An important way to do this is by buying individual coins like Bitcoin and Ethereum, or you can buy a cryptocurrency index fund.

This is an excellent method for diversifying your crypto portfolio and spreading your risk. When investing in cryptocurrency, make it a point to research and comprehend the risks involved thoroughly.

How to Earn Crypto With Investment

After all, investors need to buy their chosen cryptocurrency and leave the tokens in a private wallet. Nothing else needs to be done until the time comes to cash out. Crucially, when taking a long-term buy-and-hold strategy, investors can avoid the need to constantly check market prices.

Source: CoinGecko

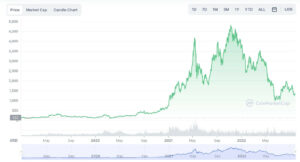

Moreover, holding onto a cryptocurrency position long-term enables the investor to ride out short-term volatility and wild pricing swings.

This is especially the case in the cryptocurrency scene, which is prone to extended bull and bear cycles. Let’s consider some examples to illustrate the point. In the build-up to the pandemic, Bitcoin was trading at the $10,000 level. After the markets crashed temporarily due to fears surrounding COVID, Bitcoin dropped by 50% to around $5,000.

Long-Term Coins as a Strategy

Those who panic-sold their tokens would have therefore made a sizable loss. On the other hand, those who undertook a long-term buy-and-hold strategy would have witnessed the complete opposite. After hitting lows of $5,000, Bitcoin then went on an extended bull run, with the digital asset subsequently going on to breach $68,000 in late 2021. Michael Saylor, CEO of MicroStrategy, is the perfect example of how to hold an asset.

“Going forward, we continue to plan to hold our bitcoin and invest additional excess cash flows in bitcoin. Additionally, we will explore various approaches to acquire additional bitcoin as part of our overall corporate strategy.”https://t.co/RNs8E0XF6J

— Michael Saylor⚡️ (@saylor) January 28, 2021

In another example, during the extended bear market of 2018, Ethereum hit unprecedented lows of $85. Fast forward to late 2021, and Ethereum hit all-time highs of almost $5,000. Compared to the aforementioned low, this represents a growth of over 5,700%

Examples of Long-term Success

Consider the case of Bitcoin, the most prominent cryptocurrency. In 2011, Bitcoin’s price was around $1. If you had invested $100 in Bitcoin at that time and held onto it, your investment would be worth over $4 million today.

Similarly, Ethereum, the second-largest cryptocurrency, was trading at around $10 in 2016. If you had invested $100 in Ethereum then and held onto it, your investment would be worth over $13,000 today.

Diversification and Risk Management

While long-term investing has proven successful for many cryptocurrency investors, it’s essential to diversify your portfolio and manage risk. Don’t put all your eggs in one basket; consider investing in a variety of cryptocurrencies and other asset classes.

Those who panic-sold their tokens would have therefore made a sizable loss. On the other hand, those who undertook a long-term buy-and-hold strategy would have witnessed the complete opposite. After hitting lows of $5,000, Bitcoin then went on an extended bull run – with the digital asset subsequently going on to breach $68,000 in late 2021.

In another example, during the extended bear market of 2018, Ethereum hit unprecedented lows of $85. Fast forward to late 2021, and Ethereum hit all-time highs of almost $5,000. Compared to the aforementioned low, this represents a growth of over 5,700%

Nobody saw the USDC depeg coming.

Risk management is not just about setting a stop loss or portfolio diversification.

Here are 10(+ a bonus) categories of risk you should be aware of as a crypto investor

Thread 🧵 pic.twitter.com/FUWem53rfI

— Crypto Koryo (@CryptoKoryo) March 12, 2023

Conclusion

In the world of cryptocurrency, there’s the potential for substantial gains, but it comes with significant risks. Approach crypto investment with caution, a long-term perspective, and a commitment to continuous learning. It’s not a guaranteed way to make money, and losses are possible, so only invest what you can afford to lose.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.