In May 2023, Kyberswap announced its latest updates. From KyberSwap Elastic comeback to the addition of more liquidity in DEXs.

Source: Twitter

Altcoin Buzz General Manager Anindya (Ani) Baidya anchored the KyberSwap AMA session with Imran Mohamed, CEO of KyberSwap.

Segment 1: Introduction

Q – It’s been almost 10 months since we last spoke. Can you take us through what’s been happening in your space during this time and what have been the key milestones achieved

That’s right Ani. What 10 months it has been. We witnessed some massive events in the market and even today. KyberSwap has released the first on-chain trading tool using AI to help traders scan the whole market and make better decisions. It’s called KyberAI.

As you can see here. Using our proprietary KyberScore, you can get Bullish & Bearish signals for 4000+ tokens on 7 chains giving you alpha before it happens. We deployed on Arbitrum; run liquidity mining campaigns with the Foundation, and closed protocols. It was the largest airdrop in history and our users had a lot of fun and also received the airdrop.

For airdrop & NFT hunters, you can use KyberSwap to trade & earn on 13 chains at excellent rates & have lots of fun too!

Q – I remember that immediately after Arbitrum launched its mainnet, Kyber was one of the leading projects to push things forwards. You build and implement at a fast pace. I am specifically interested in the new project, Kyber AI. Kyberswap has always been known for its robust DeFi features. Recently you have opened up KyberAI, a powerful tool for alpha hunters. Tell us more.

Sure, happy to do so. Using KyberAI has the potential to change the way you trade. How? KyberAI’s flagship indicator, KyberScore, leverages the power of AI to provide you with valuable insights into token performance in the markets.

At its core, KyberScore reflects the probability that a token will enter into bullish or bearish territory over the next 24 hours. Ranging from 0-100, a KyberScore of 100 indicates that the token price will perform extremely well over the next day and vice versa.

Source: Website

How often? KyberScores are recomputed every 4 hours and hence comparing the historical KyberScores for a token could also indicate when a token might be starting to move or if the token is overbought or oversold.

By contrasting KyberScores across tokens, users are quickly able to deduce which token will likely outperform or underperform the mean. Moreover, KyberScore represents the token performance for a token across all the supported chains hence users can even compare tokens on different networks easily. KyberScore supports 4,000+ tokens on 7 chains at the same time.

But, what data is used? The KyberScore takes on-chain data such as Netflow to CEX, Netflow to Whale Wallets, Number of Transfers, and Number of Holders into account. It also takes into account Off-chain Data such as Simple Moving Average (SMA), Exponential Moving Average (EMA), Moving Average Convergence Divergence (MACD), and Relative Strength Index (RSI).

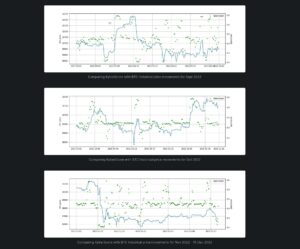

Source: Website

The question is – does it really work? Here’s one test – based on extensive testing of KyberScore with BTC historical price in September, October, and November-December 2022, KyberScore has consistently managed to anticipate the relative performance of a token over the next 24 hours.

Source: Website

Backtesting with Trading Strategies

A simulation was carried out comparing a static hold strategy against different strategies that trade based on KyberScore thresholds. This simulation covered 5 different tokens (WBTC, WETH, KNC, UNI, LINK) for the period 01/09/2023 until 18/12/2023.

For all tokens tracked, it was shown that trading with Kyber Score outperformed a “buy and hold” strategy for the period.

We’d like to think it gives traders a superpower to get all-in-one insights in 1 place. On 4000+ tokens all at the same time, to give you alpha before it happens. It’s pretty exciting! Of course, we must disclaim that nothing can be guaranteed and everyone should still research & make their own informed decisions.

Right now we are in the BETA phase, so you can get access to it for free.

Segment 2: Deep Dive

Q – We were tracking the performance occasionally. In February 2023, KyberAI spotted coins like zkSpace (ZKS) and Skale (SKL), before a breakout. In mid-May, it predicted a Lido token breakout. Does this effectiveness is equal for all tokens, or is the hit rate more for certain ones, and does the other ones need to be worked on further?

That’s a great question. First of all, we cover EVM chains (7 of them) and thus you may not get all the tokens you are looking for – but if they are on ETH, BNB, Polygon, Arbitrum, Optimism, etc no problem.

Secondly – this indicator of KyberScore is *short term* and not meant to be used as a long-term decision-making tool. It’s perfect for traders, and day traders, looking at making quick decisions, and the KyberScore is updated every 4 hours for all tracked tokens.

Even though it tracks tokens from WBTC and ETH to the smaller new tokens or meme tokens, everyone needs to be careful when they make their decisions still. Some tokens can be very illiquid, have low trading volume, or have a very large majority of holding in a few whale wallets, and could be manipulated either way easily.

We invite many people to try it out and share your insights and your wins. Our beta users have been posting actively their longs, shorts, and trades that have won on Twitter!

Q – Yes. This is good advice for anyone who starts testing. Thank you for that. Without naming any competitors, there have been few projects that give coin ratings. However, they have made the data token gated. Do you also want to follow the same path, will KNC be involved in the long run?

That’s a great question. We do note that many analytics tools can cost up to hundreds of dollars per month, or otherwise may have some token gate as you mentioned.

KyberAI is a proprietary tool on KyberSwap and it’s meant to give all DeFi traders and users the insights and edge to make meaningful decisions quickly – and this does not require or have any plan to involve the $KNC token.

Before we complete the beta phase and go to the public phase, the access & insights are completely free. Depending on the usage, and market conditions, we may consider implementing a paid subscription model after the public phase. But this has not yet been decided.

Q – Cool. It completely makes sense. This increases the stickiness of traders. They can analyze and trade on the same platform now.

Exactly Ani. The whole goal is to make Decentralized Finance easy to use. KyberAI gives you:

- insights at your fingertips. KyberSwap aggregator allows you to swap on 13 chains at excellent swap rates.

- KyberSwap liquidity allows you to participate in the DeFi economy as a liquidity provider and earn great fees + additional farming rewards.

All these within 1 platform, built by a trusted team that has been in Decentralized Finance for a long time & will continue building for the benefit of all users.

Segment 3: Community Questions.

Q – Can you create triggers, and alerts and automate trades too in the long run? How can a user incorporate KyberAI with Swap, Farm, Stake, etc to build a comprehensive Trading Strategy in Kyber Swap?

You can create watchlists of your favorite tokens so you can see them in 1 location. We’ve incorporated wallet (UI) notifications and email notifications which right now provide product triggers. However, what you asked about setting specific triggers for specific tokens and price movements or even looking at automated trades, could be possible in the future after going into the public phase.

This is exactly what we are getting in terms of feedback from all the beta users. You can tell us what are the most requested features you need to make your life easier, and we will look into it.

Source: Website

With regards to the product features, like Swap, Limit Order, or Liquidity Provision. For example, if you have a trading strategy (similar to what I shared above), you can identify the tokens you would like to utilize via KyberAI.

1. You can swap them on the Swap at the market rate.

2. You can also set Limit Orders to buy at a certain price or sell if it goes X% above or a stop loss sell at Y% below.

3. It definitely is possible if you are thinking of being a liquidity provider to look at which tokens may trend and then be an LP to take advantage of the increase in trade volumes, but this is quite a different story from that of a trader.

Here you can see the interface of our Limit Order – so that traders can set the price at which they want to buy/sell.

Source: Website

Q – Moving from the current thread of questions, we are very curious to know how Kyber Network has been impacted by the recent SEC moves. Are you seeing any trends and patterns in trading certain coins in KyberSwap?

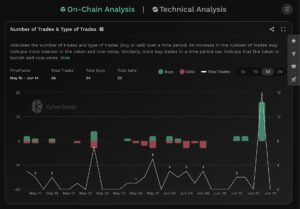

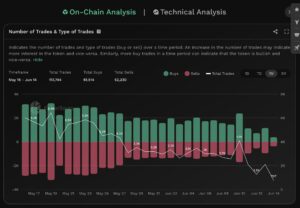

Just on that topic of copy trading, one can definitely look at the buy / sell stats as well as whale wallet movements for each token!

Source: Website

This would give you some indication of the buy or sell pressure plus what whale wallets are doing with respect to a token in question.

Source: Website

Right now, because KyberSwap does not operate in or target the US market or users, this is not a direct or immediate concern for operations.

However, there is a larger, and more important implication for blockchain and crypto. We believe that building decentralized finance. Immutable, composable, transparent, fair, and accessible financial systems, are even more so important for everyday people like you & me.

Of course, like any company in the industry, we monitor all movements from the SEC, as well as other regulators closely, to ensure that we operate with minimal risk and to provide the best UX, safety, and assurance possible to users.

Personally, as a builder and believer in blockchain and crypto, I think this industry is important not so much that it pumps my bags or your bags. It gives us our birthright to human freedom and financial autonomy. My opinion only.

Q – I will take a community question from Twitter. The question was a bit odd, so I modified it a little. “What are Kyber Network’s plans to introduce NFTs, for example, APY boosters, etc?

While implementing a product-utility-NFT requires really careful planning of economics and technicalities, KyberSwap has embarked on the journey of NFT hunting with our community here. You can find our Signature NFT campaign.

Source: Twitter

Here’s a *small* alpha, those who claimed our Arbitrum NFT, were airdropped more tokens afterward. I’d really recommend everyone to collect all the Signature NFTs cos it’s fun, and you’ll be really glad you did.

With regards to enabling higher APY or other features, we are looking at various product features and this including:

1. Swap gas refunds if you stake KNC or perhaps a KyberSwap NFT in future

2. Getting increased APY in the farms if you stake KNC or a KyberSwap NFT, in future

3. Creating a revenue share referral program – and enabling increased revenue share if you are an NFT holder or KNC stalker.

These are all in discussion and certainly not a simple thing to implement sustainably and long term. However – we are looking into all possibilities and really appreciate the question. TLDR the NFTs exist – and you can grab them and get rewarded. The further utility will be looked at down the road.

Q – These will take Kyber Network to the next level. Everything you guys are doing, looking like it’s focused on keeping the users with you and increasing loyalty. Kudos to that. I have another community question: Staking and Farming are two features that can be of interest to a large number of users. How profitable is (ATM) token Staking and Farming? How do you plan to create an APY that standout amidst other platforms?

These are great questions. I’ll split them into 2 and address Farming first. These are farming pools that are live now – this is the Polygon chain.

Source: Website

You can see that even during the bear market, you can earn safely, and reliably build towards the next bull market as an LP. Concentrated liquidity, means your capital goes a long way. How do we increase APY? A few ways:

- We have a vast ecosystem partnership where dApps and wallets, for example, DexTools, Defillama, etc route through their trade volume through KyberSwap pools.

- We constantly aim to grow our users & trade volume on KyberSwap and this means if you farm on KyberSwap, and you do your trading on KyberSwap. Also, invite your circle to do so, the volume will grow, thus giving LPs more returns.

- We work with partners, like Avalanche Foundation, Arbitrum, Optimism, Lido Finance, QiDao Protocol, Stafi, and more to provide added rewards for farmers.

On the other hand, Liquidity aggregation, and being a liquidity provider, is *ESSENTIAL* to the whole economy of DeFi. KyberSwap is a key pillar in this economy, and you as a liquidity provider, can participate and earn.

Secondly: For $KNC staking, we invite those who are bullish on Kyber Network, $KNC to hold KNC, stake it in KyberDAO and you earn part of all the volume that goes through our liquidity pools.

Source: Website

How do we increase staking returns over time?

- More volume (as above) increases yield over time and this is underway with our ecosystem partnerships, and the growth of our user base and community.

- KyberDAO is always looking at more innovative ways to increase revenue & returns to holders. One thing to note is that KNC is a fixed supply token and has no auto-emissions.

If you’re interested to be part of the DAO, governance, and even putting up proposals for evolving the DAO, this is truly the embodiment of the decentralized spirit and we welcome you to do so. You can also be a KyberSwap Ambassador, get first dibs and alpha to all our releases, news, and campaigns, and be recognized as an important contributor to the community.

Q – Kyber Network is buzzing with a long list of integrations and partnerships. Can you take us through some of the most important ones and how you will mutually benefit from each other?

I sure can. KyberSwap as a DEX & Aggregator – you can see is integrated on 13 chains + hundreds of protocols.

Source: Website

As a trader, when you swap through KyberSwap, you get optimized and excellent trading rates because we dynamically route through the top liquidity sources in defi, not just our own pools. For example, we integrate UniSwap, PancakeSwap, Trader Joe, and QuickSwap pools amongst many other DEXes.

As a liquidity provider, your liquidity is routed through many different aggregators, not just KyberSwap’s. This means more trading fees returning to you. For example, Defillama, 1inch, Dextools, and many other dApps, aggregators, and wallets utilize KyberSwap pools. You can find endless announcements like the one I share below from Fizen Wallet.

DeFi is early, and it’s really important as builders to link all the ecosystems together. It will provide a smooth experience for users + leverage each others’ strengths. We’re really not competitors. We are fellow builders making a better system for all.

Q – Which part of the project are you most focused on right now? What is the current revenue model? I want to ask, Which one is the most important for you in developing the community and increasing the value of the project? Which one Will you do first?

KyberSwap is our all in 1 defi platform and is the primary focus of Kyber Network. It’s super important for DeFi to make a platform that is easy to use, well-integrated, and able to give users benefits. This is why you can swap, and earn, at excellent rates with us on most major chains + get proprietary insights from KyberAI and our free pro trading tools.

Q – Several major hacking cases in the crypto space have occurred, Dex Platform and GameFi Platform cannot be separated from the threat of hackers, How does Kyber Network see this problem? how does Kyber Network Minimize and prevent the risk of hacking? Is Kyber Network’s security system strong enough to prevent hacking?

I’m glad you asked. KyberSwap is a secure platform because:

- We are a public team, so you can go to KyberSwap and find our team members, including myself, the CEO & founders there. You can even come over to our office.

- Our smart contract code is built from scratch, not forked (copy-paste) by others. It is intensely scrutinized with SAFETY being the top priority and audited by ChainSecurity.

You can find for example our Elastic Liquidity audit here. We also have a DEDICATED SECURITY FUND by KyberDAO to insure losses (to a limit).

Q – The governance system of the blockchain platform plays a very important role in organically connecting users. How does the $KNC governance system work & what are the disadvantages of Governors’ failure to fulfill their obligations? The governance system of the blockchain platform plays a very important role in organically connecting users. How does $KNC governance system work & what are the disadvantages of Governors’ failure to fulfill their obligations

$KNC stakers & governance participants are important to us. These include key supporters, team members, users, and even centralized players like Binance who participate in our governance.

This robustness displays the spirit of decentralization and governs how we mint, utilize & conduct the KyberDAO, and KNC supply and circulation. It also gives us direction towards how we allocate KNC for activities for example liquidity mining and trading campaigns. This year we have several million KNC allocated to users for growth.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by Kyber. Copyright Altcoin Buzz Pte Ltd.