There are a few narratives that are in the spotlight for 2024. These include AI, RWA, DA (data availability or modular chains), and DePIN. The latter is what we are highlighting in this article. By 2028 DePIN should be a $3.5 trillion industry.

That’s reason enough to take a closer look at everything that is DePIN.

What Is DePIN?

The Decentralized Physical Infrastructure, that’s what DePIN stands for. We’re looking at applying blockchain tech to physical hardware and systems. Of course, this is all done in a decentralized set-up. So, if you have, for example, spare GPU, you can monetize this. When somebody uses our GPU, you get rewarded for that. These rewards tend to be in the platform’s native token.

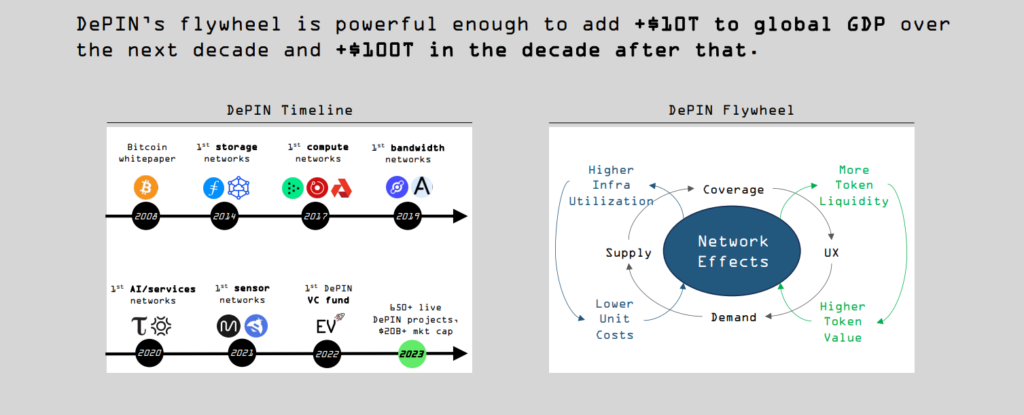

Messari published a DePIN report, and they came up with some interesting insights. For example, they state that the DePIN flywheel can add $10 trillion to the global GDP over the next decade. In the decade after that, they foresee a growth of $100 trillion. See the picture below.

Source: Messari DePIN report 2023

Now, historically, physical infrastructure has always been a monopoly executed by Big Tech. Small players could never get a foot in that door, due to the high costs. For example, AWS sells it services at top prices. They take full advantage of this.

However, now that DePIN arrived on the scene, it starts to look different. Out of the many benefits that DePIN offers, these four stand out.

- Reduces costs.

- Horizontal scaling.

- Rewards network contributors.

- Enhances security.

The DePIN Flywheel

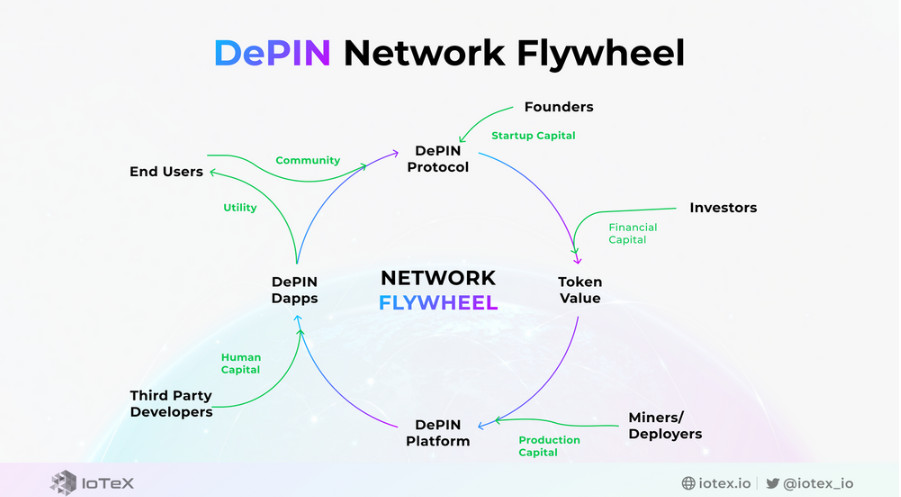

This culminates into a flywheel. Such a flywheel means that there’s a continuous growth of the narrative. Let me explain this for DePIN.

- You offer your resources on a marketplace and receive network token rewards.

- The token becomes more valuable because of token burns or buyback programs.

- Because the rewards become more valuable, more resources are being deployed.

- Higher network activity increases end user demand.

- A growing network attracts devs who build Dapps on top of the network.

- This results in more end users and suppliers.

So, as you can see, there’s a flywheel at work in this sector. It gives traction to projects, once they start to expand. Currently, DePIN already generates $15 million per year. According to Messari, this sector should see a $3.5 trillion increase over the next four years. See the picture below.

Source: Iotex blog

The DePIN Landscape

You can split DePIN up in three wider groups. Each of these groups currently represents a value of around $1 trillion. So, the potential growth is immense. Here are the three groups.

- Physical Resource Networks — Like sensors or wireless.

- Digital Resource Networks — This includes, among others, compute, bandwidth, AI, and storage.

- DePIN Module — For example, wallets or storage.

You can break these groups down even further. Let’s take a look at that.

Decentralized Storage

For example, decentralized storage is a big narrative. This group offers unused storage capacity. That comes in the form of computing resources. The data across a network first gets encrypted. After that, it’s stored among a decentralized computer network. So, this can be hundreds to thousands of computers. In other words, there’s no single point of failure in this set-up. The network users pay the network for storing and retrieving their data. Here’s the cherry on the cake. These decentralized networks are 78% cheaper compared to centralized networks.

Some players in this field are, for example,

- Filecoin — Offers some of the cheapest fees in this field. It has three amazing growth verticals.

- Storage with a 2.8x YoY (year-on-year) growth.

- The FIL virtual machine, which has $254M TVL.

- Projects building on top of Filecoin, involving 254K users.

- Arweave — One of our favorite platforms. For a one-time fee, you can store data permanently. That means 200 years. Metaverses or social media platforms may favor this. Here you can find our previous articles on Arweave.

They don't know that @ArweaveEco has processed over 3 billion transactions (434% year-over-year) and currently has 1.1M users (+90% growth compared to last year) 🐘🤫 pic.twitter.com/orEKzwKQCf

— Mardeni (🧱, 🚀) (@Mardeni01) February 23, 2024

Decentralized Computing

This is where you can borrow GPU power. This allows you to run complex cloud computations. And guess which narrative needs lots of GPU? Right, that’s AI. This is also a vertical that will keep growing. Validators will also need GPU to run their nodes. So, there will be a constant demand for more GPU.

Currently, the legacy computing networks have a $5 trillion marketcap. If DePIN manages to get 1% of this market, that means a 10x growth factor. Some players in this vertical are, for instance,

- Akash — One of the best performing platforms on the Cosmos Hub. It offers a marketplace where you can buy and sell GPU storage.

- Render Network — One of the bigger GPU players. However, this protocol is not as decentralized as they portray themselves.

We have confirmation from several providers to supply high-density NVIDIA GPUs to Akash, estimated to come online next week.

✦ 64 x H100s

✦ 64 x A100 – 80GB

✦ 64 x A6000

✦ 1 x HGX (8 x H100)Details will follow soon. $AKT party just got better. https://t.co/qYyXuyvCDE

— Greg Osuri ⟁ d/acc (@gregosuri) February 22, 2024

AI Infrastructure

The AI vertical saw some scaling challenges that DePIN can solve. For instance,

- Lack of specialized hardware — Platforms like Akash are crowdsourcing GPU power. This can relieve this pain point.

- Lack of effective collaboration — With decentralized platforms, scaling becomes a lot easier.

- Ineffective data storage — Decentralized storage options use all the available storage room. Data gets encrypted and split-up over the network. Thus, utilizing the full potential of all available storage space.

⛈️☀️ @WeatherXM is a community-powered weather network and a crucial project in the Filecoin ecosystem that rewards weather station owners and provides accurate weather services to individuals, businesses, and research organizations.

🌐 Over 4000 live weather stations across… pic.twitter.com/UvDO3DaSno

— Filecoin (@Filecoin) February 22, 2024

Conclusion

DePIN is one of the fastest growing verticals in the crypto space. There also doesn’t seem to an ed in sight. Many other narratives, like AI, will only need more GPU and social media will need more storage. Demand and supply will keep growing. That’s the DePIN flywheel in a nutshell. It’s currently one of the most exciting crypto narratives available. And it feels like we’re only scratching at the surface.

This article was inspired by this X thread.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.