Get this, cryptocurrencies are largely unregulated, and their status as securities is still unclear. So, exchanges and crypto developers are cautious about operating within the law in various financial jurisdictions.

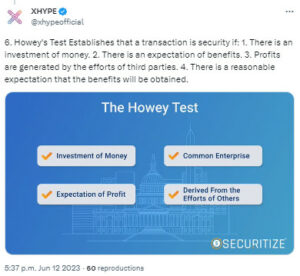

The SEC had proposed the Howey Test to determine which coins qualify as securities. This test posits that for something to be classified as a security, it must involve an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.” Let’s discover the best sec safe coins.

What is The Howey Test?

Now let’s apply the Howey Test to cryptocurrencies:

- Investment in Money: Cryptocurrencies pass this criterion as investing in them involves money.

- In a Common Enterprise: This criterion is met to some extent. For instance, in crypto lending services, clients lend out their money expecting a fixed or variable profit based on how an exchange uses it.

- The expectation of Profit: While many crypto investors aim to profit, there are exceptions, like stablecoins, which are used as a store of wealth, not for profit, classifying them more as a currency than a security.

- Efforts of Others: Here, cryptos generally do not pass the test, as no third party is typically involved in ensuring investors’ profits. It is more about collective market sentiment and investor activities. But at times, due to third-party involvement, stablecoins and certain cases like crypto staking and lending services may pass this test.

Source: Twitter

Now his generates mixed results. Despite these guidelines, confusion lingers over which cryptos the SEC’s criteria should label as securities. Conversely, commodities are interchangeable basic goods that commerce utilizes, substitutable with other goods of a similar kind. Some cryptos, particularly Bitcoin, have been considered commodities because any particular entity did not issue it, and their value does not depend on the performance of an underlying company.

Which Cryptocurrencies Are Considered Securities?

The SEC typically applies the Howey Test to determine whether a cryptocurrency qualifies as a security. The SEC has identified a number of cryptocurrencies as securities:

- Registration: The issuer must register the offering with the SEC, involving extensive paperwork, cost, and time.

- Disclosure: Issuers must regularly provide financial statements and information about their business operations, risks, and management to the public.

- Compliance and Enforcement: The issuer must comply with investor protection laws. Non-compliance may result in fines, penalties, or other sanctions from the SEC.

- Broker-Dealer Rules: Participants in cryptocurrency sales, including exchanges, may need to register as broker-dealers.

- Investor Limitations: Only accredited investors meeting specific financial criteria can purchase certain securities, potentially limiting the cryptocurrency’s buyer pool.

- Legal Ramifications: If a cryptocurrency violates securities laws, investors may file lawsuits against the issuer.

- Market Perception: Classification as a security can influence market perception. Some investors may view it as a more legitimate investment, while others may be deterred by increased regulation and reduced liquidity.

SEC Safe Coins

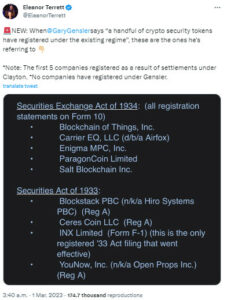

For the first time, SEC staff provided a list of firms that have attained some kind of registration with the agency:

Source: Twitter

Here’s a summary of the current status of various firms collaborating with regulators:

Gone:

- Blockchain of Things, a platform for building Bitcoin apps, shut down after 7.5 years.

- ParagonCoin, a token for the weed industry, faced trouble over an ICO and is no longer active.

- YouNow, a live-streaming company, abandoned its PROPS token in 2021.

Took new forms:

- Airfox (Carrier EQ), a platform for earning mobile time with ads, was fined by the SEC. It was later acquired by a Brazilian firm.

- Enigma MPC, a privacy technology builder, settled over an ICO. Its website is gone, but it merged with the Secret Network and swapped its token for SCRT.

Carrying on:

- SALT Lending, a crypto lender, registered after an ICO settlement and recently announced a debt-to-equity conversion.

- Hiro Systems (formerly Blockstack), a smart contract blockchain using Bitcoin, continued after a costly registration and declared its token no longer a security.

- Ceres. It’s a payment processor for the cannabis industry that also went the Reg A route. The company confirms it is still a going concern.

Now these are the top picks that are safe from SEC:

1) BTC: SEC back in 2018, said that bitcoin is not a security because it is decentralized: there is no central party whose efforts are a key determining factor in the enterprise

2) ETH: SEC has clarified before that Ether is also not a security because the Ethereum network is also sufficiently decentralized.

3) DOT: The US Securities and Exchange Commission (SEC) has not officially declared Polkadot’s DOT security. The Web3 Foundation, which is responsible for developing the Polkadot network, has argued that DOT does not meet the definition of security under US law

Source: Review

4) Ripple’s XRP: SEC has been in a legal battle against Ripple – the company behind XRP since 2020. SEC had claimed that Ripple has conducted an unregistered sale of securities (XRP). The curious thing is that the SEC’s list of securities coins in the lawsuit doesn’t even mention XRP anywhere. And XRP tokens are on the rise once again. The coin experienced a massive price surge in Q2, 2023, reaching around $0.50.

And if the court rules in XRP’s favor in the ongoing matter, the token will likely reach $1 once again. Keep an eye on XRP, as all of this is indicating Ripple could likely emerge as the winner. If that happens, Ripple will clear its name, motivating investors in mass to adopt the platform’s unique global payments system. Moreover, XRP tokens will be fully legalized and regulated, just like Bitcoin, making XRP one of the most trusted cryptos on the market.

5) EWT:

- Energy Web Chain is not considered a security by the SEC

- Energy Web Chain has followed necessary compliance measures to establish its non-security status

- Energy Web Chain and the SEC have collaborated in conferences and events together

6) Stacks (STX): Hiro, formerly known as Blockstack, announced last week that its Stacks token (STX) is no longer a security, and as such, Hiro will stop filing annual reports to the SEC.

Source: Twitter

Previously, Stacks were treated as security “out of an abundance of caution,” the company says. Now the company believes it has made good on its promise to decentralize the Stacks ecosystem because the broader Stacks ecosystem has no central governing authority behind it.

6) INX: In 2021, INX became the first company to complete a security token offering that was registered with the U.S. Securities and Exchange Commission (SEC). The INX token issuance raised $85 million. INX continued filling with the SEC to date.

Conclusions

What we think is compliance may be necessary for success for entrepreneurs but they get into business to succeed, not to comply. It is not known how many others have tried to register and failed or simply gave up on the process. But according to at least one that succeeded, the system is in need of improvement.

As the industry rapidly evolves, it is crucial for the laws to adapt and strike a balance between encouraging innovation and protecting investor interests. So, the SEC needs to make a more friendly environment for people trying to adhere to the law, Alan Silbert, the North American CEO for crypto exchange INX, said They need to advance registrations that have been toiling for too long.”

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.