Mark Cuban is a well-known name in the crypto space. This entrepreneur and billionaire has plenty of crypto investments. In a recent Twitter thread, MooMs covered eight crypto projects Cuban invested in. It never hurts to know in which projects big names invest.

Maybe this gives you some ideas for your own portfolio. So, let’s take a look at some projects that Mark Cuban has in his portfolio.

From Shark Tank to the Dallas Mavericks.@mcuban has a net worth of $5.1 billion.

He has made 420+ investments over 20 years.

Here are the Top 8 crypto projects inside his portfolio.

A thread🧵👇 pic.twitter.com/Md00O6rNOX

— MooMs (@Moomsxxx) July 12, 2023

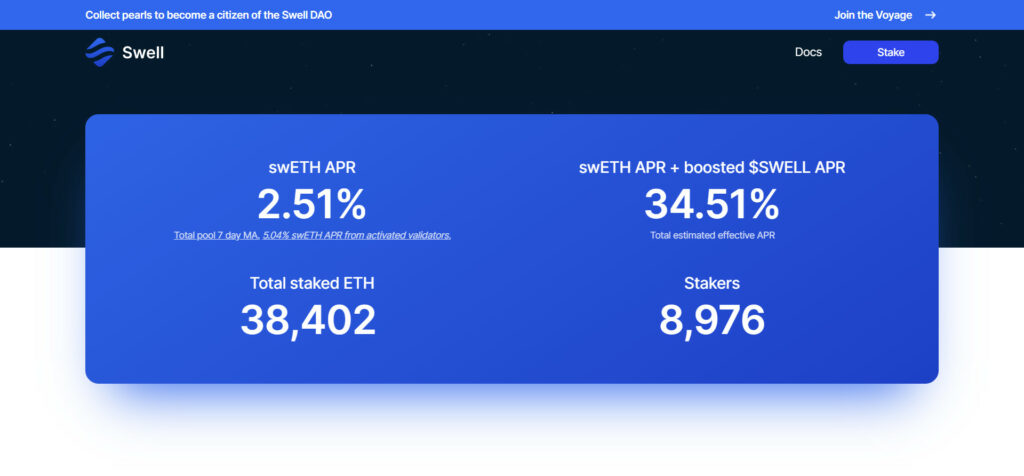

1) Swell Network (SWELL)

Swell Network makes liquid staking simple. You can stake ETH and optimize your yield in various DeFi projects. For this purpose, Swell gives you liquid staking tokens, swETH. Currently, they have 38,402 ETH staked on their platform. The APR for their swETH is 2.51% but with a booster, it goes up to 34.51%. See the picture below.

The platform also had some good funding. They managed to raise $3.75 million. Some backers, besides Cuban, are, for example, Apollo Crypto or Framework Ventures.

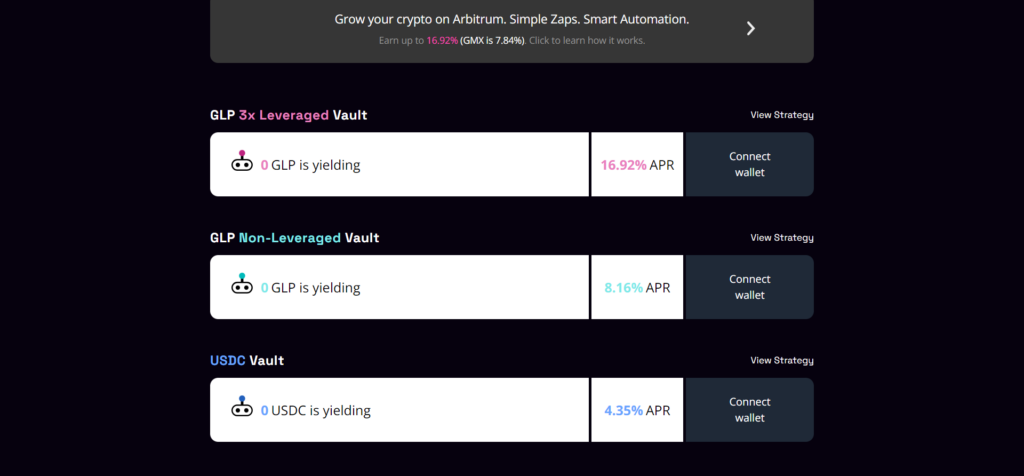

2) Seashell

Seashell offers vaults, the Blueberry vaults. They offer a simple and easy way to get DeFi rewards. Currently, they only support the Arbitrum chain. They use the popular GMX exchange. Seashell offers three different vaults:

- 3x leveraged vault with 16.92% APR.

- A non-leveraged vault with 8.19% APR.

- A USDC vault with 4.35% APR.

Seashell doesn’t have a token yet. Besides, Mark Cuban, Solana, Avalanche, and Polygon are among other investors. Seashell raised $6 million in a seed round.

Source: Seashell

3) Injective (INJ)

Injective is one of our fave projects. It is purpose-built for all kinds of financial apps. For example:

- Spot exchanges.

- Derivatives exchanges.

- Prediction markets.

- Various other options.

What makes them special is that they are an app chain. This means that there is a main chain, but each app is its own chain. However, they stay connected to the main chain.

20K $INJ delegators milestone unlocked 🥷

7 days @Injective_ stats change:

• Total staked: +171 133 $INJ

• Cumulative trading volume: +510M

• $INJ Price: +$1.2

• Market Cap: +$101,3M

• Delegators: +778

• Active addresses: +3 621

• Total amount burnt: +3 321 INJ… pic.twitter.com/9S6OMfgSkO— Iryna | Everstake 🥷 (@iryna_everstake) July 16, 2023

Injective is part of the Cosmos IBC ecosystem. Their token is up a stunning 574% during last year. So far, they raised $59.7 million.

4) Offchain Labs

Offchain Labs is the team that built the Arbitrum blockchain. They are also behind Prysmatic Labs. Here they build a technical infrastructure for Ethereum. In other words, they are building scaling solutions for Ethereum.

Today, we’re releasing tooling that will make building your own Arbitrum Orbit chain easier than ever.

To start, we’re providing a quickstart guide & tools to help you with building your Orbit DevNet chain!

🔗 start building via docs: https://t.co/syIhWswIlD

— Offchain Labs (@OffchainLabs) June 21, 2023

Offchain Labs raised no less than $173.7 million. So, besides Mark Cuban, we see a list of other well-known crypto investors. For example, Pantera Capital, IOSG Ventures, Samsung Next, or Stone Bridge.

5) Zapper

Zapper tracks your Ethereum-based on-chain portfolio. You get access to all kinds of Web3 data. For instance:

- Portfolio tracker.

- Social apps.

- NFTs projects and marketplaces.

- Crypto wallets.

- Swaps.

- Exchanges, and more.

Let's make Ethereum readable. Together. ⚡️

We're excited to launch event curation, allowing you to contribute and help make onchain events understandable to everyone. pic.twitter.com/xz6CJ1U3Ny

— Zapper ⚡️ (@zapper_fi) June 15, 2023

It allows you to build personalized Ethereum activity feeds. On the other hand, they also offer curated lists. For example, NFT personalities or whales, Ethereum OGs, or founders. Furthermore, they offer a swap and a bridging option for 9 chains. They raised $16.5 million. Backers are, for example, Coinbase Ventures or CoinGecko.

6) Yuga Labs

Yuga Labs is the team that created the BAYC or Bored Ape Yacht Club. So, we’re in NFT territory here. After BAYC they also created the Bored Ape Kennel Club and the Mutant Ape Yacht Club. They also released the Otherside which is a gamified metaverse.

A very different approach to making games. Yuga Labs launches 1st season of HV-MTL Forge Web3 crafting game https://t.co/2orySLbdES via @GamesBeat

— Dean Takahashi (@deantak) June 29, 2023

In 2022, they purchased the CryptoPunks and Meebits. They originated from Larva Labs in 2017. All mentioned NFT projects are among the top-notch NFT projects. To date, Yuga Labs raised $450 million. Animoca Brands and a16z are other backers of Yuga Labs.

7) Polygon Labs (MATIC)

Polygon Labs is currently one of the most popular Layer-2 solutions to solve Ethereum’s shortcomings. For example, scalability or cheap and fast transactions. This year, they have been constantly in the news with new partnerships. Among others, Disneyland, Starbucks, Stripe, Adidas, and Meta.

1/ Polygon 2.0 is a concrete vision to build the Value Layer of the Internet, and expand Ethereum to Internet-scale.

It is a series of proposals for unlimited scalability & unified liquidity.

Why is this such a big deal? 🧵 pic.twitter.com/Jv7PvRfxFN

— Polygon (@0xPolygon) June 22, 2023

In July 2023, they announced an update on their tokenomics. They also introduced the zkEVM. A scalable solution for the Ethereum Virtual Machine. Thus allowing for integration of smart contracts and developer tools. To date, they raised $451 million.

8) Axie Infinity (AXS)

Axie Infinity is one of the most successful blockchain games. It has a P2E (Play to Earn) mechanism and was wildly popular during COVID-19. Especially in developing countries like the Philippines, it was very popular. It offered players an extra stream of income.

Animoca Brands is the team behind Axie. As a result, they have become a power to reckon with in the blockchain gaming space. To date, they raised $311 million. Besides Cuban, Binance and Paradigm are among their backers.

Congrats @chan103199, our S5 Buy-In Brawl Champion!

We saw some highly contested matchups with a variety of metas on display.

The tournament gave us a good look at the meta as we prepare any potential adjustments leading into the launch of Origins season 5.

The tournament also… pic.twitter.com/zOTECzcsZu

— Axie Infinity (@AxieInfinity) July 16, 2023

Conclusion

We followed Mark Cuban and looked at some of his investments. It’s interesting to see a variety of investments. From small DeFi projects like Swell to current big players like Polygon or Axie.

What makes his investment strategy interesting is, among others, the variety. He also seems to have the knowledge to pick successful projects.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.