So the Bitcoin ETF gets approved. Prices increase for a couple of days and then start dropping.

So where is the market headed now? Is it BTC or some specific altcoins that will pump in the coming days? I found answers to all these questions in Glassdoor’s recent Market sentiment report.

ETF Approved, Yet Price is Dropping. Why?

So the 11 Bitcoin ETFs are approved, yet the price has dropped since that happened. From a peak on January 11 of $48,462 to its current price at the time we wrote this of $39,876, we have an almost 20% drop. And that’s post-ETF approval, which the market sees as a huge positive move for Bitcoin and crypto. So what’s that about?

- Grayscale

For reasons beyond the scope of this video, Grayscale and its GBTC are one of the big reasons. Grayscale is a BIG seller in this market. They sold over $500 million in Bitcoin on both January 23rd and 24th alone. According to LookOnChain, that equals over 15,000 BTC and 13,000 BTC in just 2 days.

Jan 25 Update:#Grayscale decreased 13,179 $BTC($529.2M) on Jan 24.

8 ETFs added 8,251 $BTC($331.3M) on Jan 24, of which #Fidelity added 4,023 $BTC($161.5M).https://t.co/j8M4izWBnF pic.twitter.com/aW01DLRjTY

— Lookonchain (@lookonchain) January 25, 2024

They have been selling since the approval as now Grayscale holders can get their money out and buy one of the other ETFs and have better liquidity. More importantly, these numbers are WAY more than the 900 new BTC created each day with new blocks.

So the new ETFs are absorbing the new 900 BTC per day AND all of this Grayscale selling of BTC. Naturally, there is a little selling pressure for this reason.

BTC & ETH Market Cap Dominance

Market cap dominance helps us see if we are in a Bitcoin season, alt season, or tough market with no season. Thanks to this chart from our friends at Glassnode, we can see that Bitcoin dominance has been growing.

Even with the recent price correction, this is no big surprise. It’s been in the headlines and the ETF speculation was big. Since the collapse of FTX in November 2022, Bitcoin’s dominance is up from 38.9% to 49.8%. Almost 11 full percent.

Ethereum on the other hand, stayed almost exactly the same in this same period. Down just slightly from 18.9% to 18.2%. So their position in the market hasn’t changed much. So by definition, that means that Bitcoin’s 11% gain is altcoins’ 11% loss.

Source: Glassnode

It’s an almost near-equal loss of 6% in stablecoins and the remaining 5% in the altcoin market. Stablecoin market value declines are common in bull markets as people are putting their stables to work by buying the projects they like. That’s bullish.

While alts are slower to catch up, as is typical, too. Bitcoin rises first, and then alts follow.

ETH Sentiment Improving

Post ETF approval, ETH sentiment is improving. The Net Realized Profit is how profitable sellers are when they sell. It has been on the increase since early October and hit a 1-year high AFTER ETF approval.

Source: Glassnode

So, short-term holders’ net unrealized profits are on the increase too. They are at their highest point now since November 2021. You may remember that’s when the last long bear market started. So that means short-term ETH holders have been out of money for quite a while but conditions are now improving for all ETH holders.

Then lastly on ETH sentiment, we look at Open Interest. This is a function of how many are buying futures or perpetual contracts on BTC or ETH. Bitcoin is declining slightly while ETH is increasing slightly. This implies people are willing to speculate more on ETH than on Bitcoin.

Source: Glassnode

OR the risk/return ratio is considered better for ETH at the moment.

ETH or Alts Post ETF

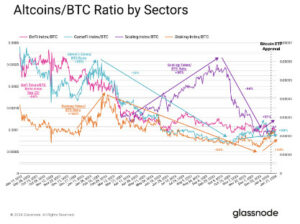

So ETH sentiment is getting better and Bitcoin sentiment is positive due to the ETF approval. What about alts? Solana is a recent outlier outperforming both BTC and ETH. Most of the others that outperformed both are much smaller projects that carry other risks. Solana is the only big cap to beat both. In Q4, the major alt categories of:

- Staking.

- Gaming.

- Scaling Solutions.

- DeFi.

Source: Glassnode

All lost ground to Bitcoin since September despite many of these sectors doing a little better than Bitcoin in the first 3 quarters of 2023. Scaling solutions did the best against Bitcoin in 2023 but the Arbitrum coin launch played a big part in that.

The Bitcoin price correction means these 4 groups are gaining slightly against Bitcoin since the ETF approval. ETH is outperforming the alts right now. It looks like it will be a big winner post-ETF just as Bitcoin will be once the ETFs absorb all the Grayscale BTC and the halving takes place in April.

So be selective with your alts right now and pick quality. If you like what you have, then hold or consider buying more if prices come down. But focus on high quality so you will be ok now and for the rest of the year.

And if you enjoyed this, here is the link to the full Glassnode Market Sentiment report.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.