In the previous part of this series, we have explained how you can swap your tokens and add liquidity into the SushiSwap liquidity pools. In this article, we will explore how you can use the BentoBox vault to lend and borrow tokens, yield farm, and carry out $SUSHI token staking on the Ethereum network.

Table of Contents

BentoBox

BentoBox is a token vault on Sushiswap where users can deposit funds. The vault offers the liquidity provider (LP) the ability to earn by charging a fee to users who use the existing liquidity of the BentoBox. This could involve making flash loans or other community-approved strategies.

BentoBox is permissionless. The platform has decided to incentivize projects that will be built on BentoBox.

Kashi

Kashi is the first decentralized finance (DeFi) protocol built on BentoBox. It allows users to create customized, gas-efficient markets while also lending, and borrowing from existing token pairs. It uses a unique isolated market framework where the risk associated with assets in one lending market has no impact on the risk from other lending markets.

How To Deposit Funds Into BentoBox Vault

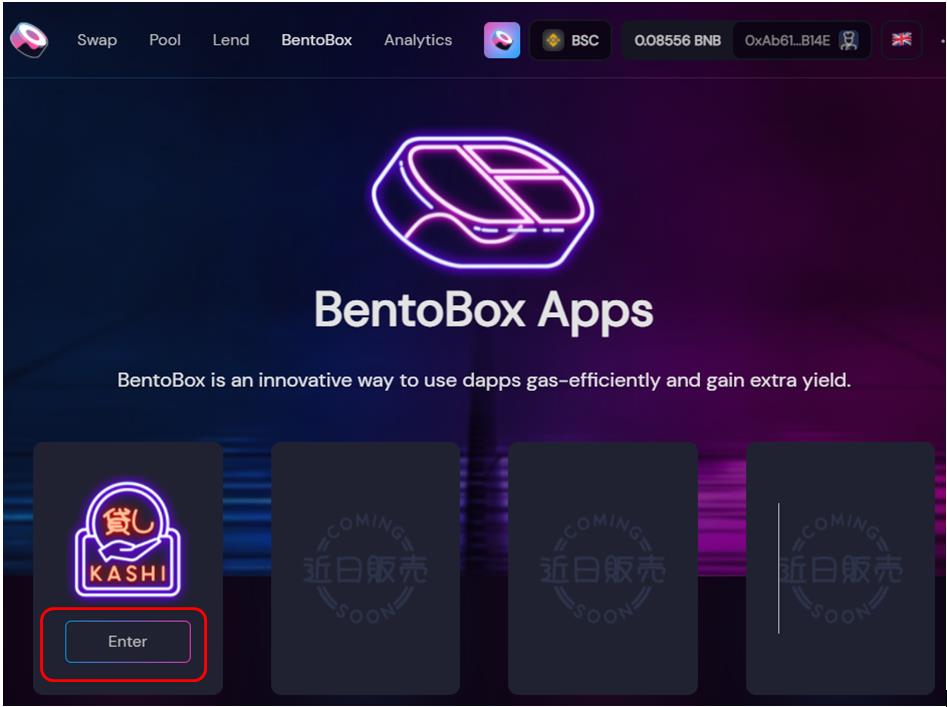

Go to the BentoBox tab, you will find the currently available market i.e Kashi.

Click on Enter.

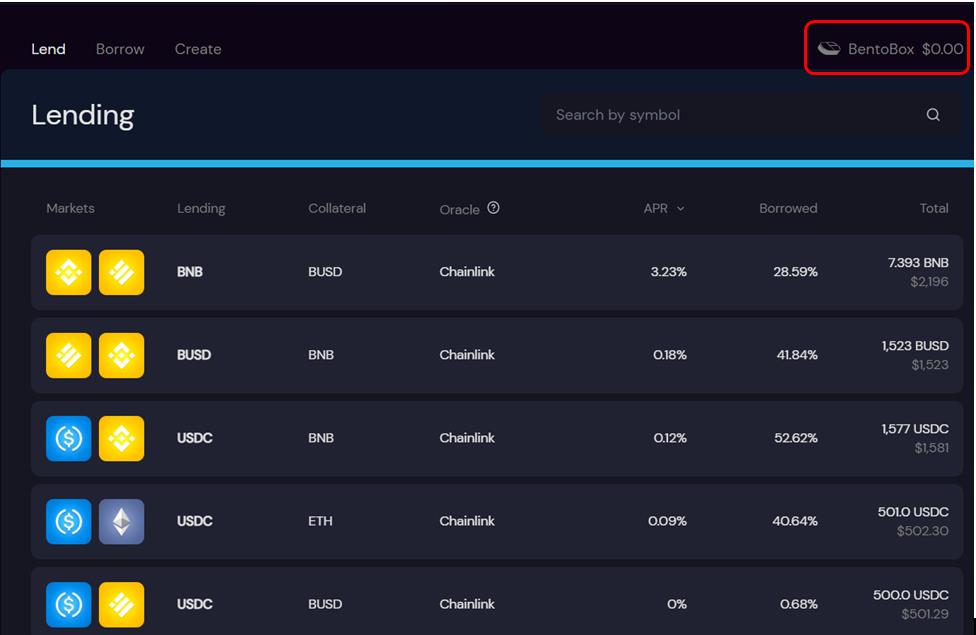

You will be redirected to the Lending tab. At the top, you will find the BentoBox button (highlighted in the below screenshot).

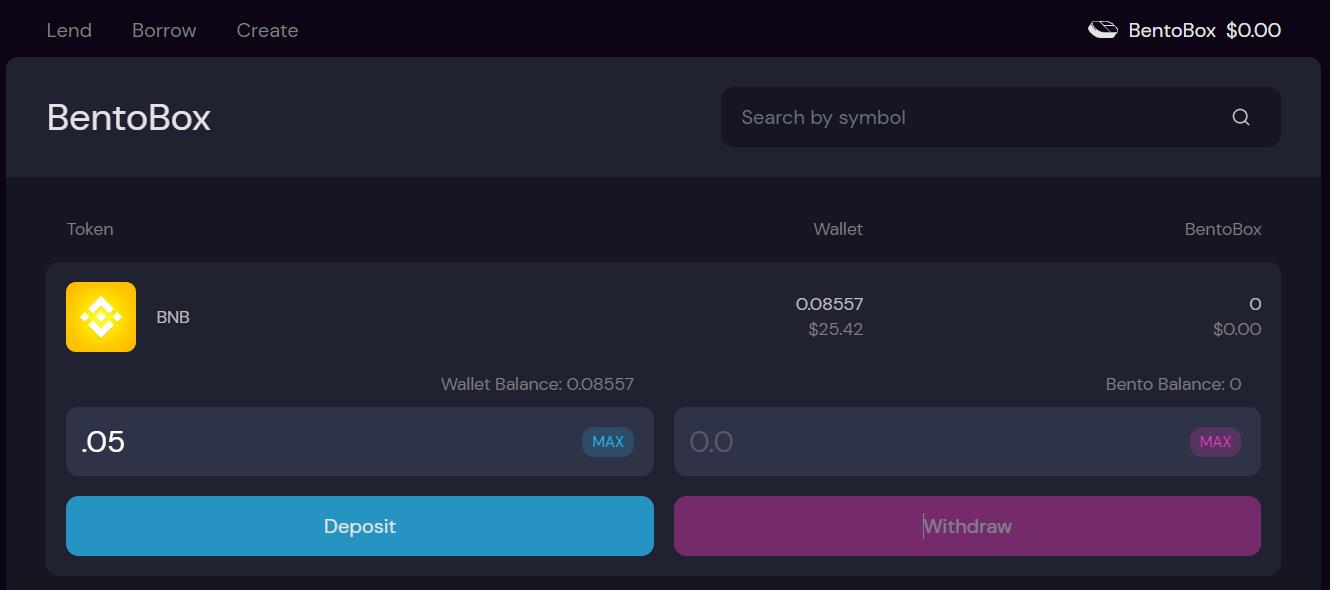

Click on it and it will show the list of tokens present in your wallet that you can use to deposit into the BentoBox vault.

Select the token that you wish to deposit and enter your desired deposit amount.

Confirm the process by pressing the Deposit button.

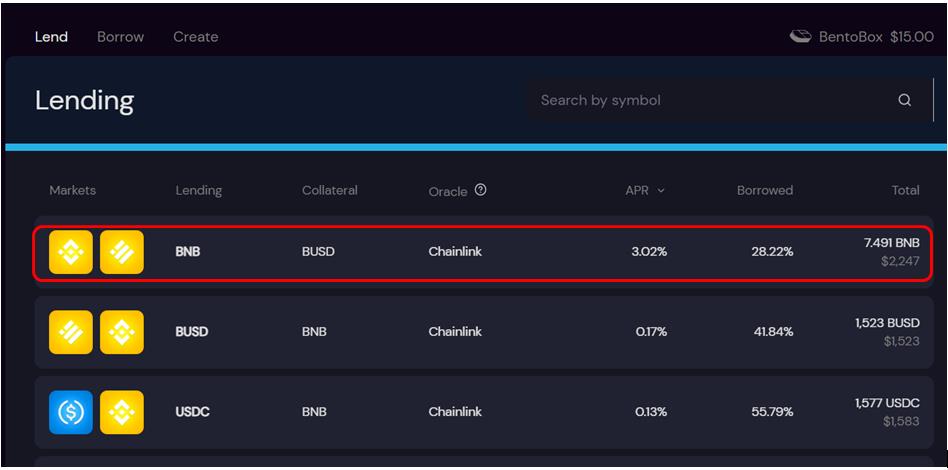

Once the process is successful, you can see your deposited amount available in the vault that you can use for the lending and borrowing process.

Lend

All Kashi markets are supported by one token and one collateral liquidity concept. You can lend your tokens that other users can use for different purposes like flash lending, strategies, and fixed, low-gas transfers among integrated decentralized applications (dapps) like Kashi markets. In return, you will earn interest.

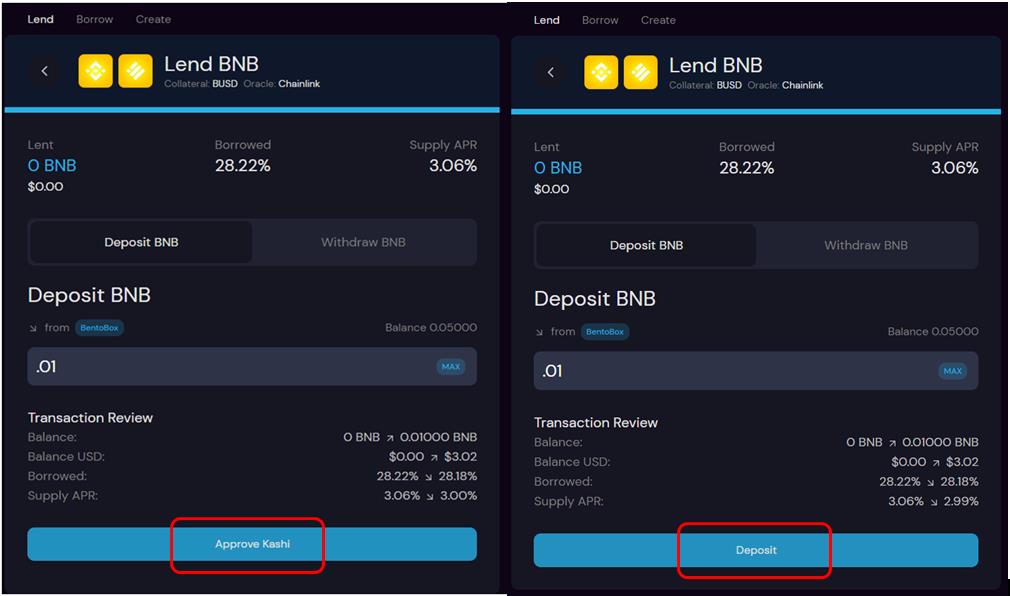

To Lend, first, select the token pair.

You can easily see both the tokens that will be used as lending and collateral.

Now enter the amount of token that you have chosen as collateral and confirm the process by clicking on the Deposit button.

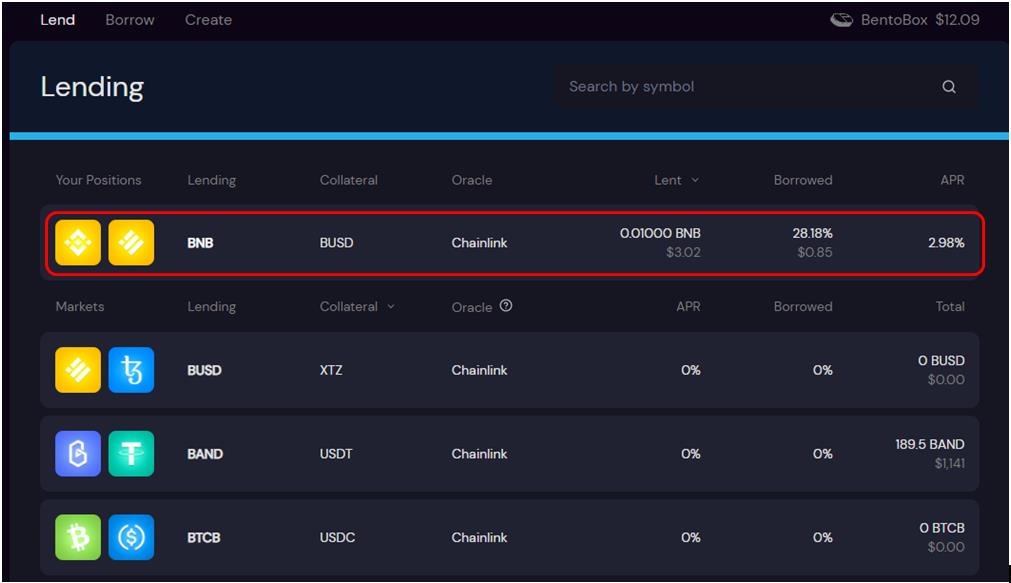

Once the transaction is successful you can see your lending details on the dashboard.

Withdraw

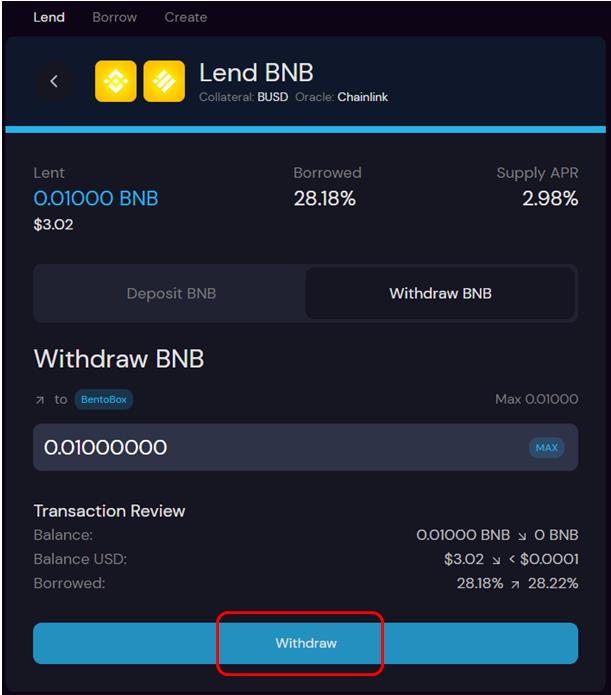

The withdrawal process is quite simple. Users can withdraw their tokens anytime.

To withdraw your lending tokens, click on your position.

Now go to the Withdraw tab and enter the percentage of tokens that you wish to withdraw.

Confirm the process by clicking on the withdraw button. This will trigger a Metamask transaction that you need to confirm.

Borrow

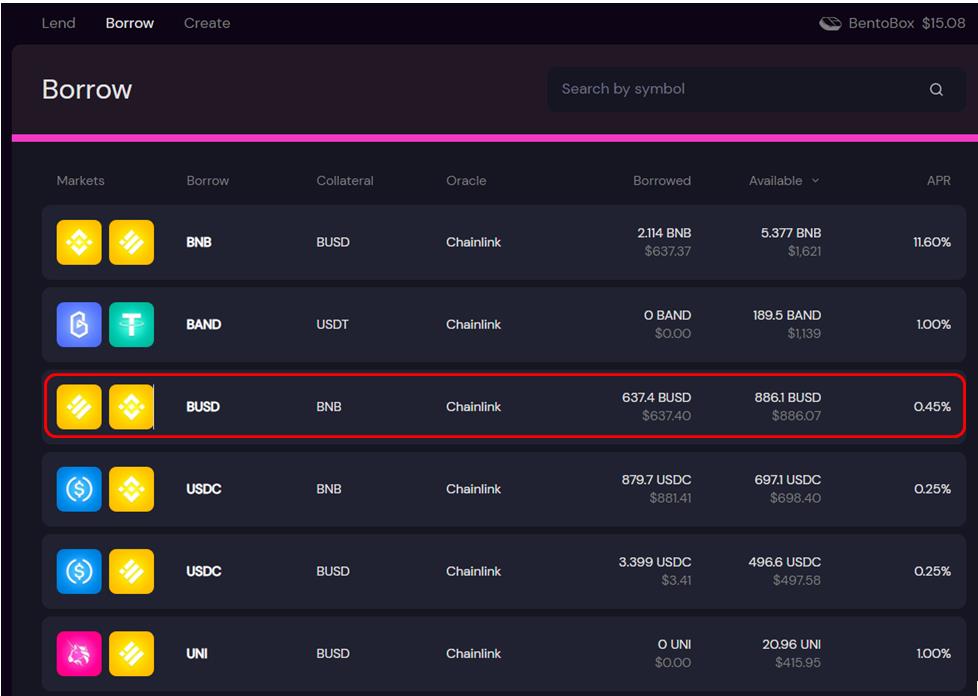

To borrow, you need to first deposit the collateral that is paired with the token you wish to borrow.

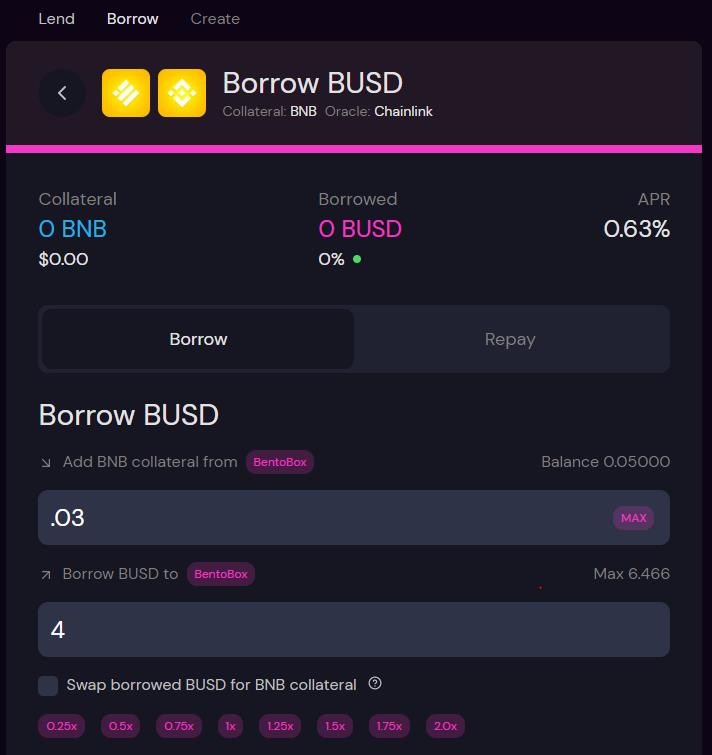

See the below screenshot. For example, to borrow BUSD, we have to first deposit BNB as collateral.

Click on your desired token pair to borrow.

Now add the amount of collateral in the first field (Add BNB collateral). The application will show you the maximum amount of tokens that you can borrow. However, we suggest you not borrow the maximum amount to avoid liquidation.

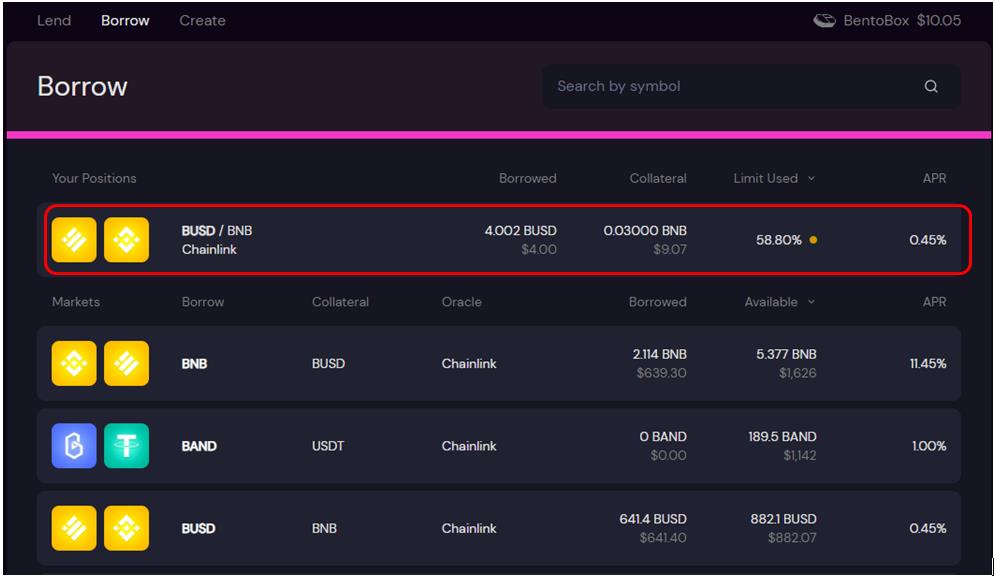

Click on the Add collateral and borrow button at the bottom of the page. Once the transaction is successful, you can see your borrowed position from the dashboard.

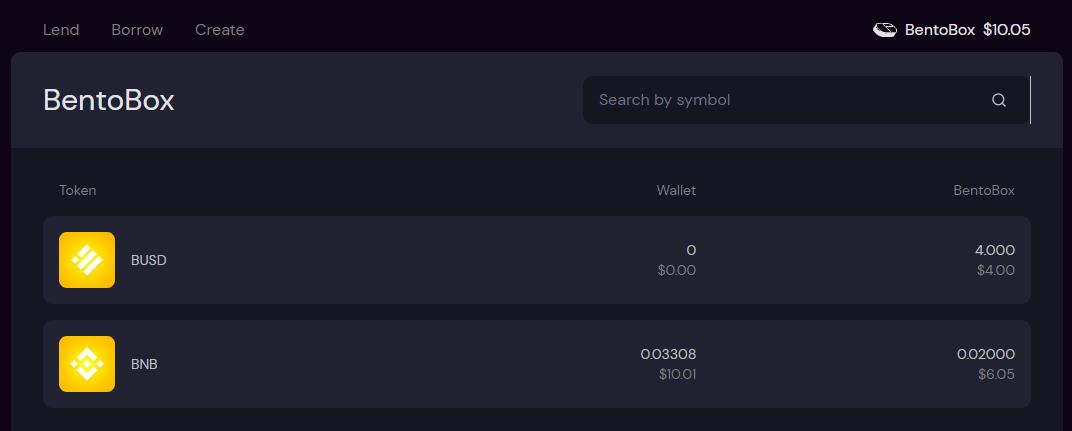

Note that we have selected to deposit the borrowed token in BentoBox. Hence, you can find the resultant borrowed BUSD token in your BentoBox vault.

Repay

Users can repay (partial/complete) the borrowed tokens anytime and close their position.

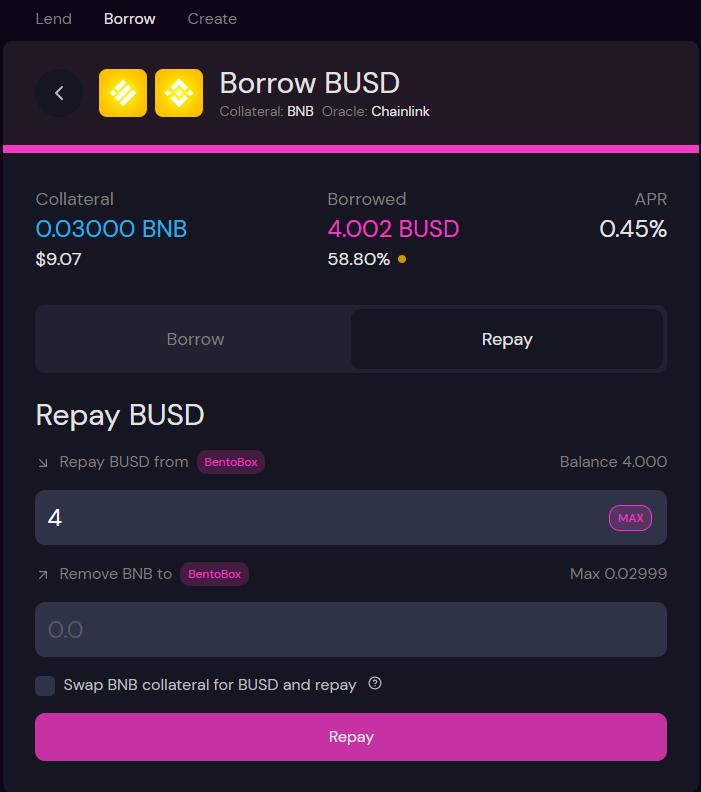

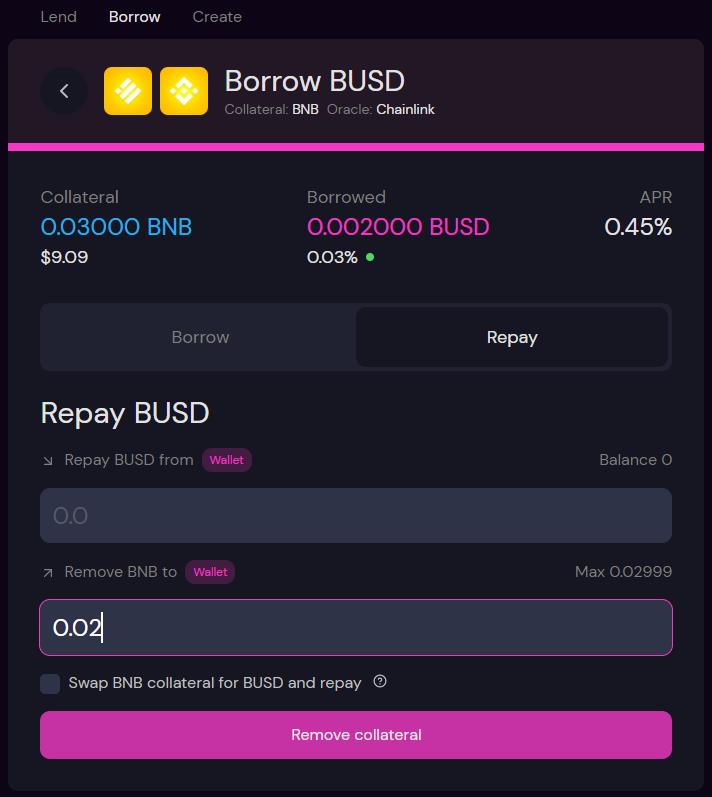

To repay, click on your borrowed position, and go to the Repay tab.

Now enter the number of tokens that you want to repay and confirm the transaction.

Once the transaction is successful, your borrowed amount will become almost negligible.

You will also find the Create button that will allow you to create a pair that is not present in the market currently.

Remove Collateral

If you no longer wish to borrow any token that is paired with your deposited collateral, then you can go ahead, and withdraw it.

You can also perform this step combined with the repay process.

Enter the amount of collateral in the Remove BNB to wallet field that you wish to withdraw, and click on the Remove Collateral button.

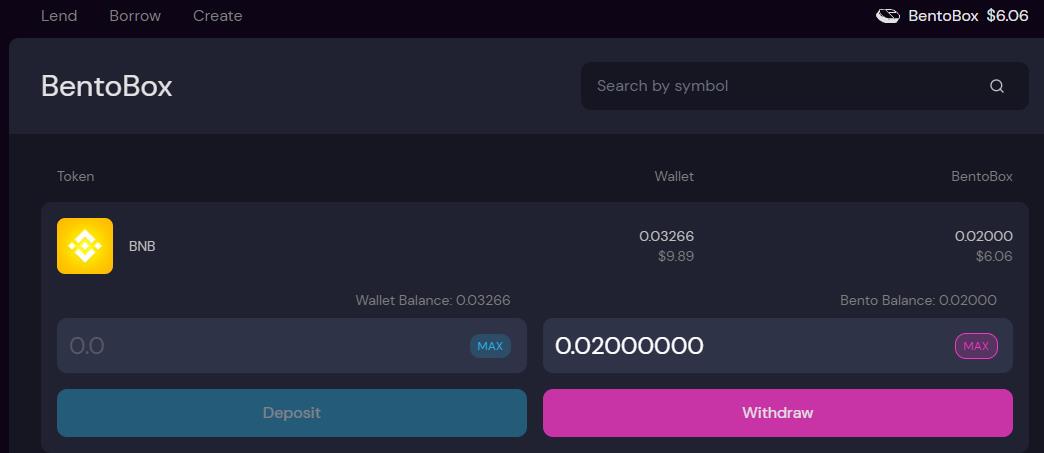

Withdraw Funds from BentoBox

Users can withdraw the funds that they have deposited into the BentoBox vault if they do not wish to use the vault services.

To withdraw from BentoBox, click on the BentoBox button appearing on the application.

A page will pop up where you need to fill in the number of tokens that you wish to withdraw. You can select the Max option to withdraw the maximum possible amount from the vault.

Confirm the process by clicking on the Withdraw button. Once confirmed, your vault will be empty.

Features Supported by SushiSwap In Ethereum Network

Certain features are not available on the Binance Smart Chain network. Farming and staking $SUSHI tokens are available on the Ethereum network that users can use and earn rewards.

Note that we have only tested the Sushiswap platform for Binance Smart Chain and Ethereum network only.

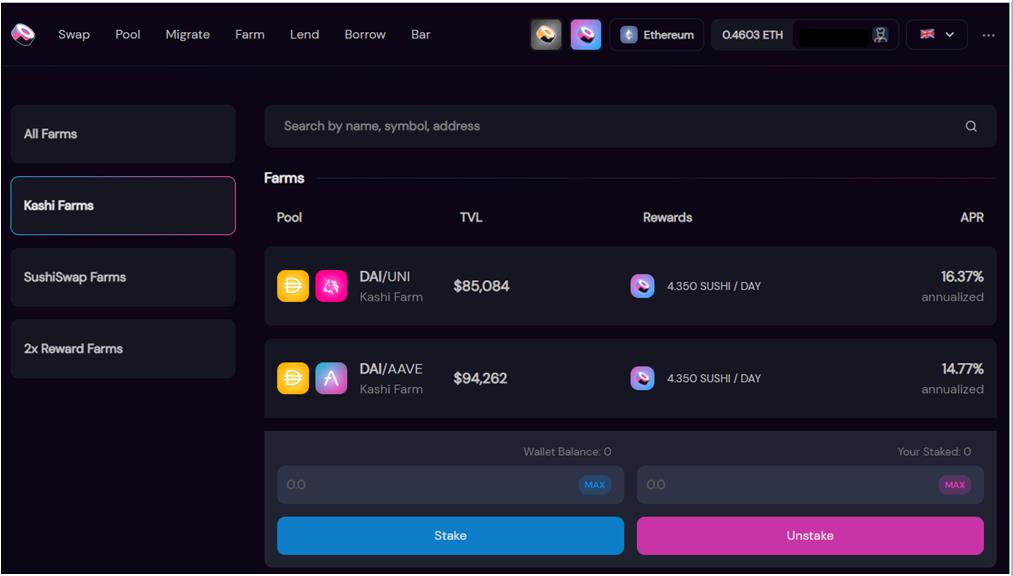

Farm

If you go to the Farm tab, you will find the following different farm types each supporting tokens pairs with a different APY:

- Kashi Farm

- Sushi Farm

- 2x Rewards Farm

To participate in yield farming, users need to first add liquidity into their desired pool.

Then, they can go to the Farm tab, and stake their LP token into the farm pool to begin earning rewards.

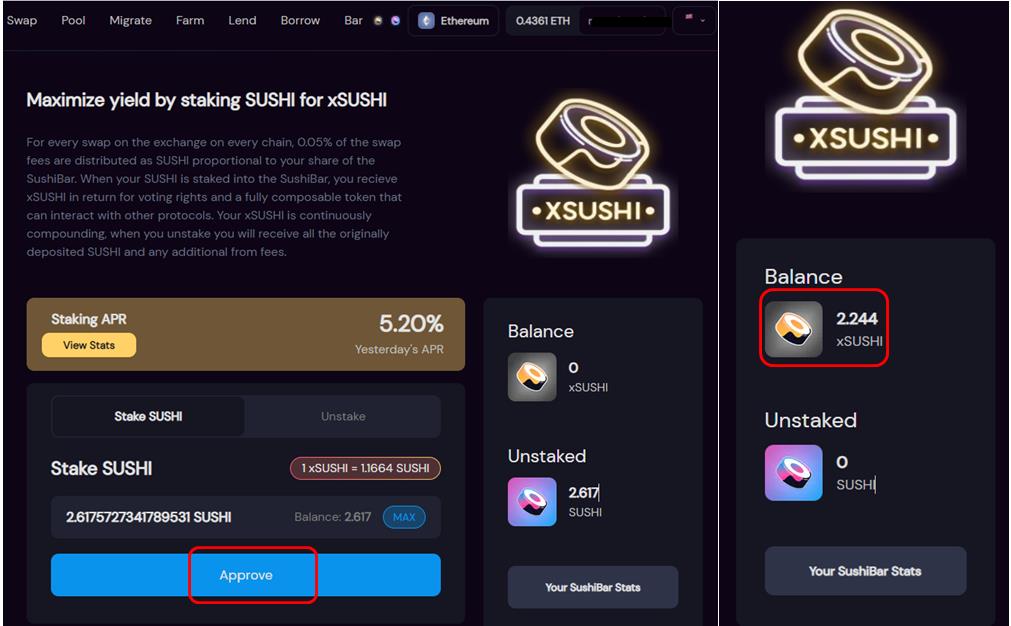

Stake SUSHI

Ethereum network users can maximize their yield by staking SUSHI. Stakeholders receive the xSUSHI token which has more value than the $SUSHI token. The xSUSHI token is compounded and xSUSHI holders earn 5% of all platform transaction fees.

To stake your $SUSHI tokens, go to the Bar tab.

Enter the amount of $SUSHI token that you wish to stake, and Approve the process.

Once the transaction is successful, you will see your xSUSHI token balance in your dashboard.

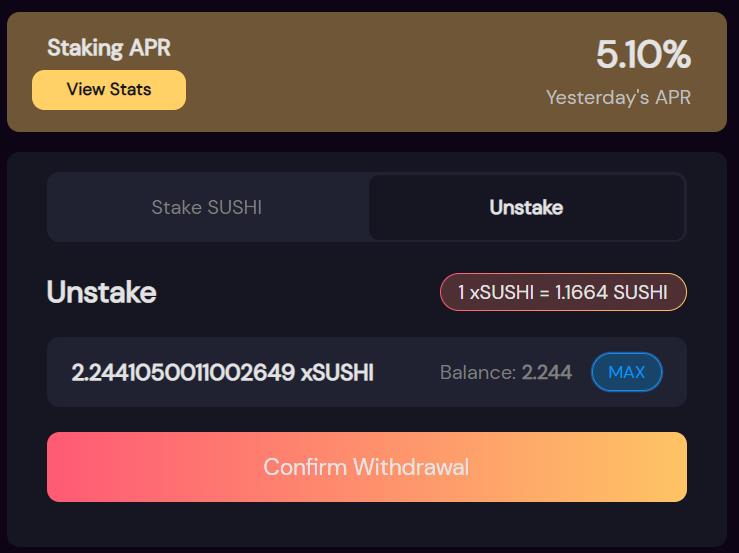

Unstake $SUSHI

Users can unstake their $SUSHI tokens any time and receive the originally deposited $SUSHI along with the fees earned during the staked period.

To unstake, go to the unstake tab, and enter the amount of token that you want unstake.

Confirm the withdrawal process.

Conclusion

Sushiswap has emerged as one of the major players in the DeFi ecosystem competing successfully with big platforms like Uniswap. It has slowly evolved from a simple automated market maker (AMM) platform to a multi-feature DeFi product. The UI is simple and allows the users to access multiple networks. We hope that the platform will maintain its growth in the future.

Resources: SushiSwap

Read More: How to Do BakerySwap Farming, Mint NFTs