF?

So, why wouldn’t investors just buy Bitcoin? For most regular retail investors, Bitcoin and cryptocurrencies in general still look risky. Besides having unclear regulations around them, owning Bitcoin requires keeping a Bitcoin wallet and trusting crypto exchanges, which are still uncharted territory for people unfamiliar with the space and require a certain level of self-education.

Holding Bitcoin places the burden of security squarely on you, making you responsible for keeping your own private keys safe (unless you want to entrust them to the exchange). This may mean buying a hardware wallet to protect purchased Bitcoin or storing private keys in a secure manner. You’d also have to work out how to file taxes for sales of Bitcoin that resulted in capital gains.

With a Bitcoin ETF, investors need not worry about private keys, storage, or security. They own shares in the ETF just like their shares of stock and can gain exposure to the cryptocurrency market without having to go through the hoops of purchasing and holding crypto. And to put it plainly, that is an extremely appealing proposition for many regular folks—as well as sophisticated institutional investors. Here are some examples of Bitcoin ETFs:

1) Blackrock Filed With the SEC to Launch a Bitcoin Spot ETF.

The $10 trillion asset management giant BlackRock filed with the Securities and Exchange Commission (SEC) to launch a Bitcoin Spot ETF on Thursday – This would be the first Bitcoin spot ETF in the US, and it would allow investors to get exposure to Bitcoin without actually buying it.

Source: Twitter

The asset manager BlackRock is executing this through – the iShares Bitcoin Trust – an investment trust offered by iShares (BlackRock’s ETF provider). BlackRock is proposing to use two partners to hold the Bitcoin and cash for the ETF: Coinbase Custody and BNY Mellon.

- The custodial arm of Coinbase is the “Bitcoin Custodian” and it will hold all the Bitcoin to back the ETF. -The Bank of New York Mellon is the “Cash Custodian” and it will hold the investors’ cash.

With these parties, iShares will:

Hold Bitcoin as a primary asset (through Coinbase Custody) and issue shares to investors for cash (through BNY Mellon).

The SEC has been hesitant to approve Bitcoin ETFs in the past, due to concerns about the ability of large whales to manipulate Bitcoin’s price and market manipulation. However, BlackRock is addressing these concerns by proposing to only use the top Bitcoin exchanges and by entering into a surveillance-sharing agreement with Nasdaq.

This will give the Nasdaq price data on spot Bitcoin trades to ensure there is no price manipulation. This would provide easy investor access to Bitcoin from a Wall Street giant. The filing added that shares in the trust are meant to constitute a simple means of investing in Bitcoin rather than trading and holding it on a peer-to-peer basis.

Summarising the Key Points of the Bitcoin ETF Filing

- The other name of the ETF would be iShares Bitcoin Trust.

- It would be backed by Coinbase Custody.

- The price of the ETF would be based on the spot price of Bitcoin on six exchanges: itBit, LMAX, Gemini, Kraken, Bitstamp, and Coinbase.

- BlackRock has entered into a surveillance-sharing agreement with Nasdaq to ensure that the ETF is not manipulated.

Source: Twitter

The SEC is expected to take several months to review the filing. If approved, the BlackRock Bitcoin spot ETF would be a major milestone for the cryptocurrency industry. It would make it easier for investors to get exposure to Bitcoin, and it could help to legitimize the cryptocurrency market

Other firms have spent years trying to launch a similar product but have continuously been denied by the SEC. By contrast, the agency has approved multiple Bitcoin Futures ETFs for instance the Bitcoin Strategy fund (BITO) by Proshares and others, which are backed by Bitcoin futures contracts rather than real BTC.

The SEC prefers the futures product because the market for its underlying assets is surveilled by the Chicago Mercantile Exchange (CME), which can help detect market manipulation.

Can BlackRock’s ETF Succeed?

Grayscale’s spot ETF proposal was rejected last year because it tried to form a surveillance-sharing agreement with the CME Bitcoin Futures market, which the SEC did not consider closely related enough to the spot Bitcoin market. Grayscale has since sued the SEC, and judges overseeing the case have expressed skepticism over the SEC’s argument.

Blackrock said it would determine the value of the Bitcoin in its trust each day with reference to the CF Benchmarks Index. The Index tracks the price of Bitcoin across Coinbase, Bitstamp, iBit, Kraken, Gemini, and LMAX Digital and strives for “resistance to manipulation” while not including “any futures prices in its methodology.”

Many hedge funds and other investment firms have filed applications with the U.S. Securities and Exchange Commission (SEC) for Bitcoin ETFs in the past week. We’ve seen 5 Bitcoin ETF applications in 5 days:

- Blackrock.

- Fidelity.

- Invesco.

- Wisdom Tree.

- Valkyrie.

The SEC is facing a fresh wave of spot Bitcoin ETF applications from major investment firms, in the wake of BlackRock’s filing:

WisdomTree

ETF provider WisdomTree re-submitted an application requesting regulatory approval for the launch of the WisdomTree Bitcoin Trust on Tuesday, June 20. The watchdog has previously rejected WisdomTree’s attempt to release a BTC ETF, citing possible risks for consumers, such as fraud and market manipulation. The trust aims to be in the list of the Cboe BZX Exchange under the ticker symbol “BTCW.”

Source: Twitter

Invesco

Eric Balchunas announced on his Twitter account that Invesco has renewed its efforts to launch a Bitcoin ETF in the United States. The company’s first filing was in 2021 when it partnered with Galaxy Digital.

Source: Twitter

Invesco was initially interested in launching a Bitcoin Futures ETF; however, it abandoned those plans at the end of 2021. Instead, it is focusing on a product that enables customers to invest in the primary cryptocurrency based on its actual market price.

Although the investment company is still awaiting approval from the US SEC, it has already introduced a product in Europe. The “Invesco Physical Bitcoin” ETN (ticker: BTIC) was created through a collaboration with Deutsche Borse and provides “physically secured access” to Bitcoin’s performance, albeit a derivative.

Valkyrie

Financial services firm Valkyrie Digital Assets updated its filing for the Valkyrie Bitcoin Fund on Wednesday with the Securities and Exchange Commission, a fresh prospectus reflecting today’s dominant crypto narrative.

Source: Twitter

The company says the goal of the Valkyrie Bitcoin Fund is to reflect the price of CME CF Bitcoin Reference Rate – New York Variant (BRRNY), a figure calculated based on trading data aggregated across a handful of major Bitcoin exchanges: Coinbase, Bitstamp, Gemini, itBit, Kraken, and LMAX Digital.

The filing notes that BRRNY is the same figure that Bitcoin futures contracts are settled on, which trade on the Chicago Mercantile Exchange.

Fidelity

Fidelity Investments is said to enter the Bitcoin (BTC) ETF space soon. Other than filing for an ETF, it is being said it can buy Grayscale Investments.

Source: Twitter

We’ve been seeing the continued outflows among exchange-traded products, mutual funds, and over-the-counter (OTC) trusts because of the crackdown on crypto markets by high-profile SEC lawsuits against Coinbase and Binance that labeled a slew of altcoins securities.

In total, investors have pulled $423 million from funds over the past nine weeks.

People have been feeling out of the ordinary when one of the world’s most prestigious financial institutions applies for a cryptocurrency investment product during a tough regulatory crackdown.

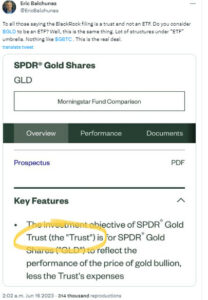

Source: Twitter

CoinShares attributed the comparative trickle of outflows to BlackRock’s Bitcoin exchange-traded product (ETP) gambit. So, Senior ETF analyst Eric Balchunas said this on Twitter, defending the use of the “ETF” label, saying It’s the “real deal”.

He also pointed out that BlackRock has a nearly undefeated record when it comes to the SEC, with 575 of its ETF applications being approved. In contrast, other Bitcoin ETF applicants over the years can’t say the same.

Source: Twitter

Asset managers VanEck, Ark Invest, and Bitwise have all been rejected by the regulator. The issue is so contentious, Grayscale Investments even sued the SEC after it was rejected for converting its Grayscale Bitcoin Trust (GBTC) to an ETF. BlackRock is a serious institution and New York Mellon would be the custodian for the Trust’s cash holdings—another reputable financial institution.

The current regulatory environment may prove difficult to manage an ETF, but the Wall Street giant doesn’t just play around and certainly has the best odds yet.

ETF Impacts

Price Action of Bitcoin:

- Bitcoin market dominance has reached 50% for the first time in two years due to BlackRock’s filing for a Bitcoin spot ETF.

- Bitcoin climbed to $30,000 for the first time since April. Buoyed by The BlackRock announcement on a Bitcoin ETF and EDX Markets. The rally is backed by institutional demand!

- BlackRock’s ETF is expected to be around $5 billion. This is certainly going to be worlds most anticipated ETF ever

Potential impacts:

- Bitcoin market dominance: The launch of the BlackRock ETF could lead to Bitcoin increasing its market dominance further. As more institutional investors gain exposure to the cryptocurrency. This is because the ETF will make it easier for institutional investors to buy and sell Bitcoin. This could increase demand for of the cryptocurrency.

- Halving: The launch of the ETF could also coincide with the Bitcoin halving. Is an event that occurs every four years when the reward for mining a mined block of Bitcoin. This could lead to a further increase in the price of Bitcoin. As the halving will reduce the supply of new Bitcoin.

- Can Really Drive up Institutional Adoption: An approval of BlackRock’s Bitcoin ETF could increase institutional adoption. This will provide a regulated and secure avenue for investors to access Bitcoin.

GBTC Sees Over 400% Surge in Trading Volume

Grayscale’s Bitcoin Investment Trust (GBTC) is currently enjoying some attention from investors. Its trading volume is a testament to this fact. This follows after GBTC’s trading volume spiked by over 400% within the last week.

As of June 14, the daily trading volume of GBTC was still standing at $16.1 million. But within just 5 days, following the BlackRock filing for a spot Bitcoin ETF on June 15. That volume surged massively to about $80 million.

In this case, Grayscale itself can be optimistic about its proposal to convert GBTC into a spot bitcoin ETF. Although Grayscale, like many others, has had its proposal rejected by the SEC up until this moment.

Plus there have been rumors earlier this week that claims Fidelity might be planning to acquire Grayscale. If that also turns out to be true, then that helps GBTC’s cause with the SEC. Especially with regard to Fidelity’s repute as an old, traditional firm.

Whatever might be the case, there is a general sense of optimism around BlackRock being successful. And when that happens, This will pave the way for Grayscale to share its non-redeemable trust shares too.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.